The Inputs to Innovation for B2B

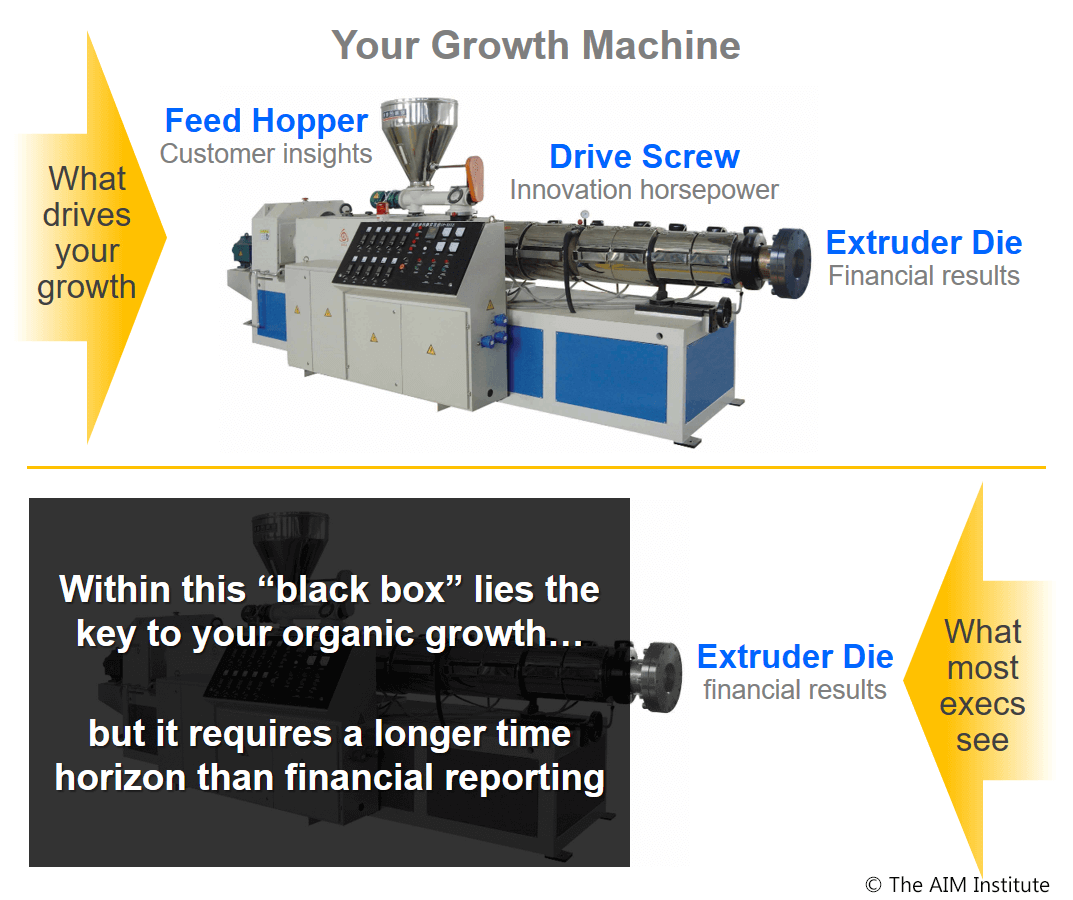

When I was a freshly-minted chemical engineer, my first job was night-shift foreman overseeing a nitrile rubber extruder. Every hour I would take a sample coming out of the extruder die to make sure it was within specification. If it was out of spec, did I stand at the extruder die and exhort it to do a better job? Of course not. I examined the raw material going into the feed hopper, and I checked the horsepower and heat going into the drive screw. Years later, I see parallels for getting the inputs to innovation correct.

Extruder Die: This represents your financial results. High rate & quality from the extruder die correlates to top-line growth and profitability in your business.

Feed Hopper: Unbiased, unfiltered insight into customers’ needs is critical. You simply cannot extrude good product with defective raw material.

Drive Screw: Serious horsepower is needed to transform raw material into high-value product. You need skilled, focused people to “power” your innovation.

During financial review meetings, you’re looking at the extruder die output. But for what purpose? If the goal is simply to improve this quarter’s financial results, you have a time horizon problem.

There is little you can do this year to impact profitable, sustainable growth this year.

The Inputs to Innovation and…. time horizon

There is little you can do this year to impact profitable, sustainable growth this year. What comes out of your extruder die today entered the feed hopper years ago. What you did 3-5 years ago has a huge impact today. What you do now has little impact today. The more time you give yourself, the longer your lever. And long levers are good for moving something big… like your company.

Sure, you can take actions this year to impact financial performance this year… but they may well detract from profitable, sustainable growth overall. If you want to keep battling growth and profitability crises every quarter for the rest of your career… obsessing with financial reviews is just the way to spend your time.

For serious growth, you can’t treat your growth machine like a “black box.” You must examine what’s really going on inside. Beyond project reviews and R&D budget talks, much closer examination is needed… especially concerning capabilities.

Fixing the inputs to innovation (to your “feed hopper)

The typical B2B supplier has terrible insight into customer needs. In our recent benchmarking study, project teams were asked how much Blueprinting interviews impacted their new product design. Over 80% said “greatly” or “significantly.” (See Preference Interview Research Report, page 10.)

This means the teams would have developed a different product without these interviews. Their products would have suffered errors of omission (overlooking customer outcomes) and errors of commission (focusing on the wrong outcomes.) In other words… defective raw material into the feed hopper. Bad inputs to innovation can’t end with good results.

I’d ask business leaders for their growth machine repair plan.

What would you do if you were the CEO? Hope your direct reports fix their feed hoppers and drive screws? I wouldn’t. If they weren’t already showing strong, reliable growth, I’d ask business leaders for their growth machine repair plan.

