Developing Great Products for Unfamiliar Markets

Imagine this: Your company is routinely developing blockbuster products for markets it has never supplied before. For this to happen, you’ll need to change your thinking. First, think of these as “unfamiliar markets” rather than “new”. Second, stop thinking of uncertainty as something to fear.

Download free white paper

That market isn’t really “new”: You may have noticed I’ve used the term “unfamiliar” market instead of “new” market. Many B2B companies call a market “new” when in fact they mean, “new to us.” This strikes me as supplier-centric—not customer-centric—thinking. The market was there first. It is the supplier that is new.

This means you don’t have to live with uncertainty. Customers in these pre-existing markets are very certain about much you need to learn. And these B2B customers—rich in knowledge, interest, objectivity and foresight—can eliminate your uncertainty. In a Discovery interview, “unfamiliar market” contacts are capable of giving you every bit as much valuable information as those in markets you’ve supplied for 30 years.

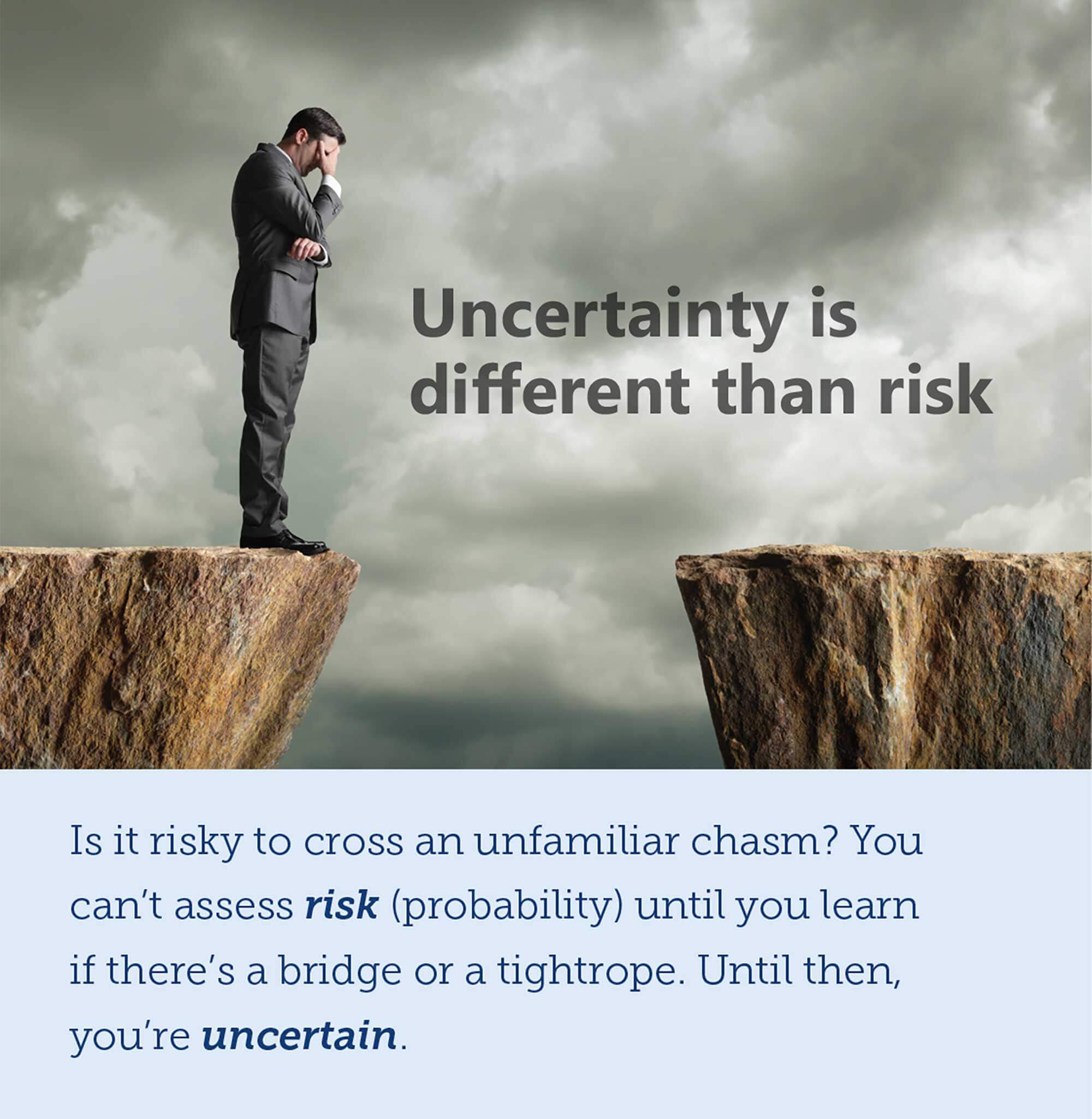

Uncertainty is different than risk: Many companies fear uncertainty, associating it with risk. But risk and uncertainty are different beasts. Suppose you were asked to cross an unfamiliar chasm. Would that be risky? Hard to say. You can’t assess risk (which assigns a probability to the downside) unless you know if you’ll be facing a tightrope or a sturdy bridge. Until then, you’re simply uncertain. This isn’t just semantics. If you had a cost-efficient, structured approach to studying every chasm of interest, you’d a) know how to eliminate your uncertainty before crossing, and b) avoid undue risk, by simply opting out of chasms requiring tightropes or motorcycle ramps.

This is precisely how to pursue unfamiliar markets… with a structured approach for stripping away uncertainty. You’ll no longer shun unfamiliar markets, leaving sleepy incumbent suppliers to enjoy them in peace. Instead, you’ll know how to explore them quickly and cheaply, giving you an edge most competitors lack.

