Many ventures try to create new products or services under conditions of market uncertainty. This is a huge challenge for B2C. But uncertainty does not exist in the minds of most B2B customers… who have great knowledge, interest, objectivity and foresight. If you know how to access this, your supplier uncertainty will plummet.

More in white paper, Lean Startup for B2B (page 12).

Understand customer outcomes thoroughly before entering solution space. The drill bit is the supplier solution; the hole is the customer outcome. For every job, there are scores of outcomes your product could deliver… how fast the hole is drilled, how accurately, how easily centered, how much mess is created, etc. Outcome insight leads to solution brilliance.

More in article, The Inputs to Innovation for B2B

We asked how much B2B-optimized interviews impacted teams’ designs for the products they were developing. Five out of six teams said the impact was “great” or “significant.” Hmmm… makes you wonder what those products would have looked like without these interviews. Do you think your new products could be improved this way?

More in white paper, Guessing at Customer Needs (page 2).

Many companies develop and lob new products at their B2B customers without first exploring their needs. There may be less efficient ways to understand customer needs than waiting to see if they buy your product… but I truly don’t know what they would be. Years from now, companies will be amazed that our innovation methods were so supplier-centric and inefficient.

More in white paper, Timing is Everything (page 5).

The #1 culprit for wrong facts is the untested assumption. Someone thinks the customer would like this or that, and the assumption morphs into a “fact” over time. A missing fact occurs when an important question is not answered. The overwhelming reason is… it’s never asked. With proper B2B customer interviews, you can avoid most wrong and missing facts.

More in article, Should Your Stage-Gate® Get a No-Go?

In the front end of innovation, though, there are just two ways to fail. An error omission is failing to uncover an unarticulated customer need. An error of commission is choosing the wrong customer need to work on. Funny thing about errors of omission: No one knows you erred… until a competitor launches a blockbuster product.

More in white paper, Guessing at Customer Needs (page 5).

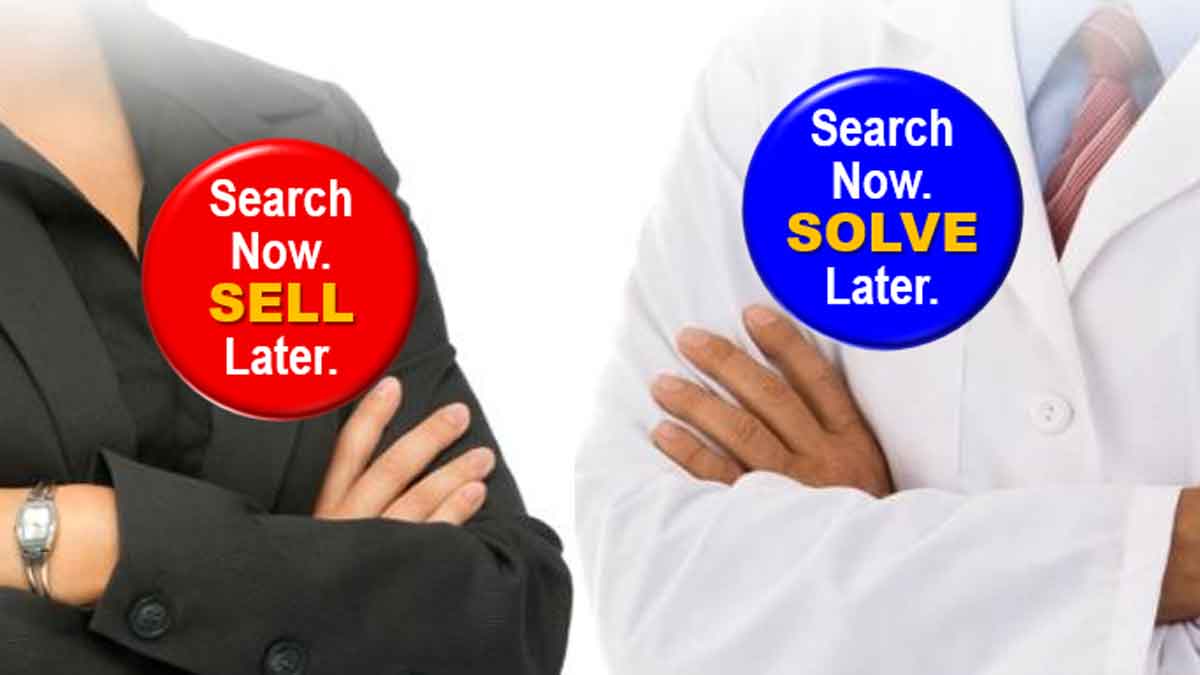

Send commercial-technical teams on interviews… but don’t let them sell or solve. If you sell during voice-of-customer sessions, customers know you’re not really interested in them. If you solve, you’re jeopardizing your intellectual property. In either case, you’re wasting precious time better used to understand customer needs.

More in e-book, Reinventing VOC for B2B (page 24).

After qualitative interviews, seek customer ratings on key outcomes: “How important is abrasion resistance on a 1-10 scale? And how satisfied are you today with abrasion resistance on a 1-10 scale?” This lets you converge with confidence on only those outcomes customers care about… those with Market Satisfaction Gaps over 30% (important and unsatisfied).

More in white paper, Catch the Innovation Wave (page 11).

I love it when our clients have cool technology and clever ideas. But don’t mention these to customers during VOC interviews. From the customer’s perspective, the interview should look exactly the same whether or not you’ve got a great hypothesis. Give your hypothesis the silent treatment for now. Simply listen to the customer.

More in article, Give your Hypothesis the “Silent Treatment” (Originally published in B2B Organic Growth).

Sure, the most important practice is understanding customer needs. But most overlooked? Few suppliers ask customers 1) for the most important, unsatisfied outcomes, 2) what test methods measure these outcomes, and 3) how satisfied customers are by various test results. Without these questions, you cannot properly assess competing alternatives.

More in article, Four Steps Needed for New Product Differentiation (Originally published in B2B Organic Growth newsletter).

If any process in your company should be customer-driven, it should be the one developing products for customers, right? So try this at your next review: Ask team members how many hours they spent talking to customers… and how many hours working internally. You may be surprised at how little time was spent understanding customer needs.

More in article, Should Your Stage-Gate® Get a No-Go?

If you ask B2B customers the right questions, you can replicate their experience within your operation. Learn which outcomes they care about, which test methods simulate those outcomes, and how much satisfaction would be delivered by any test result. Do this properly and you’ll know how they’ll react before they react.

More in white paper, Catch the Innovation Wave (page 11).

Imagine you’re planning to build a new home: Your architect sees you for half an hour, spends the first 15 minutes talking about sports, and then shows you pictures of other houses he designed. Later, when the house fails to please you, he dismisses it saying, “Well that buyer just didn’t know what he wanted.” Ever treat customers this way?

More in article, What is New Product Blueprinting?

Most of their thinking goes into adjusting their hardhats. Too bad: Tour insights provide great context for interviews… and your “fresh eyes” may yield ideas for improvement. You might see what everyone else has seen, but think what no one else has thought. You just need to learn the proper skills to do this.

More in e-book, Reinventing VOC for B2B (page 17).