If your new product development process does not require customer interviews today, consider two questions: 1) Do I have competitors beating me to the new product punch because they are using such interviews to uncover market needs? 2) Could I leapfrog them by building a company-wide competency of B2B-optimized interviews?

More in e-book, www.reinventingvocforb2b.com

With a high-certainty project, you can accurately predict your financial profits. With an uncertain project, you face significant potential downside and upside profits. In B2B markets, you can understand the downside very early. You’ll kill the project cheaply if the downside cannot be eliminated. And reap big upside profits if it can.

More in white paper, Innovating in Unfamiliar Markets (page 5)

The research on B2B sales call preparation isn’t encouraging: 75% of B2B executive buyers say salespeople are not knowledgeable about their business and do not understand the issues they face.1 Unsurprisingly, only one in four salespeople get agreement from these buyers to meet again.2 Let’s see how the clever use of AI can change this. ... Read More

You have to deliver important value that customers cannot get anywhere else. If customers can get this same value from just one other supplier, they’ll use it as leverage for lower pricing. So the difference between delivering new value and matching existing value is the difference between raising and lowering market pricing.

More in white paper, Catch the Innovation Wave (page 8)

Many suppliers ask “low-lumen” questions that neither illuminate nor engage customers. They may be biased, close-ended or too complex. Beware requesting sensitive information, or asking, “What would you pay for this?” When you ask for problems, don’t try to “help” with examples. Instead, let the customer choose the next topic to discuss.

More in white paper, Everyday VOC

Three conditions must be met: 1) A market segment (cluster of customers with similar needs) is clearly defined. 2) The segment is worth winning in terms of size, growth, profit potential, etc. 3) The segment is winnable, i.e., it’s not defended by a well-entrenched competitor. Overlook these conditions and you’ll waste resources. Great market segmentation is key to successful innovation.

More in 2-minute video at 16. Segment by markets for innovation

Could customers help with a product as radical as iTunes or iPod? They’d probably be hopeless on solutions… but helpful on outcomes: access a broad range of music, instantly purchase music, transport music anywhere, purchase single tunes, store music on multiple devices, etc. These would be great insights for any solution-provider.

More in 2-minute video at 18. Avoid the ‘Faster Horse’ Fallacy

If you don’t ask customers the right questions, you can’t quantitatively assess their next best alternative. So you’ll have to guess at pricing. Guess too high and customers won’t buy. Guess too low and… well, customers will let it go this time. And you leave money on the table, perhaps for a decade or more.

More in white paper, Catch the Innovation Wave (page 12)

Think of a great radio interview. Did the host say, “I have 10 questions about your book”? Or did he listen carefully, asking wonderful questions? Did these questions cause the guest to think deeply? Did the guest enjoy the stimulating exchange, even thanking the host? This is how you learn what competitors miss. Check out our What-Why-Clarify probing method that’s part of Everyday VOC training.

More in white paper, Everyday VOC

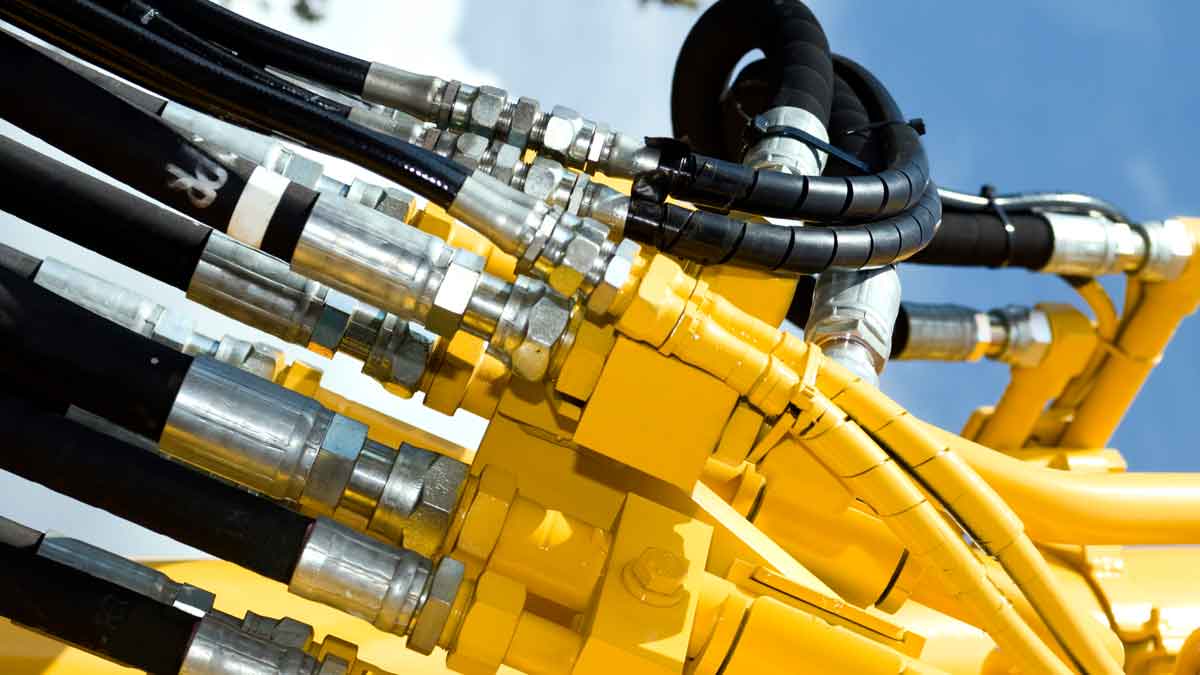

You can have an intelligent, peer-to-peer conversation about pressure ratings, fluid specifications, etc. And expect greater B2B interest vs. B2C, since your innovations can help the hydraulics engineer become a hero with his next new product. Without innovative suppliers like you, his path to recognition is a difficult one. The more you understand B2B vs. B2C, the more you can “take advantage of your B2B advantages.”

More in white paper, B2B vs. B2C