Of course, you could simply decide to keep focusing on your existing markets. But this often leads to incremental, not transformational innovation. A recent study examined high-performing companies, and found that 70% of their total return on investment came from transformational projects. (See white paper, Innovating in Unfamiliar Markets, page 3.) Develop skills to pursue unfamiliar markets and you’ll have unfettered innovation.

Why Blueprinting—by itself—isn’t enough

It’s sad but true: New Product Blueprinting can’t solve all of life’s problems. When pursuing unfamiliar markets, you need to boost your certainty in two areas: 1) what customers get now from incumbent suppliers, and 2) what they would like to get.

Through our fieldwork with Cameron and Associates, we have found that two proven methodologies must be “intertwined” to accomplish this: Discovery-Driven Planning and New Product Blueprinting. The former was introduced in one of the most popular Harvard Business Review articles of all time. (For more, see Innovating in Unfamiliar Markets, page 7.)

So what do customers in an unfamiliar market get now from incumbent suppliers? These suppliers have built up many competencies over the years: strong relationships, channels-to-market, responsive technical support, warranty history, production flexibility, returned-goods systems, high product uniformity, etc. These competencies may be so expected and taken for granted that existing customers don’t even mention them during Blueprinting interviews with a challenging supplier. Discovery-Driven Planning methods uncover a broad range of assumptions to test.

Figuring out how to match what customers get today is necessary, but not sufficient. As David Lloyd George said, “The most dangerous thing in the world is to leap a chasm in two jumps.” If your leap stops at matching—but not exceeding—incumbents’ offerings, why would customers buy from you? Will you drop your price? How would incumbent competitors with a great deal at stake respond to that?

Indeed, you will need to offer customers much greater value than what they now receive. Here’s where your “outsider” status may help you. Incumbent suppliers often become complacent, assuming they fully understand their customers’ needs. A challenger using New Product Blueprinting methods can actually understand what B2B customers would like to get better than incumbents.

Discovery Driven Planning + Blueprinting = Your Plan for Unfamiliar Markets

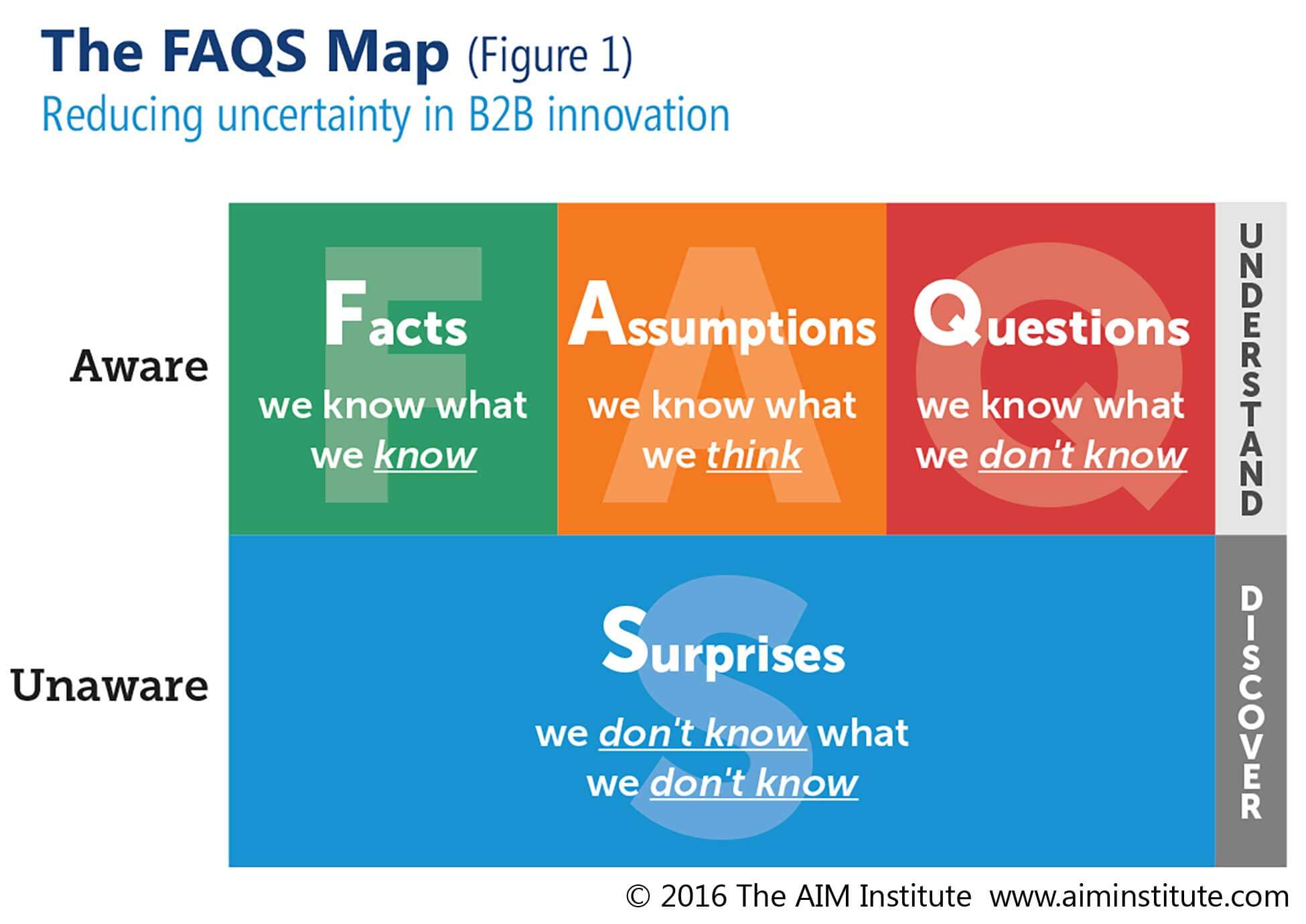

Earlier, I mentioned you’ll need a structured approach to driving out uncertainty in unfamiliar markets. This approach involves two types of learning: understanding and discovery. And it examines four elements…