If this seems overbearing, remember your fiduciary duty isn’t to win quarterly battles on the way to losing the war. Financial reports won’t tell you if a business is eating its seed corn or preparing for a bountiful harvest. To your accounting system, $100K of innovation training looks the same as a $100K boondoggle. So you must get inside the growth machine to see how it operates, not just what comes out.

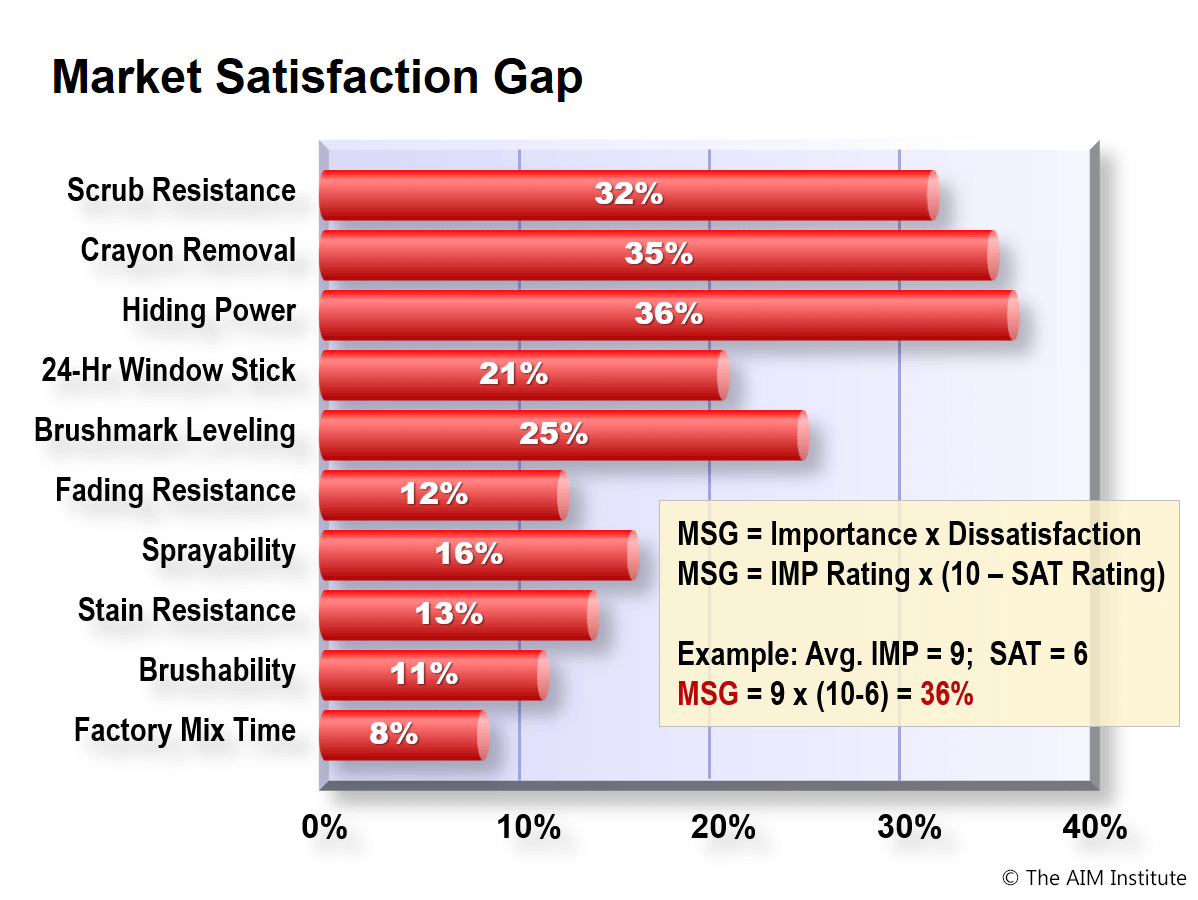

Your repair plan should start by eliminating R&D based on assumed customer needs. Here’s how: During Preference interviews, customers give 1-10 ratings for importance and satisfaction on key outcomes. They’ll only pay a premium for products that satisfy outcomes both important and unsatisfied today. Such outcomes have a Market Satisfaction Gap of 30% or more. This tells you precisely what your R&D should work on. If the inputs to innovation are correct, you can then trust the rest of your organization to process them into something…. desirable.

A growth-oriented business leader might commit to the CEO, “By year-end, we won’t begin work on any project with an R&D spend of $1 million or more unless we have unfiltered, quantitative customer data (e.g. Market Satisfaction Gaps). Next year, the hurdle will be a $500K spend.”

Fixing your drive screw

New Product Blueprinting is all about the feed hopper: B2B customer insight. But it’s not enough. Customer insight is necessary, but not sufficient. You can forget about real growth if you lack the horsepower to convert customer needs into innovative products.

What does real innovation horsepower look like? Teams are motivated to succeed as a team. They have mastered innovation skills and tools. They devote enough time to rapidly advance their project. This type of innovation horsepower is rare.

Far more common is massive internal friction inside the “black box.”

Far more common is massive internal friction inside the “black box.” Like a poorly-fitted extruder, your business puts enormous energy into turning the screw… but has little to show for it. Here are four examples:

1. Available time: Since the Great Recession, we see fewer people doing more work. I sometimes ask workshop attendees, “What did your boss take off your plate so you could learn these new skills?” Always good for a chuckle. The “tyranny of the urgent” hinders important progress. Even if team members devote enough time “on paper,” they often lack the flexibility to act when the task requires attention. Research by Michael George (Fast Innovation, p. 55) indicates lead times are four times as long for those at 95% capacity utilization vs. 65%. Time is one of your inputs to innovation.

2. Required skills: Too many teams work inefficiently. Companies that invest to improve manufacturing productivity often lag in training to improve innovation productivity. As a result, teams use out-of-date voice-of-customer methods… develop customer-reactive products instead of market-proactive ones… leave money on the table when pricing, etc. Skills and knowledge are inputs to innovation. Make sure your folks have the training they need to succeed.

