Here is our #1 recommendation for innovation success: Don’t start development stage work without quantitative evidence of customer needs. You can use Preference interviews followed by Market Satisfaction Gaps… or some other unfiltered, unbiased evidence. Two tips: 1) Don’t do this for very small projects, just those requiring 1+ person-year of development. 2) Don’t do this for technology development. Just product development, where you’ve targeted a specific market segment.

More in article, Market Satisfaction Gaps… your key to B2B organic growth

In B2B-optimize quantitative interviews you ask customers to rate importance and current satisfaction for key customer outcomes. Without these convergent interviews, you’re essentially “guessing” what customers want. You simply cannot trust qualitative insight alone, as we all tend to “hear what we want to hear.” This is called confirmation bias… and the only antidote is to ask customers to think in a structured manner, giving you quantitative data in an unfiltered fashion.

More in Preference Interview Research Report

Without well-executed, qualitative, divergent interviews, you can expect errors of omission… failing to uncover unarticulated customer needs. Are teams criticized for these errors? No, because no one realizes something was omitted at the time of the error. A second problem is the failure to engage customers. You miss the chance to impress them as a supplier that wants to better understand and meet their needs.

More in article, The Front End of Innovation: How much is “too much”?

What should be done if highway traffic slows to a crawl? Probably not put more cars on the entrance ramp, right? With every month of delay, a typical B2B new product loses $80K in net present value. So reduce your number of active projects and accelerate those that remain. The best way to kill dead-end projects—or stop them from even starting? Better up-front work. Then your R&D only works on customer outcomes you know they want, not hope they want.

More in white paper, Guessing at Customer Needs

If your NPD teams are confident of customer needs, your projects will go faster for 3 reasons: 1) Bad ideas are killed quickly, freeing up resources. 2) Dead-end detours and diversions are avoided. 3) Hesitation—with second-guessing, delays and debates—is squelched. As Netscape founder, Jim Barksdale, said “If we have data, let’s use it. If we have opinions, let’s use mine.” B2B innovators can find the data they need in Market Satisfaction Gaps.

More in white paper, Market Satisfaction Gaps

We asked this question of 540 B2B professionals—with over 10,000 years of combined experience. Of 24 possible growth drivers, what were they most eager to improve? Market insight. We defined this as “Obtain market insight proactively to drive strategic decisions (vs. being just customer-reactive).” Just as quality and productivity each had their waves of popularity, so market insight is increasingly sought today. Here’s a short video on one way to succeed: Focusing the fuzzy front-end of B2B product development.

More in research report, What Drives B2B Organic Growth?

Our survey of 540 B2B professionals—with over 10,000 years of combined experience—investigated 24 possible growth drivers. The highest rated driver of growth was delivering strong, differentiated value propositions. Doing so requires both 1) understanding and 2) meeting customer needs. Respondents felt a much greater desire to improve the former (understanding) than the latter (meeting.) Of 24 growth drivers, what were they most eager to improve? Market insight.

More in research report, What Drives B2B Organic Growth?

Leadership is less about motivating employees to create value for customers… and more about equipping them with the tools, training, and environment for doing so. A good leader provides and clears the path for innovation. When employees gain customer-insight skills and are free to practice them, they “rise to the occasion.” Sadly, some leaders’ net impact on innovation is more negative than positive due to their short-term actions, e.g. travel bans, hiring delays and spending freezes. They would boost innovation by staying home.

More in e-book, Leader’s Guide to B2B Organic Growth

How often have you heard this at a financial review meeting, “Well, one reason our revenue is lagging today is that crazy spending freeze we put in place last year”? If you’ve never heard this, it’s because leadership was fixated on last year’s first-order action (making the quarterly numbers), not the second-order effect (slower growth later). And they probably remain so today. If so, what does this tell us about a) our ability to learn from our mistakes, and b) our future growth prospects?

More in article, Stop Stifling B2B Organic Growth with 2nd Order Effects

Confirmation bias is seeking and interpreting data in a manner that supports our pre-conceived notions. Most innovation processes treat confirmation bias with apathy, when the proper response is dread. You increase your exposure to confirmation bias when you 1) start projects with your solutions, not customers’ outcomes, 2) ask customers to “validate” your ideas, 3) fail to identify and test all assumptions, and 4) skip quantitative customer interviews.

