B2B vs B2C: Why B2B companies have advantages

When you consider B2B vs B2C, which market profession has greater advantages? Business schools offer more B2C courses, consumer research tools abound, and sophisticated marketers at B2C companies like Apple and P&G are held in high esteem. B2B marketers are often engineers or sales reps that were tapped on the shoulder and told to “do marketing.”

B2B marketers are often engineers or sales reps that were tapped on the shoulder and told to “do marketing.”

But here’s the B2B vs B2C paradox: B2B marketers receive less glory, but have more potential to drive organic growth. Why? Good marketing includes both an early stage and a late stage. While many focus on late-stage marketing (promotion), early-stage marketing is more critical. This is understanding customer needs so you can develop and promote a product that customers truly want.

Download white paper at www.B2BvsB2C.com

As we’ll see, B2B marketers can improve this understanding of customer needs more than their B2C counterparts. That’s because B2B customers have higher “engagement potential,” and can explain their needs very well. We’ll explore these B2B vs B2C topics:

- The Customer Insight Gap: Why B2B companies can elevate their understanding of customer needs more than B2C.

- B2B vs B2C Comparison: 12 Fundamental differences and their implications for B2B companies.

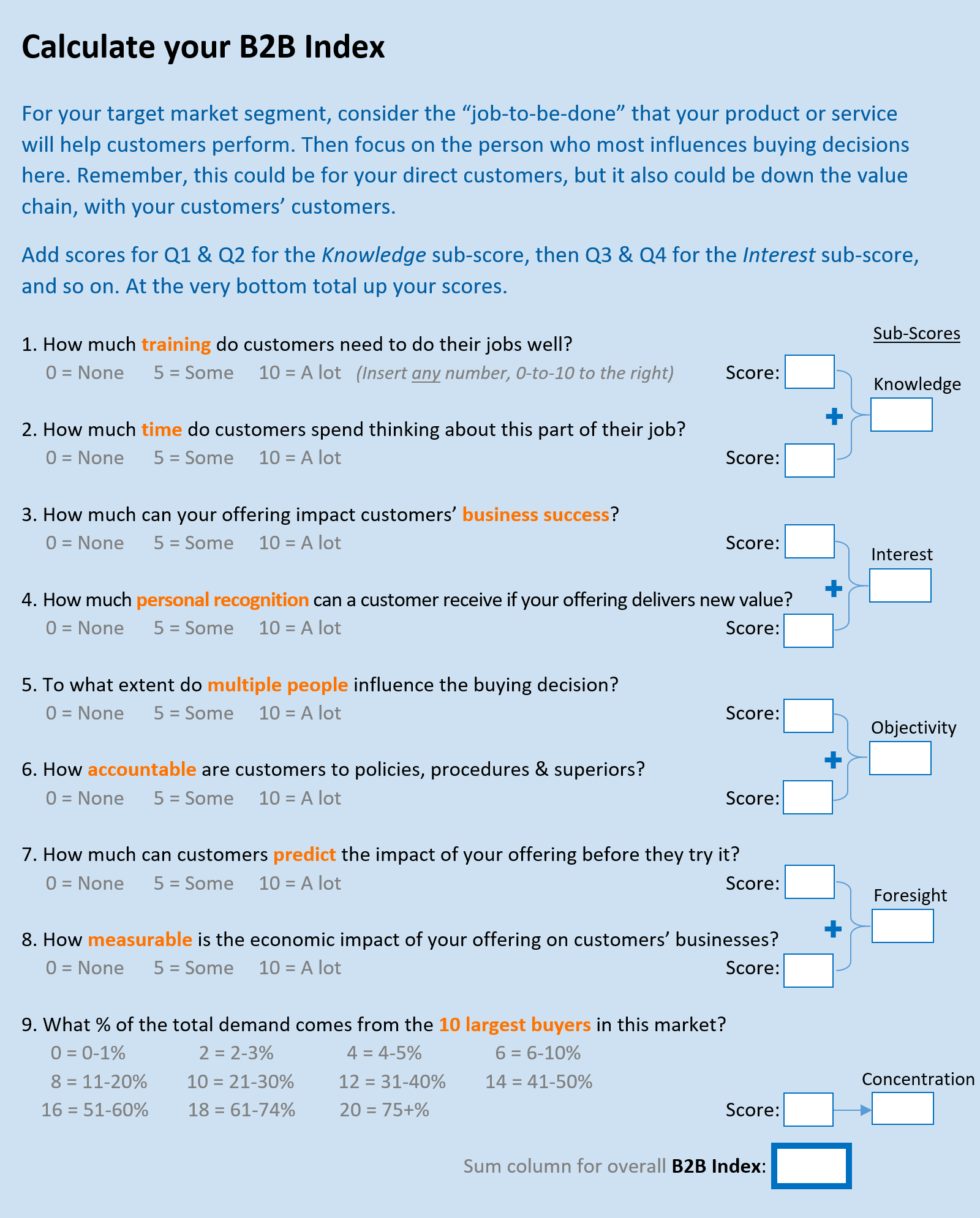

- The B2B Index: Why calling something B2B vs B2C is imprecise… and how to calculate your market’s engagement potential.

1. The Customer Insight Gap

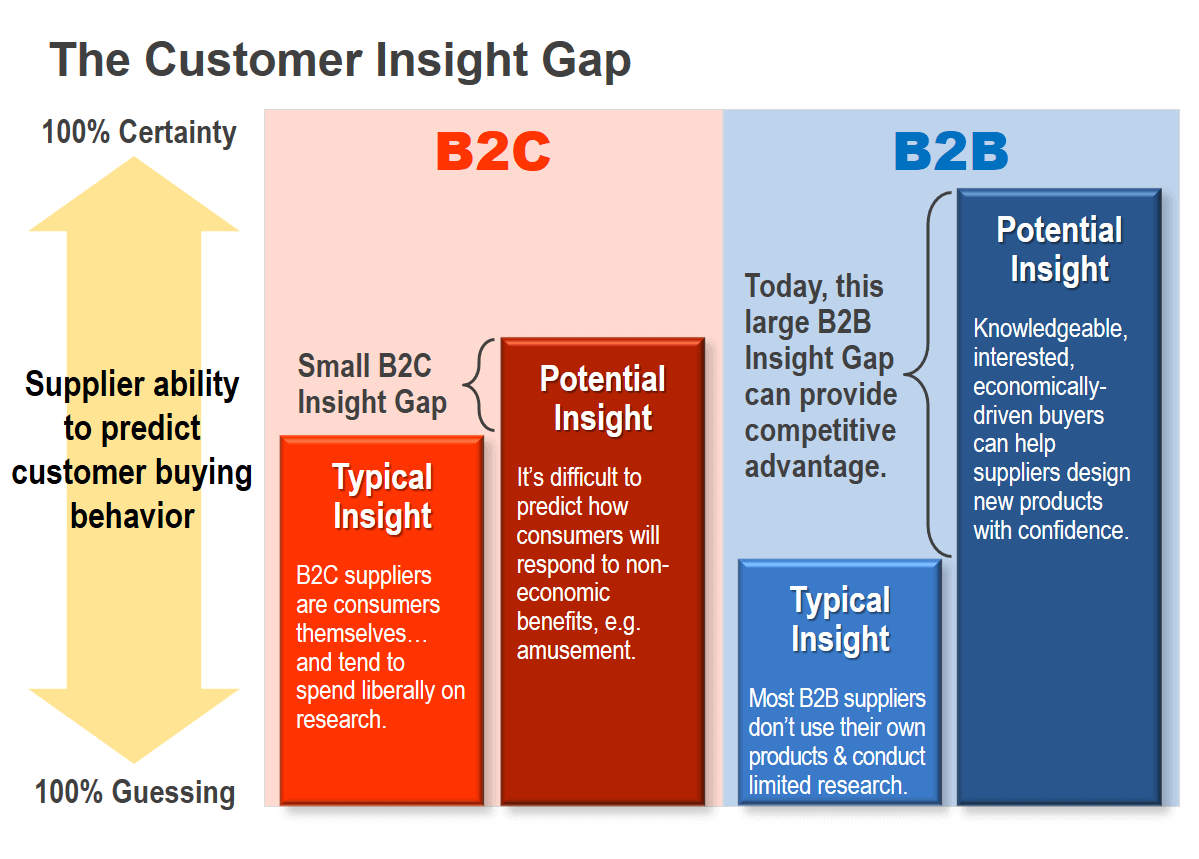

The Customer Insight Gap chart below illustrates a key B2B vs B2C difference: B2B companies have more potential to improve customer insight. Imagine you can measure a supplier’s ability to predict customer buying behavior, from 100% guessing to 100% certainty.