- Facts—you know what you know

- Assumptions—you know what you think

- Questions—you know what you don’t know

- Surprises—you don’t know what you don’t know

For unfamiliar markets, we recommend a thorough process that incorporates both Discovery-Driven Planning and New Product Blueprinting. While we can’t go into the details here (for more, see Innovating in Unfamiliar Markets, page 12), here’s the essence of what you must do…

1. Identify everything you know or should know as either a Fact, Assumption or Question (using Consumption Chain and Assumption Mapping.) Your “understanding” goal will be to convert all the high-impact Assumptions and Questions into Facts.

2. Use divergent Discovery Interviews to uncover Surprises. Use all of your standard Blueprinting practices—digital projection, asking “what else,” etc.—to let prospects teach you what you didn’t know you didn’t know. Your “discovery” goal will be to convert Surprises into Facts.

3. Use these same Discovery Interviews to turn your Assumptions and Questions into Facts. To do this, use your normal Current State questions and Trigger Maps… but also have a side-list of questions you ask at appropriate points in the conversation. In our new cloud-enabled Blueprinter® software, we call these bonus questions.

4. After you have diverged to all outcomes of interest via qualitative Discovery interviews, conduct quantitative Preference interviews to develop Market Satisfaction Gaps on key outcomes. Now you’ll know precisely where to focus your innovation.

With this process, you’ll know what customers are now receiving from incumbent suppliers… a huge step toward eliminating risk in unfamiliar markets. Better yet, you’ll leap-frog incumbent suppliers’ insight on what customers would like to get. Do this well and you’ll get familiar with success in unfamiliar markets. We’re certain.

Unfamiliar Markets and More…

This is a big topic for a small article, so my apologies for just providing an overview. My co-authors, Alex van Putten, Ron Pierantozzi, and I invite you to read the entire white paper, Innovating in Unfamiliar Markets at AIM Whitepapers.

To further explore it, join us for one of our open Workshops or schedule a free consultation. Or, for a quick overview of the previously mentioned New Product Blueprinting process, check out this brief video.

Kamagra pharmacie en ligne: kamagra livraison 24h – acheter kamagra site fiable

Achetez vos kamagra medicaments Kamagra pharmacie en ligne acheter kamagra site fiable

Acheter Kamagra site fiable: Kamagra Oral Jelly pas cher – kamagra en ligne

https://kamagraprix.com/# Kamagra pharmacie en ligne

Pharmacie Internationale en ligne: Pharmacies en ligne certifiees – pharmacie en ligne fiable pharmafst.com

https://pharmafst.com/# pharmacie en ligne livraison europe

https://pharmafst.com/# pharmacie en ligne avec ordonnance

https://tadalmed.shop/# Acheter Cialis 20 mg pas cher

Kamagra Oral Jelly pas cher Acheter Kamagra site fiable Kamagra pharmacie en ligne

http://pharmafst.com/# acheter mГ©dicament en ligne sans ordonnance

Acheter Viagra Cialis sans ordonnance: cialis generique – Acheter Cialis tadalmed.shop

acheter mГ©dicament en ligne sans ordonnance: Meilleure pharmacie en ligne – Pharmacie en ligne livraison Europe pharmafst.com

Kamagra Commander maintenant: achat kamagra – Kamagra Commander maintenant

Pharmacie en ligne Cialis sans ordonnance Cialis sans ordonnance 24h Achat Cialis en ligne fiable tadalmed.com

http://kamagraprix.com/# Kamagra pharmacie en ligne

Kamagra Oral Jelly pas cher: acheter kamagra site fiable – Kamagra pharmacie en ligne

achat kamagra: acheter kamagra site fiable – acheter kamagra site fiable

http://tadalmed.com/# Pharmacie en ligne Cialis sans ordonnance

kamagra pas cher kamagra livraison 24h kamagra 100mg prix

cialis prix: Acheter Cialis – Achat Cialis en ligne fiable tadalmed.shop

Acheter Kamagra site fiable: kamagra livraison 24h – Kamagra Commander maintenant

pharmacie en ligne livraison europe: pharmacie en ligne france pas cher – п»їpharmacie en ligne france pharmafst.com

https://kamagraprix.com/# kamagra oral jelly

Cialis sans ordonnance pas cher cialis generique Cialis sans ordonnance 24h tadalmed.com

Pharmacie sans ordonnance: pharmacie en ligne sans ordonnance – pharmacie en ligne sans ordonnance pharmafst.com

http://pharmafst.com/# Achat mГ©dicament en ligne fiable

cialis generique: Tadalafil sans ordonnance en ligne – Tadalafil sans ordonnance en ligne tadalmed.shop

cialis sans ordonnance cialis prix Cialis sans ordonnance pas cher tadalmed.com

kamagra pas cher: Acheter Kamagra site fiable – Acheter Kamagra site fiable

http://pharmafst.com/# pharmacie en ligne fiable

Pharmacie en ligne Cialis sans ordonnance: Tadalafil sans ordonnance en ligne – cialis sans ordonnance tadalmed.shop

Kamagra Oral Jelly pas cher kamagra gel kamagra pas cher

Cialis en ligne: Tadalafil achat en ligne – Cialis sans ordonnance pas cher tadalmed.shop

https://pharmafst.com/# Achat mГ©dicament en ligne fiable

Acheter Viagra Cialis sans ordonnance: Tadalafil 20 mg prix en pharmacie – Cialis en ligne tadalmed.shop

