Beyond the Vitality Index: Two Metrics to Truly Assess Innovation Potential

Peter Drucker said, “If you can’t measure it, you can’t improve it.” So what’s the “it”? Consider another Drucker quote, “The business enterprise has two—and only two—basic functions: marketing and innovation. All the rest are costs.” It’s not hard to imagine this great management thinker wanted us to measure innovation. How do you measure new product innovation? Most use a metric developed by 3M in 1988 called the Vitality Index.

One of its attractions is simplicity: new product revenues as a percent of total revenues. “New” products are those introduced in the last five years (or sometimes three years.)

Is it time to apply innovation to how you measure innovation?

Should you keep using the Vitality Index? Absolutely. Should you stop relying solely on this three-decades-old metric? Is it time to apply innovation to how you measure innovation? You bet. Let’s see why.

3 Shortcomings of the Vitality Index

Don’t supplant your Vitality Index… just supplement it. The Vitality Index is helpful, but doesn’t “measure up” in three areas:

Not predictive: The Vitality Index is a lagging indicator, only telling you what already happened. It leaves you clueless as to what will happen next. That would require a leading indicator.

Not prescriptive: It doesn’t suggest how to improve. Want an impressive stream of highly-differentiated new products? Good luck getting any help from this metric.

Not precise: It’s famously easy to manipulate. Want to call your product “new” because you changed its color… its packaging… or just its name? You won’t be the first.

Imagine you were going to introduce new industry metrics for measuring innovation and ensuing growth. What criteria would you use? I’d look for four things:

- Leading Indicator: “If we do more of this, it will result in rapid, profitable, sustainable growth from our market-facing innovation.”

- Actionable: “If we make specific activities a high priority, our employees will be able to implement them.”

- Benchmarkable: “We can easily compare our performance on this year over year… and against other companies.”

- High impact: “If we improve these things, it will significantly boost the rate and quality of our growth.”

I believe two new metrics satisfy these criteria: The Growth Driver Index (GDI), and the Commercial Confidence Index (CCI). The first measures your growth capabilities, and the second your unfiltered customer insight.

Growth Driver Index (GDI)

I’d like you to imagine this: You are a decathlete, scheduled to compete in quarterly track and field competitions leading up to the Olympics in four years. You can prepare using either Plan A or Plan B. In Plan A, you and your coach adhere to a regimen aimed at improving your capabilities. Your progress on maximal oxygen uptake, strength training, sprint times, etc. is closely monitored, with ongoing adjustments made to your program. In Plan B, you show up for each quarterly competition, try really, really hard, and hope for the best. You even have meetings with your coach, who reviews your last event’s results and insists you do better next time.

Click here to learn more about the GDI in the whitepaper, “What Drives B2B Organic Growth?”

Does Plan B sound a bit silly? So are you using Plan A in your business today? Do you know…

- which capabilities drive growth the most?

- how to improve these critical capabilities?

- whether your capabilities have improved?

- how you compare to your competitors?

- how to quantitatively track your progress?

If it cost nothing more than a couple hours of your time each year to answer these questions, would you do it? For years, we’ve been concerned with LADD (leadership attention deficit disorder) for looking past the current quarter to long-term growth. So we developed a free service called the B2B Growth Diagnostic. You can learn more (and even get started) by going to B2B Growth Diagnostic.

