New Research: The impact of B2B VOC skills on NPD success

Want to boost your new product success rate? This new research by The AIM Institute shows a surprisingly strong correlation between B2B VOC skills and higher new product success rates. For the first time ever, you can now see which of 12 B2B VOC skills have the greatest impact on B2B new product success.

If you’re unhappy with your organic growth from new products, you could increase R&D spending or try to higher brighter R&D staff. But there’s a much easier way: Train your market-facing organization in strong VOC skills. Not convinced? Download this new report, jam-packed with our research results displayed in 17 charts.

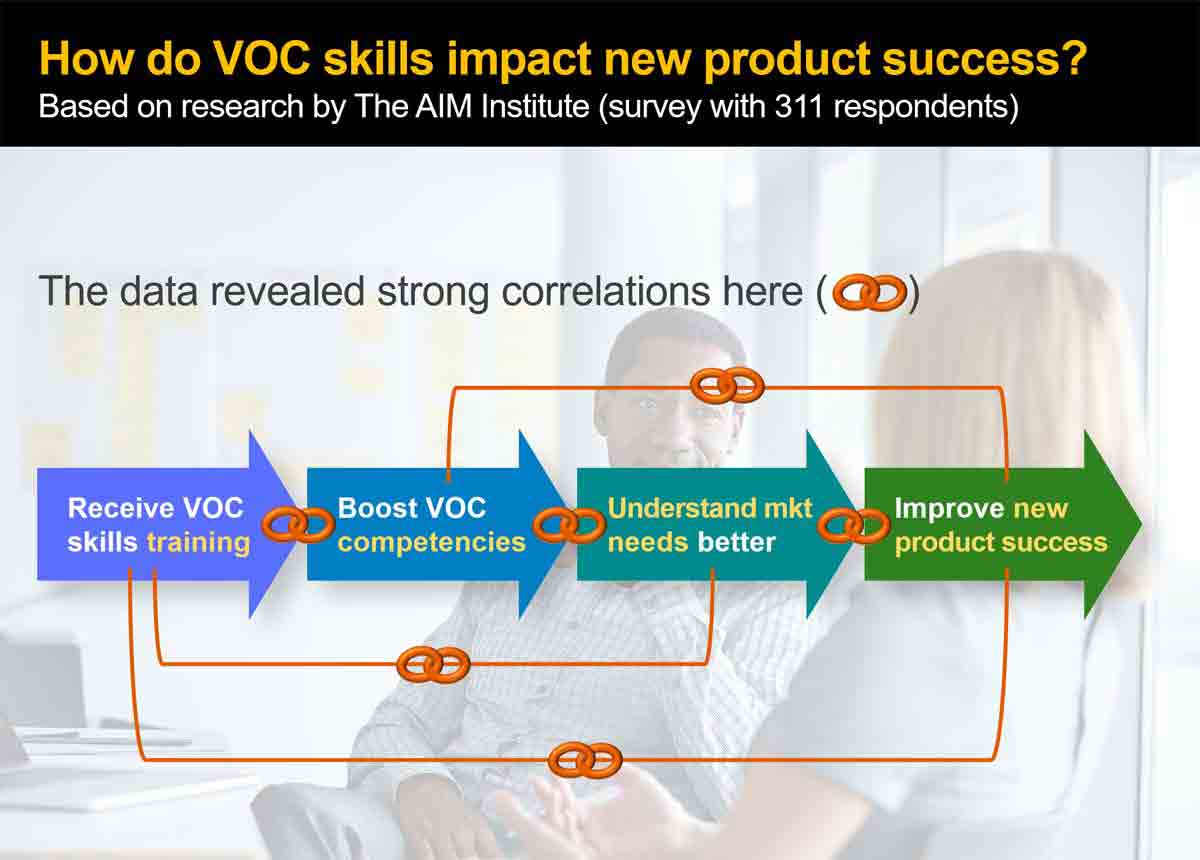

We surveyed 311 B2B professionals with nearly 5,000 years of combined experience, and here’s what the data strongly support: Training in VOC skills boosts VOC competencies… which improves understanding of market needs… which leads to higher new product success rates. As shown in this illustration, we saw these correlations (orange chain links) everywhere we looked.

Granted, we’re claiming correlation here—not causation. But the strength of these correlations and their underlying logic are compelling. We believe they’re compelling enough to encourage growth-seekers to aggressively strengthen their B2B VOC skills.

In the full report, you’ll see extensive support of seven key findings:

- Understanding market needs correlates with new product success.

- Strong VOC skills equate to understanding market needs & new product success.

- The biggest VOC differentiator in new product success is prioritizing customer needs.

- VOC skills & new product success are impacted by VOC training.

- Training in New Product Blueprinting improves VOC skills more than other methods.

- VOC skills & attitudes are impacted by a company’s use of VOC.

- Most B2B companies have similar VOC behaviors.

Training in New Product Blueprinting improves VOC skills more than other methods.

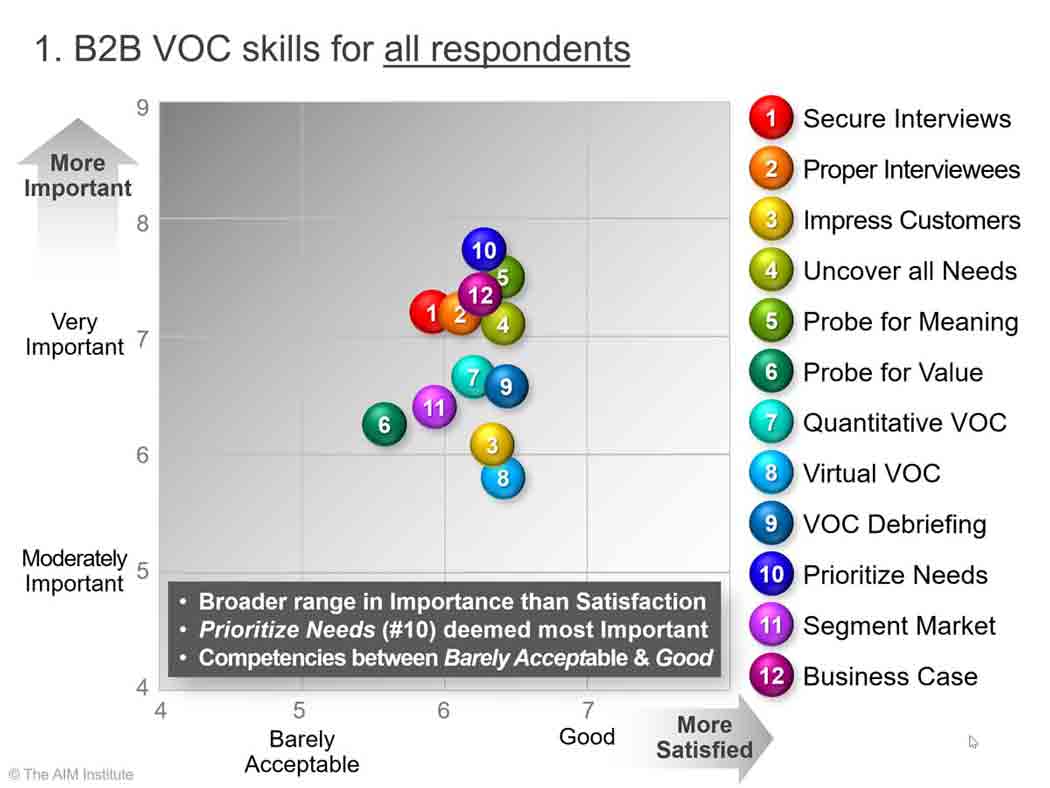

For this research, we compiled 12 VOC skills that could help new product development teams understand customer needs in a target market. (For a description of each VOC skill, see page 4 in the full report at www.b2bvocskills.com.)

We asked survey respondents to answer two questions for each VOC skill:

- How IMPORTANT is it that you are able to… (competency description here) on a scale of 1-to-10?

- How SATISFIED are you with your ability to… (competency description here) on a scale of 1-to-10?

Both the Importance (IMP) and Satisfaction (SAT) 1-to-10 scales were anchored with well-established text descriptions. This approach allowed us to investigate attitude, competency, and eagerness (to improve) for various sub-groups, e.g. well-trained respondents vs. untrained respondents, large companies vs. small companies, companies that offer services vs. physical products, etc.

- Attitude: We compared Importance scores to see how sub-groups viewed the usefulness or value of each VOC skill.

- Competency: We assumed those more Satisfied with their skills had higher competency levels.

- Eagerness to improve: The more Important and Unsatisfied a respondent was with a VOC skill, the more eager we assumed he or she was to improve it. For this we used a long-standing AIM Institute metric called Market Satisfaction Gap (described later).