3. Team motivation: Instead of true teams, many are just meetings of “emissaries visiting from foreign functional areas.” Teams that drive innovation share these traits: a) Management clearly signals this is a top priority, b) the team leader is highly-capable and enthusiastic, c) team success impacts personal performance reviews, and d) team members are excited about being part of this team. Team motivations are inputs to innovation.

Does your organization exhibit this kind of attention deficit disorder?

4. Organizational disruptions: Many teams begin with high hopes, only to be frustrated by organizational turmoil. A travel ban causes confusion as to which trips are authorized. Spending freezes delay important work. The latest reorganization creates uncertainty until the “dust settles.” New initiatives overshadow or kill the team’s project. Key team members are given new assignments. Does your organization exhibit this kind of attention deficit disorder? If so, it’s not going to see the smooth and efficient transformation of customer insight into customer value. Disruptions are, unfortunately, also inputs to innovation…. and not the desirable kind.

Is there hope?

I hope I haven’t left you crestfallen. If you are willing to change your time horizon, you can transform this dismal state of affairs into a strong competitive advantage:

First, this is something you can control. These problems can be fixed by a leadership team that moves beyond the extruder die into the black box. Unless your leaders are just in this for their short-term personal gain—uncommon in my experience—there is hope.

Second, Wall Street will want you to change. In Makers and Takers: The Rise of Finance and the Fall of American Business, Rana Foroohar explains that finance once worked for business… and now business works for finance. But Wall Street is realizing its mistake in driving short-term focus. In a scorching letter to CEO’s, Larry Fink, CEO of BlackRock (the world’s biggest investor) said, “Today’s culture of quarterly earnings hysteria is totally contrary to the long-term approach we need.”

Third, the problem is so severe today that even modest repairs will work wonders. Some research indicates half of R&D is squandered on failed projects. With proper customer insight, you might double your R&D productivity. Bottom line: Don’t spend R&D resources unless you know they’re only pursuing outcomes customers care about. Expect the results to reflect the quality of the given inputs of innovation.

You probably have time to pull ahead of your competitors.

Fourth, you probably have time to pull ahead of your competitors. At The AIM Institute, we have a broad perspective that comes from working in nearly every imaginable B2B industry around the world. We have yet to see a firm that was already getting this right.

If your company is willing to adopt a longer time horizon, it can build a machine that will drive profitable, sustainable, organic growth. Instead of engaging in a spectator sport at the extruder die, you’ll be making a difference in a participant sport. The “future you” will thank the “you” reading this now.

canadian pharmacy world: USACanadaPharm – canada pharmacy

best online canadian pharmacy: USACanadaPharm – USACanadaPharm

canada drug pharmacy [url=https://usacanadapharm.shop/#]USACanadaPharm[/url] pharmacy wholesalers canada

canada rx pharmacy world: canadian pharmacy drugs online – usa canada pharm

http://usacanadapharm.com/# canadian pharmacy online store

USACanadaPharm: usa canada pharm – USACanadaPharm

usa canada pharm: canada online pharmacy – onlinecanadianpharmacy 24

USACanadaPharm: onlinecanadianpharmacy 24 – pharmacy com canada

https://usacanadapharm.shop/# usa canada pharm

usa canada pharm: USACanadaPharm – usa canada pharm

USACanadaPharm [url=https://usacanadapharm.shop/#]USACanadaPharm[/url] canada drugs online review

pharmacy wholesalers canada: USACanadaPharm – USACanadaPharm

canadian pharmacies comparison: canadian family pharmacy – usa canada pharm

https://usacanadapharm.shop/# adderall canadian pharmacy

usa canada pharm: canadian pharmacy meds – usa canada pharm

usa canada pharm [url=http://usacanadapharm.com/#]USACanadaPharm[/url] rate canadian pharmacies

canadian pharmacy no scripts: USACanadaPharm – usa canada pharm

https://usacanadapharm.shop/# canadian pharmacy ltd

USACanadaPharm: usa canada pharm – online canadian pharmacy

UsaIndiaPharm: buy medicines online in india – USA India Pharm

https://usaindiapharm.shop/# USA India Pharm

india pharmacy: п»їlegitimate online pharmacies india – Online medicine home delivery

reputable indian online pharmacy [url=https://usaindiapharm.shop/#]UsaIndiaPharm[/url] top 10 pharmacies in india

п»їlegitimate online pharmacies india: best india pharmacy – top 10 pharmacies in india

UsaIndiaPharm: mail order pharmacy india – india pharmacy mail order

https://usaindiapharm.shop/# UsaIndiaPharm

india pharmacy mail order: UsaIndiaPharm – USA India Pharm

UsaIndiaPharm: indian pharmacy online – buy prescription drugs from india

UsaIndiaPharm: buy prescription drugs from india – UsaIndiaPharm

buy prescription drugs from india [url=https://usaindiapharm.com/#]top online pharmacy india[/url] reputable indian pharmacies

http://usaindiapharm.com/# buy prescription drugs from india

top online pharmacy india: buy medicines online in india – UsaIndiaPharm

indian pharmacy paypal: USA India Pharm – USA India Pharm

USA India Pharm: indian pharmacies safe – USA India Pharm

https://usaindiapharm.shop/# USA India Pharm

top 10 online pharmacy in india: buy medicines online in india – pharmacy website india

USA India Pharm [url=https://usaindiapharm.shop/#]UsaIndiaPharm[/url] reputable indian pharmacies

USA India Pharm: USA India Pharm – buy prescription drugs from india

https://usaindiapharm.com/# world pharmacy india

india pharmacy mail order: india online pharmacy – UsaIndiaPharm

USA India Pharm: best india pharmacy – USA India Pharm

top 10 online pharmacy in india: UsaIndiaPharm – USA India Pharm

https://usaindiapharm.com/# UsaIndiaPharm

UsaIndiaPharm: USA India Pharm – USA India Pharm

UsaIndiaPharm [url=https://usaindiapharm.com/#]reputable indian pharmacies[/url] Online medicine order