Achat Cialis en ligne fiable: Tadalafil 20 mg prix en pharmacie – Tadalafil 20 mg prix en pharmacie tadalmed.shop

kamagra gel Achetez vos kamagra medicaments kamagra 100mg prix

achat kamagra: acheter kamagra site fiable – Kamagra Oral Jelly pas cher

https://tadalmed.com/# cialis sans ordonnance

Tadalafil sans ordonnance en ligne: Cialis sans ordonnance pas cher – Tadalafil achat en ligne tadalmed.shop

Cialis sans ordonnance 24h: Cialis generique prix – Tadalafil 20 mg prix en pharmacie tadalmed.shop

pharmacie en ligne france fiable Meilleure pharmacie en ligne trouver un mГ©dicament en pharmacie pharmafst.shop

Cialis en ligne: Acheter Cialis 20 mg pas cher – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

https://kamagraprix.com/# kamagra gel

Pharmacie en ligne livraison Europe: pharmacie en ligne sans ordonnance – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

Acheter Kamagra site fiable: Achetez vos kamagra medicaments – achat kamagra

pharmacie en ligne avec ordonnance: pharmacie en ligne – pharmacie en ligne avec ordonnance pharmafst.com

Cialis sans ordonnance 24h: Acheter Viagra Cialis sans ordonnance – Cialis sans ordonnance 24h tadalmed.shop

http://kamagraprix.com/# Kamagra Commander maintenant

pharmacie en ligne fiable: pharmacie en ligne sans ordonnance – pharmacie en ligne france livraison internationale pharmafst.com

Pharmacie en ligne Cialis sans ordonnance: Tadalafil sans ordonnance en ligne – Cialis en ligne tadalmed.shop

http://tadalmed.com/# cialis sans ordonnance

Acheter Cialis 20 mg pas cher: Tadalafil sans ordonnance en ligne – Cialis sans ordonnance 24h tadalmed.shop

Kamagra Oral Jelly pas cher: kamagra pas cher – kamagra 100mg prix

https://kamagraprix.shop/# Kamagra Commander maintenant

pharmacie en ligne fiable: Pharmacie en ligne France – pharmacie en ligne france livraison internationale pharmafst.com

pharmacie en ligne livraison europe: Pharmacie en ligne France – vente de mГ©dicament en ligne pharmafst.com

https://pharmafst.com/# Pharmacie en ligne livraison Europe

Acheter Cialis 20 mg pas cher: Acheter Cialis – cialis prix tadalmed.shop

pharmacie en ligne france pas cher: Medicaments en ligne livres en 24h – pharmacie en ligne france livraison belgique pharmafst.com

https://pharmafst.com/# Pharmacie Internationale en ligne

Acheter Kamagra site fiable: kamagra 100mg prix – Kamagra Commander maintenant

Achat Cialis en ligne fiable: Tadalafil 20 mg prix en pharmacie – cialis generique tadalmed.shop

https://tadalmed.shop/# Cialis sans ordonnance pas cher

Pharmacie en ligne livraison Europe: Meilleure pharmacie en ligne – Pharmacie sans ordonnance pharmafst.com

cialis sans ordonnance: Tadalafil achat en ligne – cialis sans ordonnance tadalmed.shop

https://kamagraprix.com/# Kamagra pharmacie en ligne

achat kamagra: kamagra gel – kamagra oral jelly

acheter mГ©dicament en ligne sans ordonnance: pharmacie en ligne sans ordonnance – pharmacie en ligne livraison europe pharmafst.com

https://kamagraprix.com/# Acheter Kamagra site fiable

Kamagra pharmacie en ligne: kamagra oral jelly – Acheter Kamagra site fiable

Cialis generique prix: cialis sans ordonnance – Cialis sans ordonnance 24h tadalmed.shop

