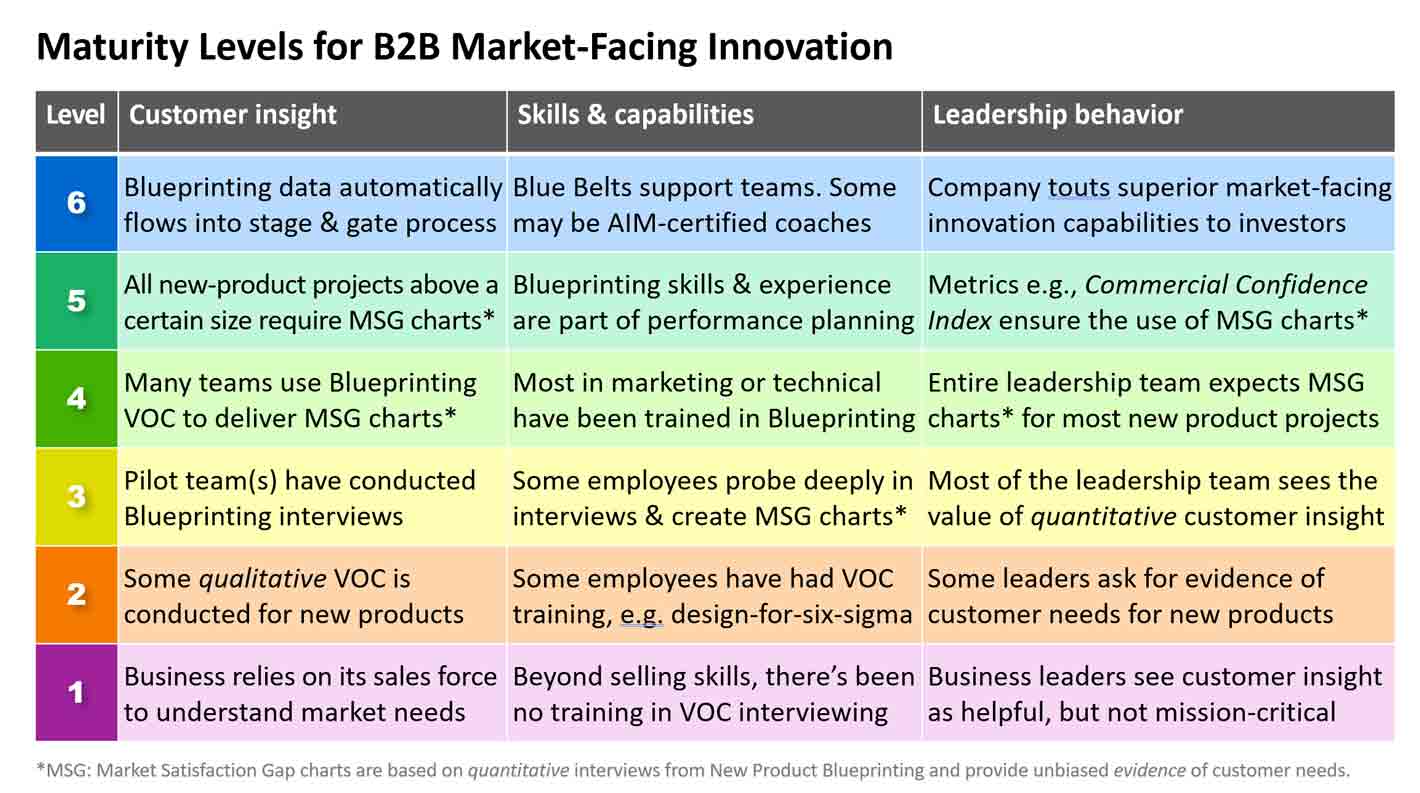

6 Maturity Levels for B2B Market-Facing Innovation

What’s the key to accelerating your B2B business’s organic growth? The research is clear: Superior customer insight drives stronger new product value propositions… which in turn boosts organic growth. Now you can use this new Innovation Maturity Level chart to assess your current level… and plan your ascent all the way to Level 6.

The AIM Institute has conducted considerable research into how B2B companies accelerate their organic growth. What drives your growth is no longer a matter of conjecture: Your growth will be determined by your leadership’s appetite for investing in the right capabilities. Here’s what we know (and how we know it) …

- The most important driver of B2B organic growth is delivering products with strong value propositions. (See pg. 6 at whatdrivesb2borganicgrowth.com.)

- Successful B2B companies are stronger at customer interviewing and the front-end of innovation. (See pg. 10 at whatdrivesb2borganicgrowth.com.)

- Voice of customer skills strongly correlate with new product success rates. (See pg. 10 at b2bvocskills.com.)

- Training in New Product Blueprinting improves VOC skills more than other methods. (See pg. 17 at b2bvocskills.com.)

Your growth will be determined by your leadership’s appetite for investing in the right capabilities.

These conclusions don’t surprise most business leaders. And yet, given the near-term pressures they face, most struggle to create a multi-year plan that will ensure strong, profitable, sustainable growth.

To help, we’ve created the Innovation Maturity Chart below. It’s based on our 18 years of helping B2B companies achieve superior growth via New Product Blueprinting, a B2B-optimized way to understand market needs for new product development.

I invite you to begin by determining which level your business is at today. In the rest of this article, we’ll describe each level and discuss practical recommendations for moving up to higher maturity levels.