USA India Pharm: online pharmacy india – reputable indian pharmacies

Online medicine home delivery: Online medicine order – reputable indian online pharmacy

http://usaindiapharm.com/# USA India Pharm

indian pharmacy online: UsaIndiaPharm – UsaIndiaPharm

USA India Pharm: USA India Pharm – UsaIndiaPharm

top 10 pharmacies in india: reputable indian online pharmacy – USA India Pharm

cheapest online pharmacy india [url=https://usaindiapharm.shop/#]top online pharmacy india[/url] best india pharmacy

http://usaindiapharm.com/# UsaIndiaPharm

mail order pharmacy india: UsaIndiaPharm – USA India Pharm

best online pharmacy india: UsaIndiaPharm – reputable indian pharmacies

USA India Pharm: UsaIndiaPharm – UsaIndiaPharm

http://usaindiapharm.com/# reputable indian online pharmacy

Online medicine order: UsaIndiaPharm – UsaIndiaPharm

online shopping pharmacy india: USA India Pharm – india pharmacy

indian pharmacy paypal: cheapest online pharmacy india – top online pharmacy india

india online pharmacy [url=https://usaindiapharm.com/#]indian pharmacy paypal[/url] mail order pharmacy india

indian pharmacy: india pharmacy mail order – UsaIndiaPharm

https://usaindiapharm.shop/# online shopping pharmacy india

UsaIndiaPharm: UsaIndiaPharm – top online pharmacy india

best online pharmacy india: UsaIndiaPharm – UsaIndiaPharm

indian pharmacy paypal: USA India Pharm – UsaIndiaPharm

https://usaindiapharm.com/# USA India Pharm

UsaIndiaPharm [url=https://usaindiapharm.com/#]online pharmacy india[/url] USA India Pharm

indian pharmacies safe: UsaIndiaPharm – USA India Pharm

india pharmacy: india pharmacy – cheapest online pharmacy india

indian pharmacy: UsaIndiaPharm – Online medicine home delivery

http://usmexpharm.com/# Us Mex Pharm

UsMex Pharm: Us Mex Pharm – usa mexico pharmacy

USMexPharm: Us Mex Pharm – Mexican pharmacy ship to USA

Mexican pharmacy ship to USA: mexican pharmacy – mexican pharmacy

mexican pharmacy [url=https://usmexpharm.com/#]Us Mex Pharm[/url] UsMex Pharm

https://usmexpharm.shop/# UsMex Pharm

UsMex Pharm: Us Mex Pharm – Mexican pharmacy ship to USA

UsMex Pharm: Us Mex Pharm – USMexPharm

mexican pharmacy: UsMex Pharm – USMexPharm

Us Mex Pharm: mexican pharmacy – USMexPharm

http://usmexpharm.com/# UsMex Pharm

USMexPharm: UsMex Pharm – USMexPharm

usa mexico pharmacy [url=https://usmexpharm.shop/#]Mexican pharmacy ship to USA[/url] UsMex Pharm

usa mexico pharmacy: Us Mex Pharm – usa mexico pharmacy

mexican pharmacy: USMexPharm – mexican pharmacy

http://usmexpharm.com/# certified Mexican pharmacy

usa mexico pharmacy: UsMex Pharm – usa mexico pharmacy

Us Mex Pharm: Mexican pharmacy ship to USA – mexican rx online

Us Mex Pharm: mexican pharmacy – mexican pharmacy

mexican pharmacy [url=https://usmexpharm.shop/#]purple pharmacy mexico price list[/url] usa mexico pharmacy

https://usmexpharm.com/# UsMex Pharm

reputable mexican pharmacies online: USMexPharm – Mexican pharmacy ship to USA

UsMex Pharm: usa mexico pharmacy – usa mexico pharmacy

mexican pharmacy: UsMex Pharm – certified Mexican pharmacy

http://usmexpharm.com/# UsMex Pharm

Mexican pharmacy ship to USA: Mexican pharmacy ship to USA – mexican pharmacy

mexican pharmacy: mexican pharmacy – usa mexico pharmacy

usa mexico pharmacy [url=http://usmexpharm.com/#]Mexican pharmacy ship to USA[/url] mexican pharmacy

Mexican pharmacy ship to USA: medication from mexico pharmacy – mexico drug stores pharmacies

certified Mexican pharmacy: Mexican pharmacy ship to USA – Us Mex Pharm

https://usmexpharm.shop/# certified Mexican pharmacy

Us Mex Pharm: Mexican pharmacy ship to USA – certified Mexican pharmacy

Mexican pharmacy ship to USA: USMexPharm – usa mexico pharmacy

Mexican pharmacy ship to USA: USMexPharm – usa mexico pharmacy

https://usmexpharm.com/# mexico pharmacies prescription drugs

Us Mex Pharm: UsMex Pharm – usa mexico pharmacy

sweet bonanza slot: sweet bonanza giris – sweet bonanza slot sweetbonanza1st.shop

lisansl? casino siteleri: slot casino siteleri – casino siteleri 2025 casinositeleri1st.com

en iyi bet siteleri: casibom 1st – deneme bonusu bahis siteleri casibom1st.com

casino siteleri 2025: bahis oyun siteleri – deneme bonusu veren siteler casinositeleri1st.com

yasal casino siteleri [url=http://casibom1st.com/#]casibom guncel adres[/url] ilk giriЕџte bonus veren bahis siteleri casibom1st.shop

https://casinositeleri1st.shop/# casino siteleri 2025

dГјnyanД±n en iyi bahis siteleri: casibom mobil giris – Г§evrim ЕџartsД±z deneme bonusu veren siteler 2025 casibom1st.com

yasal kumar oyunlarД±: casibom mobil giris – tГјrkiye casino siteleri casibom1st.com