Achetez vos kamagra medicaments: kamagra pas cher – Kamagra pharmacie en ligne

olympe casino avis: casino olympe – olympe casino

olympe casino: olympe casino en ligne – olympe casino en ligne

https://olympecasino.pro/# olympe

olympe casino en ligne: olympe – olympe casino avis

olympe: casino olympe – casino olympe

casino olympe: olympe casino en ligne – olympe casino en ligne

olympe casino: olympe casino – olympe casino

olympe casino avis: olympe casino – olympe casino cresus

olympe: olympe casino cresus – olympe

olympe casino cresus: olympe – olympe

olympe casino: olympe casino cresus – olympe casino avis

olympe: olympe casino cresus – olympe casino cresus

olympe casino: olympe casino en ligne – olympe

olympe casino avis: olympe casino – olympe casino cresus

olympe casino avis: olympe casino cresus – olympe

olympe casino avis: olympe casino – casino olympe

olympe: olympe casino – olympe casino cresus

https://olympecasino.pro/# olympe

olympe casino: olympe casino cresus – olympe

olympe: casino olympe – casino olympe

olympe: casino olympe – casino olympe

olympe casino: casino olympe – casino olympe

casino olympe: olympe casino cresus – olympe casino

olympe casino: olympe casino avis – olympe casino cresus

casino olympe: olympe casino en ligne – olympe

olympe casino cresus: olympe – olympe casino

olympe casino avis: olympe casino – olympe casino

casino olympe: olympe casino en ligne – olympe casino cresus

olympe: olympe casino – casino olympe

olympe casino cresus: olympe casino cresus – casino olympe

casino olympe: olympe – casino olympe

https://olympecasino.pro/# olympe casino avis

olympe: casino olympe – olympe casino

olympe: casino olympe – casino olympe

olympe: olympe casino en ligne – olympe

olympe casino cresus: olympe – olympe casino

olympe casino cresus: casino olympe – olympe casino cresus

olympe casino: olympe casino en ligne – olympe casino en ligne

casino olympe: casino olympe – casino olympe

olympe casino en ligne: olympe – casino olympe

olympe casino: olympe casino cresus – olympe casino cresus

olympe casino avis: olympe casino cresus – olympe casino en ligne

olympe casino avis: casino olympe – olympe casino avis

olympe casino cresus: casino olympe – casino olympe

olympe casino en ligne: olympe casino cresus – olympe casino avis

olympe casino avis: olympe casino cresus – olympe casino cresus

https://olympecasino.pro/# olympe casino cresus

olympe: olympe casino – olympe casino en ligne

olympe casino cresus: olympe casino cresus – casino olympe

olympe casino avis: olympe casino avis – olympe casino avis

olympe casino: olympe casino – olympe

https://olympecasino.pro/# olympe casino cresus

olympe casino avis: olympe casino – olympe casino en ligne

olympe casino: olympe – casino olympe

https://olympecasino.pro/# olympe casino en ligne

legitimate canadian pharmacies: canada rx pharmacy – online canadian pharmacy

canada drugstore pharmacy rx: usa canada pharm – cheap canadian pharmacy online

usa canada pharm: USACanadaPharm – USACanadaPharm

trustworthy canadian pharmacy USACanadaPharm legitimate canadian pharmacy

http://usacanadapharm.com/# medication canadian pharmacy

safe online pharmacies in canada: USACanadaPharm – canadian pharmacy

USACanadaPharm: usa canada pharm – my canadian pharmacy review

https://usacanadapharm.com/# safe reliable canadian pharmacy

USACanadaPharm: USACanadaPharm – USACanadaPharm

usa canada pharm: usa canada pharm – usa canada pharm

USACanadaPharm usa canada pharm buying drugs from canada

canadian discount pharmacy http://usacanadapharm.com/# canadian pharmacy meds

pharmacy canadian

https://usacanadapharm.com/# best canadian pharmacy online

77 canadian pharmacy: usa canada pharm – onlinecanadianpharmacy 24

usa canada pharm: cheap canadian pharmacy – canadian pharmacy mall

USACanadaPharm cheapest pharmacy canada usa canada pharm

usa canada pharm: USACanadaPharm – USACanadaPharm

canadian pharmacy online reviews: usa canada pharm – usa canada pharm

https://usacanadapharm.shop/# usa canada pharm

USACanadaPharm: vipps approved canadian online pharmacy – canadian pharmacy near me

best online canadian pharmacy: usa canada pharm – canadian world pharmacy

USACanadaPharm canadian family pharmacy canadapharmacyonline

https://usacanadapharm.com/# canadianpharmacyworld com

usa canada pharm: canadian online pharmacy reviews – legitimate canadian mail order pharmacy

usa canada pharm: usa canada pharm – USACanadaPharm

USACanadaPharm: pharmacy com canada – usa canada pharm

canadian pharmacy no rx needed usa canada pharm buy canadian drugs

usa canada pharm: buying from canadian pharmacies – usa canada pharm

usa canada pharm USACanadaPharm USACanadaPharm

USACanadaPharm: usa canada pharm – canadian pharmacy online

usa canada pharm: pharmacy in canada – canadian pharmacy meds reviews

buy prescription drugs from india UsaIndiaPharm USA India Pharm

indian pharmacy paypal: USA India Pharm – indian pharmacy online

http://usaindiapharm.com/# best india pharmacy

indian pharmacies safe: USA India Pharm – indian pharmacies safe

UsaIndiaPharm: UsaIndiaPharm – best online pharmacy india

buy medicines online in india: buy medicines online in india – UsaIndiaPharm

reputable indian online pharmacy UsaIndiaPharm UsaIndiaPharm

https://usaindiapharm.com/# UsaIndiaPharm

UsaIndiaPharm: online shopping pharmacy india – UsaIndiaPharm

best india pharmacy: online shopping pharmacy india – USA India Pharm

http://usaindiapharm.com/# best online pharmacy india

UsaIndiaPharm: UsaIndiaPharm – USA India Pharm

UsaIndiaPharm USA India Pharm UsaIndiaPharm

top 10 online pharmacy in india: UsaIndiaPharm – UsaIndiaPharm

indian pharmacy online: USA India Pharm – USA India Pharm

top 10 online pharmacy in india: world pharmacy india – USA India Pharm

best online pharmacy india: best online pharmacy india – india pharmacy

best online pharmacy india Online medicine order USA India Pharm

USA India Pharm: top 10 online pharmacy in india – UsaIndiaPharm

USA India Pharm: USA India Pharm – pharmacy website india

USA India Pharm USA India Pharm UsaIndiaPharm

pharmacy website india: UsaIndiaPharm – UsaIndiaPharm

UsaIndiaPharm: USA India Pharm – india online pharmacy

UsaIndiaPharm: UsaIndiaPharm – online pharmacy india

UsaIndiaPharm: USA India Pharm – buy prescription drugs from india

best india pharmacy best india pharmacy USA India Pharm

mail order pharmacy india: indian pharmacy online – UsaIndiaPharm

reputable indian pharmacies: top 10 online pharmacy in india – pharmacy website india

UsaIndiaPharm: USA India Pharm – UsaIndiaPharm

indian pharmacy paypal USA India Pharm india pharmacy mail order

Online medicine order: indian pharmacy online – online shopping pharmacy india

https://usaindiapharm.shop/# USA India Pharm

UsaIndiaPharm: USA India Pharm – UsaIndiaPharm

UsaIndiaPharm: UsaIndiaPharm – UsaIndiaPharm

Us Mex Pharm usa mexico pharmacy UsMex Pharm

https://usmexpharm.com/# USMexPharm

mexican pharmacy: usa mexico pharmacy – USMexPharm

UsMex Pharm: Us Mex Pharm – mexican pharmacy

https://usmexpharm.com/# usa mexico pharmacy

certified Mexican pharmacy: Mexican pharmacy ship to USA – certified Mexican pharmacy

