Your new product development should start where it ends: with the customer. When you take your “pride and joy” hypothesis to customers and ask their opinion, two bad things can happen: 1) They tell you what they think you want to hear. 2) You hear what you want to hear. Start by uncovering their needs, not testing your pre-conceived notions. And be sure to use quantitative interviews to eliminate confirmation bias.

More in 2-minute video at 35. Insist on data-driven innovation

It’s much more likely you don’t know how to ask them. B2C customers can seldom describe what will entertain them or boost their self-esteem. But B2B customers are knowledgeable, interested, and objective. They may not know the solutions, but they do know their desired end-results. You’ll learn this when you learn how to ask.

More in e-book, Reinventing VOC for B2B (page 15)

One of our best innovations started as an experiment. In 2004 I projected my notes during a customer interview. The customer loved it, the meeting went far longer than expected, and we haven’t looked back since. Sure, customers can correct your notes this way, but our biggest discovery was that customers own what they create and can see. We’ve been calling these “Discovery” interviews ever since.

More in video, Reinventing VOC for B2B

Lean Startup methodology refers to “Leap of Faith Assumptions,” and recommends testing assumptions with customers at the first opportunity. For B2B, this “first opportunity” to learn comes before a prototype is created… through VOC interviews to mine the foresight of knowledgeable customers. Don’t miss this B2B adjustment to Lean Startup.

More in white paper, Lean Startup for B2B (page 6)

Avoid “technology push.” But should you just leave your technology quivering on the lab bench? Hardly. Conduct customer interviews without mentioning your technology. If customer outcomes match your technology… wonderful! Otherwise, look for different technology (for this market), or look for another market (for this technology).

More in 2-minute video at 21. Give your hypotheses the silent treatment

Here’s the logic: You want profitable, sustainable growth. The only way to achieve this growth is through customer value creation. And all value creation comes from improving important, unmet customer outcomes. So the better you understand customer outcomes, the better your growth can be. Are you doing this better than competitors?

More in e-book, Reinventing VOC for B2B

In many areas of life, there’s the “old way” and the “new way.” Does your company still develop “hypotheses” internally, and then meet with customers to validate them? This can lead to confirmation bias for you and stifled yawns for your customers. In the “new way,” you start by uncovering customer needs, not by internally “ideating” your solutions.

More in e-book, Reinventing VOC for B2B

If your new product development process does not require customer interviews today, consider two questions: 1) Do I have competitors beating me to the new product punch because they are using such interviews to uncover market needs? 2) Could I leapfrog them by building a company-wide competency of B2B-optimized interviews?

More in e-book, www.reinventingvocforb2b.com

The research on B2B sales call preparation isn’t encouraging: 75% of B2B executive buyers say salespeople are not knowledgeable about their business and do not understand the issues they face.1 Unsurprisingly, only one in four salespeople get agreement from these buyers to meet again.2 Let’s see how the clever use of AI can change this. ... Read More

Many suppliers ask “low-lumen” questions that neither illuminate nor engage customers. They may be biased, close-ended or too complex. Beware requesting sensitive information, or asking, “What would you pay for this?” When you ask for problems, don’t try to “help” with examples. Instead, let the customer choose the next topic to discuss.

More in white paper, Everyday VOC

Could customers help with a product as radical as iTunes or iPod? They’d probably be hopeless on solutions… but helpful on outcomes: access a broad range of music, instantly purchase music, transport music anywhere, purchase single tunes, store music on multiple devices, etc. These would be great insights for any solution-provider.

More in 2-minute video at 18. Avoid the ‘Faster Horse’ Fallacy

Think of a great radio interview. Did the host say, “I have 10 questions about your book”? Or did he listen carefully, asking wonderful questions? Did these questions cause the guest to think deeply? Did the guest enjoy the stimulating exchange, even thanking the host? This is how you learn what competitors miss. Check out our What-Why-Clarify probing method that’s part of Everyday VOC training.

More in white paper, Everyday VOC

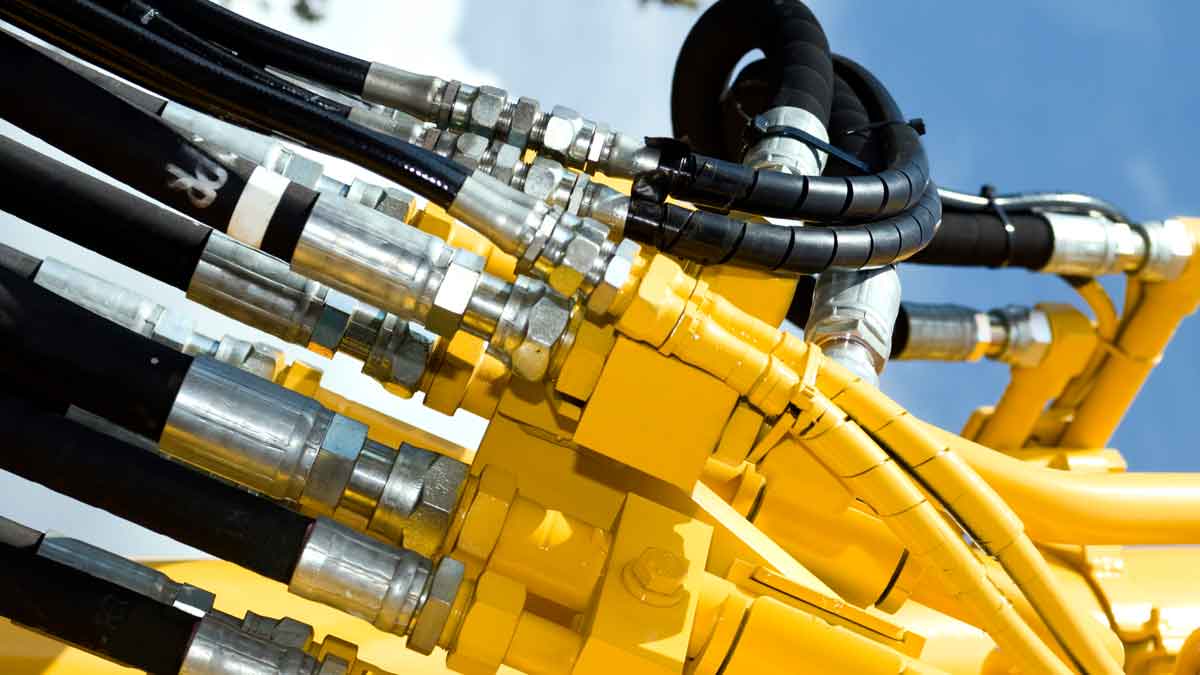

You can have an intelligent, peer-to-peer conversation about pressure ratings, fluid specifications, etc. And expect greater B2B interest vs. B2C, since your innovations can help the hydraulics engineer become a hero with his next new product. Without innovative suppliers like you, his path to recognition is a difficult one. The more you understand B2B vs. B2C, the more you can “take advantage of your B2B advantages.”

More in white paper, B2B vs. B2C

Let’s learn to moderate focus groups with jobs-to-be-done. Focus groups are a cornerstone of market research, providing valuable insights into consumer behaviors, preferences, and perceptions. Jobs-to-be-done is our primary methodology to understand customer behavior and decision-making. It’s natural to consider the interplay of moderation skills, the special context of the focus group, and the mental ... Read More