sweet bonanza yorumlar: sweet bonanza – sweet bonanza sweetbonanza1st.shop

yeni casino siteleri: casibom giris – curacao lisans siteleri casibom1st.com

canlД± bahis siteleri: casibom giris adresi – en gГјvenilir yatД±rД±m siteleri casibom1st.com

guvenilir casino siteleri [url=https://casinositeleri1st.shop/#]lisansl? casino siteleri[/url] bahis oyun siteleri casinositeleri1st.shop

casino siteleri 2025: casino siteleri 2025 – casino siteleri 2025 casinositeleri1st.com

https://sweetbonanza1st.shop/# sweet bonanza siteleri

kazino online: casibom guncel giris – п»їcasino casibom1st.com

gore siteler: casibom guncel giris – bonus veren site casibom1st.com

deneme bonusu veren siteler: slot casino siteleri – guvenilir casino siteleri casinositeleri1st.com

discount casД±no: casibom giris – como bakery yorumlarД± casibom1st.com

bonus slot: casibom giris – superbeting casibom1st.com

sweet bonanza [url=http://sweetbonanza1st.com/#]sweet bonanza yorumlar[/url] sweet bonanza demo sweetbonanza1st.com

casino bet gГјncel giriЕџ: casibom guncel giris – yeni gГјncel deneme bonusu veren siteler casibom1st.com

sweet bonanza slot: sweet bonanza siteleri – sweet bonanza giris sweetbonanza1st.shop

bet turkiye: casibom guncel giris – yeni bahis siteleri deneme bonusu casibom1st.com

casino siteleri: casino slot – lisansl? casino siteleri casinositeleri1st.com

casinomaxi: casibom resmi – en iyi kumar sitesi casibom1st.com

guvenilir casino siteleri: slot casino siteleri – casino siteleri 2025 casinositeleri1st.com

casino siteleri [url=https://casinositeleri1st.com/#]guvenilir casino siteleri[/url] deneme bonusu veren siteler casinositeleri1st.shop

sweet bonanza oyna: sweet bonanza slot – sweet bonanza giris sweetbonanza1st.shop

ilk Гјyelik deneme bonusu veren siteler: casibom giris adresi – deneme bonusu bahis siteleri casibom1st.com

deneme bonusu veren siteler: deneme bonusu veren siteler – deneme bonusu veren siteler casinositeleri1st.com

sweet bonanza 1st: sweet bonanza oyna – sweet bonanza yorumlar sweetbonanza1st.shop

deneme bonusu veren siteler: deneme bonusu veren siteler – deneme bonusu veren siteler casinositeleri1st.com

sweet bonanza 1st [url=http://sweetbonanza1st.com/#]sweet bonanza oyna[/url] sweet bonanza siteleri sweetbonanza1st.com

kaГ§ak bahis siteleri bonus veren: casibom guncel adres – deneme bonusu veren yeni siteler 2025 casibom1st.com

sweet bonanza oyna: sweet bonanza – sweet bonanza demo sweetbonanza1st.shop

https://casinositeleri1st.com/# slot casino siteleri

slot casino siteleri: casino siteleri – guvenilir casino siteleri casinositeleri1st.com

guvenilir casino siteleri: en gГјvenilir bahis – slot casino siteleri casinositeleri1st.com

yeni deneme bonusu veren siteler 2025: casibom giris adresi – casino slot online casibom1st.com

bonus veren bahis siteleri yasal [url=https://casibom1st.shop/#]casibom guncel adres[/url] sГјperbetine casibom1st.shop

curacao lisans siteleri: casibom mobil giris – son bahis gГјncel giriЕџ casibom1st.com

yurt dД±ЕџД± bahis sitesi: casibom – eski oyunlarД± oynama sitesi casibom1st.com

https://casinositeleri1st.shop/# casino siteleri

gГјvenilir oyun alma siteleri: casibom giris – free spin casino casibom1st.com

ZithPharmOnline: zithromax capsules price – zithromax for sale 500 mg

buy zithromax online: ZithPharmOnline – ZithPharmOnline

https://predpharmnet.com/# Pred Pharm Net

prednisone prescription online [url=http://predpharmnet.com/#]Pred Pharm Net[/url] Pred Pharm Net

AmOnlinePharm: order amoxicillin online uk – amoxicillin 500mg capsule buy online

Lisin Express: cost for generic lisinopril – Lisin Express

Lisin Express: zestril pill – Lisin Express

http://lisinexpress.com/# Lisin Express

prednisone 20mg for sale: prednisone 5084 – Pred Pharm Net

Lisin Express: lisinopril 20 mg canadian pharmacy – buy lisinopril 20 mg

Clom Fast Pharm: Clom Fast Pharm – can you get clomid without dr prescription

lisinopril 1.25 [url=https://lisinexpress.shop/#]prinivil[/url] rx drug lisinopril

Pred Pharm Net: prednisone buy without prescription – 80 mg prednisone daily

https://amonlinepharm.com/# AmOnlinePharm

lisinopril 20 mg canadian pharmacy: lisinopril online without a prescription – lisinopril 5 mg price in india

Clom Fast Pharm: Clom Fast Pharm – where can i buy generic clomid without prescription