For B2C, the gap between typical insight and potential insight is small for two reasons. First, most B2C professionals are consumers themselves of the products they wish to design—be it a phone or laundry detergent—so they already have good insight. And many consumer goods firms, e.g. Proctor & Gamble, invest heavily in consumer research.

Second, potential B2C insight may not be much higher. After all, it’s hard to predict consumer response to non-economic benefits: being amused by a game, enjoying the taste of a snack food, or feeling good about oneself when wearing a certain tie. So we see a small gap between typical and potential insight.

It’s different in most B2B markets. These suppliers know less about customer needs than the engineers, scientists, and other professionals at those customers. If you make pigment, there’s much you could learn about its use in customers’ paper manufacturing. Also, B2B market research sophistication often lags that of consumer product companies.

At the same time, B2B customers will usually share their knowledge with suppliers because they want to access external innovation. If they need encouragement, the B2B supplier’s case is compelling: “We have experts ready to innovate for you, you’ll absorb no risk, and you won’t pay us unless we succeed. We just need to know what you want us to work on.”

This yields a large gap between the customer insight B2B companies typically possess and what they could possess. To close this gap, it helps to first understand the fundamental B2B vs B2C differences.

2. B2B vs B2C Comparison: 12 Differences

There are 12 B2B vs B2C differences with implications for your business’s organic growth. Some are apparent, but others are less obvious… in the same way fish don’t notice water. And not all have the same implications for your growth. Later in this paper, we’ll focus on the first five characteristics, which have the most impact on your all-important customer insight.

Some B2B vs B2C differences are less obvious… in the same way fish don’t notice water.

- Knowledge: B2B customers understand their subject matter better due to years of education, on-the-job training, and significant time thinking about this subject at work. This means knowledgeable B2B customers are able to help you design better products. Plan to use B2B-optimized voice-of-customer (VOC) interviews to understand their needs in depth. This is a critical B2B vs B2C difference.

- Interest: Contacts at your B2B customers appreciate external innovation, since this can help their company make or save money… and make them a hero at work. These B2B customers are willing to help you design better products, whereas you must pay end-consumers to attend focus groups. Ask for sufficient B2B VOC interview time to discuss their needs. And be sure to ask why they want these needs satisfied.

- Objectivity: Company procedures, group decisions, and accountability force B2B customers to be more rational in their decisions. And rational decision-making can be explained by them and understood by you. In contrast, try explaining why you’d like a certain taste, color, or style in a consumer product. Use advanced probing during B2B customer VOC to uncover the root causes of their desires… something customers are usually quite capable of explaining. This is how you take advantage of this B2B vs B2C difference.

Rational decision-making can be explained by customers and understood by you.

- Foresight: B2B customers are in business to make money, and can tell you what they need to do this better: “Increase my line speed… reduce my defect rate… make my products more durable.” Unlike B2C, you don’t need to show them a prototype to stimulate such thinking. Use in-depth B2B customer interviews and facility tours to understand the economics driving customer decisions. Then model these decisions using a value calculator… a tool that lets you predict customers’ ROI.

- Market Concentration: Most B2B markets have tens, hundreds, or thousands of potential buyers… not millions as is often the case in B2C markets. A very important B2B vs B2C difference. If your market is highly concentrated (with just a few buyers), target a large percentage of the market buying power for your customer interviews. This type of engagement “primes” these big customers to buy your new product later.

