VoC Customer Interviews — By the Numbers

If your new product development teams aren’t routinely conducting quantitative VoC customer interviews, you’re squandering R&D resources. I say this for two reasons: First, studies show the average company wastes 25-50% of its R&D spending on new product failures (generally something the customer never wanted). Second, our experience at AIM shows that clients are usually surprised by the results of quantitative customer interviews. Said another way, they would have developed a different product without this explicit direction from customers.

Qualitative vs. Quantitative VoC Customer Interviews

It’s common for 6-10 market segment-focused qualitative interviews to give you scores of desired customer “outcomes” or end results…which are typically reduced to a “top ten” list. During quantitative—or Preference Interviews —you ask two key questions: 1) How important is this outcome to you, and 2) How satisfied are you with it today? You record a 1-10 customer response… with 10 being “critically important” for the first question, and 10 being “totally satisfied” for the second. Of course, you’re hoping to find some outcomes that score very high in importance and very low in current satisfaction. That would be an outcome you could sink your R&D teeth into with confidence.

Click here to learn more about Market Segmentation using Blueprinting

VoC Customer Interviews can Yield Quant Data

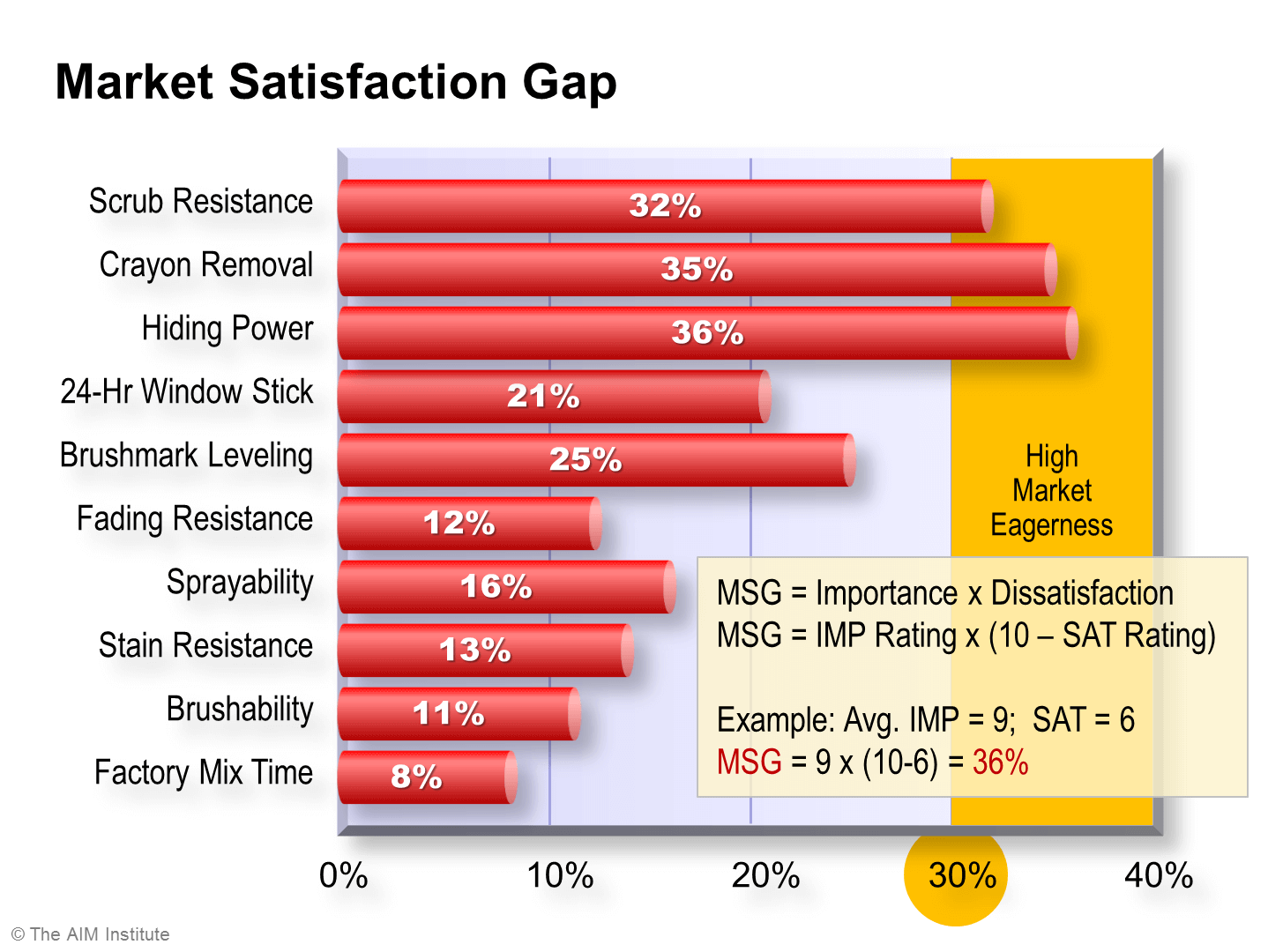

I developed a simple algorithm years ago that combines the answers to the above two questions. It’s called the Market Satisfaction Gap (MSG). If IMP is customers’ average 1-10 score on the first question, and SAT is their 1-10 score on the second, the formula looks like this:

MSG = IMP x (10 – SAT)

So the more important the outcome is to customers—and the less satisfied they are today with this outcome—the higher the Market Satisfaction Gap. If you supplied resins to paint producers, your Market Satisfaction Gap profile might look like this:

Interpreting the Market Satisfaction Gap

A market segment is eager for improvement in any outcome with an MSG above 30%.

VoC customer interviews, in the form of quantitative “Preference” interviews provides the data. And here’s where it gets fun: Our experience shows that a market segment is eager for improvement in any outcome with an MSG above 30%. In the above chart, paint producers would like a resin that helped them with hiding power, crayon removal and scrub resistance.

