B2B Customer Needs: Predict the customer’s experience with modeling

How well do we understand B2B customer needs? How well is this even possible?

Consider that a model is a simplified reflection of reality… a “stand-in” for what will happen. Maps, budgets, and recipes are models. Advanced scientific models help us predict hurricanes, solar eclipses and tectonic plate shifts. A good model…

- Incorporates all important predictive data and ignores the rest.

- Explains the past and predicts future real-world behavior.

- Provides cost-effective benefits in the real-world.

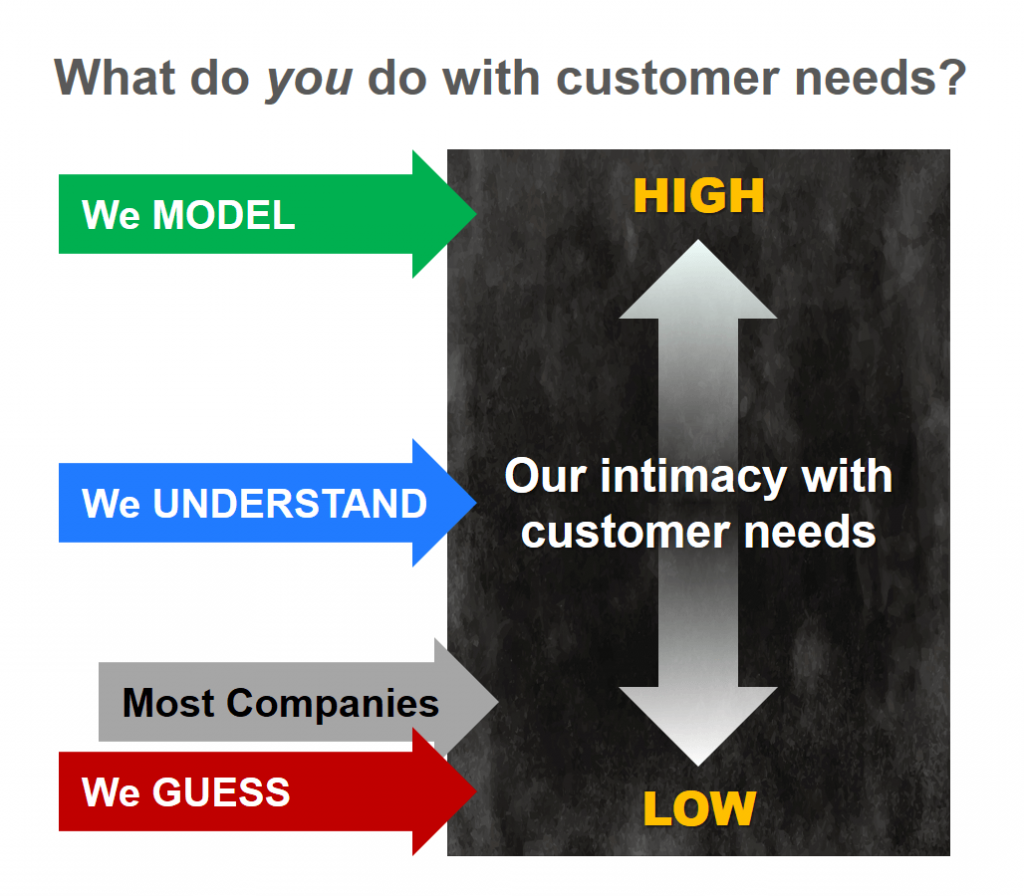

Your company’s relationship with customer needs lies somewhere on an “intimacy” continuum anchored by three points: We Guess, We Understand, and We Model. Before describing how to model customer needs—and why this is so important—let’s see what “guessing” and “understanding” look like.

Guessing and understanding customer needs

We recently researched the impact of B2B-optimized interviewing by 50 new-product teams from 20 prominent client companies. These teams had views of what their new products should look like before—and after—their 875 interviews. How much did these interviews impact their product designs? For only one out of every six teams was the impact “moderate” or “slight.” For five out of six teams, the impact was “great” or “significant.” (For more, see Guessing at Customer Needs at AIM Whitepapers.)

