How to avoid new product failures… in one easy step

Tired of new product failures? Get one simple step right and your new product success rates will soar. For B2B companies, this step is prioritizing customers’ needs. Not sure about that? We’ll show you strong evidence that supports this… and show you how to turn new product failures into rare and distant memories.

What’s more disheartening in business than new product failures? You tell your boss about this cool new product idea, develop an impressive version of it in the lab, and launch it with great fanfare. And wait. And wait. Then you get to explain to your boss why this new product—which consumed a lot of time and resources—failed.

In Anna Karenina, Tolstoy opened with, “Happy families are all alike; every unhappy family is unhappy in its own way.” It’s quite the opposite with new product failures: They are usually unhappy for the same reason.

With apologies to Tolstoy, new product failures are usually “unhappy” for the same reason.

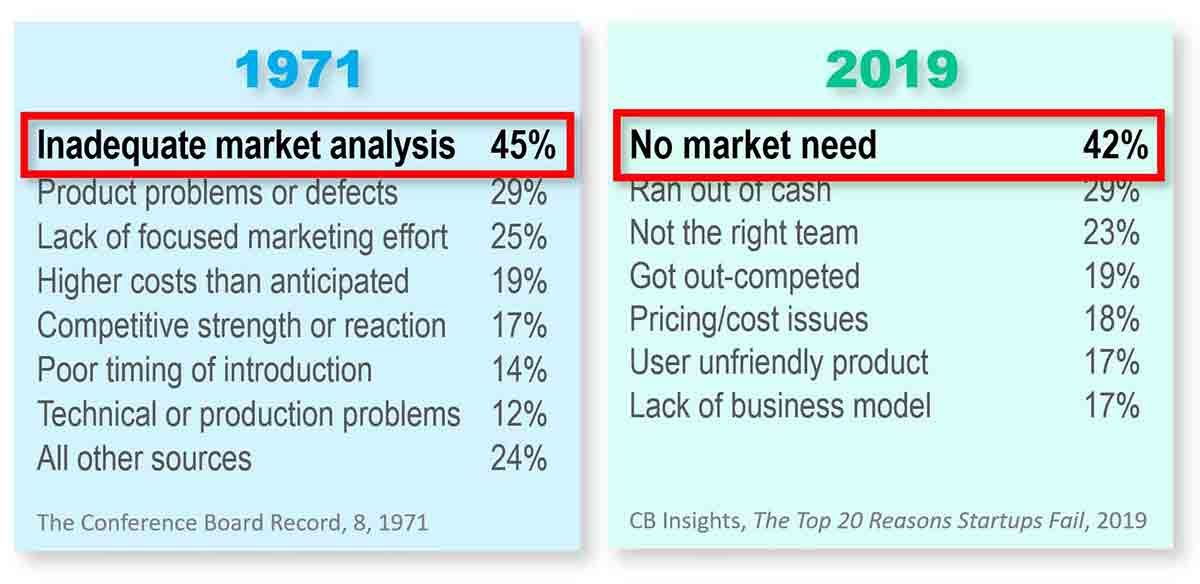

That unhappy reason is inadequate market understanding. The chart below shows the leading causes of new product failures. As you can see, poor market understanding has remained the top cause for five decades.

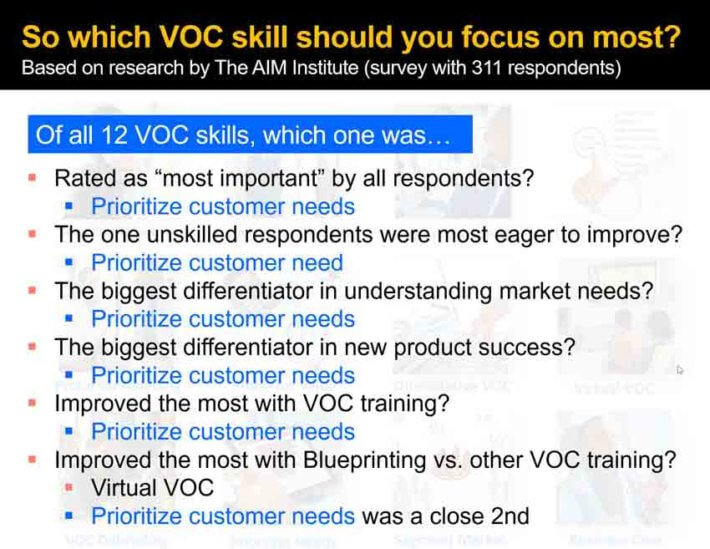

But new research—conducted in early 2022 by The AIM Institute—puts a finer point on this. Many companies—rightly or wrongly—believe they “understand” market needs. This new research shows that to reduce new product failures, you must move beyond “understanding” to “prioritizing” market needs.