We’ll start with a chart showing the results for all respondents. Chart #1 doesn’t offer too much insight because so many different types of respondents have been grouped together: different types of companies, different levels of training, different job functions, and so on.

Here’s what we can glean from this “overall” chart:

- There’s a broader range in perceived VOC skill Importance (vertical scale) than in Satisfaction (horizontal scale).

- Prioritizing market needs (#10) is seen as the most important VOC skill.

- Overall, VOC competencies fall between Barely Acceptable &

With this background, let’s take a deeper dive into the data, exploring various sub-groups and correlations. We’ll capture these insights in seven findings.

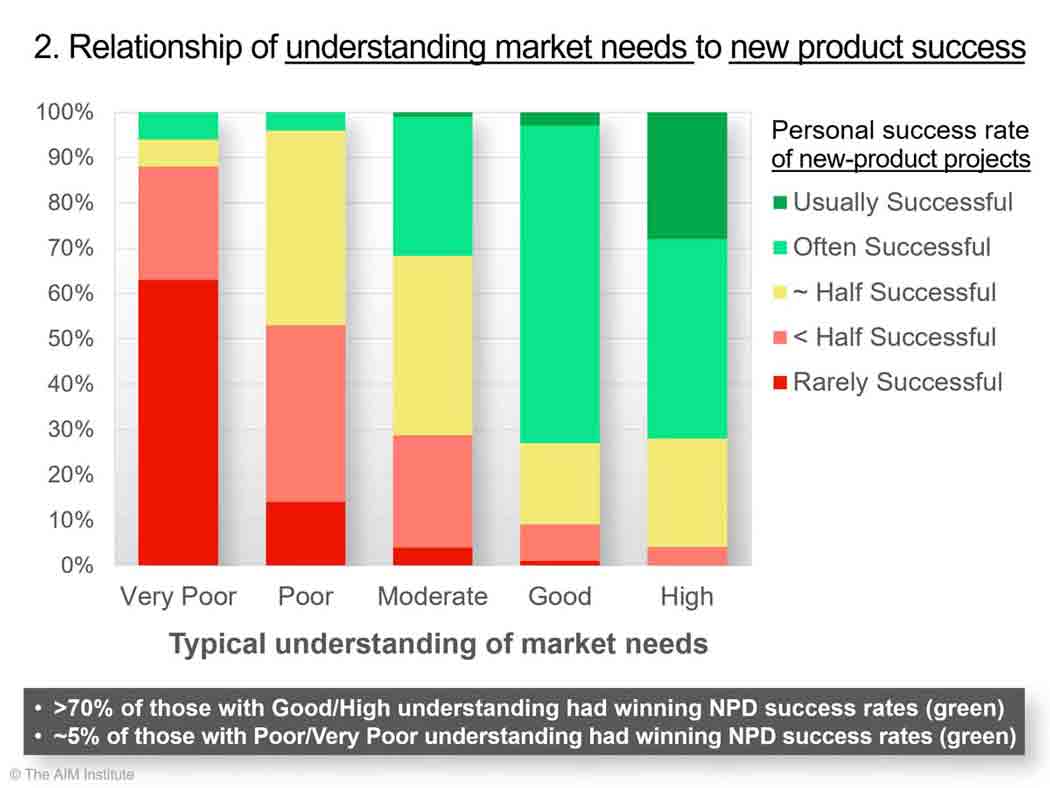

Finding #1: Understanding market needs correlates with new product success

At the beginning of this report, we suggested a relationship between four factors: from 1) VOC training… to 2) VOC competencies… to 3) understanding market needs… to 4) new product success. We’ll begin by looking for a correlation between the last two: understanding market needs and the successful introduction of new products into these markets.

After all, if understanding market needs doesn’t help new product success, what’s the point of developing strong VOC skills? This would be a very short report titled, “VOC skills don’t matter.” But as it turns out, Chart #2 suggests this will be a longer report.

In Chart #2, the color zones represent self-reported personal success rates in new product development (NPD) projects… from “Rarely Successful” (deep red) to “Usually Successful” (deep green). We weren’t surprised by the trend, but we were by the strength of the correlation:

- Over 70% of those with self-rated “Good” or “High” understanding of market needs said their new products were successful over half the time (light and deep green).

- But only about 5% of those with “Very Poor” or “Poor” market needs understanding said their new product introductions were more often successful than not (green).

Imagine 5% of your people had winning NPD track records today and you wanted to boost this to 70%. How would you do it? Spend more on R&D? Hire smarter R&D? Work on easier projects? These results suggest you don’t have to spend more, high brighter, or shoot lower. Just understand market needs better.

You don’t have to spend more, high smarter, or shoot lower. Just understand market needs better.

Finding #2: Strong VOC skills equate to understanding market needs & new product success

If you’re comfortable that understanding market needs can lead to more successful new products, let’s see what could help you understand market needs better. There are many approaches we did not study: multi-client market studies, industry expert consultations, ethnographic research, market satisfaction studies, and so on. In our experience, B2B markets beg for intelligent, peer-to-peer, “voice-of-customer” interviews… so that’s what we studied here.

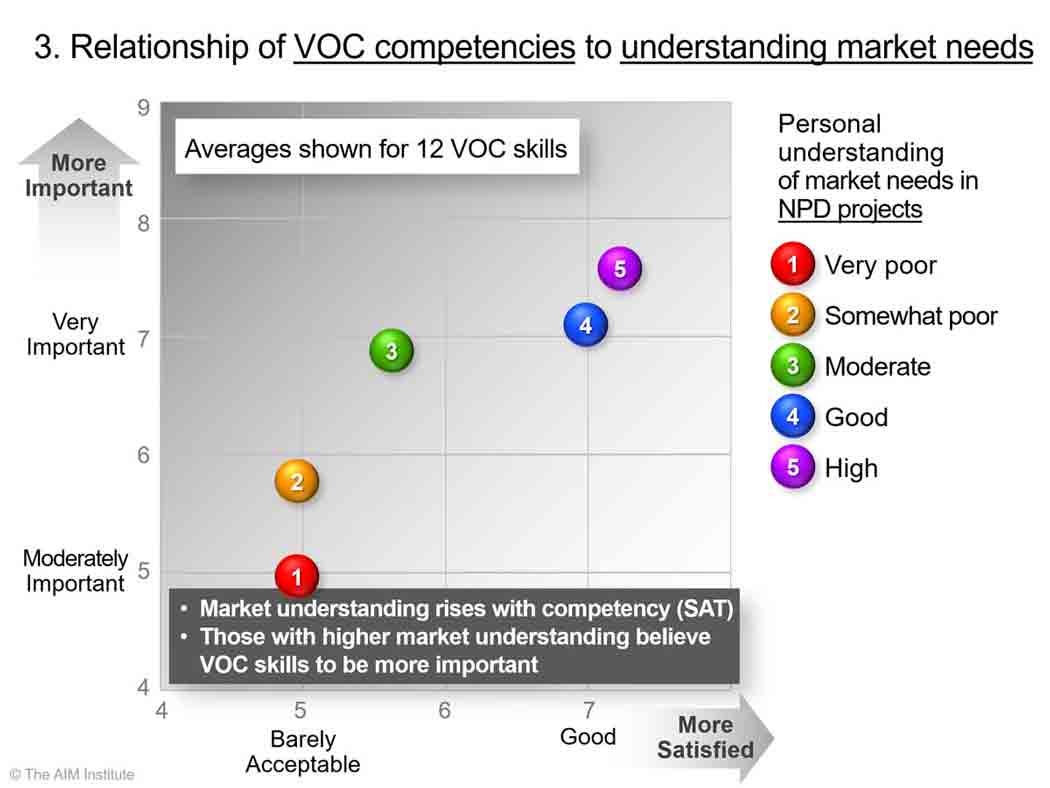

In Chart #3 we averaged IMP (Importance) and SAT (Satisfaction) 1-to-10 scores for all 12 VOC skills presented earlier. We did this for five groups of respondents that rated their personal understanding of market needs in their NPD projects from “Very poor” (red) to “High” (purple).

We were surprised by the strength of the correlation between understanding market needs and both Importance (a measure of respondent attitude) and Satisfaction (a measure of respondent competency):

- Those with a “Very poor” (red) or “Somewhat poor” (orange) understanding of market needs had an average VOC competency of “Barely Acceptable.”

- Those with a “Good” (blue) or “High” (purple) understanding of market needs had an average VOC competency of “Good.”

- Those with a better understanding of market needs also had a greater appreciation for the value of VOC skills, as indicated by higher average Importance ratings.

But Chart #3 just shows average VOC skills for these five groups of respondents. Surely all VOC skills aren’t “created equal.” To understand which of the 12 VOC skills has the greatest correlation with market understanding, let’s explore Chart #4.