So it seems most B2B companies—without proper interviews—have a poor understanding of customer needs. They’re probably somewhere on the continuum between “guessing” and “understanding,” and probably much closer to the former. Your company is in this group if you…

- Start with your own ideas instead of customers’ ideas.

- Use customer interviews to “validate” your pre-conceived notions.

- Only learn how your new product will sell after you launch it.

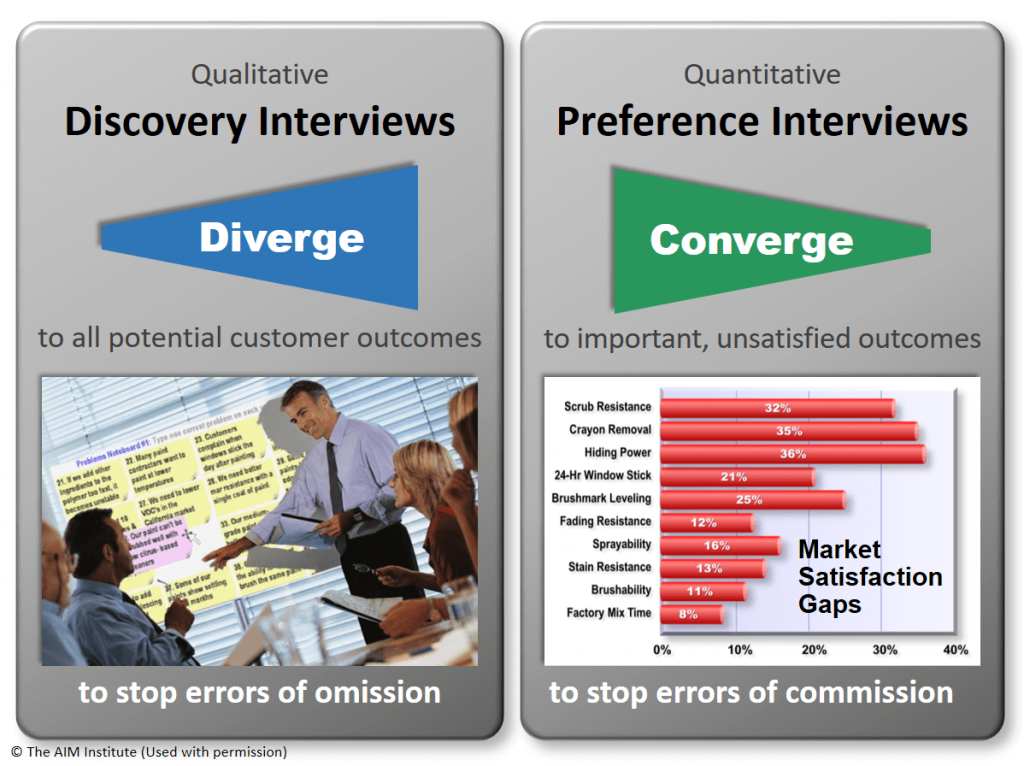

When your company moves from “guessing” to “understanding,” you eliminate two types of errors: errors of omission and errors of commission. The first is failing to uncover unarticulated customer needs, and the second is selecting the wrong customer needs to pursue.

Click here to learn more about the B2B growth tools available from AIM

For years, Blueprinting practitioners have used divergent, qualitative Discovery interviews and convergent, quantitative Preference interviews to avoid errors of omission and commission, respectively. Many teams stop after these interviews… and that may be OK if your competitors are still guessing.

But some day even lagging competitors will stop guessing and start understanding. As the Quality Wave showed, Detroit automakers eventually had to close the gap with Japanese competitors. (See Catch the Innovation Wave.) Why not build modeling skills now to put maximum daylight between you and competitors for as long as possible?

Modeling B2B customer needs

When you model B2B customer needs, you learn enough to replicate the customer experience yourself. This only works for B2B. It is the complete opposite of B2C methods, where you ask customer to react to your prototype, hypothesis, sample, conjoint survey, price survey, minimum viable product, etc. Future innovators will understand this: For markets with a low B2B Index, use customer reaction. For a high B2B Index, use customer modeling. (Calculate your market’s B2B Index for free at B2B Market View.)