To reduce new product failures, you must move beyond “understanding” to “prioritizing” market needs.

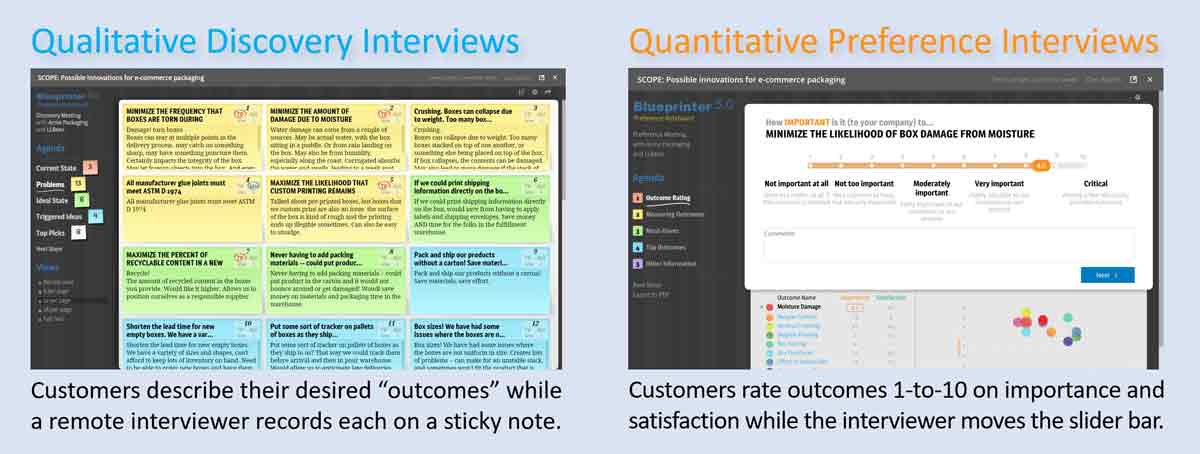

Here’s what we mean by this. At least in the world of B2B markets, customer insight in the front end of innovation should involve two distinct steps.

- First you conduct a round of divergent qualitative interviews to capture all customer outcomes, aka, their desired end results. The goal of this step is to avoid errors of omission, which is failing to uncover unarticulated needs. These new product failures are never noticed at the time but become obvious later if a competitor launches a great product that satisfies this need.

- Then you conduct convergent quantitative interviews, to assess a set of customer outcomes for customer importance and current satisfaction. To avoid new product failures—what we call errors of commission—you should only work on those outcomes customers deemed both important and currently unsatisfied.

For B2B companies, the most popular way to reduce new product failures in the front end of innovation is through Discovery and Preference interviews, as taught in the New Product Blueprinting methodology.

In this article, we’ll focus on the second round of interviews… the quantitative Preference interviews. These are key to dramatically reducing new product failures, as was shown in AIM research published in January, 2022.

We’ll summarize this research here, but if you’d like your own copy, you can download it at www.B2Bvocskills.com. AIM surveyed 311 B2B professionals with nearly 5,000 years of combined experience. Here’s what the data strongly support: Training in VOC skills boosts VOC competencies… which improves understanding of market needs… which leads to higher new product success rates. And of course, fewer new product failures.

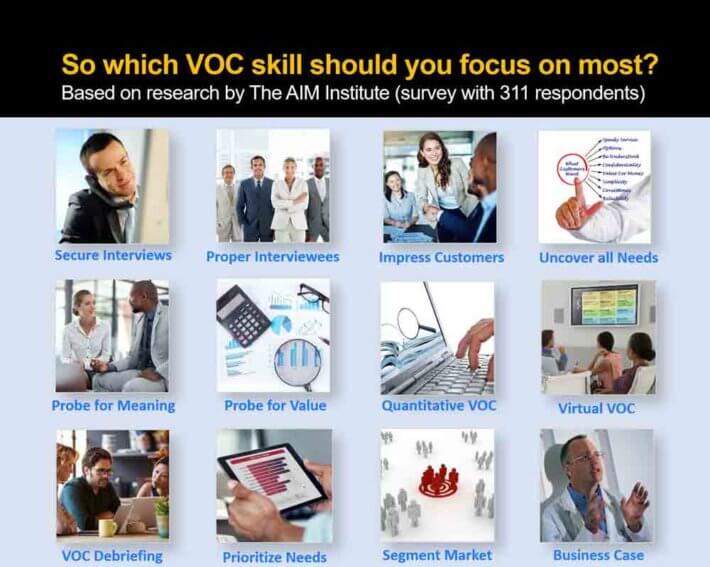

We weren’t surprised by these correlations, but we were surprised by something else. In this survey we asked respondents to score importance and satisfaction for 12 voice-of-customer skills. (This was our own version of a Preference survey, and our way to reduce new product failures… where our training is “the product.”) Here are the 12 skills we asked about in the survey.