Pred Pharm Net: Pred Pharm Net – prednisone tablets 2.5 mg

https://predpharmnet.com/# Pred Pharm Net

Pred Pharm Net: where can i get prednisone – Pred Pharm Net

AmOnlinePharm [url=http://amonlinepharm.com/#]AmOnlinePharm[/url] AmOnlinePharm

Pred Pharm Net: Pred Pharm Net – where to buy prednisone in australia

ZithPharmOnline: ZithPharmOnline – zithromax 1000 mg online

https://clomfastpharm.shop/# cost of clomid prices

AmOnlinePharm: AmOnlinePharm – AmOnlinePharm

AmOnlinePharm: AmOnlinePharm – buy amoxicillin online uk

zithromax z-pak: ZithPharmOnline – ZithPharmOnline

where to buy lisinopril 2.5 mg: lisinopril 2mg tablet – lisinopril 10 mg online

http://zithpharmonline.com/# generic zithromax 500mg

AmOnlinePharm [url=https://amonlinepharm.com/#]AmOnlinePharm[/url] AmOnlinePharm

AmOnlinePharm: AmOnlinePharm – AmOnlinePharm

AmOnlinePharm: buy amoxicillin online no prescription – amoxicillin generic

Pred Pharm Net: 50 mg prednisone tablet – Pred Pharm Net

http://lisinexpress.com/# lisinopril 1 mg

prednisone 10 mg price: buy prednisone online india – prednisone oral

Lisin Express: lisinopril 40 coupon – Lisin Express

ZithPharmOnline: ZithPharmOnline – where can you buy zithromax

amoxicillin 500mg for sale uk [url=http://amonlinepharm.com/#]AmOnlinePharm[/url] AmOnlinePharm

http://zithpharmonline.com/# ZithPharmOnline

lisinopril 2.5 pill: Lisin Express – lisinopril capsule

AmOnlinePharm: AmOnlinePharm – buy amoxicillin 500mg canada

AmOnlinePharm: AmOnlinePharm – buy amoxicillin 500mg uk

http://clomfastpharm.com/# where to get generic clomid pills

how to buy amoxycillin: AmOnlinePharm – buy amoxicillin online without prescription

Clom Fast Pharm [url=https://clomfastpharm.com/#]Clom Fast Pharm[/url] Clom Fast Pharm

AmOnlinePharm: AmOnlinePharm – AmOnlinePharm

where can i get generic clomid without insurance: Clom Fast Pharm – clomid sale

https://clomfastpharm.com/# can i buy clomid without rx

ZithPharmOnline: zithromax cost australia – zithromax 250 mg pill

www india pharm: www india pharm – indianpharmacy com

the canadian pharmacy: canadian pharmacy ltd – canadian pharmacy near me

canadian drugs online [url=http://gocanadapharm.com/#]GoCanadaPharm[/url] canada drugstore pharmacy rx

medicine in mexico pharmacies: mexico pharmacies prescription drugs – Agb Mexico Pharm

http://wwwindiapharm.com/# mail order pharmacy india

www india pharm: www india pharm – pharmacy website india

www india pharm: indianpharmacy com – world pharmacy india

mexican mail order pharmacies: Agb Mexico Pharm – mexican online pharmacies prescription drugs

http://agbmexicopharm.com/# medication from mexico pharmacy

mexican pharmaceuticals online [url=https://agbmexicopharm.com/#]medicine in mexico pharmacies[/url] Agb Mexico Pharm

www india pharm: www india pharm – www india pharm

cheap canadian pharmacy: go canada pharm – canadian online drugs

www india pharm: world pharmacy india – www india pharm

https://wwwindiapharm.com/# indianpharmacy com

ed meds online canada: go canada pharm – best canadian pharmacy to order from

Agb Mexico Pharm: Agb Mexico Pharm – Agb Mexico Pharm

reputable canadian pharmacy: go canada pharm – reputable canadian online pharmacy

Agb Mexico Pharm: Agb Mexico Pharm – mexican pharmaceuticals online

Agb Mexico Pharm [url=https://agbmexicopharm.shop/#]Agb Mexico Pharm[/url] п»їbest mexican online pharmacies

https://agbmexicopharm.com/# mexico pharmacies prescription drugs

best online pharmacy india: www india pharm – cheapest online pharmacy india

Online medicine home delivery: www india pharm – online shopping pharmacy india

Agb Mexico Pharm: Agb Mexico Pharm – п»їbest mexican online pharmacies

https://agbmexicopharm.com/# Agb Mexico Pharm

canadian pharmacy price checker: canadian world pharmacy – my canadian pharmacy review

mexico pharmacies prescription drugs: Agb Mexico Pharm – mexico pharmacies prescription drugs

purple pharmacy mexico price list [url=https://agbmexicopharm.shop/#]buying prescription drugs in mexico[/url] Agb Mexico Pharm

Online medicine home delivery: top 10 pharmacies in india – п»їlegitimate online pharmacies india

www india pharm: www india pharm – www india pharm

http://gocanadapharm.com/# online canadian pharmacy

Agb Mexico Pharm: Agb Mexico Pharm – mexico drug stores pharmacies

www india pharm: india online pharmacy – indian pharmacy paypal

Agb Mexico Pharm: mexico drug stores pharmacies – Agb Mexico Pharm

https://wwwindiapharm.shop/# www india pharm

india online pharmacy [url=https://wwwindiapharm.com/#]www india pharm[/url] www india pharm

india pharmacy: india pharmacy – www india pharm

reputable canadian pharmacy: cheapest pharmacy canada – canadian pharmacy no rx needed

buying prescription drugs in mexico: mexican pharmaceuticals online – Agb Mexico Pharm

https://agbmexicopharm.com/# Agb Mexico Pharm

cheapest online pharmacy india: www india pharm – www india pharm

best india pharmacy: buy medicines online in india – www india pharm

best india pharmacy [url=https://wwwindiapharm.shop/#]www india pharm[/url] Online medicine order

canadian pharmacy india: go canada pharm – canadian pharmacy com

https://agbmexicopharm.shop/# Agb Mexico Pharm

Online medicine home delivery: www india pharm – pharmacy website india

best online canadian pharmacy: GoCanadaPharm – canadian pharmacy king

http://apotheekmax.com/# Beste online drogist

Apotheek Max: Online apotheek Nederland zonder recept – Online apotheek Nederland zonder recept

https://apotheekmax.com/# Apotheek Max

Online apotheek Nederland met recept: de online drogist kortingscode – Betrouwbare online apotheek zonder recept