Every MSG profile tells a story. If your product development team gets a profile in which the highest gap is 15%, your question should be, “What other market segments do you want to pursue?” Because this market segment is over-served. They’re happy with everything they’ve already got… except a lower price, of course. We’ve seen other market segments in which every single outcome scored in the 30s, 40s or 50s. These segments were screaming for help!

We’ve worked with hundreds of teams, executing thousands of VoC customer interviews, in countless B2B industries, and here’s what we see: It’s rare for a team to look at its Market Satisfaction Gap chart and not be surprised. (Check out this research report on the results of many projects.) In many cases, an outcome the supplier was excited about scores very low with customers. It’s hard for suppliers to see their lovely theory attacked by a brutal gang of facts. The only thing harder would be to spend a million dollars developing a product… which is then attacked by a brutal gang of facts.

In many other cases, an outcome suppliers thought to be of low interest—or wasn’t even on their radar screen prior to interviewing—actually has the highest MSG. Having this hard data gives you the confidence to enter the costly product development stage with gusto. Ideally your competitors will continue to squander their resources on what they—and not their customers—want developed. And you’ll know what customers want, so you can tightly focus your R&D resources on pleasing them.

To learn more, check out this video on the value of “customer surprises.” Or to go deeper download Chapter 14 at New Product Blueprinting Chapter Downloads.

canadian pharmacy ratings: legit canadian pharmacy – canadian pharmacies compare

www india pharm www india pharm mail order pharmacy india

buying from online mexican pharmacy: mexican drugstore online – purple pharmacy mexico price list

buying from online mexican pharmacy: Agb Mexico Pharm – Agb Mexico Pharm

ordering drugs from canada: go canada pharm – the canadian pharmacy

mexican rx online buying prescription drugs in mexico online Agb Mexico Pharm

https://wwwindiapharm.shop/# www india pharm

buying from online mexican pharmacy: mexico drug stores pharmacies – Agb Mexico Pharm

www india pharm: india pharmacy mail order – best india pharmacy

www india pharm: www india pharm – indian pharmacy

https://wwwindiapharm.com/# www india pharm

reputable mexican pharmacies online: Agb Mexico Pharm – buying prescription drugs in mexico