USMexPharm: certified Mexican pharmacy – mexican pharmacy

Mexican pharmacy ship to USA UsMex Pharm USMexPharm

https://usmexpharm.shop/# usa mexico pharmacy

usa mexico pharmacy: UsMex Pharm – usa mexico pharmacy

USMexPharm: Us Mex Pharm – mexican online pharmacies prescription drugs

https://usmexpharm.shop/# certified Mexican pharmacy

usa mexico pharmacy: usa mexico pharmacy – Us Mex Pharm

certified Mexican pharmacy usa mexico pharmacy mexican drugstore online

mexican pharmacy: Us Mex Pharm – certified Mexican pharmacy

medication from mexico pharmacy: usa mexico pharmacy – mexican mail order pharmacies

buying prescription drugs in mexico: purple pharmacy mexico price list – mexican pharmacy

UsMex Pharm mexican pharmacy usa mexico pharmacy

Us Mex Pharm: USMexPharm – usa mexico pharmacy

mexican pharmacy: USMexPharm – mexican pharmaceuticals online

Mexican pharmacy ship to USA: certified Mexican pharmacy – USMexPharm

UsMex Pharm mexican pharmacy USMexPharm

lisansl? casino siteleri: canlД± oyunlar – deneme bonusu veren siteler casinositeleri1st.com

bahis siteleri deneme bonusu: casibom – п»їcasino casibom1st.com

sweet bonanza siteleri: sweet bonanza giris – sweet bonanza yorumlar sweetbonanza1st.shop

sweet bonanza slot sweet bonanza slot sweet bonanza oyna sweetbonanza1st.com

guvenilir casino siteleri: deneme bonusu veren siteler – guvenilir casino siteleri casinositeleri1st.com

sweet bonanza 1st: sweet bonanza siteleri – sweet bonanza sweetbonanza1st.shop

internet kumar oyunu casibom giris bahis siteleri deneme bonusu casibom1st.shop

sweet bonanza yorumlar: sweet bonanza – sweet bonanza slot sweetbonanza1st.shop

sweet bonanza yorumlar: sweet bonanza oyna – sweet bonanza slot sweetbonanza1st.shop

deneme bonusu veren siteler: lisansl? casino siteleri – casino siteleri casinositeleri1st.com

tГјrkiye bahis siteleri: tГјm bet siteleri – slot casino siteleri casinositeleri1st.com

bedbo casibom casino tГјrkiye casibom1st.shop

sweet bonanza giris: sweet bonanza yorumlar – sweet bonanza siteleri sweetbonanza1st.shop

slot casino siteleri: deneme bonusu veren siteler – guvenilir casino siteleri casinositeleri1st.com

sweet bonanza oyna: sweet bonanza giris – sweet bonanza 1st sweetbonanza1st.shop

casinoda en Г§ok kazandД±ran oyun: casibom giris adresi – casinombet casibom1st.com

sweet bonanza yorumlar sweet bonanza 1st sweet bonanza yorumlar sweetbonanza1st.com

sweet bonanza giris: sweet bonanza oyna – sweet bonanza oyna sweetbonanza1st.shop

https://casinositeleri1st.com/# casino siteleri 2025

18siteler: casibom 1st – en gГјvenilir site casibom1st.com

sweet bonanza slot: sweet bonanza giris – sweet bonanza siteleri sweetbonanza1st.shop

orisbet casibom guncel adres gГјvenilir deneme bonusu veren siteler casibom1st.shop

sweet bonanza oyna: sweet bonanza oyna – sweet bonanza giris sweetbonanza1st.shop

casinomaxi: casibom giris adresi – kumar siteleri casibom1st.com

gГјvenilir illegal bahis siteleri: casibom resmi – kumar oynama siteleri casibom1st.com

sweet bonanza 1st sweet bonanza oyna sweet bonanza demo sweetbonanza1st.com

sweet bonanza slot: sweet bonanza demo – sweet bonanza giris sweetbonanza1st.shop

bahis siteleri deneme bonusu veren: casibom giris adresi – gГјvenilir oyun alma siteleri casibom1st.com

Clom Fast Pharm: Clom Fast Pharm – can you get generic clomid

http://clomfastpharm.com/# can i buy clomid

Clom Fast Pharm: Clom Fast Pharm – Clom Fast Pharm

where can i buy cheap clomid without insurance Clom Fast Pharm Clom Fast Pharm

ZithPharmOnline: zithromax 500mg price in india – generic zithromax azithromycin

https://predpharmnet.com/# buy prednisone from india

Pred Pharm Net: prednisone 5 mg tablet rx – Pred Pharm Net

amoxicillin no prescription: amoxicillin over counter – buy amoxicillin 500mg uk

https://clomfastpharm.shop/# how to buy clomid online

zithromax over the counter ZithPharmOnline ZithPharmOnline

Lisin Express: 60 lisinopril cost – lisinopril 20 mg no prescription

Pred Pharm Net: how to get prednisone without a prescription – Pred Pharm Net

https://clomfastpharm.shop/# where can i buy clomid

lisinopril 10 mg 12.5mg: lisinopril price in india – Lisin Express

cheap generic prednisone: Pred Pharm Net – where can i buy prednisone without prescription

can you get clomid now: Clom Fast Pharm – Clom Fast Pharm

zestoretic 20 mg Lisin Express Lisin Express

https://predpharmnet.com/# prednisone without a prescription

ZithPharmOnline: ZithPharmOnline – ZithPharmOnline

Clom Fast Pharm: Clom Fast Pharm – get clomid without rx

https://lisinexpress.com/# Lisin Express

iv prednisone [url=https://predpharmnet.com/#]buy 40 mg prednisone[/url] prednisone 5mg daily