Characteristic B2B vs. B2C Comparison Implications for B2B suppliers 1. Knowledge B2B customers understand their subject matter better due to education, training, and considerable time spent on the job. Knowledgeable B2B customers are able to help suppliers design better products. Use voice-of-customer (VOC) interviews to understand their needs in depth. 2. Interest B2B customers often seek innovation from outside their company, which can add value and make them a hero at work. Interested B2B customers are willing to help suppliers design better products. Ask for sufficient VOC interview time to discuss their needs… and why they want them met. 3. Objectivity Company procedures, group decisions, and accountability force B2B customers to be more rational in their decisions. Rational B2B decision-making means it can be explained and understood. Use advanced probing during customer VOC to uncover the root causes of customer desires. 4. Foresight “For-profit” B2B customers can explain the costs they want to reduce, or features they want to improve in their products. Use in-depth customer interviews and facility tours to understand the economics driving customer decisions. Then model these decisions using a value calculator. 5. Market Concentration Most B2B markets have tens, hundreds, or thousands of potential buyers… not millions as is common in B2C markets. If your market is highly concentrated (just a few buyers), engage a large % of the market buying power in customer interviews. This “primes” these big customers to buy later. 6. Market Size Since many B2B products are needed to make a single B2C product, total revenue of each B2C product tends to be larger. B2C suppliers can afford 3rd party market research and design help for each “big” launch. You should hone internal, cost-effective means for many smaller launches. 7. Decision-makers B2B purchasing decisions often involve multiple people, while end-consumers often decide to buy on their own. Conduct customer VOC interviews with all relevant job functions simultaneously. Let them debate so you can capture natural decision-making for their entire company. 8. Value Chain B2C products serve only immediate customers, but B2B products can impact customers’ customers. Interview companies all the way down the value chain. Then design your product to especially meet the needs of companies at the most influential point in the chain. 9. Sales Cycle B2B buyers typically take longer than B2C buyers to begin purchasing a product once they become aware of it. If you surprise customers when you launch your product, expect long evaluation times. Instead, engage customers with your product concept in parallel with your development. 10. Purchase Commitment B2B customers often sign multi-year contracts worth thousands or millions of dollars. B2C commitment is often smaller. Design products that help customers make or save real money, based on front-end insights and a value calculator. Promote your product with fact-based ‘content marketing.’ 11. Pricing Decisions B2C surveys ask for point-in-time price decisions, but B2B suppliers need to understand price decision-making. B2B customers seldom volunteer accurate info in pricing surveys. Instead, gather economic data during interviews & tours. Then model customer price decision-making later. 12. Supplier Insight Unlike B2C suppliers, B2B suppliers seldom use their own products, which limits their insights to customer needs. Since your B2B competitors probably lack deep market insights, achieve a competitive advantage by learning and applying the skills needed to capture these insights. - Market Size: This B2B vs B2C difference is often overlooked. Many B2B products are often needed to make a single B2C product, so annual revenue of each B2C product tends to be larger. A B2C cellphone producer might have annual sales of hundreds of millions of dollars, while the B2B supplier of that phone’s gasketing has much smaller sales. So B2C suppliers can afford expensive third-party market research & design help for each “big launch.” B2B suppliers should hone cost-effective, DIY methods and skills to understand customer needs for many product introductions.

B2B suppliers should hone cost-effective, DIY methods and skills to understand customer needs.

- Decision-makers: B2B purchasing decisions often involve multiple job functions, while end-consumers usually decide to buy a product on their own. Conduct B2B customer VOC interviews with all relevant decision-makers and decision-influencers in a customer company at the same time. Let them debate so you can capture the natural decision-making for their entire company. This B2B vs B2C difference gives B2B producers incredible access to customer decision-making.