Notice that one of these skills is called “Prioritize Needs,” which we defined this way: Determine which desired outcomes are most critical to your target market. In other words, if you want to reduce new product failures, don’t just “gather” customer outcomes or “understand” them. But rather learn which of these outcomes customers in your target market segment are most eager to see you satisfy with your new product.

This is precisely what you accomplish with quantitative Preference interviews, which result in something called a Market Satisfaction Gap chart. (You can learn more about these charts in a white paper at www.marketsatisfactiongaps.com.) These Gap charts tell you exactly what customers do and do not want, and so are critical to avoiding new product failures.

Here’s the part that surprised us: Of the 12 VOC skills, the one that kept “rising to the top” over and over was “Prioritize Needs.” Respondents said this was the most important of all 12 skills… the one unskilled respondents were most eager to improve… the biggest differentiator in understanding market needs. Are you getting the sense that this could help reduce new product failures?

Of the 12 VOC skills, the one that kept “rising to the top” over and over was “Prioritize Customer Needs.”

Our favorite finding was this: The ability to prioritize customer needs was the biggest differentiator in new product success. In other words, the greatest factor separating new product successes and new product failures is prioritizing customer needs.

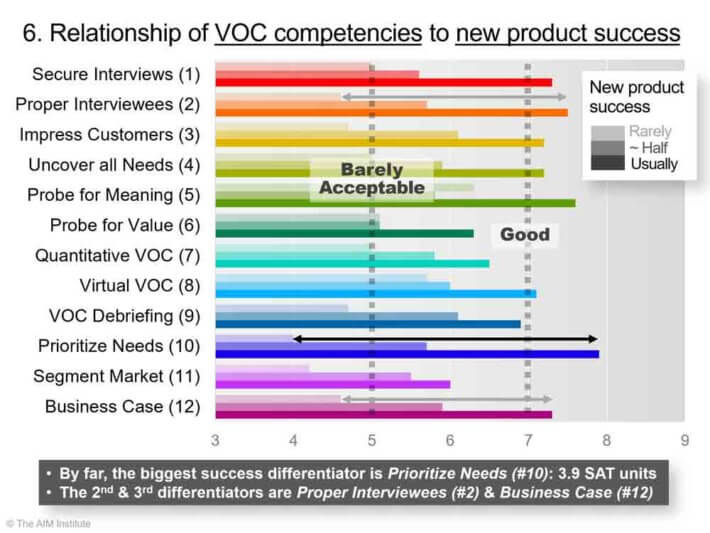

You can see this in more detail in the chart below. The horizontal axis shows respondents’ current level of satisfaction with each of the 12 VOC skills. Think of this as their current level of competency, where a 5 = “barely acceptable” and 7 = “good.”

The greatest factor separating new product successes and new product failures is prioritizing customer needs.

For the skill, “Prioritize Needs,” the dark blue bar represents respondents who said they were “usually successful” in their new product development projects: Their competency was well over “7.” The lightest blue bar shows responses from those who said they were “rarely successful” in their NPD projects. These folks rated their competency well below a “5” or barely acceptable. If you don’t like new product failures, you don’t want these folks on your team!

The difference between the “usually successful” and “rarely successful” respondents was enormous: far greater than any other VOC skill. Those looking for a good way to reduce new product failures will do well to prioritize customer needs better.

In conclusion…

If you’re tired of new product failures, here’s the one-step shortcut: Learn how to prioritize customer needs. It’s not at all difficult. You can learn more in several ways…

- Watch a short overview video at newproductblueprinting.com

- Attend one of our public workshops. See blueprintingworkshop.com

- View all our training options at blueprintingtraining.com

The payoff for doing this can be enormous, because this eliminates most commercial risk, leaving you primarily with technical risk in your development stage. You’re already spending a bundle on engineering or other R&D. Now you can “aim” it properly, saying goodbye to most new product failures.

Comments