You don’t need to show customers your prototype and ask what they think… because you’ve modeled how they think.

With customer needs modeling you don’t seek customer reaction. You predict it. You don’t need to show customers your prototype and ask what they think… because you’ve modeled how they think. But you can only do this by first letting your smart B2B customers make you smarter during those “understanding” interviews mentioned earlier.

Just as a weather forecast model relies on key input data—barometric pressures, temperatures, and wind speeds—your interviews capture vital customer data in a measurable form. Imagine you make plastic, and customer interviews in your target market segment taught you…

- Cold-temperature impact resistance is important and unsatisfactory today.

- A good test is to drop a 1 kilogram steel ball on a test panel at -20oC.

- A plastic sample surviving a 100 cm drop is considered “barely acceptable.”

- A sample surviving a 300 cm drop would make customers “totally satisfied.”

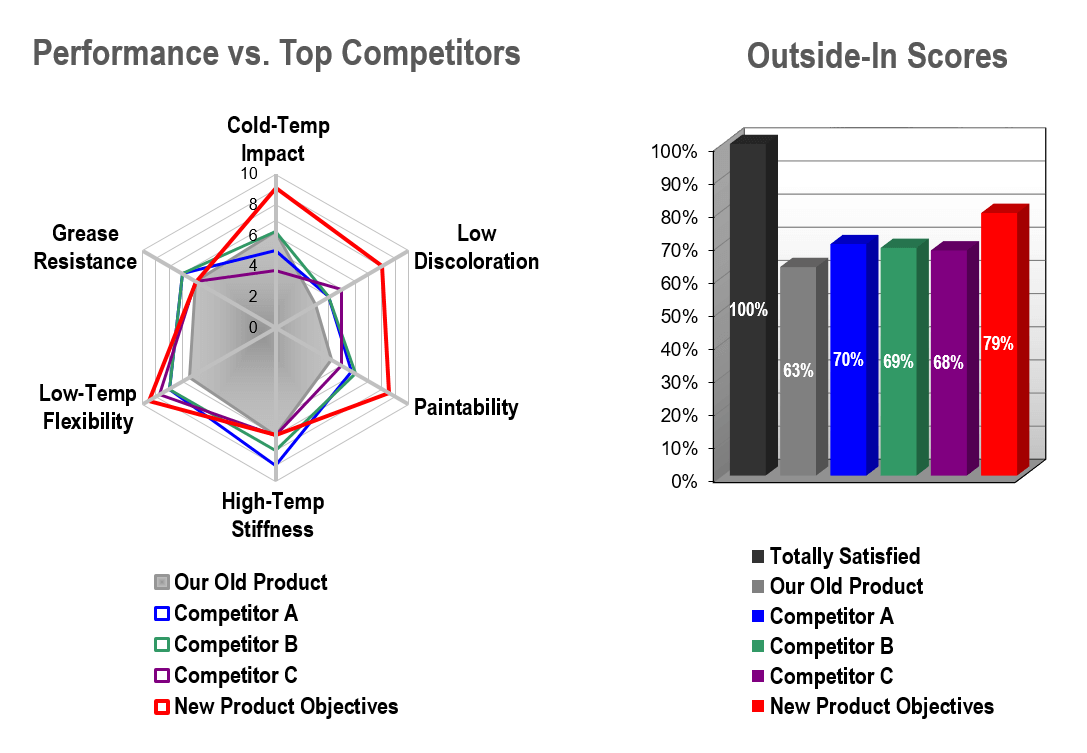

Next you conduct side-by-side tests on competitors’ products and any pre-existing products you may have. You convert all test results (centimeters here) to a 1-to-10 scale, where 5 = barely acceptable, and 10 = totally satisfied. This yields the radar chart shown, where blue, green and violet are your toughest competitors, and grey is your pre-existing product.

Now the fun part: Your team imagines its first product design, shown as a red line in the radar chart. The red column in the “Outside-In” chart models how the market would react to this product vis-à-vis competitors’ products. Each column models that product’s performance (on cold-temperature impact and other outcomes) and is weighted for the importance customers assigned to each outcome. (This can all be done within Blueprinter® software.)