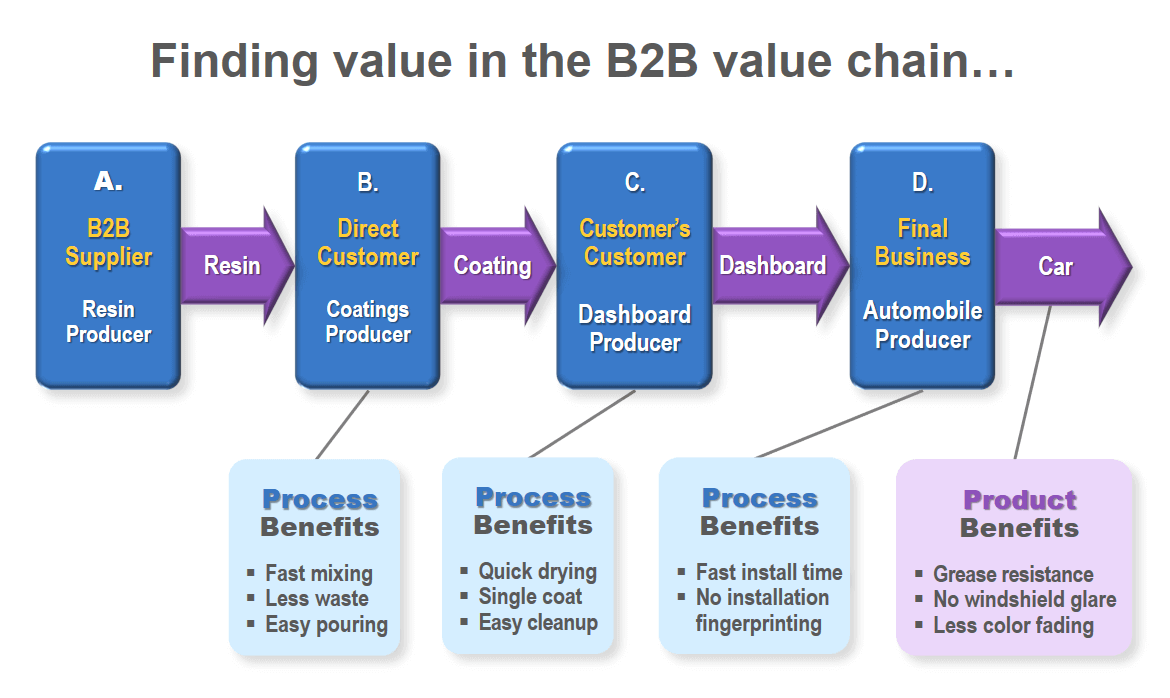

- Value Chain: This is one of the more obvious B2B vs B2C differences: B2C products serve the needs of immediate customers, but B2B products can impact customers’ customers. B2B companies should generally interview companies all the way down the value chain. Then design your B2B product to especially meet the needs of companies at the most influential point in the chain. These needs could be for a downstream process, or the ultimate product. Here’s an example:

- Sales Cycle: The time it takes buyers to begin buying is a key B2B vs B2C difference. B2B buyers typically take far longer. Don’t keep your B2B product development a secret and then surprise customers when you launch it. If you do, it may take months before they even begin evaluating your new product. Instead, engage customers using VOC interviews, product concept discussions, progress updates, and pre-launch samples. Do this in parallel with your new product development.

- Purchase Commitment: B2B customers often sign multi-year contracts worth thousands or millions of dollars. The commitment by end-consumers is usually much smaller. B2B customers need to see solid evidence of their expected ROI before making this commitment. Design products that help customers measurably improve their bottom line, supported by your front-end insights and a value calculator model. Then promote your product with fact-based “content marketing.”

- Pricing Decisions: B2C surveys ask for point-in-time price decisions, but B2B suppliers should understand price decision-making. That’s because B2B customers seldom give accurate responses in pricing surveys… lest they forfeit price negotiating leverage later. Instead, gather economic data during interviews and model customers’ price decision-making with a value calculator. This B2B vs B2C difference favors B2C producers because surveys are easy. On the other hand, B2B producers can create a predictive model so they don’t have to conduct a survey for every new product variation they imagine.

- Supplier Insight: This B2B vs B2C difference speaks to initial insight. Unlike B2C companies, B2B providers seldom use their own products, which limits their understanding of customer needs. And most B2B companies today are terrible at B2B-optimized VOC interviews. Since your B2B competitors probably lack these deep market insights, you can achieve a competitive advantage by learning and applying the skills needed to capture these insights.

