Commercialize technology… in 6 foolproof steps

In 1965, DuPont scientist Stephanie Kwolek synthesized the first Kevlar polymer, an amazing fiber with five times the strength of steel. DuPont invested several hundred million dollars to commercialize the technology for tire cords, with disappointing results. It would be another decade before the company found its first major market for this material: bullet-proof vests.

How well does your company commercialize technology? Want to do it faster… more efficiently… with greater confidence? You can, with these six steps:

- Separate your jungle animals and farm animals.

- Select your first target market segment.

- Investigate all assumptions that “must be true.”

- Explore assumptions about customer needs first.

- Try to kill your project quickly.

- Test the next market segment (maybe).

Six Steps to Commercialize Technology

Step 1. Separate your jungle animals and farm animals

If you ran a zoo, you’d keep your jungle animals and farm animals in separate enclosures, right? Your technology development projects are untamed, jungle animals: You don’t completely understand them, and you’re not sure what they’ll do or where they’ll go next. Your product development projects are predictable farm animals. You know what they’re supposed to do, and who they’re supposed to do it for.

When you commercialize technology, you are “domesticating” wild animals for productive purposes. As a first step, you must be crystal clear about which type of project your scientists or engineers are working on at any point in time. Consider the differences:

- Technology development is science-facing; product development is market-facing.

- Technology development turns money into knowledge; product development turns knowledge back into money.

- Technology development builds supplier capabilities; product development builds customer solutions.

To successfully commercialize technology, be especially clear about the last point. Does it build a capability for your company that might be used across multiple markets? Then it’s technology development. But once you target a specific market segment, you’ve begun product development.

So when you develop technology, you’re putting something valuable into your pantry for later use. When you commercialize technology, you’re taking something out of your pantry and using it for a new product. These are very different actions that should not be intermingled and confused.

Step 2. Select your first target market segment

As described above, your technology development might result in new products for several market segments. A market segment is simply a “cluster of customers with similar needs.” To commercialize technology efficiently, you need to target the most attractive market segment(s) as soon as possible.

Why this focus on market segments? The only way to successfully commercialize technology is by improving important, unmet customer outcomes in customer jobs-to-done. Since customer outcomes and jobs-to-be-done are unique to each market segment, you must explore each segment individually.

Since customer outcomes and jobs-to-be-done are unique to each market segment, you must explore each segment individually.

Imagine you have a new metal coating technology with great corrosion resistance. Your team would list the potential market segments (the rows below) and your selection criteria (the columns below). Then your team would assign A, B and C levels in each cell and select your first target market segment… in this case, bridge coatings.

You don’t have to commercialize technology in just a single market segment, but you do have to target and test each market segment individually. In this example, the team might pursue construction equipment coatings after bridge coatings, or they might do this in parallel. But each should be run as a separate new product development project.

Step 3. Investigate all assumptions that “must be true”

When you commercialize technology, be nervous about hidden assumptions. These are factors that must be true for your new product to succeed, which are not properly addressed. Think of these as potential “landmines” that could blow up your project’s schedule, budget, or viability. Identify them as soon as possible. After all, no one steps on a landmine they can see.

No one steps on a landmine they can see.

For our bridge coatings example, the team might brainstorm assumptions as shown in the illustration below. It helps to follow three guidelines:

- Always state the assumption in the positive sense: “For our project to succeed, it must be true that…”

- Classify assumptions as Market Dynamics (yellow below), Internal Capabilities (purple) or Customer Outcomes (blue). For market-facing innovation, all assumptions fall into one of these classes.

- For Customer Outcomes, separate Required Outcomes (red “R” below) from Desired Outcomes (blue “D” below).

Don’t stop with this brainstorming as you commercialize technology. It’s likely you’ll uncover 50-to-100 assumptions, and if you try to investigate all of them, you’ll suffer “paralysis by analysis.” It’s best to isolate those assumptions that are both high-impact and low-certainty… and focus only on these.

How does your team decide which assumptions are high impact and low certainty? First, have each team member individually rate all assumptions using the definitions shown below. Then create histograms of individual responses (see left side below), and have a team discussion to agree on unified team ratings for each assumption.

Two cautions when determining these team ratings:

- Don’t average the individual responses: When you commercialize technology, some team members have special knowledge or unique perspectives that may “win over” other team members after discussion and debate.