Seem like too much work? It probably is for minor product “tweaks.” But consider these advantages for real new product innovation:

- Its much cheaper and faster to perform “what if” mental experiments in the front-end of innovation than to create physical prototypes for customer evaluation in the development stage.

- Your testing lets you understand customers’ next best alternatives… the only way to optimize the design, pricing and promotion of your new product.

- Your B2B customers will be more engaged when you seek their early advice vs. lobbing your prototypes at them. And if you do create a prototype later, they’ll appreciate that you didn’t waste their evaluation time with frivolous concepts.

So should you abandon the use of prototypes? Nope, just use them later and for different reasons. Use them in the development stage instead of the front-end of innovation. And use them to continue engaging customers and refining (not guessing) your product design.

What will you do with this?

Do you believe B2B customer needs modeling will eventually become standard practice? I do, because I believe in three principles:

These three principles lead to an inescapable fact: Intimacy with customer needs is crucial to your organic growth.

- Your company’s only path to profitable, sustainable organic growth is creating customer value.

- You only create customer value by improving an important, unmet customer need (somewhere along the value chain).

- You cannot efficiently, effectively improve that which you do not fully comprehend.

These three principles lead to an inescapable fact: Intimacy with customer needs is crucial to your organic growth. We’d like to help you move from guessing customer needs… to understanding them… to modeling them. The single most effective way to begin is to have someone from your company join us at our next New Product Blueprinting open workshop. To learn more, visit Blueprinting Workshops.

If you’re not already practicing New Product Blueprinting, we’re pretty sure you’ll be surprised at what you’ve been missing. If that’s not the case, we’ll happily return your registration fee and congratulate you on the way you are understanding and modeling customer needs.

