What Drives B2B Organic Growth? Now we know.

What are the critical B2B growth drivers? This was the topic of a recent research project by The AIM Institute.

We’re grateful to the 540 newsletter readers who participated in our research survey. These folks had more than 10,000 years of combined B2B management, marketing, technical and sales experience… so we were eager to learn from them.

Does the B2B distinction matter? YES, it does. Click here to learn the reason why.

Discovery: B2B Growth Drivers

Our research objective was simple: What drives rapid, profitable, sustainable B2B growth? For each of 24 “B2B growth drivers” we asked how important the driver was for promoting growth, and how satisfied respondents were with their business’s current performance.

Our working hypothesis—confirmed by the research—was that these 24 drivers would help a business grow by “understanding and meeting customer needs.” These growth drivers covered…

- Understanding customer needs, e.g. Customer Interviews, Market Concentration, and Secondary Market Research.

- Meeting customer needs, e.g. Gate Review Process, Portfolio

Management, and Technical Solutions. - Both understanding and meeting, e.g. Team Accountability,

Culture of Innovation, and Talent Management.

Here’s what did not matter much

Besides the 24 B2B growth drivers, our survey asked respondents some background questions about themselves and their companies. We were expecting significant differences depending on who was responding… but this didn’t happen. While we saw some subtle differences, the following factors really didn’t matter much:

- How large the company is

- Whether the company produces materials, components, equipment or services

- Whether the company is publicly traded or privately held

- The respondent’s job function

- The respondent’s job level

- How much business experience the respondent has

Click here to learn more about AIM’s B2B Growth Driver Diagnostic

Bottom line: If you’re in a B2B business, these results probably apply to you. As you may have heard, “Sure, you’re unique… just like everyone else.” Here’s the good news: If you were thinking of paying an expensive consultant to tell you how to grow, you can put your wallet away.