kamagra [url=https://kamagrapotenzmittel.com/#]kamagra[/url] Kamagra Original

http://apotheekmax.com/# de online drogist kortingscode

Beste online drogist: online apotheek – Apotheek online bestellen

apotek pa nett: apotek online recept – apotek online recept

https://apotekonlinerecept.com/# Apoteket online

https://apotheekmax.shop/# online apotheek

Kamagra Oral Jelly [url=http://kamagrapotenzmittel.com/#]Kamagra Oral Jelly[/url] kamagra

https://kamagrapotenzmittel.com/# Kamagra Original

Kamagra online bestellen: Kamagra Oral Jelly kaufen – Kamagra Oral Jelly

de online drogist kortingscode: de online drogist kortingscode – Apotheek Max

https://kamagrapotenzmittel.com/# Kamagra kaufen

https://apotheekmax.com/# Online apotheek Nederland met recept

Apotek hemleverans idag: Apoteket online – apotek online

kamagra: Kamagra Gel – Kamagra kaufen

Apotek hemleverans idag [url=http://apotekonlinerecept.com/#]apotek online[/url] Apotek hemleverans recept

https://kamagrapotenzmittel.shop/# Kamagra kaufen

https://apotekonlinerecept.com/# Apoteket online

online apotheek: Apotheek Max – Online apotheek Nederland met recept

de online drogist kortingscode: Online apotheek Nederland met recept – Apotheek Max

https://apotekonlinerecept.shop/# Apotek hemleverans idag

https://apotekonlinerecept.shop/# Apoteket online

http://apotheekmax.com/# Betrouwbare online apotheek zonder recept

Apotek hemleverans recept [url=https://apotekonlinerecept.com/#]Apotek hemleverans recept[/url] Apoteket online

ApotheekMax: de online drogist kortingscode – ApotheekMax

apotek online: apotek online – Apotek hemleverans idag

https://apotheekmax.shop/# Beste online drogist

https://apotheekmax.shop/# Online apotheek Nederland zonder recept

de online drogist kortingscode: Beste online drogist – Beste online drogist

apotek pa nett: Apotek hemleverans idag – Apotek hemleverans recept

https://apotheekmax.com/# online apotheek

Apotheek online bestellen [url=https://apotheekmax.com/#]de online drogist kortingscode[/url] Online apotheek Nederland met recept

https://apotekonlinerecept.shop/# apotek online recept

Betrouwbare online apotheek zonder recept: Apotheek Max – Online apotheek Nederland met recept

Kamagra Original: Kamagra kaufen – kamagra

https://kamagrapotenzmittel.shop/# kamagra

https://apotheekmax.com/# Apotheek online bestellen

http://kamagrapotenzmittel.com/# Kamagra Gel

Betrouwbare online apotheek zonder recept: Beste online drogist – de online drogist kortingscode

apotek online: Apoteket online – Apoteket online

Kamagra Original [url=http://kamagrapotenzmittel.com/#]Kamagra Oral Jelly[/url] Kamagra Oral Jelly

http://kamagrapotenzmittel.com/# Kamagra online bestellen

https://apotheekmax.shop/# Online apotheek Nederland met recept

apotek pa nett: Apoteket online – apotek pa nett

Kamagra Gel: Kamagra kaufen ohne Rezept – Kamagra Oral Jelly kaufen

https://apotheekmax.shop/# ApotheekMax

apotek online [url=http://apotekonlinerecept.com/#]apotek online recept[/url] Apoteket online

http://apotheekmax.com/# Online apotheek Nederland zonder recept

apotek online recept: Apoteket online – apotek online

Online apotheek Nederland zonder recept: Online apotheek Nederland zonder recept – online apotheek

пин ап зеркало – пинап казино

cialis without a doctor prescription [url=https://tadalafileasybuy.com/#]cialis without a doctor prescription[/url] Tadalafil Easy Buy

пин ап казино официальный сайт – пин ап казино официальный сайт

пин ап зеркало: https://pinupkz.life/

пин ап вход – пин ап казино официальный сайт

pinup 2025 – pinup 2025

пин ап казино: https://pinupkz.life/

пин ап казино официальный сайт – пин ап казино официальный сайт

Generic 100mg Easy [url=https://generic100mgeasy.shop/#]sildenafil over the counter[/url] cheapest viagra

пин ап – pinup 2025

пин ап вход: https://pinupkz.life/

пин ап вход – пинап казино

пин ап казино зеркало – пин ап казино официальный сайт

пин ап казино зеркало: https://pinupkz.life/

kamagra jelly kopen [url=https://kamagrakopen.pro/#]Kamagra Kopen[/url] kamagra pillen kopen

пин ап казино официальный сайт – пин ап вход

пин ап вход: https://pinupkz.life/

пин ап – пин ап казино официальный сайт

пинап казино – пинап казино

пинап казино: https://pinupkz.life/

пин ап – пин ап казино

kamagra pillen kopen [url=https://kamagrakopen.pro/#]Kamagra[/url] Kamagra Kopen

пин ап казино – пин ап казино официальный сайт

пинап казино: https://pinupkz.life/

пин ап – pinup 2025

пин ап казино – пин ап казино зеркало

https://generic100mgeasy.com/# Cheapest Sildenafil online

buy generic 100mg viagra online: Cheapest Sildenafil online – buy generic 100mg viagra online

buy generic 100mg viagra online: Generic100mgEasy – Generic 100mg Easy

https://kamagrakopen.pro/# Kamagra

Tadalafil Easy Buy [url=https://tadalafileasybuy.shop/#]TadalafilEasyBuy.com[/url] cialis without a doctor prescription

https://tadalafileasybuy.com/# Cialis over the counter

Generic 100mg Easy: Generic100mgEasy – Generic 100mg Easy

kamagra 100mg kopen: Kamagra – kamagra jelly kopen

https://kamagrakopen.pro/# Kamagra

http://tadalafileasybuy.com/# cialis without a doctor prescription

http://generic100mgeasy.com/# Generic 100mg Easy

buy generic 100mg viagra online [url=http://generic100mgeasy.com/#]Generic100mgEasy[/url] Generic100mgEasy