The B2B Index

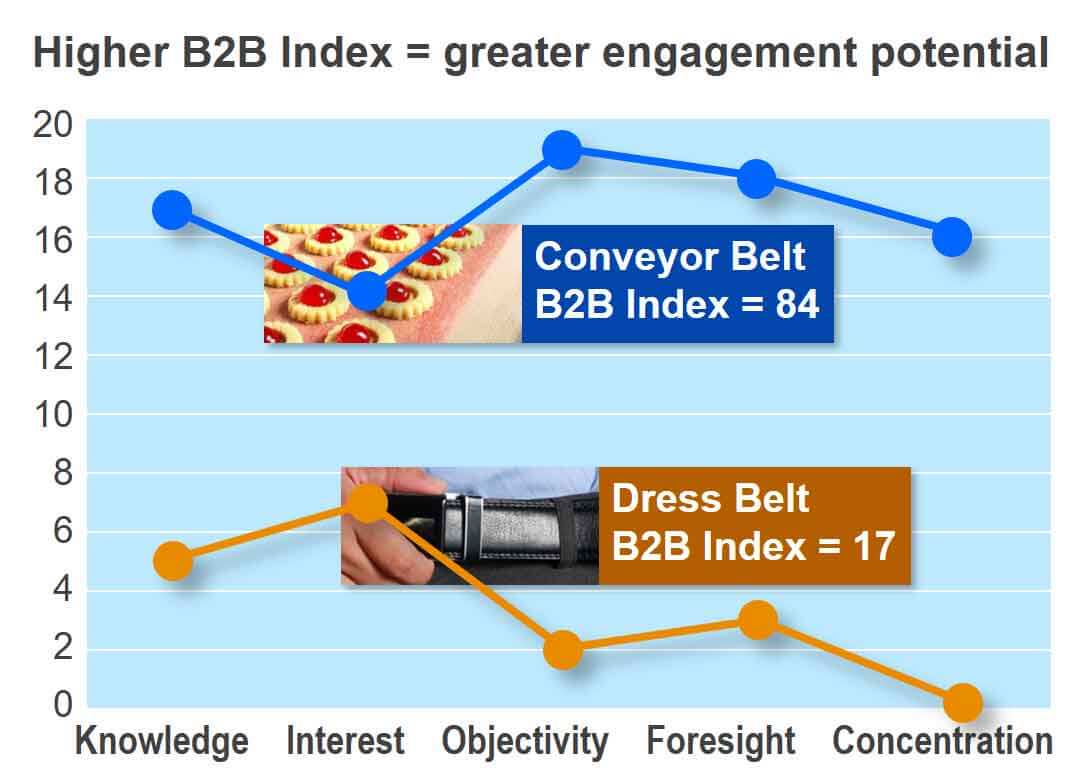

Now let’s look at a B2B vs B2C example, using two belt producers. One makes B2B conveyor belts used in the food processing industry. The other makes men’s B2C dress belts. Should they use different approaches to understand customers’ needs? They certainly should. The first 5 characteristics from our list of 12 are the most important to consider.

Knowledge: Imagine you interview a food processing engineer about conveyor belts, and then a consumer about dress belts. The engineer knows much more about her food belt requirements than you—operating speed, disinfection procedure, maintenance schedule, etc. But you, the supplier, may know more about dress belts requirements than the consumer.

Interest: The engineer will be interested in speaking with you because you could make her a hero at work… perhaps helping her increase processing speed or reduce downtime. Interest in dress belts is so low that you’ll need to pay consumers to attend a focus group. This is a major B2B vs B2C contrast.

Objectivity: The engineer is also more objective in her decisions. In some B2B vs B2C comparisons, B2B is characterized as emotionless. We reject this notion: The passion for innovation and achievement can run high with business customers. But this emotion is grounded in objectivity, not divorced from it. The dress belt buyer’s preferences will be more subjective.

B2B emotion is grounded in objectivity, not divorced from it.

Foresight: The engineer might say, “If your belt operated at a lower tension without slippage, we could extend the life of the bearings and cut maintenance costs.” With no knowledge of your product concept, she could predict likely benefits in a measurable fashion. The dress belt buyer might say, “Show me your belts and I’ll tell you which I like.”

Market Concentration: You can measure market concentration by asking, “What percent of the total demand comes from the 10 largest buyers in this market segment?” The answer might be 80% for the confectionary market, and less than 1% for dress belt consumers. This is an enormous B2B vs B2C difference.

With this background, consider the B2B Index… a B2B vs B2C tool for measuring “how B2B” your market segment is. The AIM Institute developed this because simply calling a market B2B or B2C can be misleading. From our discussion so far, you might think your potential to engage a B2B customer is higher than a B2C customer, right? You’d usually be right.

But imagine your office colleagues ask you to pick up a stapler on your way to work. A B2B purchase, right? Your stapler knowledge and interest are probably rather low. What if you’re shopping for a new sports car, a B2C purchase? Isn’t your knowledge and interest higher than for the stapler? In B2B vs B2C discussions, these terms can be blunt and imprecise.

The B2B Index measures these five characteristics. Each has a 0-to-20 scale, so the maximum total—the B2B Index—is 100. The higher your B2B Index, the “more B2B” your market is. This means you have more potential to engage customers. As you see in this illustration, the B2B Index is much higher for the confectionary conveyor belt market (84) than the consumer dress belt market (17). This B2B vs B2C comparison will inform many of your marketing decisions.

Try it yourself. Select a market segment and enter your answers to nine questions below. Sum these to see your market’s overall B2B Index.

