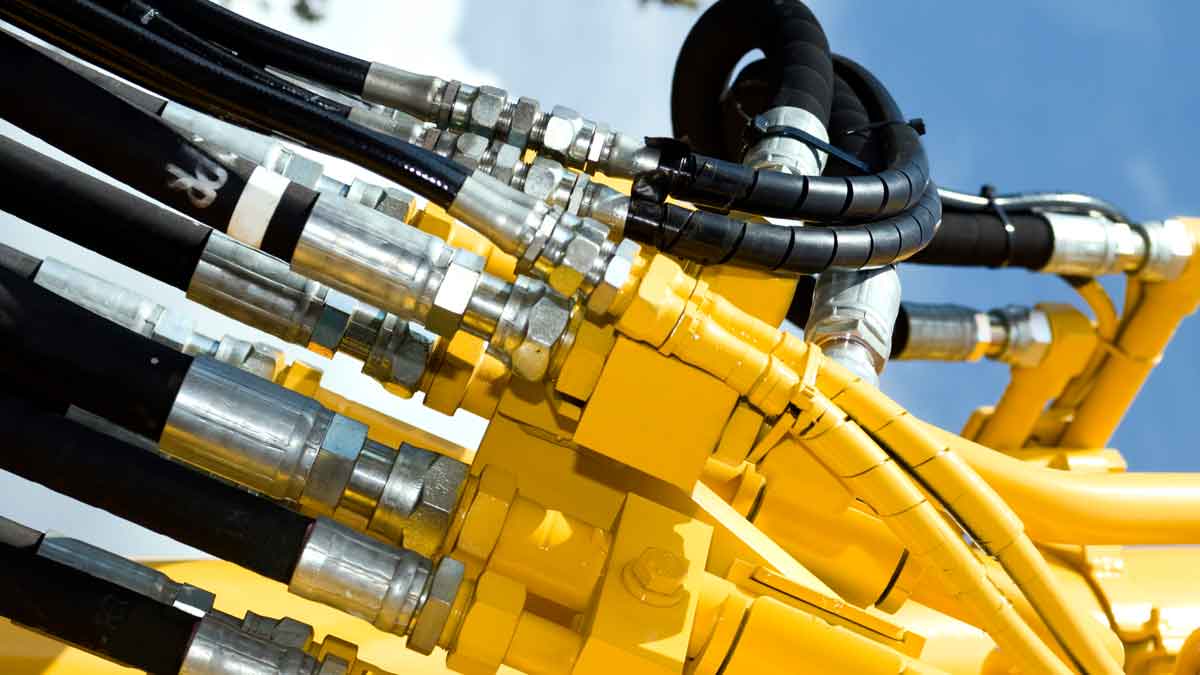

You can have an intelligent, peer-to-peer conversation about pressure ratings, fluid specifications, etc. And expect greater B2B interest vs. B2C, since your innovations can help the hydraulics engineer become a hero with his next new product. Without innovative suppliers like you, his path to recognition is a difficult one. The more you understand B2B vs. B2C, the more you can “take advantage of your B2B advantages.”

More in white paper, B2B vs. B2C

The “Build-Measure-Learn” cycle in Lean Startup begins with a hypothesis, and is great for B2C. End-consumers can seldom tell you what will amuse them or increase their sense of self-worth. But knowledgeable B2B customer can predict their desired outcomes. So start with a “Learn” pre-step. Customers will tell you all you need if you know how to ask.

More in white paper, Lean Startup for B2B (page 3)

Consider three product development stages: front-end, development and launch. Most projects reach commercial certainty in the launch phase, as sales are monitored. But you can move this certainty to the front-end. Nearly all commercial uncertainty can be eliminated before development using the science of B2B customer insight.

More in white paper, Timing is Everything (page 6)

B2B companies have huge advantages over B2C, but they may not be obvious. After all, didn’t the same fellow who bought a rail car of soda ash also buy a can of soda pop? Nope. He changed… a lot. B2B customers are more technically savvy, objective, supplier-dependent, and can predict their needs. Careful reflection of these differences leads to different approaches.

More in 2-minute video at 15. Put your B2B advantages to work

Steve Jobs quoted Henry Ford, who said, “If I had asked people want they wanted, they would have said faster horses.’” But these men were end-consumers themselves, so they understood their markets. Most B2B suppliers, typically have much to learn about customer desired outcomes… and B2B customers are willing and able to tell them.

More in 2-minute video at 18. Avoid the faster horse fallacy

Good questions demonstrate you’re more interested in the other person than yourself. What do you call someone who listens to you and seems fascinated by your responses? You call them a brilliant conversationalist. Think of it this way: Your customers have a hard time getting their boss to listen to them. They go home and their kids don’t listen to them. Now a supplier (you) is leaning forward and asking, “Really? Could you tell me more about that?” If you were the customer, wouldn’t you like to talk to such a person?

More in white paper, Everyday VOC at www.EVOCpaper.com

B2C companies seek to understand customer needs. B2B companies should do this and engage customers, priming them to buy later. If you interview ten customers that represent 20% or 50% of the market segment’s buying power, wouldn’t it be an incredible waste if you failed to engage these companies… so they wanted to work with you?

More in 2-minute video at 29. Engage your B2B customers

Here’s the “B2B Advantage”: Your customers can offer more insight than end-consumers due to their knowledge, interest, objectivity and foresight. But if your company uses hand-me-down consumer goods voice-of-customer methods, you’ve ignored your own advantage. Your competitors may not.

More in 2-minute video at 15. Put your B2B advantages to work

You can ask for pricing decisions using a survey, e.g. Van Westendorp. But it’s hard to get a straight answer in concentrated B2B markets: They know they’ll be negotiating prices later. Better to understand the customer’s world so well you can create a value calculator… to model their pricing decision-making. You’ll have longer-lasting insights vs. a one-time survey.

If you were gathering customer insights about belts, would you rather interview someone using a belt to convey iron ore… or to hold up their pants? B2B customers can usually provide more insight than end-consumers due to greater knowledge, interest, objectivity and foresight. But these advantages are no advantage unless you use a B2B-optimized approach.

More in 2-minute video at 14. Understand your B2B advantages

Unlike many B2C benefits, e.g. amusement, comfort, and self-esteem, B2B customer benefits are usually measurable, economic and—wait for it now—predictable. This predictability means B2B suppliers who study customer outcomes, like a science, will be handsomely rewarded. B2B customers will eagerly help you… if you know how to ask them.

More in white paper, www.guessingatcustomerneeds.com

If the customer felt they helped you with your interview, you probably wasted your airfare. But if they felt it was their interview, asked for a copy of the notes, and said you were a good meeting facilitator… you probably learned things your competitors don’t know. B2B insight skills are needed for this. Do your people have them?

More in e-book, www.reinventingvocforb2b.com (page 9)

Your “second objective” after customer insight should be customer engagement. These 9 approaches help: 1) Kill the questionnaire, 2) let customers lead, 3) discuss their “job-to-be-done,” 4) project your notes, 5) focus on customer outcomes, 6) probe… deeply, 7) don’t sell or solve, 8) get quantitative, and 9) use triggers. ... Read More

Clever companies realize they’ll “hear what they want to hear” without quantitative VOC. To do it right, B2B companies should weight responses based on customer buying power. And don’t just ask for importance ratings: Ask for satisfaction ratings as well. The only hope for premium pricing is pursuing needs that are both important and unsatisfied. You can use something called Market Satisfaction Gaps to point you in the right direction.

More in white paper, www.marketsatisfactiongaps.com