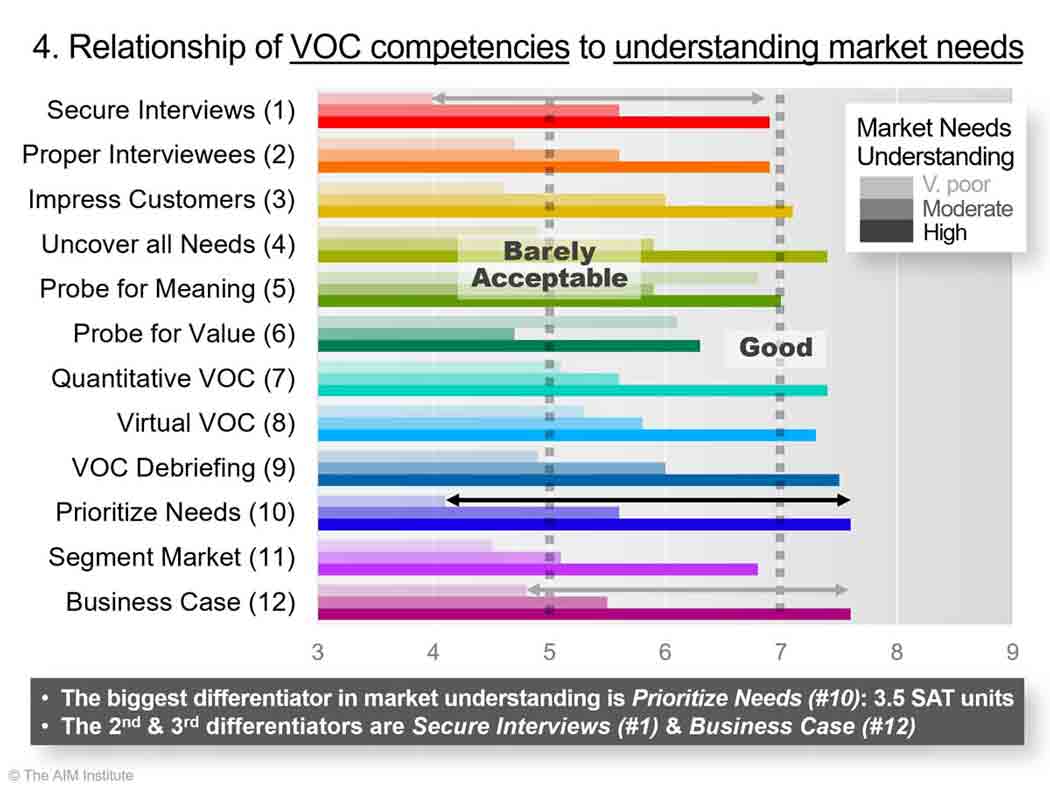

Here we looked at VOC competency levels for each of the 12 VOC skills. We did this for three groups of respondents that had varying levels of market understanding: “Very poor” (light horizontal bar shading), “Moderate” (medium shading), and “High” (deep shading).

For those wishing to improve their understanding of market needs, this chart gives strong clues for what to focus on. How? It reveals which VOC skills the best “understanders of market needs” are doing well that the worst are not:

- The biggest differentiator for understanding market needs is Prioritize Needs (#10)

- The 2nd and 3rd differentiators are Secure Interviews (#1) and Business Case (#12)

That first point is a big one: prioritizing market needs. It’s come up in Chart #1—as the most important VOC skill overall—and it will stand out in future charts as well. It’s so important, in fact, that we’ll focus on it exclusively in Finding #3.

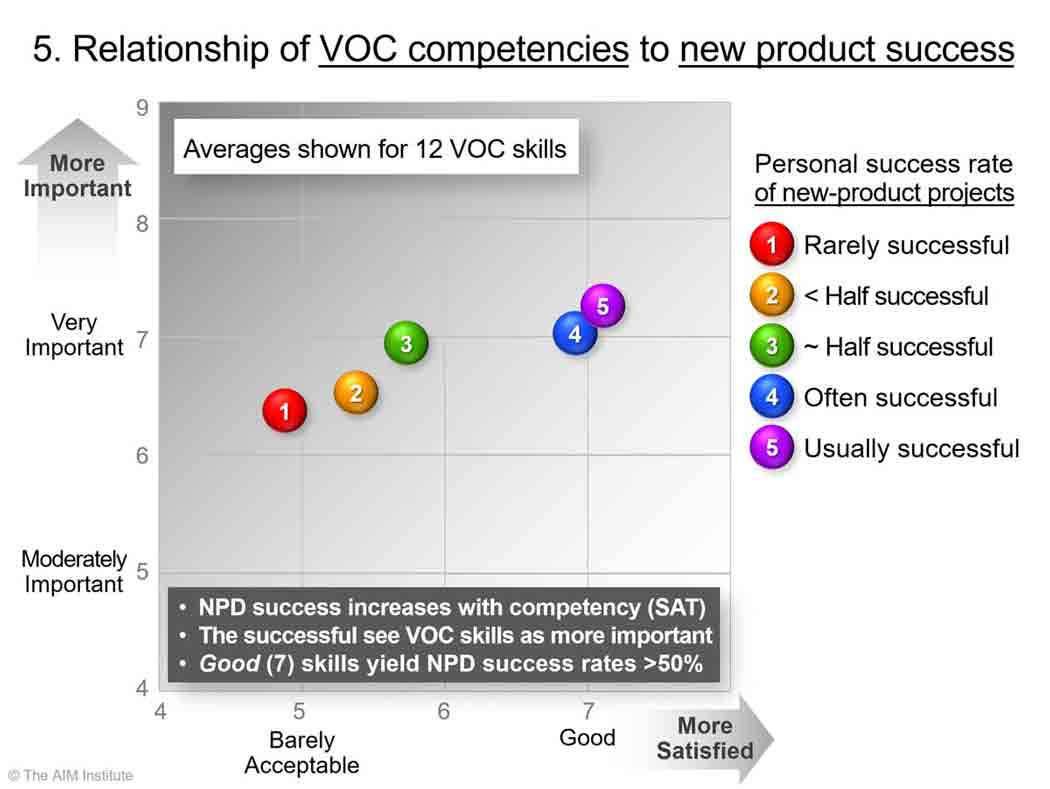

Now let’s explore the correlation between VOC skills and new product success. We’ll use Chart #5 for this. Once again, we’re using averages of all 12 VOC skills. But this time, instead of each bubble representing respondents’ understanding of market needs (Chart #3), the bubbles represent personal success rate in their NPD projects.

This chart looks familiar, doesn’t it? As with understanding market needs (Chart #3), both increasing Importance and Competency (satisfaction) correlate well with greater new product success.

Think of it this way: If your new product project teams have “Good” VOC skills, over half their projects would likely succeed (blue & purple bubbles). Conversely, if teams’ VOC skills are “Barely Acceptable,” don’t be surprised if fewer than half their projects succeed (red & orange bubbles).

If teams’ VOC skills are “barely acceptable,” don’t be surprised if fewer than half their projects succeed.

Finding #3: The biggest VOC differentiator in new product success is prioritizing customer needs

Now that we’ve seen correlations between VOC skills and new product success, we can get a bit more granular. Remember that we “guessed” which 12 VOC skills to include in this survey. But did we guess right? In terms of driving new product success, we’d like to know:

- Which VOC skills are the most and least helpful?

- Should we have excluded some skills because they have no impact at all?