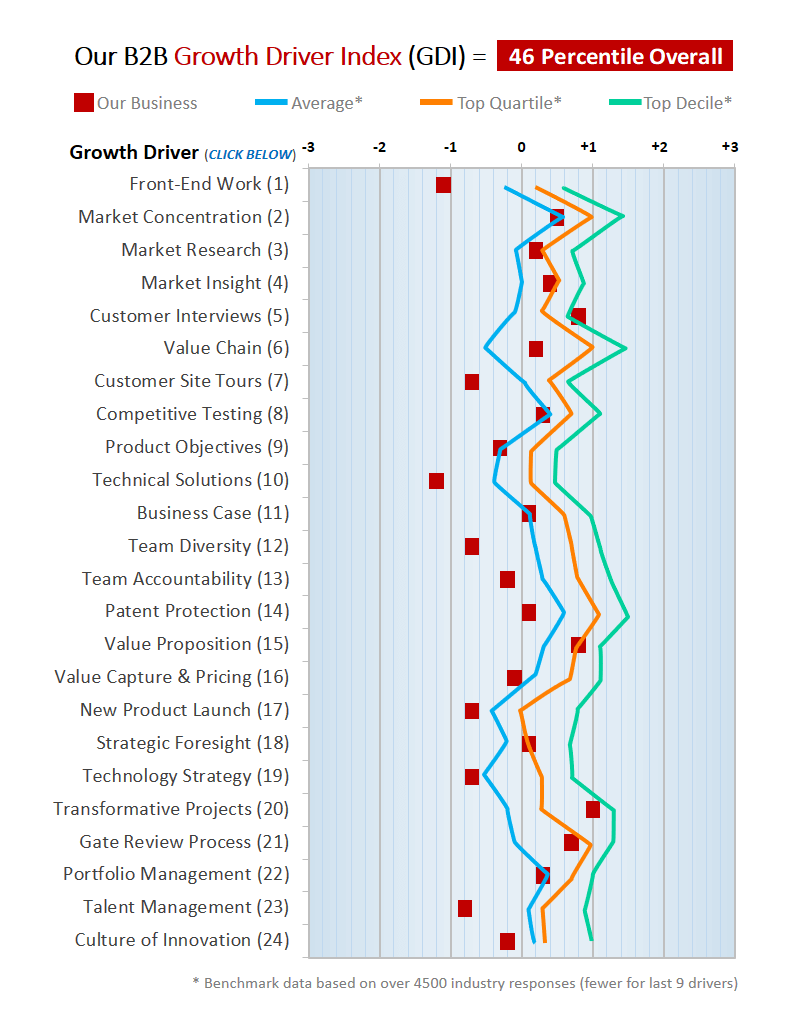

Here’s how it works: Your employees take an online survey to assess your business on 24 growth drivers. You receive a 20-page B2B Growth Diagnostic report, with your results benchmarked against our database of 4500+ respondents. A companion piece, What Drives B2B Organic Growth helps you interpret your results.

The report includes this chart, with your current position (red marker), average industry position (blue), top quartile (gold), and top decile (green). Your Growth Driver Index (GDI) is a composite of all 24 growth drivers and is shown at the top of the chart. You can run this diagnostic annually to plot a course for continually improving your growth capabilities (tools, training, people, processes, etc.) Certainly, the vitality index will still be a useful metric about the mix of new products. And additionally, the GDI will help you to understand your capabilities to increase that trajectory further.

Commercial Confidence Index (CCI)

Most new products fail for commercial—not technical—reasons. Technical risk typically drops during product development, but commercial risk often remains high all the way through launch. Companies figure out what customers want and don’t want by launching products at them.

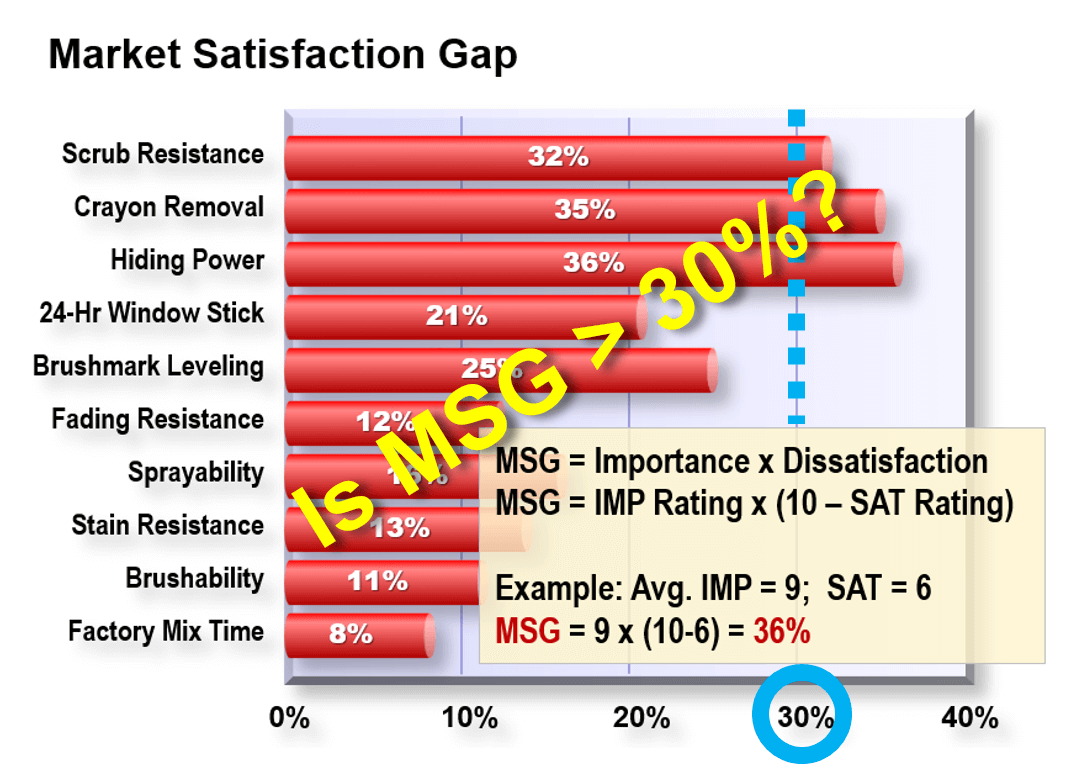

And yet with B2B customers—who have high knowledge, interest, objectivity and foresight—you can know what customers want in the front end of innovation. New Product Blueprinting practitioners interview customers, asking them to rate several outcomes on a 1-to-10 scale for both importance and satisfaction.