olympe olympe casino cresus

olympe casino avis: olympe casino avis – olympe casino cresus

olympe: olympe – casino olympe

casino olympe: olympe casino avis – olympe

olympe casino olympe casino avis

olympe casino en ligne: olympe casino avis – olympe

olympe casino cresus: olympe casino en ligne – casino olympe

olympe casino en ligne olympe casino avis

olympe casino en ligne: olympe casino cresus – olympe casino cresus

https://olympecasino.pro/# olympe

olympe casino olympe casino en ligne

casino olympe: olympe casino – olympe

casino olympe: olympe casino cresus – olympe casino en ligne

casino olympe olympe casino en ligne

casino olympe: olympe casino cresus – casino olympe

casino olympe: casino olympe – olympe

olympe casino en ligne: olympe casino cresus – olympe casino cresus

casino olympe: olympe casino en ligne – olympe

olympe casino avis: olympe casino – casino olympe

olympe casino: olympe casino cresus – olympe casino cresus

casino olympe casino olympe

olympe: olympe casino – olympe casino

olympe casino cresus: olympe casino – olympe casino cresus

olympe: olympe casino avis – olympe casino en ligne

casino olympe olympe

olympe casino cresus: olympe casino avis – casino olympe

olympe casino cresus: olympe casino avis – olympe casino cresus

olympe casino cresus olympe casino en ligne

olympe casino avis: casino olympe – casino olympe

olympe: olympe casino en ligne – olympe

olympe casino cresus olympe

olympe casino: olympe casino – olympe casino

olympe casino olympe casino cresus

olympe casino: olympe casino en ligne – olympe casino

olympe casino: olympe casino – casino olympe

olympe casino avis olympe casino

olympe casino en ligne: olympe casino en ligne – olympe casino

olympe casino cresus: olympe casino – olympe

olympe casino en ligne olympe

olympe casino: olympe – olympe casino cresus

olympe casino cresus: olympe casino avis – olympe casino

olympe casino cresus olympe casino cresus

olympe casino cresus: olympe casino cresus – olympe casino en ligne

olympe: olympe casino avis – olympe casino cresus

olympe casino avis olympe casino cresus

olympe: olympe casino – olympe casino en ligne

olympe casino en ligne casino olympe

olympe casino avis: olympe casino en ligne – olympe casino

olympe casino en ligne olympe

olympe casino en ligne: olympe casino cresus – olympe casino avis

olympe olympe

https://olympecasino.pro/# olympe casino avis

olympe casino en ligne: olympe casino avis – olympe casino

olympe casino avis: olympe casino – olympe casino en ligne

olympe: olympe casino cresus – olympe casino

olympe casino olympe casino

casino olympe: casino olympe – olympe

olympe casino olympe

casino olympe: olympe casino avis – olympe

casino olympe: casino olympe – olympe casino cresus

olympe: olympe – olympe

olympe casino cresus olympe casino cresus

casino olympe: casino olympe – olympe

olympe casino avis casino olympe

olympe casino avis: olympe casino – olympe casino

https://olympecasino.pro/# olympe

casino olympe olympe casino avis

olympe casino: olympe casino – olympe

https://olympecasino.pro/# olympe casino en ligne

olympe casino en ligne: casino olympe – olympe

olympe casino en ligne: olympe casino cresus – olympe

olympe casino cresus olympe

USACanadaPharm: canadian drug pharmacy – usa canada pharm

usa canada pharm: reputable canadian pharmacy – usa canada pharm

https://usacanadapharm.shop/# reliable canadian pharmacy

canadian pharmacy 24 com canadian pharmacy no scripts reputable canadian online pharmacies

usa canada pharm: USACanadaPharm – USACanadaPharm

https://usacanadapharm.shop/# best rated canadian pharmacy

canadian pharmacy king reviews https://usacanadapharm.shop/# canadian pharmacy com

reliable canadian online pharmacy

USACanadaPharm vipps canadian pharmacy USACanadaPharm

https://usacanadapharm.shop/# USACanadaPharm

buy drugs from canada: usa canada pharm – USACanadaPharm

usa canada pharm: cross border pharmacy canada – USACanadaPharm

USACanadaPharm escrow pharmacy canada USACanadaPharm

https://usacanadapharm.com/# canada drug pharmacy

reputable canadian pharmacy: usa canada pharm – best canadian online pharmacy reviews

http://usacanadapharm.com/# online canadian pharmacy

usa canada pharm usa canada pharm my canadian pharmacy rx

online pharmacy canada: canadian pharmacy scam – usa canada pharm

usa canada pharm: usa canada pharm – canada cloud pharmacy

canadian pharmacy 24 USACanadaPharm canadian family pharmacy

USACanadaPharm canada drugs online review canada drugs reviews

https://usaindiapharm.shop/# india pharmacy

UsaIndiaPharm: online shopping pharmacy india – reputable indian online pharmacy

indian pharmacies safe top online pharmacy india indianpharmacy com

https://usaindiapharm.com/# USA India Pharm

Online medicine order: buy medicines online in india – top 10 pharmacies in india

https://usaindiapharm.shop/# UsaIndiaPharm

india pharmacy USA India Pharm USA India Pharm

best india pharmacy: top 10 pharmacies in india – top online pharmacy india

UsaIndiaPharm: buy medicines online in india – UsaIndiaPharm

https://usaindiapharm.com/# UsaIndiaPharm

USA India Pharm: online shopping pharmacy india – best india pharmacy

UsaIndiaPharm best online pharmacy india top 10 pharmacies in india

https://usaindiapharm.com/# indian pharmacies safe

USA India Pharm: USA India Pharm – india online pharmacy

top 10 pharmacies in india: UsaIndiaPharm – UsaIndiaPharm

https://usaindiapharm.shop/# USA India Pharm

online pharmacy india buy medicines online in india buy medicines online in india

pharmacy website india: Online medicine order – india pharmacy mail order

https://usaindiapharm.com/# india online pharmacy

UsaIndiaPharm: UsaIndiaPharm – UsaIndiaPharm

https://usaindiapharm.com/# indian pharmacy online

indian pharmacies safe reputable indian pharmacies USA India Pharm

UsaIndiaPharm: reputable indian pharmacies – top 10 online pharmacy in india

UsaIndiaPharm USA India Pharm USA India Pharm

indian pharmacy: world pharmacy india – UsaIndiaPharm

http://usaindiapharm.com/# indian pharmacy paypal

USA India Pharm: USA India Pharm – UsaIndiaPharm

https://usaindiapharm.shop/# USA India Pharm

USA India Pharm USA India Pharm best online pharmacy india

Online medicine home delivery: USA India Pharm – UsaIndiaPharm

https://usmexpharm.shop/# USMexPharm

Us Mex Pharm: Us Mex Pharm – usa mexico pharmacy

UsMex Pharm: UsMex Pharm – mexican pharmacy

https://usmexpharm.shop/# usa mexico pharmacy

Mexican pharmacy ship to USA: п»їbest mexican online pharmacies – Us Mex Pharm

mexican pharmacy certified Mexican pharmacy buying prescription drugs in mexico online