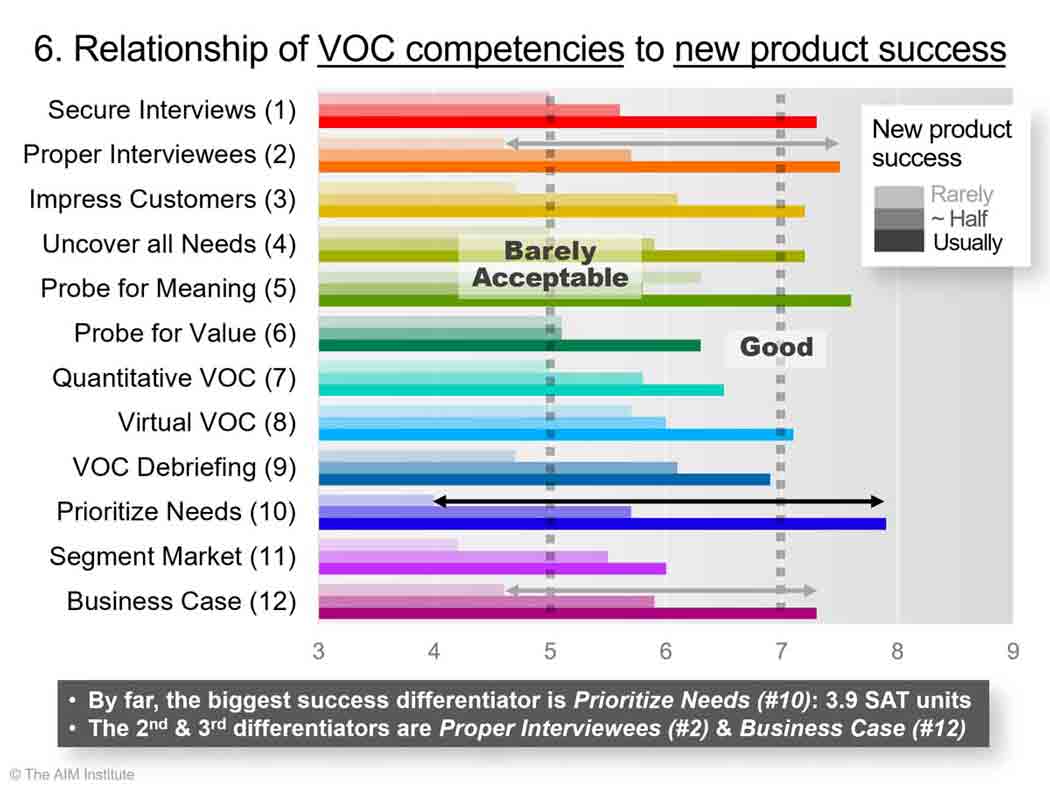

We’ll use Chart #6 to answer these questions. It’s similar to Chart #4, except the bar shadings relate to new product success instead of understanding market needs. Most would agree that this is the more important question: “Which VOC competencies relate to new product success?”

As you compare respondents that “Rarely” succeed in new products (light horizontal bar shading) to those that “Usually” succeed (deep shading), consider three takeaways:

- The biggest differentiator is Prioritize Needs (#10), with a huge gap (3.9 SAT units).

- The 2nd and 3rd differentiators are Proper Interviewees (#2) and Business Case (#12).

- None of the 12 VOC skills is superfluous: There is some differentiation in each one.

Let’s spend more time on Prioritize Needs. If you remember Chart #1, this was rated as the most important VOC skill overall. And in Chart #4 it was the biggest differentiator for understanding market needs. In later charts, you’ll also see the “untrained” are most eager to improve this VOC skill.

So what’s going on with the VOC skill of prioritizing market needs? To understand it better, consider two innovation errors you should avoid in new product development:

- Errors of omission: This is failing to uncover all articulated and unarticulated customer needs. This is addressed in VOC skill #4, Uncover all Needs.

- Errors of commission: This is choosing the wrong needs to work on. It requires prioritization of customer needs, and is addressed in VOC skill #10, Prioritize Needs.

As you’ll see later in this report, most B2B companies are terrible at prioritizing market needs—unless they’ve had special training in this. They “go interview” customers and bring back a mishmash of customer needs. Then they try to figure out what to do with these needs, unfortunately leaving customers out of this part of the process.

We’ll explore a better way later, but for now, just remember prioritizing market needs is a huge differentiator. Suppose someone asks, “How can we boost market understanding and new product success?” Most likely your best answer is, “We need to prioritize market needs better.”

Your best answer is, “We need to prioritize market needs better.”

Finding #4: VOC skills & new product success are impacted by VOC training

Let’s do a process check. So far, Charts #2 through #6 have shown correlations between the last three steps in the 4-step “chain” introduced in the beginning. But we haven’t examined the impact of VOC training yet. We’ll begin by looking at all types of VOC skills training, and then—in the next Finding—we’ll explore a certain form of B2B-optmized training called New Product Blueprinting.

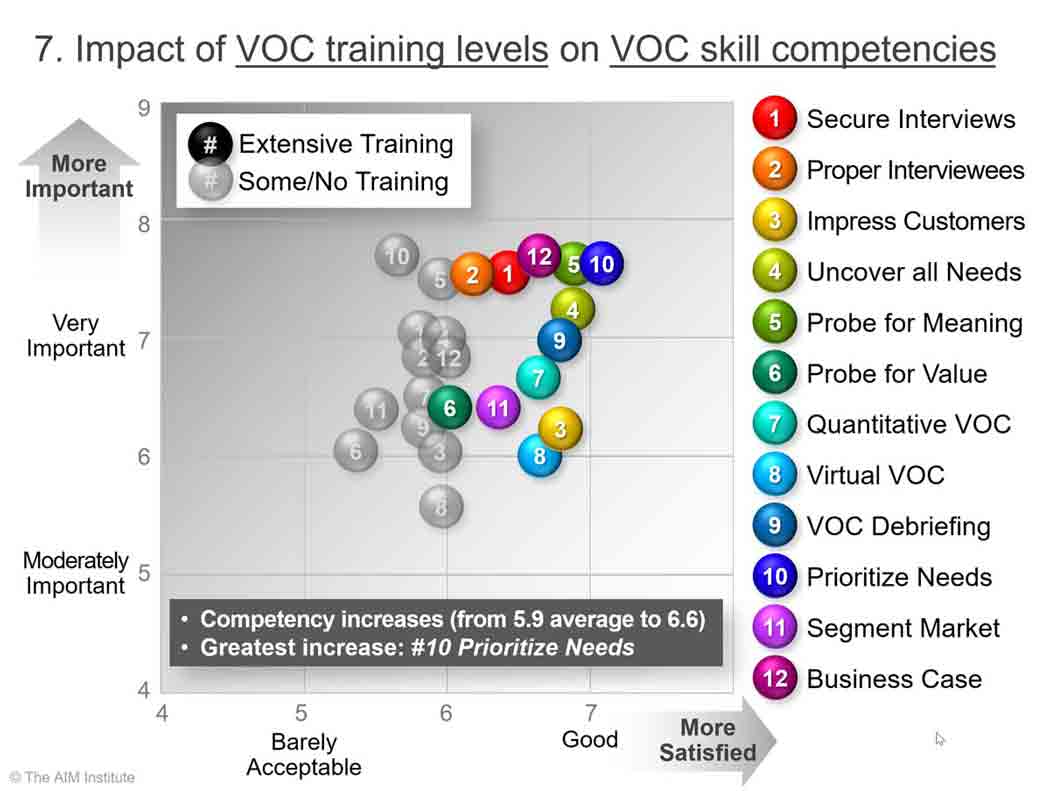

Chart #7 is a variation of Chart #1, except here we’ve divided the respondents into two groups: Those that had “Extensive” VOC training and those that had “Some or No” training. (We didn’t have enough respondents admitting to “No” training to create its own group.)

Frankly, aren’t the bubble “shifts” a bit smaller than what you’d hope for? They certainly aren’t as big as the “Barely Acceptable” to “Good” shifts we’ve seen in prior charts. We’ll come back to this point later, but the question it raises is, “Is the typical VOC training program as good as it could be?”

Is the typical VOC training program as good as it could be?

If you’ve been keeping track, you’ve now seen correlations between each of these four factors: VOC training to VOC skills… to understanding market needs… to new product success. Now we’ll see if we can make a connection across all four, from VOC training all the way to new product success.