Clom Fast Pharm: Clom Fast Pharm – cheap clomid without insurance

Pred Pharm Net: Pred Pharm Net – Pred Pharm Net

AmOnlinePharm: amoxicillin from canada – amoxicillin without rx

where to get clomid without rx: how can i get cheap clomid online – where to buy clomid without insurance

zestril generic: Lisin Express – lisinopril 40mg

Lisin Express lisinopril buy in canada zestoretic

amoxicillin tablet 500mg: amoxicillin from canada – AmOnlinePharm

Lisin Express: Lisin Express – ordering lisinopril without a prescription uk

can i order generic clomid for sale: Clom Fast Pharm – where can i get generic clomid without insurance

how to get zithromax over the counter: ZithPharmOnline – how to get zithromax online

Clom Fast Pharm clomid generics Clom Fast Pharm

cost of lisinopril in mexico: Lisin Express – lisinopril 15mg

prednisone 20 tablet: prednisone buy without prescription – prednisone prescription online

https://gocanadapharm.com/# safe canadian pharmacy

buy medicines online in india www india pharm reputable indian online pharmacy

the canadian pharmacy: GoCanadaPharm – canada drugstore pharmacy rx

canadian pharmacy 24h com: go canada pharm – online canadian pharmacy reviews

https://agbmexicopharm.shop/# Agb Mexico Pharm

buying prescription drugs in mexico online: mexican pharmaceuticals online – buying prescription drugs in mexico

safe online pharmacies in canada GoCanadaPharm canadian pharmacy 24

canadian pharmacy drugs online: reliable canadian online pharmacy – canadian family pharmacy

https://wwwindiapharm.shop/# www india pharm

best online pharmacies in mexico: п»їbest mexican online pharmacies – Agb Mexico Pharm

Agb Mexico Pharm: reputable mexican pharmacies online – purple pharmacy mexico price list

canada drug pharmacy escrow pharmacy canada canadapharmacyonline legit

medicine in mexico pharmacies: mexican pharmaceuticals online – Agb Mexico Pharm

canadian pharmacy no scripts: northern pharmacy canada – the canadian drugstore

http://gocanadapharm.com/# legitimate canadian mail order pharmacy

reputable canadian pharmacy: go canada pharm – onlinecanadianpharmacy 24

www india pharm india online pharmacy mail order pharmacy india

www india pharm: www india pharm – www india pharm

pharmacy canadian superstore: northwest canadian pharmacy – canadian valley pharmacy

buying prescription drugs in mexico: purple pharmacy mexico price list – п»їbest mexican online pharmacies

http://gocanadapharm.com/# 77 canadian pharmacy

pharmacy website india: www india pharm – п»їlegitimate online pharmacies india

mail order pharmacy india online shopping pharmacy india www india pharm

Agb Mexico Pharm: mexico drug stores pharmacies – Agb Mexico Pharm

canadian pharmacy 24h com: canada pharmacy world – pharmacies in canada that ship to the us

www india pharm top 10 online pharmacy in india www india pharm

best india pharmacy: www india pharm – Online medicine order

canadian pharmacy online: go canada pharm – the canadian pharmacy

https://apotekonlinerecept.shop/# Apoteket online

ApotheekMax: Apotheek online bestellen – Online apotheek Nederland met recept

online apotheek online apotheek ApotheekMax

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Apotheek online bestellen: Online apotheek Nederland met recept – Beste online drogist

apotek online: Apotek hemleverans idag – Apotek hemleverans idag

https://kamagrapotenzmittel.shop/# Kamagra Oral Jelly kaufen

Apoteket online apotek online apotek online recept

Kamagra Oral Jelly: Kamagra kaufen ohne Rezept – Kamagra Gel

Online apotheek Nederland met recept: Apotheek Max – de online drogist kortingscode

https://kamagrapotenzmittel.com/# Kamagra Oral Jelly

Apoteket online: apotek online recept – apotek online

Kamagra Original: Kamagra Original – Kamagra kaufen ohne Rezept

http://apotekonlinerecept.com/# apotek online

Kamagra kaufen ohne Rezept Kamagra Oral Jelly kaufen Kamagra Oral Jelly kaufen

Apotek hemleverans recept: apotek online – apotek pa nett

Betrouwbare online apotheek zonder recept: de online drogist kortingscode – ApotheekMax

http://apotekonlinerecept.com/# Apotek hemleverans recept

Apoteket online: Apoteket online – apotek pa nett

Online apotheek Nederland zonder recept: Apotheek Max – de online drogist kortingscode

apotek online Apotek hemleverans idag Apoteket online

https://kamagrapotenzmittel.com/# kamagra

Kamagra online bestellen: Kamagra Oral Jelly – Kamagra Oral Jelly

https://kamagrapotenzmittel.shop/# Kamagra Original

https://kamagrapotenzmittel.com/# Kamagra Oral Jelly

Apotek hemleverans recept: apotek pa nett – Apotek hemleverans idag

Kamagra Original kamagra Kamagra online bestellen

https://apotekonlinerecept.shop/# Apotek hemleverans recept

Kamagra kaufen: Kamagra Oral Jelly kaufen – Kamagra kaufen

https://kamagrapotenzmittel.shop/# Kamagra Oral Jelly kaufen

Kamagra online bestellen: Kamagra kaufen – Kamagra kaufen

ApotheekMax Beste online drogist Beste online drogist

Apotek hemleverans idag: apotek online recept – apotek pa nett

https://kamagrapotenzmittel.shop/# Kamagra Oral Jelly kaufen

пин ап казино зеркало – пин ап казино официальный сайт

cialis without a doctor prescription Buy Cialis online cialis without a doctor prescription