www india pharm: п»їlegitimate online pharmacies india – www india pharm

www india pharm www india pharm www india pharm

canadian medications: best canadian pharmacy to order from – canadian pharmacy 24

best canadian pharmacy online: canadian pharmacy 24h com – canadian world pharmacy

https://gocanadapharm.shop/# pharmacy canadian

top 10 pharmacies in india: www india pharm – www india pharm

Agb Mexico Pharm: purple pharmacy mexico price list – medicine in mexico pharmacies

www india pharm: www india pharm – mail order pharmacy india

https://gocanadapharm.com/# buy prescription drugs from canada cheap

buy medicines online in india www india pharm india online pharmacy

Agb Mexico Pharm: Agb Mexico Pharm – Agb Mexico Pharm

www india pharm: www india pharm – indian pharmacy

buying drugs from canada: GoCanadaPharm – canadian pharmacies that deliver to the us

http://agbmexicopharm.com/# mexico drug stores pharmacies

mexican rx online: reputable mexican pharmacies online – mexican rx online

indian pharmacies safe: п»їlegitimate online pharmacies india – www india pharm

www india pharm online shopping pharmacy india india pharmacy mail order

canada drugs online: best canadian pharmacy online – canadian pharmacy meds reviews

https://agbmexicopharm.com/# mexican pharmaceuticals online

mexico pharmacies prescription drugs: reputable mexican pharmacies online – Agb Mexico Pharm

mexican rx online: Agb Mexico Pharm – mexico drug stores pharmacies

canadian pharmacy store: go canada pharm – online canadian pharmacy review

https://wwwindiapharm.shop/# www india pharm

mail order pharmacy india buy prescription drugs from india www india pharm

mexican drugstore online: Agb Mexico Pharm – Agb Mexico Pharm

www india pharm: indian pharmacy – india pharmacy mail order

www india pharm: best online pharmacy india – www india pharm

https://kamagrapotenzmittel.com/# Kamagra kaufen

Kamagra Oral Jelly Kamagra Original Kamagra kaufen

Online apotheek Nederland zonder recept: Online apotheek Nederland met recept – Apotheek Max

Kamagra Gel: Kamagra Oral Jelly – Kamagra kaufen ohne Rezept

https://apotheekmax.shop/# Betrouwbare online apotheek zonder recept

https://kamagrapotenzmittel.com/# Kamagra Gel

Online apotheek Nederland zonder recept: Beste online drogist – Betrouwbare online apotheek zonder recept

Betrouwbare online apotheek zonder recept: Online apotheek Nederland met recept – Beste online drogist

https://kamagrapotenzmittel.shop/# Kamagra Gel

ApotheekMax Online apotheek Nederland met recept de online drogist kortingscode

Apotek hemleverans recept: apotek online – Apotek hemleverans recept

https://apotekonlinerecept.com/# apotek pa nett

Kamagra kaufen ohne Rezept: Kamagra kaufen – Kamagra online bestellen

https://kamagrapotenzmittel.shop/# Kamagra Original

Kamagra kaufen ohne Rezept: Kamagra Oral Jelly kaufen – Kamagra kaufen ohne Rezept

apotek online Apoteket online Apoteket online

Apotheek Max: Apotheek Max – Online apotheek Nederland zonder recept

https://apotheekmax.shop/# Online apotheek Nederland met recept

Kamagra Oral Jelly kaufen: Kamagra Gel – kamagra

https://apotekonlinerecept.shop/# apotek online recept

Online apotheek Nederland zonder recept: Betrouwbare online apotheek zonder recept – Online apotheek Nederland met recept