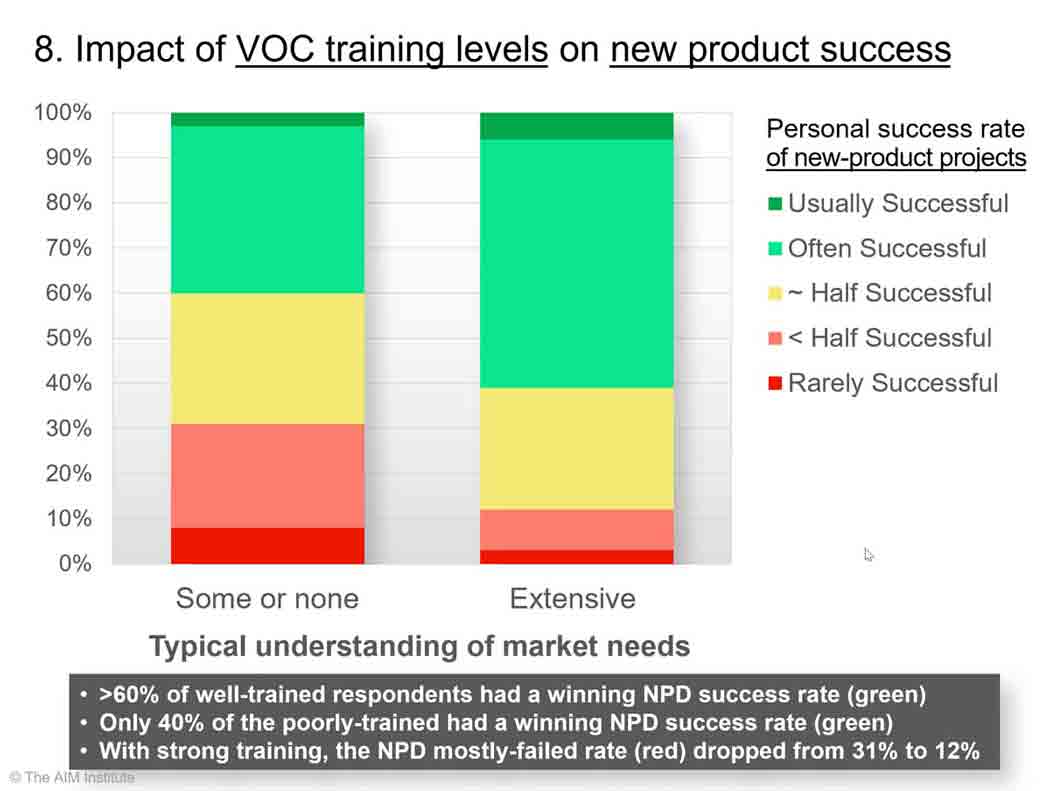

We’ll use Chart #8 for this. We divided all respondents into two groups: those with “Some or No” VOC training, and those with “Extensive” VOC training. (And at this point, we don’t care what type of VOC training they received.)

We then segmented both groups by respondents’ personal new-product success rate, from “Rarely Successful” (deep red) to “Usually Successful” (deep green).

Have you ever heard someone in your company ask, “But how do we know VOC training will help our new product success?” This would be a good chart to show them. Here we see a correlation from VOC training all the way to new product success rates:

- 61% of extensively trained respondents had a winning NPD success rate (green)

- Only 40% of those with some/no training had a winning NPD success rate (green)

- With extensive training, the NPD “mostly-failed” rate (red) drop from 31% to 12%.

These aren’t enormous gains, but let’s put this into perspective. Consider the cost of training employees in VOC skills to the cost of R&D working on dead-end projects. What would the impact be if 61% of your employees had winning NPD success rates instead of 40%? To get a sense for this, check out the section in the full report (at www.b2bvocskills.com) on page 15 called, “Let’s do the math.” You’ll see a 30-fold ROI on VOC training is entirely possible.

You’ll see a 30-fold ROI on VOC training is entirely possible.

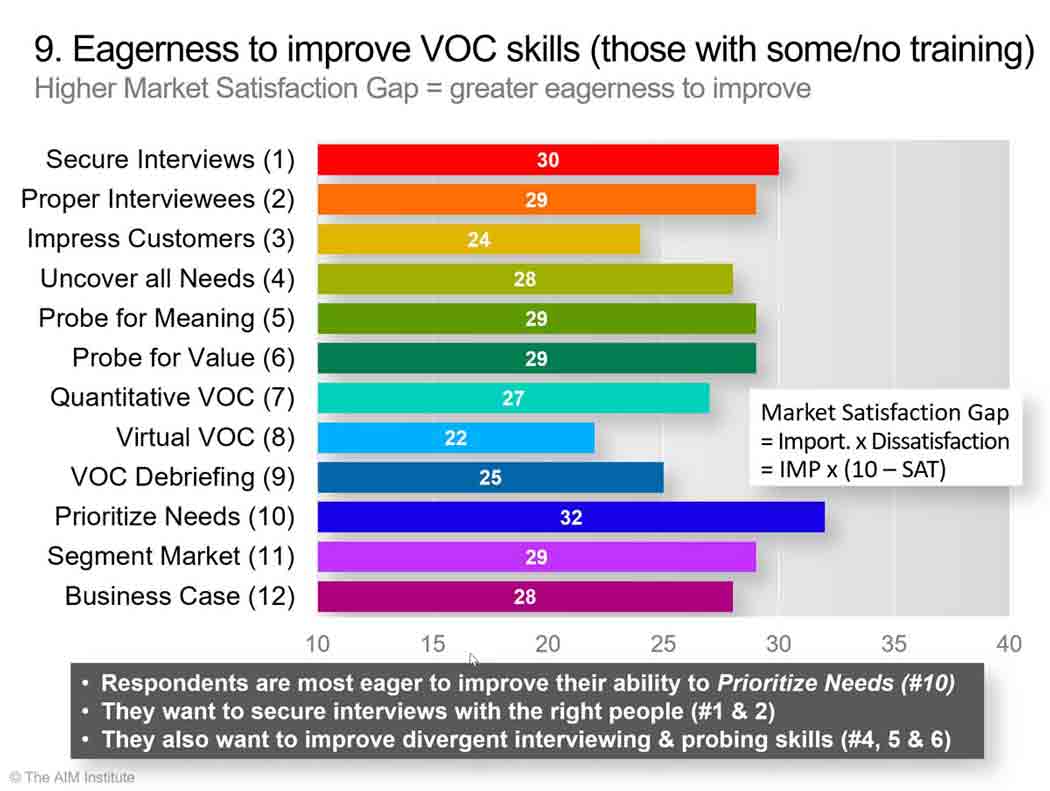

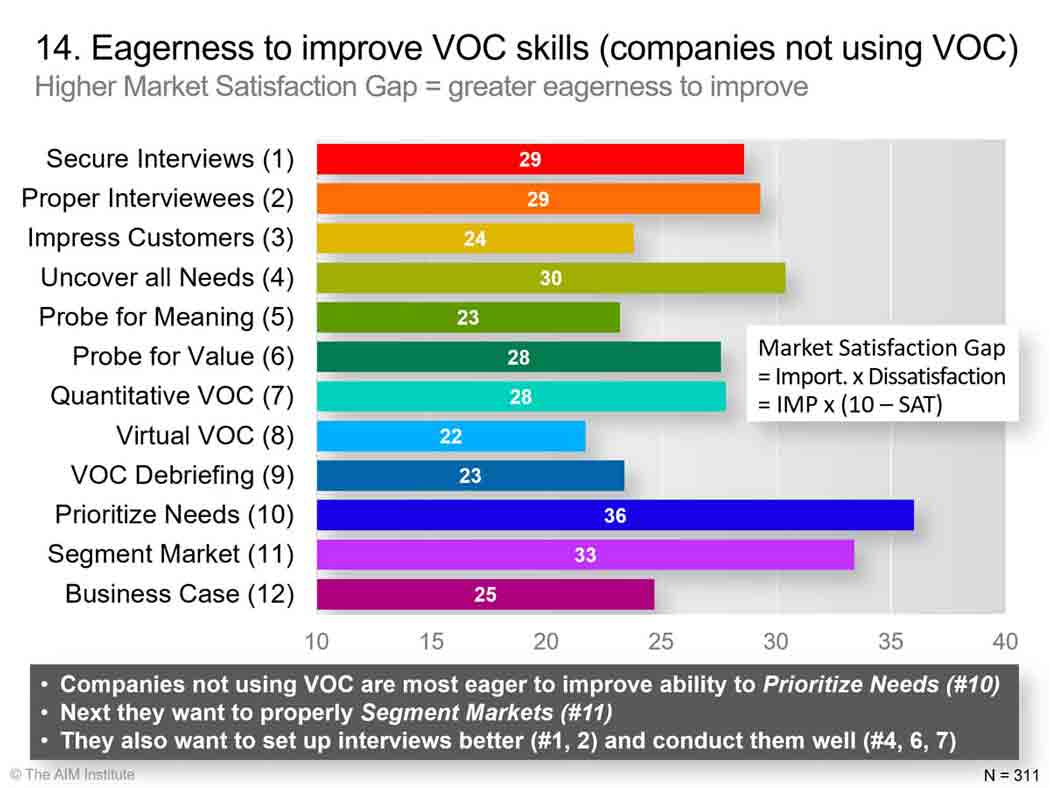

VOC training seems important enough that we should consider types of training. But before we do that, let’s ask the question, “What are those with some or no training most eager to improve?” For this, we’ll use something called Market Satisfaction Gaps (fully explained in the white paper, Market Satisfaction Gaps).

Market Satisfaction Gap = Avg IMP x (10 – Avg SAT)

This is something the AIM Institute’s VOC trainees use to gauge the level of “eagerness” their customers have to improve certain outcomes (desired end results). We’ve had the benefit of coaching thousands of B2B new-product teams in every conceivable industry, and here’s what we’ve learned. If an outcome has a Market Satisfaction Gap of around 30%, it indicates high eagerness for improvement.

Let’s apply this to those 12 VOC skills. We won’t bother with the respondents that had “extensive” training: They had low Market Satisfaction Gaps since they were already satisfied with their skills. Chart #9 reveals which VOC skills those with some or no VOC training are most eager to improve.