- If the team cannot reach a consensus, use the most “cautious” voice on the team. In other words, use the rating of the team member who thought the assumption had a higher impact or lower certainty than his or her teammates.

When you commercialize technology, it helps to visualize your team’s work at this point. In the Certainty Matrix below, you’ll see three groupings of assumptions:

- Danger: Assumptions in the red zone are high-impact and low-certainty. Your team must investigate these because they could become landmines.

- Caution: Assumptions in the yellow zone have enough impact and uncertainty that your team should also investigate.

- Safe: Assumptions in the green zone either have little impact or are already well-understood (high certainty), so you don’t need to investigate them.

Note that the above Certainty Matrix only addresses those purple “sticky note” assumptions the team generated for Internal Capabilities. Additional Certainty Matrices are built for Market Dynamics and Customer Outcomes.

The team now creates an action plan specifying who will investigate each assumption by a certain deadline. When most companies commercialize technology, they fail to rapidly identify and aggressively investigate potential landmines as soon as possible. Step 3 is key to accelerating the success—or rightful demise—of projects when you commercialize technology.

Step 4. Explore assumptions about customer needs first

You may have dozens of assumptions in the red and yellow zones. So which do you investigate first? It’s usually wise to begin with customer needs. Research shows that misunderstanding customer needs is the primary cause of new product failures. This is especially true when you commercialize technology in unfamiliar markets. Also, if you’re a B2B supplier you can understand customer needs quickly and at a very low cost.

Misunderstanding customer needs is the primary cause of new product failures.

For B2B markets, conduct two rounds of customer interviews: qualitative Discovery interviews followed by quantitative Preference interviews. Today, it’s easy to do this using web-conference based “virtual VOC” (voice of customer.) For virtual VOC advantages and how-to tips, download a white paper at www.VirtualVOC.com.

Discovery interviews are divergent: You keep asking the customer, “What other problems would you like to see fixed?” Then you probe each, recording your notes for the customer to see on virtual “sticky notes” (to promote a “brainstorming” mood).

After interviewing several bridge painting contractors this way, you then conduct quantitative Preference interviews with each. Here you get their 1-to-10 ratings for Importance and Satisfaction on each customer outcome (e.g. corrosion resistance). This short video demonstrates both types of interviews: www.VOCforB2B.com.