apotek pa nett apotek pa nett apotek online

Kamagra kaufen: Kamagra Oral Jelly – Kamagra Gel

http://kamagrapotenzmittel.com/# kamagra

Apoteket online: apotek online – apotek pa nett

https://apotekonlinerecept.shop/# Apoteket online

apotek pa nett: apotek online – Apoteket online

https://kamagrapotenzmittel.shop/# Kamagra Oral Jelly

apotek online Apotek hemleverans recept Apoteket online

apotek online: Apotek hemleverans recept – apotek online recept

https://apotheekmax.com/# Apotheek online bestellen

Apotheek Max: de online drogist kortingscode – Apotheek online bestellen

https://apotheekmax.shop/# Apotheek Max

kamagra: Kamagra Original – Kamagra kaufen ohne Rezept

Online apotheek Nederland zonder recept: Apotheek online bestellen – Apotheek online bestellen

apotek pa nett apotek online apotek online recept

http://kamagrapotenzmittel.com/# Kamagra Oral Jelly

http://kamagrapotenzmittel.com/# Kamagra online bestellen

Kamagra Oral Jelly: Kamagra kaufen ohne Rezept – Kamagra online bestellen

Apotek hemleverans recept: Apoteket online – apotek online

https://kamagrapotenzmittel.com/# Kamagra Oral Jelly

https://apotekonlinerecept.com/# Apoteket online

apotek pa nett: apotek online – Apotek hemleverans recept

de online drogist kortingscode Online apotheek Nederland met recept de online drogist kortingscode

Apotek hemleverans idag: Apotek hemleverans idag – apotek online

https://apotheekmax.com/# Apotheek Max

пин ап казино – пинап казино

pinup 2025 – pinup 2025

Generic 100mg Easy Generic100mgEasy Generic100mgEasy

пинап казино: https://pinupkz.life/

пин ап зеркало – пин ап казино зеркало

пин ап казино зеркало: https://pinupkz.life/

пин ап казино зеркало – пин ап вход

пин ап казино – pinup 2025

cialis without a doctor prescription cialis without a doctor prescription Tadalafil Easy Buy

пин ап вход – пин ап казино официальный сайт

пин ап казино зеркало – пин ап казино

пинап казино – пин ап зеркало

Kamagra Kopen Kamagra kamagra pillen kopen

пин ап казино официальный сайт – пин ап казино зеркало

пинап казино – пин ап казино зеркало

пинап казино – пин ап казино

пин ап казино – пинап казино

пин ап казино – pinup 2025

cialis without a doctor prescription cialis without a doctor prescription Tadalafil Easy Buy

пинап казино – пин ап казино официальный сайт

пин ап зеркало: https://pinupkz.life/

пин ап зеркало – пин ап вход

Cheap Cialis: Tadalafil Easy Buy – Tadalafil Easy Buy

https://tadalafileasybuy.com/# Tadalafil Easy Buy

Generic 100mg Easy Generic 100mg Easy Generic 100mg Easy

Tadalafil Easy Buy: cialis without a doctor prescription – Tadalafil Easy Buy

https://tadalafileasybuy.shop/# Cialis without a doctor prescription

buy generic 100mg viagra online: buy generic 100mg viagra online – sildenafil over the counter