This chart shows those with limited training had eight VOC skills with a Market Satisfaction Gap of 28 or more. They were eager to improve much. The VOC skill they want to improve the most may be looking familiar to you: Prioritize Market Needs.

Finding #5: Training in New Product Blueprinting improves VOC skills more than other methods

If you’re comfortable that training in VOC skills can be helpful for your business, it’s probably worth exploring what type of training might be most helpful. In 2005, the AIM Institute began training large multi-national companies in New Product Blueprinting. This methodology includes B2B-optimized VOC skills, which have been continually refined and taught via hands-on, real-project practice. (See www.newproductblueprinting.com for more.)

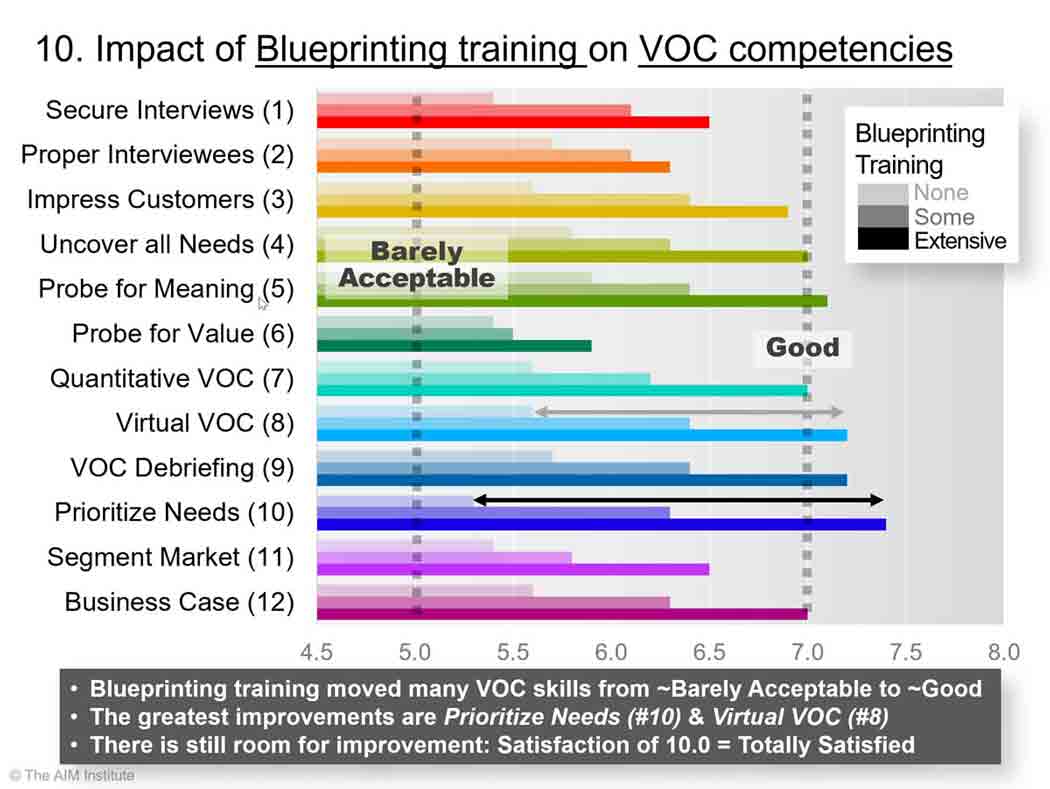

Chart #10 shows the impact of Blueprinting training on VOC competencies… from no training (light shading)… to some training (medium shading)… to extensive training (deep shading).

Those untrained in New Product Blueprinting generally had VOC skills slightly above “Barely Acceptable.” With extensive Blueprinting training, many skills approached or reached “Good.” More than any other skill, Blueprinting training helped respondents improve their ability to prioritize market needs.

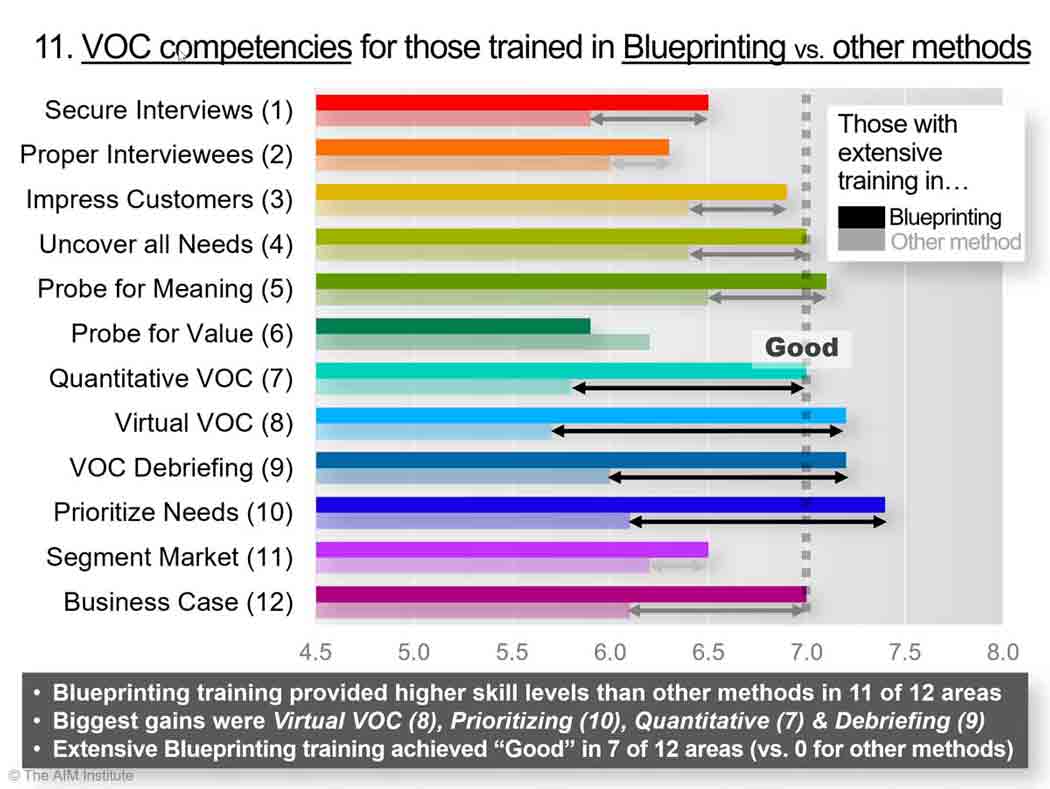

Chart #11 shows that Blueprinting training provides higher VOC skill levels in 11 of the 12 areas. The two greatest “differentiators” are Virtual VOC and Prioritizing Market Needs. For more on virtual VOC, download the white paper, www.virtualvoc.com.

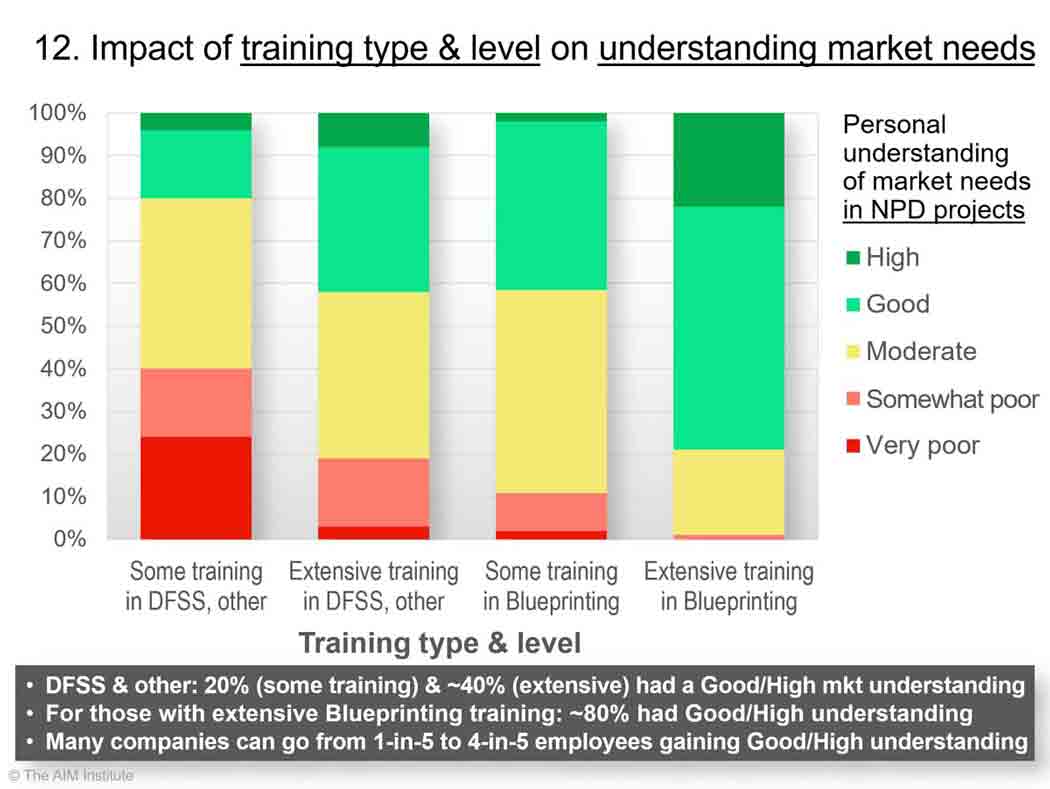

You may remember a long time ago (Chart #2), we saw a strong correlation between understanding market needs and new product success. Now let’s examine the impact of training type and level on understanding those market needs.