https://usmexpharm.com/# Mexican pharmacy ship to USA

mexico drug stores pharmacies: Us Mex Pharm – USMexPharm

usa mexico pharmacy: usa mexico pharmacy – mexican pharmacy

mexican pharmacy USMexPharm buying from online mexican pharmacy

usa mexico pharmacy: mexican online pharmacies prescription drugs – certified Mexican pharmacy

Mexican pharmacy ship to USA Us Mex Pharm medicine in mexico pharmacies

usa mexico pharmacy: mexican pharmacy – UsMex Pharm

sweet bonanza demo sweet bonanza sweet bonanza yorumlar sweetbonanza1st.com

lisansl? casino siteleri: casino siteleri 2025 – guvenilir casino siteleri casinositeleri1st.com

https://casibom1st.com/# para kazandД±ran sohbet siteleri

bet oyun siteleri: casibom guncel adres – en iyi bet siteleri casibom1st.com

deneme bonusu veren siteler casino siteleri casino siteleri casinositeleri1st.shop

sweet bonanza yorumlar: sweet bonanza – sweet bonanza sweetbonanza1st.shop

sweet bonanza: sweet bonanza demo – sweet bonanza sweetbonanza1st.shop

https://sweetbonanza1st.com/# sweet bonanza 1st

casino siteleri 2025 casino siteleri bonus veren yasal siteler casinositeleri1st.shop

oyun sitesi oyun sitesi oyun sitesi: casibom guncel adres – bonus veren yasal bahis siteleri casibom1st.com

sweet bonanza yorumlar: sweet bonanza giris – sweet bonanza oyna sweetbonanza1st.shop

slot casino siteleri guvenilir casino siteleri deneme bonusu veren siteler casinositeleri1st.shop

sweet bonanza giris: sweet bonanza slot – sweet bonanza sweetbonanza1st.shop

sweet bonanza demo: sweet bonanza yorumlar – sweet bonanza yorumlar sweetbonanza1st.shop

lisansl? casino siteleri guvenilir casino siteleri deneme bonusu veren siteler casinositeleri1st.shop

canlД± oyunlar: casibom giris – deneme bonusu veren gГјvenilir siteler casibom1st.com

https://sweetbonanza1st.shop/# sweet bonanza demo

sweet bonanza siteleri sweet bonanza yorumlar sweet bonanza siteleri sweetbonanza1st.com

sweet bonanza slot: sweet bonanza siteleri – sweet bonanza yorumlar sweetbonanza1st.shop

casino siteleri: bonus veren bahis siteleri casino – slot casino siteleri casinositeleri1st.com

canli bahis siteleri casibom mobil giris bet casino casibom1st.shop

Lisin Express: Lisin Express – lisinopril 10 mg pill

https://clomfastpharm.shop/# can i order generic clomid for sale

Lisin Express Lisin Express Lisin Express

amoxicillin online canada: where to buy amoxicillin – amoxicillin 50 mg tablets

https://zithpharmonline.shop/# ZithPharmOnline

https://amonlinepharm.shop/# amoxicillin 500 mg without a prescription

purchase lisinopril 10 mg: how much is lisinopril 40 mg – Lisin Express

buy zithromax online fast shipping zithromax 500 mg lowest price online ZithPharmOnline