As shown in this chart, this generates a Market Satisfaction Gap for each customer outcome. Customers are only eager for improvement if the Gap is over 30%.

If you are developing a product based on Market Satisfaction Gap data (or something equally rigorous), we call this a “known-need” (KN) project. Everything else is a “guessed-need” (GN) project. The Commercial Confidence Index is simply your R&D spending on KN projects divided by your total R&D spending. A better future predictor of success than the vitality index, for sure.

Let’s try an example. Your R&D product development spending this year is $10 million. You have Market Satisfaction Gap data on four of these projects, each of which consumes $1 million of R&D. Your CCI is 40%. Can you imagine the dialogue that occurs when you first introduce this?

Comment: “But I have no idea what my CCI is!”

Response: “So you’re not sure if customers really want what you’re spending millions on?”

Comment: “OK, I’ve figured out my CCI now, but it’s… uhmm… zero.”

Response: “OK, but here’s my question: What will it be next year, and the year after?”

Comment: “This is going to take extra resources to figure out Market Satisfaction Gaps.”

Response: “Could you use some resources now being wasted when you guess customer needs?”

The Vitality Index Just Isn’t Enough

The Quality Wave and Productivity Wave crested decades ago, and we’re now in the Innovation Wave. (See Catch the Innovation Wave at AIM Whitepapers.) At some point, the “normal” approach to B2B innovation will look very, very different, including our metrics. Many companies will be surprised by these changes. Others will have seen the future, and seized competitive advantage years earlier.

If you want to be in this latter group, please check out our research report, What Drives B2B Organic Growth. Or reach out to contact us to discuss this more. In the last few years, we’ve learned enough that the future of B2B innovation is becoming quite clear, almost obvious. Your path to this future can be exciting, rewarding, and ever-so-measurable.

PS: A great way to “sample the future” is by attending one of our open workshops.

https://usaindiapharm.shop/# UsaIndiaPharm

UsaIndiaPharm: top 10 online pharmacy in india – UsaIndiaPharm

UsaIndiaPharm indian pharmacy online pharmacy website india

buy prescription drugs from india: world pharmacy india – UsaIndiaPharm

india online pharmacy: online shopping pharmacy india – online shopping pharmacy india

https://usaindiapharm.shop/# USA India Pharm

UsaIndiaPharm: UsaIndiaPharm – USA India Pharm

USA India Pharm UsaIndiaPharm UsaIndiaPharm

UsaIndiaPharm: USA India Pharm – india pharmacy

https://usaindiapharm.shop/# pharmacy website india

UsaIndiaPharm: USA India Pharm – Online medicine order

UsaIndiaPharm: indian pharmacy paypal – online pharmacy india

https://usmexpharm.com/# USMexPharm

Mexican pharmacy ship to USA: Mexican pharmacy ship to USA – usa mexico pharmacy

Us Mex Pharm usa mexico pharmacy mexican pharmacy

Mexican pharmacy ship to USA: certified Mexican pharmacy – Us Mex Pharm

USMexPharm: UsMex Pharm – reputable mexican pharmacies online

USMexPharm: mexican pharmacy – UsMex Pharm

https://usmexpharm.com/# usa mexico pharmacy

UsMex Pharm pharmacies in mexico that ship to usa mexico drug stores pharmacies

UsMex Pharm: usa mexico pharmacy – UsMex Pharm

usa mexico pharmacy: Mexican pharmacy ship to USA – Mexican pharmacy ship to USA

http://usmexpharm.com/# certified Mexican pharmacy

usa mexico pharmacy: Mexican pharmacy ship to USA – certified Mexican pharmacy

mexican border pharmacies shipping to usa: USMexPharm – mexican pharmacy

certified Mexican pharmacy USMexPharm USMexPharm

https://usmexpharm.com/# certified Mexican pharmacy

mexican pharmaceuticals online: UsMex Pharm – UsMex Pharm

USMexPharm: Us Mex Pharm – mexican pharmacy

mexican pharmacy: UsMex Pharm – Us Mex Pharm

https://usmexpharm.com/# UsMex Pharm

Mexican pharmacy ship to USA Mexican pharmacy ship to USA usa mexico pharmacy

usa mexico pharmacy: Us Mex Pharm – UsMex Pharm

UsMex Pharm: mexican pharmacy – mexican pharmacy

https://usmexpharm.shop/# Us Mex Pharm

Us Mex Pharm: UsMex Pharm – Us Mex Pharm

Us Mex Pharm: mexican pharmacy – Us Mex Pharm

UsMex Pharm mexican pharmacy mexican mail order pharmacies

https://sweetbonanza1st.com/# sweet bonanza siteleri

sweet bonanza demo: sweet bonanza giris – sweet bonanza yorumlar sweetbonanza1st.shop