In the two left columns of Chart #12, you see the impact of some vs. extensive training in DFSS and other methods. Not bad: With extensive training, the percent of respondents with a Good/High understanding of market needs (green zone) doubles… from 20% to 40%.

The third column from the left shows that “some” training in Blueprinting yields similar results to “extensive” training in DFSS and other methods. In the fourth column, you see the impact of extensive training in Blueprinting: Now 80% of respondents are “in the green” with a Good or High understanding of market needs.

Let’s consider what this means for the typical B2B business. Unless they’ve been quite intentional about it, most B2B companies today are in “the far-left column.” This means about one in five of their employees has a strong (Good/High) understanding of the needs of the market for which they’d like to develop a new product.

That should make us nervous. But look at the potential in the right-hand column. Instead of one-in-five employees having a strong understanding of market needs, your business could easily have four-in five.

Instead of 1-in-5 employees having a strong understanding of market needs, your business could easily have 4-in-5.

Finding #6: VOC skills & attitudes are impacted by a company’s use of VOC

In this section, we’ll compare the VOC skills of employees working in companies that don’t employ VOC to those that do. You may find this surprising, but many B2B companies today conduct little or no VOC. They typically use a stage-and-gate process with a light-bulb graphic on the left that’s labeled, “Idea Generation.” If you ask them whose ideas are being generated—theirs or their customers—they’ll say they are their own ideas.

Such companies are “launching products at their customers” to see what works. Ask when they understand market needs, and they’ll say, “I guess we wait to see if customers buy the new product.” It apparently hasn’t occurred to them that they should first understand needs and then develop solutions… instead of the other way around.

Think about that: There might be less efficient ways to understand market needs than going through the entire new product development process first. But it’s hard to imagine what could be less efficient.

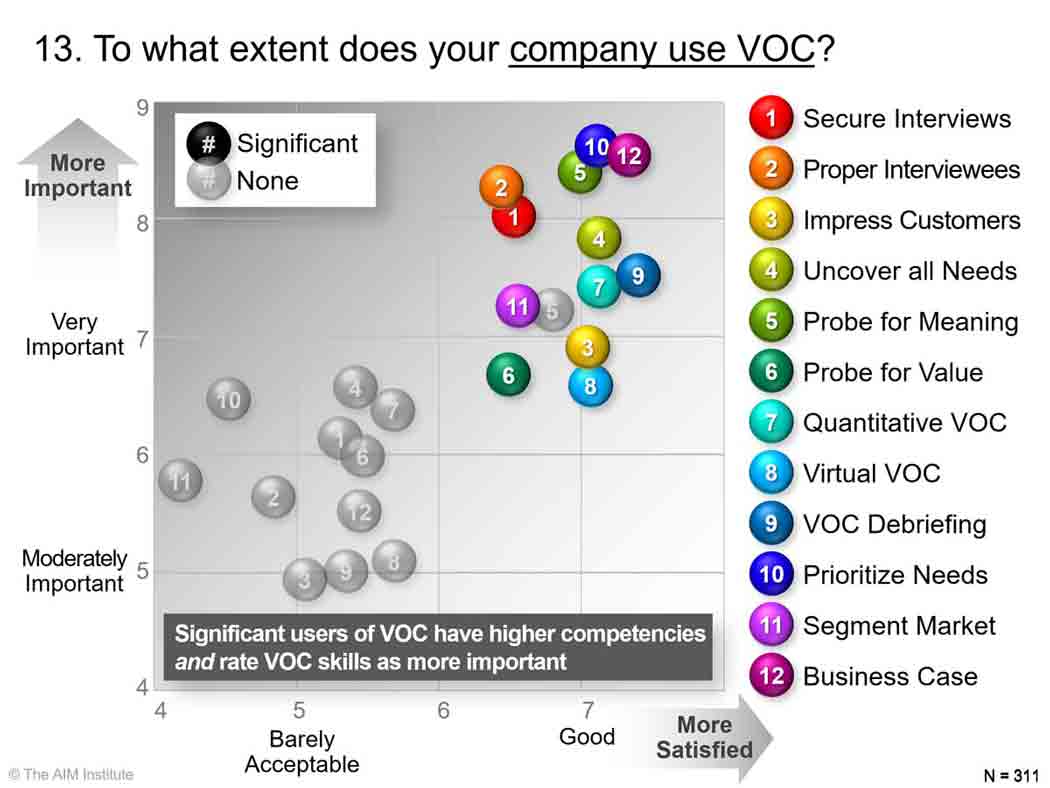

We’ll use Chart 13 to compare respondents that work for two types of companies: those that use no VOC today and those that use VOC extensively. For the “non-VOC-users,” most of the VOC competencies hover around “Barely Acceptable.” Not so at companies that extensively use VOC: These respondents average “Good” VOC competencies.

When companies don’t use VOC, respondents also assign appreciably lower Importance scores than “extensive” VOC users. Yet, even though they see less value or usefulness (Importance), non-VOC-users are eager to improve many VOC skills, as shown in Chart #14.

The highest Market Satisfaction Gap is for the VOC skill, Prioritize Market Needs, which you may remember is the strongest differentiator in new product success (Chart #6). So even companies that don’t use VOC seem to understand the value of this VOC skill.

Finding #7: Most B2B companies have similar VOC behaviors

You could certainly be excused for reading these research results and thinking, “yes, but you see my company is different.” Over the years, though, our AIM Institute staff has been quite surprised to see how similar most B2B companies are, whether they’re designing sewer pipes or satellite components or something in between.

But of course, that’s just our anecdotal experience. Let’s see what the data reveal in this new research. We like to classify B2B companies into producers of four offering types:

- Materials: chemicals, plastics, metals, glass, etc.

- Components: Parts, sub-assemblies, fixtures, etc.

- Equipment: Fully functional devices, comprised of materials and components

- Services: Non-physical offerings, such as software, support, consulting, etc.

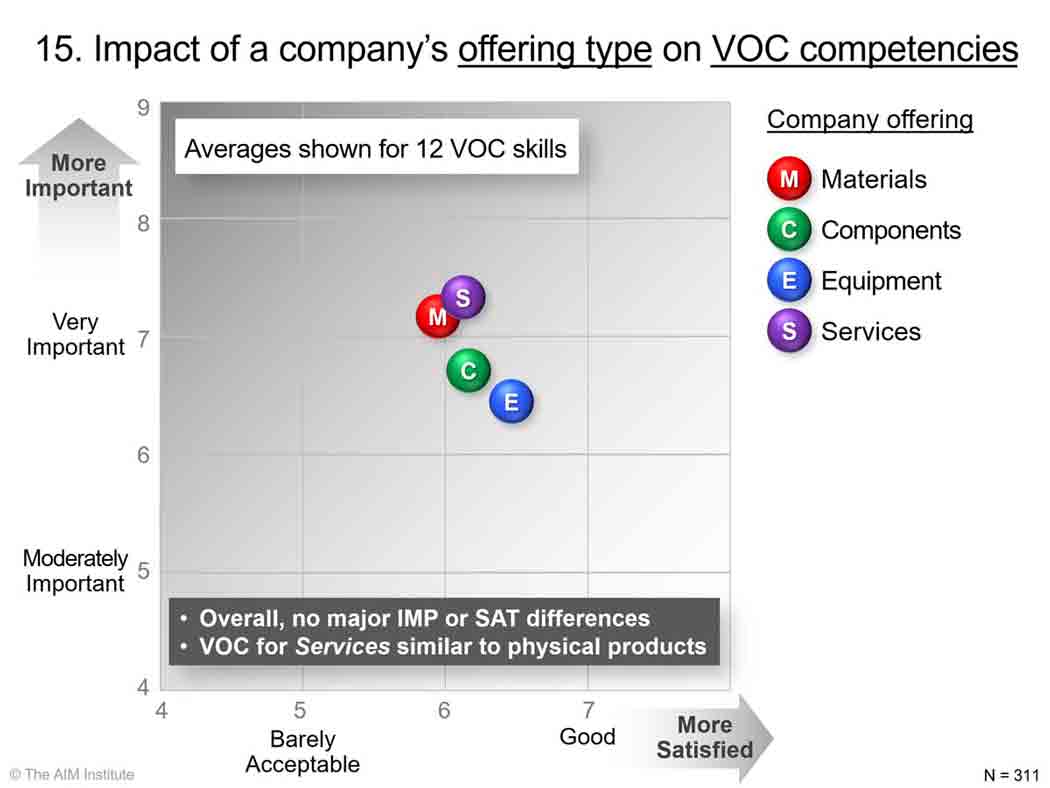

Surely this diversity in offerings is so great that VOC skill levels and importance would be quite different, right? Not really. As shown in Chart #15, there’s not much difference in Importance or Satisfaction ratings between the four types of offerings.