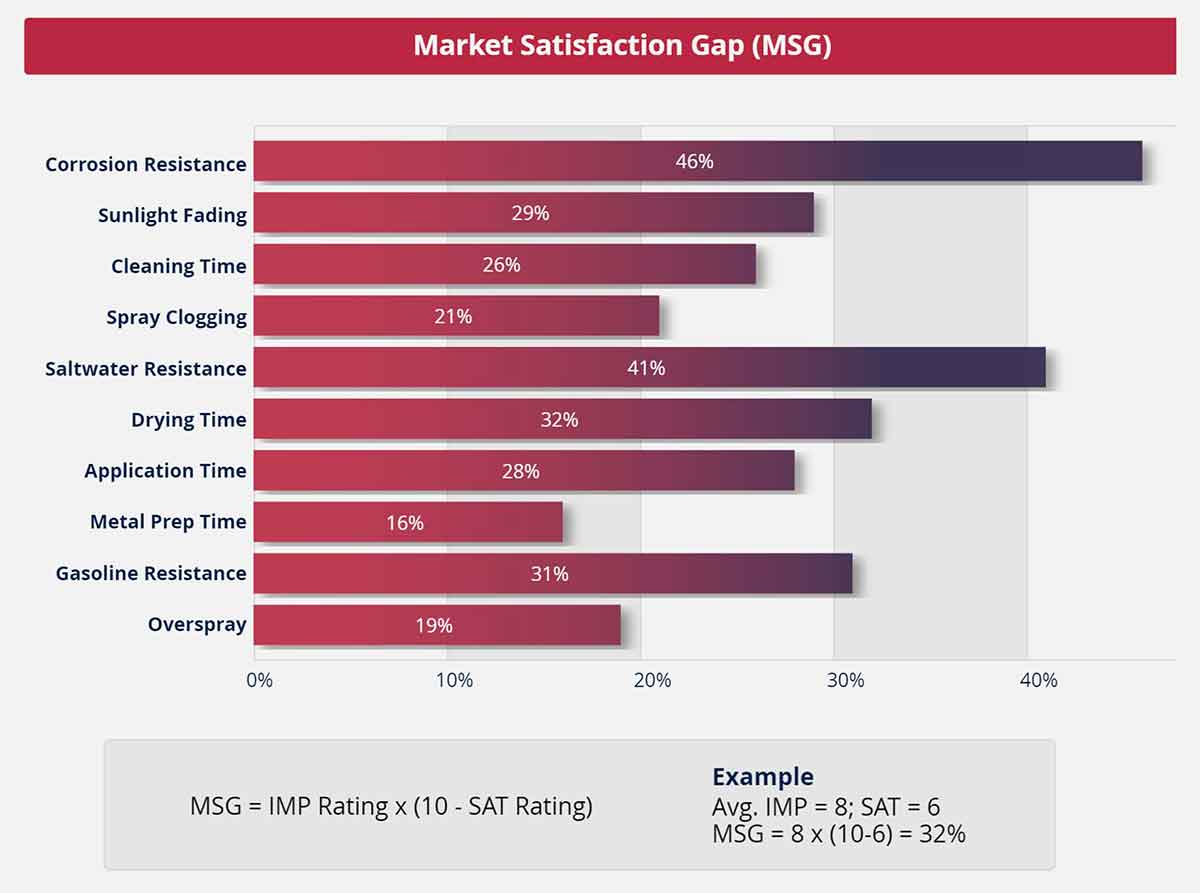

Once you have these quantitative ratings, it’s easy to create a Market Satisfaction Gap chart. As shown below, the formula is simply MSG = Average Importance Rating times (10 minus Average Satisfaction Rating). Research shows it’s worthwhile to pursue Gaps around 30% or above. For more, download the white paper, www.MarketSatisfactionGaps.com.

In this case, the bridge coatings market generated a Market Satisfaction Gap for “Corrosion Resistance” of 46%. This gives the team a strong incentive to commercialize technology for this market since this is one of their technology’s key deliverables.

What if the Market Satisfaction Gap for corrosion resistance had been 15%… because this outcome was either unimportant or already well-satisfied? If the team’s technology offered no other benefits, it should stop trying to commercialize technology for this market. Why try to satisfy a market need that doesn’t exist?

Why try to satisfy a market need that doesn’t exist?

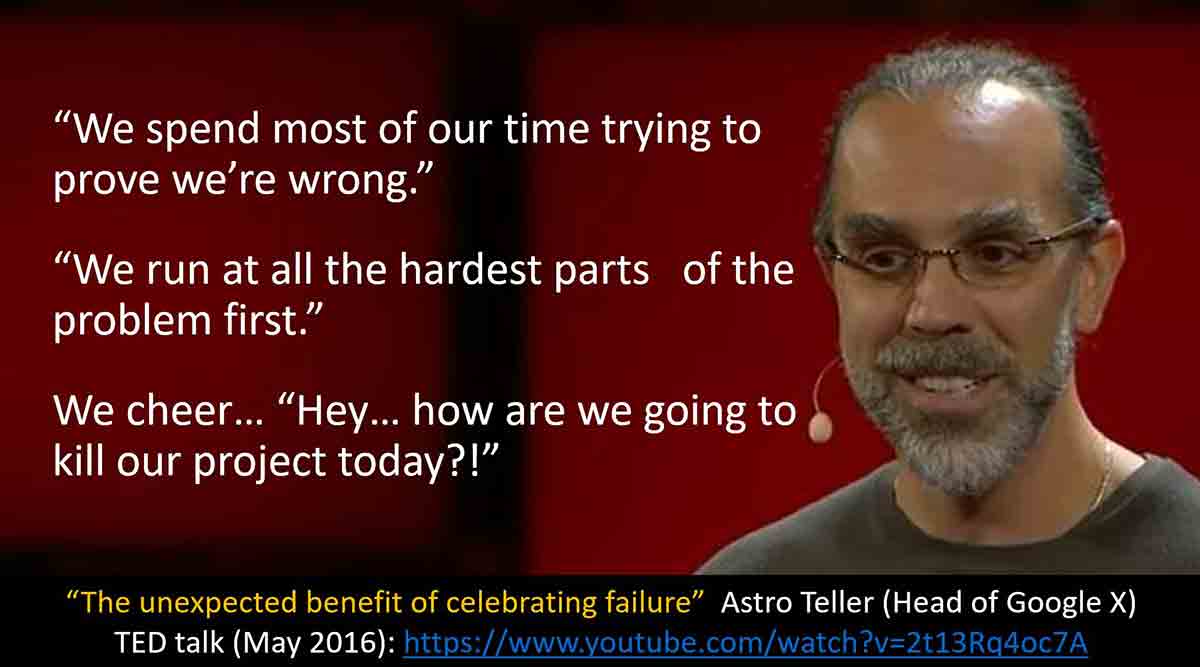

Step 5. Try to kill your project quickly

Astro Teller, head of Google X, once said… “We spend most of our time trying to prove we’re wrong. We run at all the hardest parts of the problem first. We cheer… ‘Hey… how are we going to kill our project today?!’”

