This mantra guides the decisions of the business masses. But is it right? Peter Drucker didn’t think so. He said the primary purpose of a business is to acquire and keep customers. I believe increased shareholder value is a good result, but a lousy goal. You’ll have better results if your goal becomes: “Understand and meet the needs of our customers.”

More in 2-minute video at 5. Shareholder wealth is a poor goal

New Product Blueprinting's B2B-specific methods provide the inputs for organic growth. Avoid these blunders when executing Step 2, Discovery Interviews. ... Read More

Research shows the best way to sell a product is to probe customers’ needs. But why wait until the product is developed? If you probe beforehand, you’ll create a better product and “pre-sell” your product. This isn’t practical for interviewing millions of B2C toothpaste buyers, but it is for concentrated B2B markets. B2B engagement skills aren’t difficult. Do you have them?

More in 2-minute video at 29. Engage your B2B customers

In a complex system—like your business—every action leads to a second-order effect (SOE). Some are unknowable. Others are easily predicted but routinely ignored by business leaders. We’ll explore success-stunting SOE’s you should avoid… and a 5th order plan for your B2B organic growth. A college student studies hard, gets good grades (second-order effect), and begins ... Read More

Here’s the scene: You are a B2B business leader unhappy with your membership in the Shareholder Appeasement Club and its quarterly meetings. You want profitable, reliable growth so you are free to captain your ship, not some Wall Street analysts. But what should you do—not in the abstract—but in concrete, actionable steps? Before exploring admission ... Read More

Some companies rely on a handful of internal VOC (voice-of-customer) experts to interview customers. You’ll do far better if you train a critical mass of employees—who routinely interact with customers anyway—to gather customer needs. Keep your VOC experts as coaches and trainers, but implement “VOC for the masses.”

This certainly applies to your sales team. Instead of being satisfied with just a “sales force,” why not also commission a “learning force”? That’s what happens when your sales professionals have strong voice-of-customer skills.

More in white paper, Everyday VOC at www.EVOCpaper.com

When you consider B2B vs B2C, which market profession has greater advantages? Business schools offer more B2C courses, consumer research tools abound, and sophisticated marketers at B2C companies like Apple and P&G are held in high esteem. B2B marketers are often engineers or sales reps that were tapped on the shoulder and told to “do ... Read More

When it comes to B2B customer insight, a face-to-face customer interview offers significant advantages. Some think they’ll learn all they need to know from their sales force… but there’s a big difference between customer-reactive meetings and market-proactive interviews. ... Read More

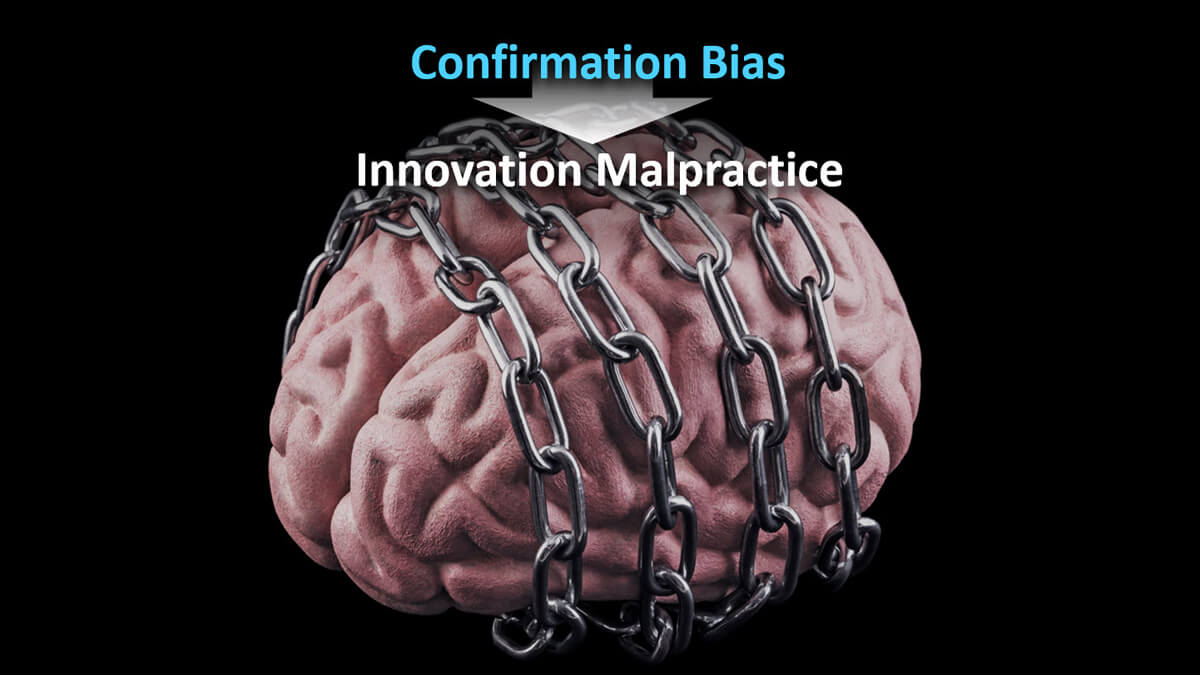

Think you can validate your new product concept with customers and avoid confirmation bias? Good luck with that. In your last performance review, did you agree with your boss’s praise more than his criticism? If so, you may not have overcome confirmation bias quite yet.

So if you want to avoid innovation malpractice, you need to stop leading the witness in interviews. Let them lead you to what really matters to them. My suggestion: Focus your customer interview on their desired outcomes. Then just check afterwards to see if their outcomes are a good match for your intended solution.

More in 2-minute video, Give your hypothesis the silent treatment

It may be OK for consumer goods producers to guess their customers’ needs. After all, their product developers are end-consumers themselves. So if you’re an Apple engineer, you already know what consumers like you want in a mobile phone.

But your B2B customers know much more than you about their needs. If you make pigment, your customers know a lot more than you about the paper production it’s used in. Isn’t it silly to guess their needs when they’d love to tell you… if you asked the right way? That’s why you need to let the customer lead the interview, not you. Yep, you can put your questionnaire or interview guide away now.

More in e-book, Reinventing VOC for B2B

Voice of the Customer projects often stumble right out of the gate. Why is this? More often than not, projects begin with optimism and energy. But all too often, somewhere in the middle, they tend to lose momentum altogether. And once the enthusiasm begins to fade, it’s challenging to recapture the magic. But why does ... Read More

With apologies to Tolstoy’s Anna Karenina… all great voice-of-customer (VOC) interviews are alike in the same way: The customer is talking during most of the interview. And they are talking about those outcomes (desired end results) they want to talk about. Anything else is clutter, much of which leads to unhappiness.

For B2B voice-of-customer interviews, plan on two rounds of interview… first qualitative interviews (called Discovery), followed by quantitative interviews (called Preference). In both cases, the customers will be doing most of the talking… and about matters that interest them. They’ll be happy. You’ll be happy.

More in video, Reinventing VOC for B2B

B2B innovation leadership is more than stoplight charts and cost-cutting. To make a real difference a B2b leader will usher in a new era of customer-driven growth. It takes patience, courage, and a commitment to finding the best people and processes. Follow these 10 best practices to lead innovation and change for B2B organic growth. ... Read More

Do your sales and tech support reps make hundreds of customer calls annually? Why not train them to probe deeply and capture customer needs uniformly in your CRM? You’ll gain unprecedented market insight when you turn your sales force into a learning force—to help you develop better future products. And with Everyday VOC probing, they’ll ... Read More