The B2B Growth drivers that matter most

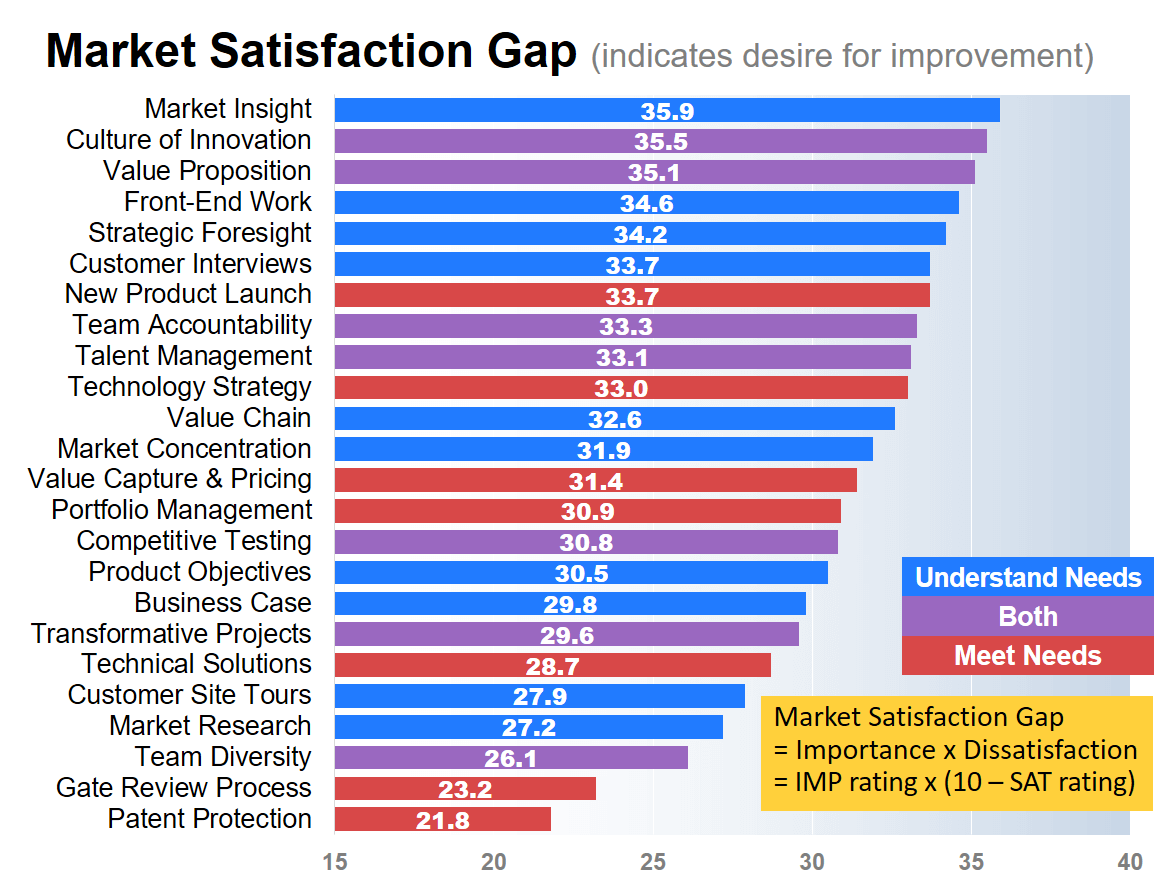

If you’re a Blueprinting practitioner, you probably know why we measured “importance” and “satisfaction” on the 24 growth drivers. Yep, this lets us create Market Satisfaction Gaps for each growth driver. (The more important and less satisfied, the higher the Gap… indicating a greater desire for improvement.)

The highest Gap of all the B2B growth drivers was for Market Insight, defined as “obtaining market insight proactively to drive strategic decisions vs. being just customer-reactive.” Notice that 10 of the top 12 drivers are about “understanding needs” (blue and purple) and only 2 are exclusively about “meeting needs” (red).

We also compared companies good at delivering strong value propositions (High-Value Providers) with those who did this poorly (Low-Value Providers). We thought the High-Value Providers might be more proficient at many of the growth drivers.

Click here to learn about the advantages when innovating in B2B markets.

Turns out the High-Value Providers were more proficient at all 24 growth drivers. The High-Value Providers especially out-paced the Low-Value Providers in—you guessed it—understanding customer needs. High-Value Providers held the biggest advantages over Low-Value Providers in three growth drivers: 1) Front-End Work, 2) Market Concentration, and 3) Customer Interviews.