What does this mean for you? Be on the constant lookout for landmines as you investigate all those assumptions that “must be true” for your project to succeed. You’re looking for one that is not true. So if it must be true that customers in this market desire improved corrosion resistance and this is not true, you want to learn this as soon as possible.

You might be thinking, “Great… how do I explain to management that I’m trying to kill this project?” First, help them understand that risk is different than uncertainty. To assess risk, you must be able to assign a probability of a negative event.

How do I explain to management that I’m trying to kill this project?

Early on, you simply don’t have enough information to assign probabilities. When you commercialize technology in this early stage, you simply are uncertain. Later you may ask management to make investment decisions, but now you are simply updating them as you drive your assumptions from uncertainty to certainty.

Second, provide frequent updates to show your progress. When most companies commercialize technology, management has no way to assess progress. The project looks like a “black box,” with the team saying, “trust us, you’ll love our project.” It’s much better to show your progress in moving assumptions from uncertainty to certainty. In the sample report below, this is converting red and yellow assumptions to green.

Step 6. Test the next market segment (maybe)

When you commercialize technology, one of three scenarios usually takes place:

- You succeed with the first market segment and then target a second.

- You fail with the first market segment and then target a second.

- You fail with the first market segment and stop.

The difference between the second and third scenarios is determined by why you failed. Was it for market-specific reasons or something else? In our bridge coatings example, some market-specific reasons for killing the project might include…

- Customers did not desire greater corrosion resistance.

- We could not meet necessary government bridge coating regulations.

- We do not accept the potential liabilities associated with bridge coatings.

Did your technology fail for market-specific reasons or something else?

If one or more of the above halted our project, we still might find another market—like construction equipment coatings—worthy of pursuit. On the other hand, imagine these non-market specific reasons that stopped our project:

- We could not successfully scale up to full production.

- We could not secure a reliable source of needed raw materials.

- We could not meet environmental regulations for our product.

In such cases, there would be no point in pursuing other market segments. Perhaps in the future, you’ll overcome one of these landmines, but for now, your technology just isn’t ready for commercialization. In other words, it’s still an untamed jungle animal.

In summary, to commercialize technology…

We’ve called these six steps “foolproof” for a reason. They’re certainly no guarantee that you can successfully commercialize any new technology you develop. But these steps do ensure you accomplish the following:

- Find the best market(s) for your technology as quickly as possible.

- Develop a product for this market based on known—not guessed—customer needs.

- Stop work on dead-end projects as rapidly and cost-effectively as possible.

These steps give you a roadmap for efficiently turning one jungle animal after another into a productive farm animal. Just as important, it gives you the confidence to pursue bigger and wilder jungle animals.

To commercialize technology, does this seem like a lot?

If these six steps seem like too much work, consider two things. First, assess how you commercialize technology today by asking…

- How much do we invest in creating new technology?

- What’s our track record for converting technology into winning new products?

- How quickly do we identify the “right” markets and penetrate them?

- How quickly do we kill dead-end projects as we commercialize technology?

Second, this paper might lead you to believe you need to create many tools and methods to commercialize technology using these six steps. You do not. They’ve already been created by the AIM Institute, and fall into two categories:

Minesweeper De-risking (for Steps 3 & 5): This is a project management framework (with training and software) that addresses all risks… commercial, technical, regulatory, operational, etc. For a short video, visit www.deriskprojects.com. To attend a 3-hour virtual public workshop, visit www.minesweeperworkshop.com.

New Product Blueprinting (for Steps 2 & 4): This is a B2B voice-of-customer methodology (with training and software) that helps you understand customer needs and reduce commercial risk. For a short video, visit www.NPBoverview.com. To attend a virtual public workshop, visit www.blueprintingworkshop.com.

If you have questions on either, contact us, and we’ll be happy to discuss your specific needs.

Comments