buy generic 100mg viagra online: Generic100mgEasy – Generic100mgEasy

TadalafilEasyBuy.com: TadalafilEasyBuy.com – Tadalafil Easy Buy

https://generic100mgeasy.shop/# buy generic 100mg viagra online

https://kamagrakopen.pro/# Kamagra Kopen Online

TadalafilEasyBuy.com: TadalafilEasyBuy.com – TadalafilEasyBuy.com

Generic 100mg Easy: cheap viagra – Generic100mgEasy

https://generic100mgeasy.shop/# Generic 100mg Easy

kamagra gel kopen [url=https://kamagrakopen.pro/#]kamagra gel kopen[/url] kamagra jelly kopen

kamagra pillen kopen: kamagra kopen nederland – kamagra jelly kopen

Generic100mgEasy: Generic 100mg Easy – Generic100mgEasy

https://tadalafileasybuy.shop/# Generic Tadalafil 20mg price

buy generic 100mg viagra online: buy generic 100mg viagra online – buy Viagra online

https://kamagrakopen.pro/# Kamagra Kopen Online

Generic100mgEasy: best price for viagra 100mg – Generic 100mg Easy

kamagra 100mg kopen [url=https://kamagrakopen.pro/#]Kamagra[/url] kamagra 100mg kopen

TadalafilEasyBuy.com: cialis without a doctor prescription – TadalafilEasyBuy.com

http://generic100mgeasy.com/# Generic 100mg Easy

https://tadalafileasybuy.com/# TadalafilEasyBuy.com

Generic 100mg Easy: Generic 100mg Easy – viagra canada

Generic 100mg Easy: Generic 100mg Easy – Generic100mgEasy

https://tadalafileasybuy.com/# Cheap Cialis

https://tadalafileasybuy.com/# TadalafilEasyBuy.com

cialis without a doctor prescription [url=https://tadalafileasybuy.com/#]Buy Tadalafil 5mg[/url] Buy Tadalafil 20mg

kamagra gel kopen: kamagra pillen kopen – kamagra jelly kopen

Generic 100mg Easy: Generic100mgEasy – generic sildenafil

https://kamagrakopen.pro/# kamagra 100mg kopen

https://tadalafileasybuy.com/# Tadalafil Easy Buy

Generic100mgEasy: Generic100mgEasy – Generic100mgEasy

https://generic100mgeasy.shop/# Cheap Viagra 100mg

Generic Cialis without a doctor prescription: cialis without a doctor prescription – TadalafilEasyBuy.com

TadalafilEasyBuy.com [url=https://tadalafileasybuy.shop/#]cialis without a doctor prescription[/url] Tadalafil Easy Buy

https://generic100mgeasy.com/# Generic 100mg Easy

Tadalafil Easy Buy: Tadalafil Easy Buy – Tadalafil Tablet

https://tadalafileasybuy.shop/# Tadalafil Easy Buy

buy generic 100mg viagra online: Generic100mgEasy – Generic 100mg Easy

https://kamagrakopen.pro/# kamagra kopen nederland

https://interpharmonline.shop/# canadian drugs

canadian neighbor pharmacy

Mexican Pharm Inter [url=http://mexicanpharminter.com/#]MexicanPharmInter[/url] reliable mexican pharmacies

http://indiamedfast.com/# online medicine shopping in india

buying prescription drugs from india: online medicine shopping in india – order medicines online india

canadian pharmacy 24 com: online canadian pharmacy no prescription – canadian pharmacy 1 internet online drugstore

https://indiamedfast.com/# online medicine shopping in india

canadian pharmacy drugs online

canadian pharmacy cheap: fda approved canadian online pharmacies – canadian mail order pharmacy

escrow pharmacy canada [url=https://interpharmonline.com/#]online canadian pharmacy no prescription[/url] onlinecanadianpharmacy 24

http://mexicanpharminter.com/# mexican pharmacy online order

best canadian online pharmacy

canadian pharmacy meds review: canadian drugstore online no prescription – canadian pharmacy world reviews

https://interpharmonline.shop/# canadian world pharmacy

buying drugs from canada: most reliable canadian online pharmacies – legitimate canadian pharmacy online

http://mexicanpharminter.com/# mexican pharmacy online

canadian world pharmacy

http://mexicanpharminter.com/# reliable mexican pharmacies

online pharmacy india [url=http://indiamedfast.com/#]india pharmacy without prescription[/url] online pharmacy india

cheapest online pharmacy india: cheapest online pharmacy india – order medicines online india

mexican pharmacy online: mexican pharmacy online store – mexican drug stores online

http://interpharmonline.com/# canadian 24 hour pharmacy

canadian pharmacy

https://interpharmonline.com/# canadian drug prices

online medicine shopping in india: online pharmacy india – IndiaMedFast

https://interpharmonline.com/# precription drugs from canada

medication canadian pharmacy

canadian pharmacy 24h com: online canadian pharmacy no prescription – legit canadian pharmacy online

mexican pharmacy online order [url=http://mexicanpharminter.com/#]mexican pharmacy online[/url] Mexican Pharm Inter

http://interpharmonline.com/# canada drugstore pharmacy rx

order medicines online india: india pharmacy without prescription – buying prescription drugs from india

http://indiamedfast.com/# IndiaMedFast.com

safe reliable canadian pharmacy

mexican pharmacy online order: reliable mexican pharmacies – Mexican Pharm Inter

https://mexicanpharminter.shop/# reliable mexican pharmacies

legitimate canadian pharmacy [url=http://interpharmonline.com/#]Pharmacies in Canada that ship to the US[/url] northwest pharmacy canada

https://interpharmonline.com/# maple leaf pharmacy in canada

canadian pharmacy 365

mexican pharmacy online order: reliable mexican pharmacies – buying from online mexican pharmacy

alo 789: alo 789 dang nh?p – alo789 chinh th?c