http://amonlinepharm.com/# AmOnlinePharm

generic zithromax azithromycin: ZithPharmOnline – ZithPharmOnline

http://predpharmnet.com/# Pred Pharm Net

Pred Pharm Net prednisone daily use Pred Pharm Net

AmOnlinePharm: amoxicillin 825 mg – AmOnlinePharm

https://amonlinepharm.com/# AmOnlinePharm

lisinopril cost 5mg: Lisin Express – buying lisinopril in mexico

ZithPharmOnline ZithPharmOnline ZithPharmOnline

lisinopril generic 20 mg: Lisin Express – Lisin Express

zithromax 250: ZithPharmOnline – zithromax for sale usa

AmOnlinePharm amoxicillin 250 mg amoxicillin online purchase

AmOnlinePharm: AmOnlinePharm – AmOnlinePharm

http://amonlinepharm.com/# can you buy amoxicillin over the counter canada

can you buy amoxicillin over the counter generic amoxicillin online AmOnlinePharm

AmOnlinePharm: cost of amoxicillin 30 capsules – AmOnlinePharm

https://wwwindiapharm.shop/# www india pharm

online canadian pharmacy GoCanadaPharm canadian pharmacy checker

www india pharm: india online pharmacy – india pharmacy

https://wwwindiapharm.com/# www india pharm

indian pharmacy: indian pharmacies safe – reputable indian online pharmacy

indian pharmacy Online medicine home delivery top online pharmacy india

http://wwwindiapharm.com/# indianpharmacy com

pharmacies in mexico that ship to usa: Agb Mexico Pharm – Agb Mexico Pharm

https://agbmexicopharm.shop/# Agb Mexico Pharm

www india pharm www india pharm www india pharm

Agb Mexico Pharm: Agb Mexico Pharm – Agb Mexico Pharm

https://gocanadapharm.shop/# reliable canadian pharmacy

www india pharm: www india pharm – www india pharm

www india pharm Online medicine order www india pharm

www india pharm: cheapest online pharmacy india – Online medicine home delivery

http://wwwindiapharm.com/# п»їlegitimate online pharmacies india

www india pharm online pharmacy india top 10 pharmacies in india

www india pharm: www india pharm – www india pharm

pharmacy website india: www india pharm – www india pharm

www india pharm www india pharm online pharmacy india

https://kamagrapotenzmittel.shop/# Kamagra Oral Jelly

apotek online: apotek online recept – Apotek hemleverans recept

online apotheek Apotheek Max online apotheek

https://kamagrapotenzmittel.shop/# Kamagra kaufen

ApotheekMax: online apotheek – online apotheek

https://apotekonlinerecept.com/# apotek pa nett

apotek online recept: Apotek hemleverans recept – Apotek hemleverans idag

Apoteket online Apotek hemleverans recept apotek online

https://apotekonlinerecept.shop/# apotek online recept

apotek online: apotek online recept – apotek online

Apotek hemleverans idag apotek online recept Apotek hemleverans recept

Kamagra Oral Jelly kaufen: Kamagra kaufen ohne Rezept – Kamagra online bestellen

https://kamagrapotenzmittel.com/# Kamagra Oral Jelly kaufen

Kamagra online bestellen: Kamagra Oral Jelly – Kamagra online bestellen

http://apotheekmax.com/# online apotheek

Kamagra online bestellen Kamagra kaufen ohne Rezept Kamagra online bestellen

https://kamagrapotenzmittel.shop/# Kamagra Original

Online apotheek Nederland met recept: ApotheekMax – Online apotheek Nederland zonder recept

http://kamagrapotenzmittel.com/# Kamagra Oral Jelly kaufen

Online apotheek Nederland zonder recept Online apotheek Nederland zonder recept de online drogist kortingscode

Apotek hemleverans recept: Apoteket online – Apotek hemleverans idag

https://kamagrapotenzmittel.com/# Kamagra Original

https://apotheekmax.shop/# online apotheek

de online drogist kortingscode Online apotheek Nederland zonder recept Beste online drogist

http://apotheekmax.com/# ApotheekMax

Online apotheek Nederland met recept Beste online drogist de online drogist kortingscode

https://kamagrapotenzmittel.shop/# Kamagra kaufen ohne Rezept

pinup 2025: https://pinupkz.life/

пин ап вход – пин ап

kamagra 100mg kopen kamagra kopen nederland Officiele Kamagra van Nederland

пин ап казино зеркало: https://pinupkz.life/

пин ап казино официальный сайт – пин ап казино зеркало

pinup 2025: https://pinupkz.life/

пин ап вход – пин ап

KamagraKopen.pro KamagraKopen.pro kamagra jelly kopen

пин ап: https://pinupkz.life/

пин ап казино зеркало: https://pinupkz.life/

Tadalafil Easy Buy cheapest cialis TadalafilEasyBuy.com

пин ап казино официальный сайт – pinup 2025

pinup 2025: https://pinupkz.life/

пин ап: https://pinupkz.life/

cialis without a doctor prescription TadalafilEasyBuy.com Generic Cialis without a doctor prescription