Level 1

- Customer insight: Your business relies on its sales force to understand market needs. This puts you on par with the weakest of your competitors. You need to move from customer-reactive to market-proactive for superior new product development.

- Skills & capabilities: Beyond selling skills, there’s been no training in voice-of-customer (VOC) interviewing methods. This is problematic: Our research shows a huge correlation between VOC training and NPD success. (See pg. 10 at b2bvocskills.com.)

- Leadership behavior: Business leaders see customer insight as helpful, but not mission-critical. Market-facing innovation is not just one more initiative. It is the only way to consistently drive strong, profitable, sustainable growth.

- Recommendation: Your leadership needs a new mindset that recognizes market-facing innovation as paramount. For starters, watch the 2-minute video in our 50-video series, Rethink your major initiatives.

Level 2

- Customer insight: Your business conducts some qualitative VOC for new products. Some VOC is better than none, but VOC interviews need to be consistently applied. And you need to add quantitative interviews to your qualitative interviews.

- Skills & capabilities: Some employees have had VOC training, e.g. design-for-six-sigma. Our research shows the vast majority of market-facing B2B professionals say they’ve had some VOC training, but few have been trained and coached in B2B-optimized interview methods.

- Leadership behavior: Some leaders ask for evidence of customer needs for new products. It’s encouraging that some leaders seek this, but quantitative, unbiased evidence of market needs should be required before any sizeable new products are developed.

- Recommendation: Your leadership team needs to understand that only quantitative VOC lets you confidently prioritize market needs, so teams can focus on what customers want the most. The critical nature of prioritizing customer needs is demonstrated on pgs. 10-12 at b2bvocskills.com.

Level 3

- Customer insight: One or two pilot team(s) in your business have now conducted Blueprinting interviews. These initial projects deliver something called a Market Satisfaction Gap chart, which clearly shows which customer outcomes (desired end-results) your target market does and does not want you to pursue.

- Skills & capabilities: Some of your employees have now learned how to probe deeply during customer interviews and are able to create Market Satisfaction Gap charts.

- Leadership behavior: Most of your leadership team sees the value of quantitative customer insight. They see that only such interviews provide hard evidence in the form of Market Satisfaction Gaps.

- Recommendation: It’s important that your entire leadership team understands the value of Market Satisfaction Gaps to prioritize market needs. This white paper can help: Market Satisfaction Gaps

Level 4

- Customer insight: Many teams in your business are using Blueprinting VOC to deliver MSG charts.

- Skills & capabilities: Most of your employees in marketing, product management, and technical positions have been trained in Blueprinting VOC (and some in sales).

- Leadership behavior: Your entire leadership team expects Market Satisfaction Gap charts for most new product projects.

- Recommendation: Your business is in a good position, but it’s a vulnerable one, because you haven’t yet formally embedded these VOC practices in your new product development process. Now is the time to vigorously pursue Level 5 to remedy this.

Level 5

- Customer insight: All new-product projects above a certain size require Market Satisfaction gap charts. If you’re unsure how large such projects should be, try this: Any NPD project that will likely require 12+ person-months of development work cannot enter the development stage without a Market Satisfaction Gap.

- Skills & capabilities: Blueprinting skills & experience are part of performance planning. Such skills are expected of key employees, in much the same way that Green and Black Belts were required by companies pursuing Six Sigma.

- Leadership behavior: Metrics e.g., the Commercial Confidence Index, ensure the use of Market Satisfaction Gap charts. This metric measures the % of NPD spending that is based on known market needs vs. assumed market needs.

- Recommendation: Three actions are key for achieving this level:

- Your stage-and-gate process requires a Market Satisfaction Gap chart for all projects above a pre-determined size.

- For key market-facing employees, performance plans include conducting a certain number of VOC interviews, Blueprinting Practitioner certification, or Blue Belt certification. (See BlueprintingCertification.com)

- In addition to the Vitality Index (a lagging metric), your business employs the Commercial Confidence Index (a leading metric). For more, see newinnovationmetrics.com.

Level 6

- Customer insight: Blueprinting data automatically flows into your stage & gate process: Cloud-based Blueprinter® software is linked to your stage-and-gate software, whether it be your “home-made” system or a third-party software package.

- Skills & capabilities: Your business has several certified Blue Belts that provide support to your NPD teams. Some of these Blue Belts may even be AIM-certified coaches, who can use the same coaching resources as AIM coaches.

- Leadership behavior: Your company touts superior market-facing innovation capabilities to investors.

- Recommendation: This level provides serious payoff for your business. World-class innovation based on known customer needs is integrated into your internal systems and is part of your culture. It not only provides you with a strong competitive edge and superior growth, it also helps you convince investors your growth isn’t temporary, but rather something they can bank on.

In conclusion…

For too long, many B2B business leaders have struggled to deliver strong organic growth that they can count on year in and year out. This can change for your business but it requires a multi—year commitment. Rising through the six innovation maturity levels can’t be done in a single year, but rather must be part of a longer-range strategy.

We’re here to help. Frankly, getting to Level 3 is quite easy, but some AIM clients are still “stuck” at Level 3 or 4. If this is your situation, will it be difficult to move to Level 5 or 6? Not at all. But it will require taking some actions you’ve not taken before. We’re happy to come alongside and support you in your journey. Just reach out to your AIM contact or drop us a message at www.talkwithaim.com.

Comments