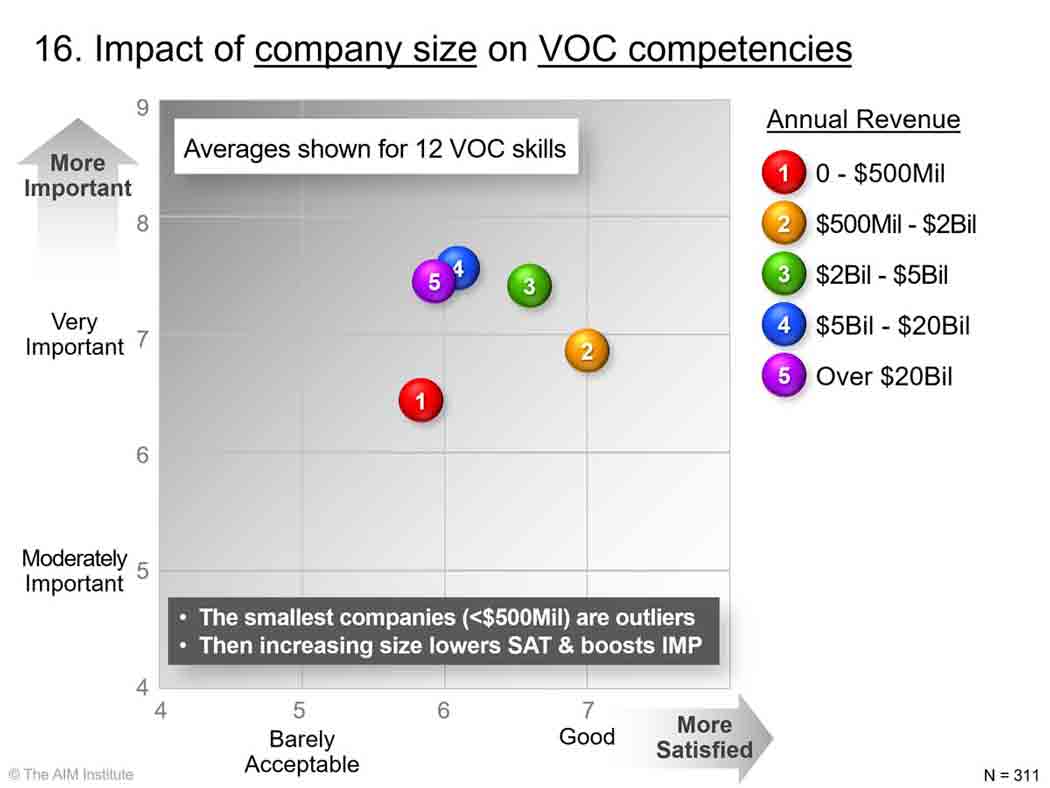

OK, the type of offering doesn’t seem to matter. But what about the size of the company? Chart #16 shows the impact of company size on VOC competencies.

Here we do see some difference, albeit small ones. The “outlier” seems to be companies with revenue less than $500 million per year. As company size increases to between $500 million and $2 billion per year, VOC skill levels climb to “Good” and Importance to “Very important.” As company size increases even further, we see this peculiar pattern: Respondents self-assess their VOC skill levels lower and their importance higher.

Some perspective is helpful here. Even though company size seems to have an impact on VOC skills, it’s relatively small. Whether a company uses VOC or has trained its employees, for instance, has a much larger impact than what that company produces or how large it is.

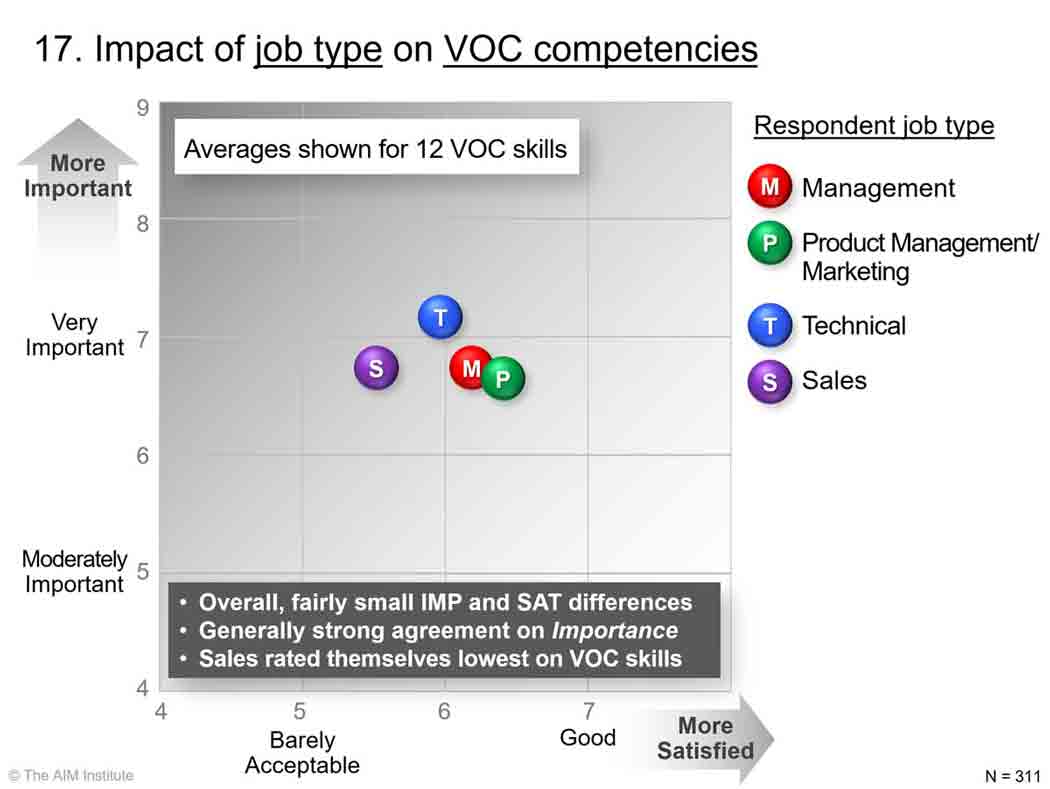

We wanted to answer one more question: Does it matter what the respondent’s job function is? As it turns out, job function seems to matter little. Chart #17 shows a reasonably tight cluster along both axes for the four job types surveyed.

If type of offering, company size and job type don’t have a large impact, is this good news, bad news, or no news at all? We think it’s good news: What matters is not the hand you’ve been dealt. It’s what you do with it. Regardless of the nature of your company or your job, you’re pretty much in the same boat as other B2B professionals.

What matters is not the hand you’ve been dealt. It’s what you do with it.

The actions of your leadership team are what make the difference. A big difference. Your business can have great success if they are committed to using VOC in a meaningful way (see Chart #13) and to training their employees in VOC skills (see Charts 8 & 12).

In conclusion…

Are you eager to drive organic growth through blockbuster new products? If you were planning to do this by hiring more R&D or fine-tuning your NPD process, please hit the pause button. It’s likely that your strongest point of leverage—by a lot—is to build and deploy strong B2B VOC skills.

You’ve seen in this research that New Product Blueprinting is a powerful way to apply powerful B2B-optimized VOC skills. You can learn more in several ways…

- Watch a short overview video at newproductblueprinting.com

- Attend one of our public workshops. See blueprintingworkshop.com

- View all our training options at blueprintingtraining.com

You’re already investing a bundle in R&D. Now it’s time to aim it with great precision. It’s time to create products customers really want. And time to drive the profitable, sustainable organic growth your business needs.

Comments