https://generic100mgeasy.shop/# buy Viagra over the counter

https://kamagrakopen.pro/# kamagra gel kopen

Kamagra: Kamagra – KamagraKopen.pro

https://kamagrakopen.pro/# KamagraKopen.pro

kamagra 100mg kopen Kamagra Kopen Kamagra

https://tadalafileasybuy.shop/# Tadalafil Easy Buy

Kamagra: kamagra 100mg kopen – Kamagra

http://tadalafileasybuy.com/# cialis without a doctor prescription

https://kamagrakopen.pro/# kamagra gel kopen

Generic 100mg Easy: buy generic 100mg viagra online – Generic100mgEasy

http://generic100mgeasy.com/# Buy generic 100mg Viagra online

best price for viagra 100mg Generic100mgEasy Generic100mgEasy

Tadalafil Easy Buy: cialis without a doctor prescription – Generic Cialis price

Kamagra Kopen Online: Kamagra Kopen – Kamagra

https://tadalafileasybuy.shop/# Generic Tadalafil 20mg price

https://tadalafileasybuy.shop/# Cialis without a doctor prescription

kamagra pillen kopen: Officiele Kamagra van Nederland – Kamagra Kopen

http://tadalafileasybuy.com/# cialis without a doctor prescription

kamagra jelly kopen Kamagra Kopen Online Officiele Kamagra van Nederland

https://generic100mgeasy.com/# Generic 100mg Easy

Officiele Kamagra van Nederland: kamagra gel kopen – Kamagra

Viagra generic over the counter: Generic 100mg Easy – Generic100mgEasy

http://tadalafileasybuy.com/# Buy Tadalafil 10mg

https://generic100mgeasy.shop/# Generic 100mg Easy

Generic100mgEasy Generic 100mg Easy Generic 100mg Easy

Generic 100mg Easy: Generic Viagra online – Generic 100mg Easy

http://generic100mgeasy.com/# buy generic 100mg viagra online

https://kamagrakopen.pro/# kamagra kopen nederland

Generic100mgEasy: Viagra online price – Generic100mgEasy

http://generic100mgeasy.com/# Cheap generic Viagra online

http://generic100mgeasy.com/# Generic 100mg Easy

kamagra kopen nederland kamagra kopen nederland kamagra pillen kopen

TadalafilEasyBuy.com: Tadalafil Easy Buy – TadalafilEasyBuy.com

Generic100mgEasy: Generic100mgEasy – Generic100mgEasy

https://kamagrakopen.pro/# kamagra kopen nederland

kamagra jelly kopen: kamagra gel kopen – Officiele Kamagra van Nederland

canadian pharmacy service Pharmacies in Canada that ship to the US reliable canadian online pharmacy

canadian neighbor pharmacy: Certified International Pharmacy Online – canadian pharmacy no rx needed

http://interpharmonline.com/# canadian pharmacy online reviews

canadianpharmacymeds

legitimate canadian pharmacy online: Online pharmacy USA – the canadian pharmacy

http://mexicanpharminter.com/# Mexican Pharm Inter

https://indiamedfast.com/# india pharmacy without prescription

canadian pharmacy service

pharmacy canadian superstore: legitimate canadian pharmacies online – my canadian pharmacy

canadian pharmacy ltd: Online pharmacy USA – is canadian pharmacy legit

buy canadian drugs legitimate canadian pharmacies online canadian online pharmacy

http://indiamedfast.com/# cheapest online pharmacy india

https://interpharmonline.shop/# canadian pharmacy meds review

canadian pharmacy prices

https://indiamedfast.shop/# buying prescription drugs from india

https://interpharmonline.com/# canadian world pharmacy

canadian drugs pharmacy

https://interpharmonline.shop/# ed drugs online from canada

https://interpharmonline.com/# my canadian pharmacy

canadian online pharmacy

mexican pharmacy online store: Mexican Pharm International – mexican pharmacy online store

online medicine shopping in india: cheapest online pharmacy india – india online pharmacy store

http://indiamedfast.com/# buying prescription drugs from india

https://interpharmonline.com/# my canadian pharmacy rx

canadian pharmacy 24h com safe

mexican pharmacy online order Mexican Pharm Inter buying from online mexican pharmacy

online pharmacy india: india online pharmacy store – online medicine shopping in india

https://interpharmonline.com/# canada rx pharmacy world

https://mexicanpharminter.com/# Mexican Pharm Inter

best canadian pharmacy to order from

MexicanPharmInter: mexican pharmacy online store – mexican pharmacy online

lowest prescription prices online india: IndiaMedFast – cheapest online pharmacy india

mexican pharmacy online mexican pharmacy online order Mexican Pharm Inter

https://indiamedfast.com/# India Med Fast

canada online pharmacy

buying from online mexican pharmacy: mexican pharmacy online – buying from online mexican pharmacy

alo 789 dang nh?p: alo789in – alo789hk

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Essay Writing Techniques and Tips help students develop clear arguments and structure their work effectively. For those https://scamfighter.net/discounts/killerpapers.org needing extra support, using a killer papers discount code can provide access to expert writing services while ensuring high-quality results for assignments and research papers. Strong preparation enhances academic success.