More in article, Market Satisfaction Gaps… your key to B2B organic growth

It’s different for consumer goods innovators, who can often observe end-consumers and then come up with clever solutions. But B2B innovators must approach their customers with hat in hand and humbly ask, “Can you help me understand your world?” Remarkably few do this. Just as remarkably, B2B customers love it when they do. The customer becomes the teacher, the supplier the student… and both are rewarded with market-changing innovation.

More in white paper, Guessing at Customer Needs

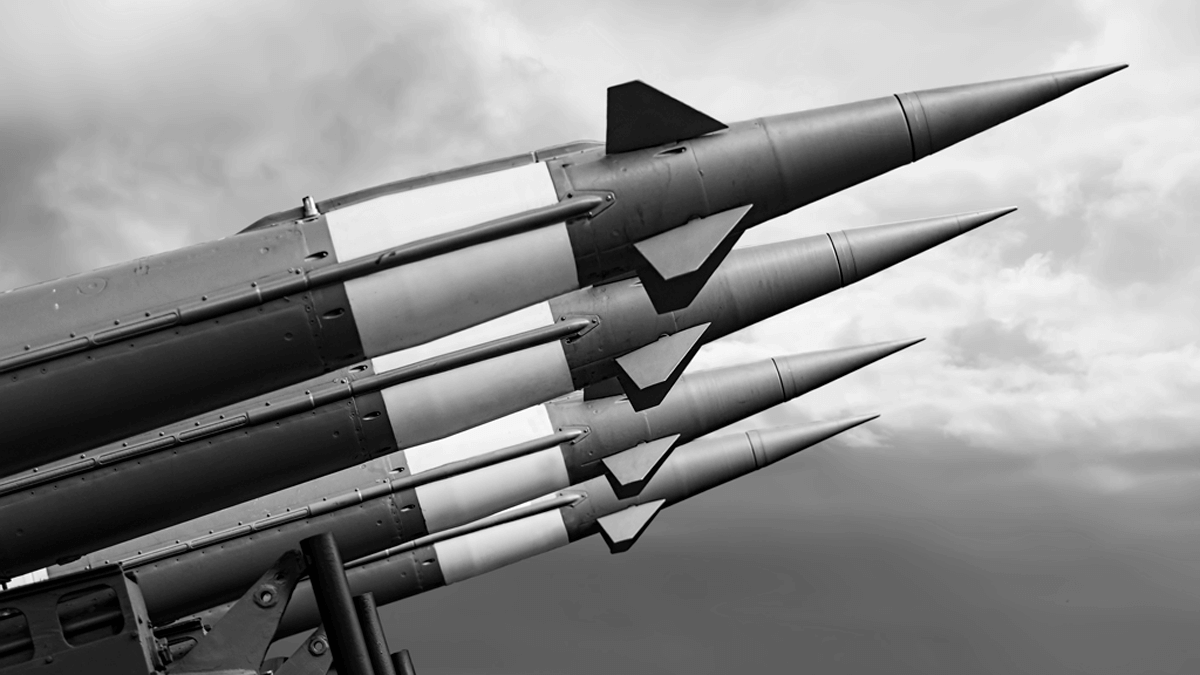

For artillery, archery or cancer treatment, you 1) scan the terrain, 2) detect the high-value targets, and 3) then commence firing. If you have weak reconnaissance, faulty satellite imagery or a blindfolded archer, it doesn’t matter how good your payload is: You won’t be successful. In NPD, this means 1) diverge to all possible customer outcomes, 2) find which are important and unsatisfied, and 3) develop your solution. Most B2B companies need to improve #1 and #2. A lot.

More in video, New Product Blueprinting—the Future of B2B Innovation

Our research into the views of B2B professionals regarding organic growth revealed: The #1 driver of profitable, sustainable growth is strong value propositions. The #1 differentiator between strong and weak value providers is front-end work. The #1 most desired area to improve is market insight. See a pattern? Today’s key to growth isn’t an improved stage-and-gate process or hiring more R&D staff. It’s understanding customer needs better than competitors.

More in article, Market Satisfaction Gaps… your key to B2B organic growth

This is also known as “attrition warfare,” and is characterized by competitors applying the same tactics. It’s also characterized by everyone losing, even the winners. Keep your productivity and quality initiatives… but understand that by themselves, these initiatives put you in a race to the bottom. Better to focus on what your competitors are not doing well. For B2B companies today, this is understanding customer needs before developing new products for them.

More in white paper, Guessing at Customer Needs