VOC matters… a lot

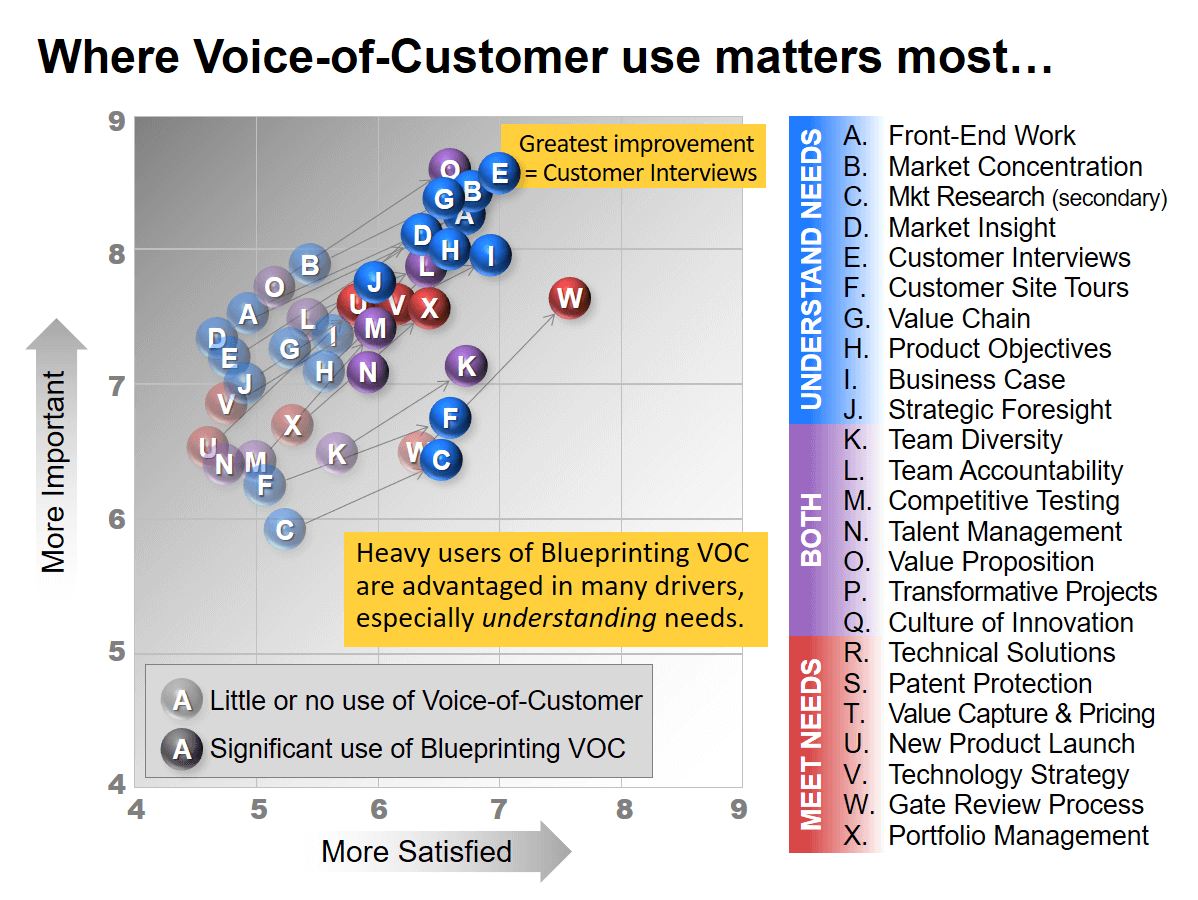

One of our background questions asked how much the respondent’s company was already using voice-of-customer methods. While other factors (like company size) had little impact, this factor made a huge difference. In fact, we were surprised by how many drivers this impacted. Then we noticed two-thirds of the significant VOC users were heavy users of New Product Blueprinting (which impacts more than just customer interviews.) Highly relevant for B2B growth – it turns out.

In this chart, we compare the responses for companies using little or no VOC… to those significantly using New Product Blueprinting VOC. Of all the B2B growth drivers, Customer Interviews (E), improved the most—from a satisfaction score of less than “5” (defined as “barely acceptable”) to “7” (“good”). In fact, all 10 of the blue “understanding needs” drivers improved by at least one satisfaction unit, as well as several other drivers.

How B2B is your business? Click here to learn the relevant differences.

As this chart shows, Blueprinting VOC practitioners were not only more proficient (more satisfied), they also placed higher importance on all of these drivers. There seems to be a connection between changed mindsets and changed practices.

One last finding

Let’s close with one last item we found interesting. We divided the 24 growth drivers into those “owned” by the marketing function vs. the technical function. We learned there is much greater eagerness to improve the marketing-related drivers.

It could be that companies have been working on many of the technical-owned drivers—e.g. Gate Review Process and Patent Protection—for a long time. But in our training work, we’ve also seen many B2B companies under-staff marketing and cut marketing budgets first when times are tough. These results suggest we need more “staying power” in building these marketing-owned growth drivers.

Learning More

We’re excited about this research and hope it gives you a fact-based foundation for your company’s growth. Learn more when you download What Drives B2B Organic Growth? at AIM Whitepapers.

Also, consider this research report as a companion guide to our B2B Growth Driver Diagnostic. You can run the B2B Growth Driver Diagnostic for your business on the very same 24 growth drivers … and then use this research report to plan your growth initiatives. Check it out for yourself at B2B Growth Driver Diagnostic.

Comments