пин ап вход: https://pinupkz.life/

https://kamagrakopen.pro/# KamagraKopen.pro

Tadalafil Easy Buy: Tadalafil Easy Buy – TadalafilEasyBuy.com

buy generic 100mg viagra online Cheap Sildenafil 100mg Generic 100mg Easy

TadalafilEasyBuy.com: TadalafilEasyBuy.com – Tadalafil Easy Buy

Officiele Kamagra van Nederland: kamagra pillen kopen – kamagra 100mg kopen

kamagra jelly kopen: kamagra 100mg kopen – Kamagra Kopen

Generic 100mg Easy buy generic 100mg viagra online buy viagra here

kamagra pillen kopen: kamagra gel kopen – kamagra pillen kopen

Generic 100mg Easy: buy generic 100mg viagra online – buy generic 100mg viagra online

https://kamagrakopen.pro/# kamagra gel kopen

TadalafilEasyBuy.com TadalafilEasyBuy.com cialis without a doctor prescription

kamagra gel kopen: Officiele Kamagra van Nederland – Kamagra Kopen

https://generic100mgeasy.shop/# Generic100mgEasy

Generic 100mg Easy: Generic100mgEasy – Generic100mgEasy

kamagra kopen nederland Kamagra Kopen kamagra kopen nederland

Kamagra: kamagra 100mg kopen – kamagra jelly kopen

TadalafilEasyBuy.com: Tadalafil Easy Buy – Tadalafil Easy Buy

Cialis over the counter cialis for sale Buy Tadalafil 5mg

kamagra gel kopen: kamagra 100mg kopen – Kamagra Kopen Online

buy generic 100mg viagra online: buy generic 100mg viagra online – Generic 100mg Easy

kamagra gel kopen: KamagraKopen.pro – kamagra pillen kopen

cialis without a doctor prescription Cialis 20mg price cialis without a doctor prescription

buy generic 100mg viagra online: Generic 100mg Easy – Generic 100mg Easy

cialis without a doctor prescription: Tadalafil Easy Buy – Generic Cialis price

https://mexicanpharminter.com/# buying from online mexican pharmacy

Mexican Pharm Inter mexican drug stores online buying from online mexican pharmacy

reliable canadian pharmacy: Certified International Pharmacy Online – reliable canadian online pharmacy

reliable mexican pharmacies: mexican pharmacy online store – buying from online mexican pharmacy

https://interpharmonline.shop/# canadapharmacyonline

canadian pharmacy 365: Inter Pharm Online – pharmacy com canada

mexican drug stores online: mexican pharmacy online order – Mexican Pharm Inter

canadian pharmacy 1 internet online drugstore certified canada pharmacy online canadian pharmacy 365

http://mexicanpharminter.com/# mexican pharmacy online order

online pharmacy india: lowest prescription prices online india – lowest prescription prices online india

reputable canadian online pharmacy: InterPharmOnline.com – northwest canadian pharmacy

IndiaMedFast india pharmacy without prescription IndiaMedFast

http://interpharmonline.com/# canadian pharmacies compare

cheapest online pharmacy india: IndiaMedFast – India Med Fast

canada drug pharmacy: InterPharmOnline – ordering drugs from canada

buying from online mexican pharmacy: mexican pharmacy online order – Mexican Pharm International

India Med Fast cheapest online pharmacy india India Med Fast

my canadian pharmacy review Cheapest online pharmacy canadian pharmacy meds

mexican pharmacy online order: mexican pharmacy online – mexican drug stores online

alo789hk: alo789in – alo789hk

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.