OK, that was the hard way to calculate your B2B Index. For the easy way, visit www.b2bmarketview.com and answer these same questions. Not only will you find this B2B vs B2C analysis quick (and still free), but you’ll be able to download a 16-page report with your results.

This report will include your B2B Index chart with the five sub-scores for knowledge, interest, objectivity, foresight, and market concentration. Perhaps most valuable, though, are the B2B vs B2C recommendations you’ll see for your specific market segment.

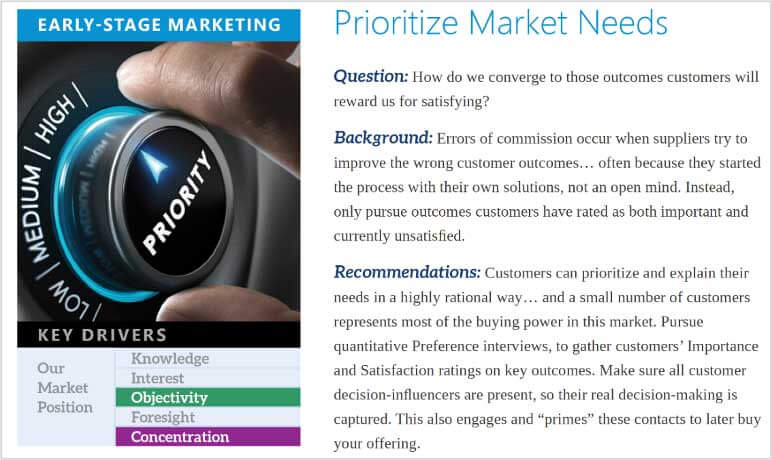

Remember early-stage marketing and late-stage marketing from our earlier B2B vs B2C discussion? By understanding your market in terms of these five characteristic sub-scores, the software on this website can make specific recommendations for your market segment. These cover the following eight early-stage marketing tasks and seven late-stage marketing tasks:

Early-Stage Marketing

- Conduct market research

- Uncover market needs

- Prioritize market needs

- Recruit VOC participants

- Conduct ethnography / tours

- Offer prototypes / samples

- Benchmark competition

- Predict value to customers

Late-Stage Marketing

- Product launch strategy

- Traditional promotional tools

- Online promotional tools

- Positioning & messaging

- Sales tools

- Pricing

- Distribution strategy

For each of these 15 marketing tasks, you’ll see a section in your report with specific B2B vs B2C recommendations. The one shown below is for the early-stage marketing task called Prioritize Market Needs. Notice “Objectivity” and “Concentration” are highlighted in the lower left. That’s because these are the two characteristics (of the five) that impact this task. You would see different recommendations for Prioritize Market Needs if you changed your answers to the www.b2bmarketview.com questions for objectivity and market concentration.

Does it seem odd that just 5 B2B vs B2C characteristics can guide us on 15 marketing tasks? After all, these tasks encompass nearly everything a marketing professional does! But marketing isn’t what most people think it is. It’s not about our trade show booths, or our branding, or our cool digital marketing techniques.

Marketing is understanding customer needs, and then promoting products that meet customer needs. This is early-stage and late-stage marketing. Today, most B2B marketers focus far too little on the early-stage.

Peter Drucker said, “The purpose of business is to create a customer. The business enterprise has two—and only two—basic functions: marketing and innovation; all the rest are costs.” These five B2B vs B2C characteristics define the customers we hope to create, understand, and satisfy with our innovations.

Ultimately the greatest advantage we have as B2B professionals is our customers: They’re smart. They want to explain their needs to us. And they can predict what will happen when we help them.

The greatest advantage we have as B2B professionals is our customers.

Most B2B companies are still just dabbling with the remarkable potential they have to engage B2B customers. They’re treating their customers too much like B2C customers and forfeiting their B2B advantages. I hope you’re inspired to do more: The most exciting times for B2B professionals truly are ahead of us.

Ready to put your B2B vs B2C advantages to work for rapid, profitable, sustainable organic growth? A good starting point is learning how to conduct B2B-optimized voice-of-customer interviews. For a deeper dive, check out these resources:

- www.reinventingvocforb2b.com An e-book explaining how voice-of-customer methods should be optimized for B2B.

- www.newproductblueprinting.com A 3-minute video that describes the world’s leading B2B voice-of-customer methodology.

- www.blueprintingworkshop.com Monthly virtual public workshops where you can learn and even role-play B2B-optimized VOC.

Comments