пин ап зеркало: https://pinupkz.life/

pinup 2025 – pinup 2025

пин ап: https://pinupkz.life/

пин ап зеркало – пин ап вход

buy cialis pill cialis for sale buy cialis pill

пинап казино – пин ап казино

пин ап зеркало: https://pinupkz.life/

пин ап казино официальный сайт – pinup 2025

pinup 2025: https://pinupkz.life/

пин ап казино – pinup 2025

Kamagra Kopen kamagra pillen kopen kamagra gel kopen

пин ап зеркало: https://pinupkz.life/

пин ап казино официальный сайт – пин ап

пин ап: https://pinupkz.life/

пин ап зеркало – пинап казино

п»їcialis generic Tadalafil Easy Buy Tadalafil Easy Buy

пинап казино – пин ап казино

пинап казино: https://pinupkz.life/

pinup 2025 – пин ап казино официальный сайт

pinup 2025: https://pinupkz.life/

Tadalafil Easy Buy TadalafilEasyBuy.com Cialis 20mg price

http://tadalafileasybuy.com/# cialis without a doctor prescription

Generic100mgEasy: buy generic 100mg viagra online – buy generic 100mg viagra online

kamagra 100mg kopen: kamagra jelly kopen – Kamagra

https://tadalafileasybuy.shop/# Tadalafil Tablet

best price for viagra 100mg: Generic 100mg Easy – Generic100mgEasy

Tadalafil Easy Buy: TadalafilEasyBuy.com – Buy Tadalafil 10mg

kamagra pillen kopen kamagra 100mg kopen kamagra 100mg kopen

https://kamagrakopen.pro/# KamagraKopen.pro

Sildenafil Citrate Tablets 100mg: Generic 100mg Easy – buy generic 100mg viagra online

https://kamagrakopen.pro/# kamagra pillen kopen

Tadalafil Easy Buy Tadalafil Easy Buy п»їcialis generic

kamagra gel kopen: Kamagra – kamagra gel kopen

https://tadalafileasybuy.shop/# cialis without a doctor prescription

kamagra jelly kopen: kamagra 100mg kopen – kamagra kopen nederland

https://tadalafileasybuy.shop/# Tadalafil Easy Buy

Generic100mgEasy Generic100mgEasy Generic100mgEasy

https://kamagrakopen.pro/# Kamagra Kopen Online

Cialis 20mg price in USA: Tadalafil Easy Buy – TadalafilEasyBuy.com

https://kamagrakopen.pro/# kamagra kopen nederland

Officiele Kamagra van Nederland KamagraKopen.pro Kamagra Kopen

buy generic 100mg viagra online: Generic100mgEasy – buy generic 100mg viagra online

https://kamagrakopen.pro/# kamagra gel kopen

kamagra gel kopen: Kamagra Kopen – kamagra 100mg kopen

https://tadalafileasybuy.shop/# cialis without a doctor prescription

Generic100mgEasy buy generic 100mg viagra online Generic100mgEasy

KamagraKopen.pro: kamagra kopen nederland – kamagra 100mg kopen

https://kamagrakopen.pro/# kamagra pillen kopen

Tadalafil Easy Buy: cialis without a doctor prescription – cialis without a doctor prescription

https://kamagrakopen.pro/# kamagra pillen kopen

Kamagra Kopen: kamagra 100mg kopen – kamagra pillen kopen

kamagra kopen nederland kamagra kopen nederland kamagra kopen nederland

canadian pharmacy online: certified canada pharmacy online – canadian pharmacy 1 internet online drugstore

https://mexicanpharminter.com/# MexicanPharmInter

legitimate canadian pharmacy

http://indiamedfast.com/# India Med Fast

India Med Fast: lowest prescription prices online india – online medicine shopping in india

https://indiamedfast.shop/# IndiaMedFast

best canadian pharmacy online

reputable canadian online pharmacies: Certified International Pharmacy Online – legit canadian pharmacy online

mexican pharmacy online mexican pharmacy online mexican pharmacy online

IndiaMedFast: order medicines online india – buying prescription drugs from india

https://indiamedfast.com/# online pharmacy india

pharmacy com canada

trustworthy canadian pharmacy Online pharmacy USA canadian pharmacy phone number

India Med Fast: online medicine shopping in india – India Med Fast

https://indiamedfast.shop/# india pharmacy without prescription

legal canadian pharmacy online

https://mexicanpharminter.com/# Mexican Pharm Inter

India Med Fast: IndiaMedFast.com – india online pharmacy store

https://interpharmonline.shop/# canadian pharmacy phone number

best canadian pharmacy online

india online pharmacy store cheapest online pharmacy india India Med Fast

canadian pharmacy antibiotics: highest rated canadian online pharmacy – canadianpharmacymeds

https://interpharmonline.shop/# drugs from canada

cheap canadian pharmacy online

canada rx pharmacy: canada pharmacy no prescription – escrow pharmacy canada

https://indiamedfast.com/# india online pharmacy store

canadian family pharmacy

buying prescription drugs from india cheapest online pharmacy india online pharmacy india

Mexican Pharm Inter: reliable mexican pharmacies – mexican drug stores online

https://indiamedfast.shop/# IndiaMedFast.com

canadian pharmacy india

alo789 dang nh?p: alo789in – dang nh?p alo789

Your article helped me a lot, is there any more related content? Thanks!