sweet bonanza siteleri: sweet bonanza 1st – sweet bonanza giris sweetbonanza1st.shop

deneme bonusu veren siteler: deneme bonusu veren siteler – deneme bonusu veren siteler casinositeleri1st.com

gerГ§ek paralД± slot uygulamalarД±: casibom guncel giris – en iyi bahis sitesi hangisi casibom1st.com

casino siteleri 2025 deneme bonusu veren siteler lisansl? casino siteleri casinositeleri1st.shop

http://casibom1st.com/# en Г§ok kazandД±ran bahis siteleri

sweet bonanza: sweet bonanza yorumlar – sweet bonanza siteleri sweetbonanza1st.shop

yeni bahis siteleri deneme bonusu: casibom resmi – casinoda en Г§ok kazandД±ran oyun casibom1st.com

casino giriЕџ: casibom – gГјvenilir kripto para siteleri casibom1st.com

sweet bonanza giris: sweet bonanza – sweet bonanza 1st sweetbonanza1st.shop

deneme bonusu veren siteler: lisansl? casino siteleri – deneme bonusu veren siteler casinositeleri1st.com

discount casД±no: casibom 1st – gГјvenilir kripto para siteleri casibom1st.com

http://sweetbonanza1st.com/# sweet bonanza

deneme bonusu veren siteler: casino siteleri 2025 – guvenilir casino siteleri casinositeleri1st.com

guvenilir casino siteleri casino siteleri slot casino siteleri casinositeleri1st.shop

slot casino siteleri: casino siteleri 2025 – lisansl? casino siteleri casinositeleri1st.com

gerГ§ek paralД± slot uygulamalarД±: casibom 1st – bahis giriЕџ casibom1st.com

l04h3r

casino siteleri: lisansl? casino siteleri – casino siteleri casinositeleri1st.com

casino oyna: casino siteleri – guvenilir casino siteleri casinositeleri1st.com

deneme bonusu veren gГјvenilir siteler casibom guncel adres en yeni deneme bonusu veren siteler 2025 casibom1st.shop

sweet bonanza yorumlar: sweet bonanza siteleri – sweet bonanza demo sweetbonanza1st.shop

sweet bonanza demo: sweet bonanza demo – sweet bonanza giris sweetbonanza1st.shop

casino siteleri 2025: slot casino siteleri – casino siteleri casinositeleri1st.com

bahis siteleri 2024: casibom guncel giris – siteler bahis casibom1st.com

sweet bonanza demo sweet bonanza sweet bonanza demo sweetbonanza1st.com

kaГ§ak bahis siteleri bonus veren: deneme bonusu veren siteler – lisansl? casino siteleri casinositeleri1st.com

sweet bonanza: sweet bonanza yorumlar – sweet bonanza yorumlar sweetbonanza1st.shop

http://casibom1st.com/# vidobet giriЕџ

guvenilir casino siteleri: oyun inceleme siteleri – casino siteleri casinositeleri1st.com

sweet bonanza: sweet bonanza demo – sweet bonanza slot sweetbonanza1st.shop

slot casino siteleri guvenilir casino siteleri casino siteleri casinositeleri1st.shop

sweet bonanza yorumlar: sweet bonanza oyna – sweet bonanza giris sweetbonanza1st.shop

https://sweetbonanza1st.shop/# sweet bonanza

Pred Pharm Net: no prescription online prednisone – prednisone tablets 2.5 mg

cost of generic clomid tablets: where to buy clomid – can i buy cheap clomid tablets

Pred Pharm Net Pred Pharm Net buy prednisone online no script

http://lisinexpress.com/# Lisin Express

Pred Pharm Net: prednisone 5mg capsules – Pred Pharm Net

buy zithromax online fast shipping: ZithPharmOnline – zithromax 250

https://clomfastpharm.com/# Clom Fast Pharm

ZithPharmOnline: ZithPharmOnline – ZithPharmOnline

AmOnlinePharm amoxicillin tablets in india AmOnlinePharm

AmOnlinePharm: AmOnlinePharm – AmOnlinePharm

https://amonlinepharm.com/# buy amoxicillin online no prescription

Clom Fast Pharm: buying generic clomid – Clom Fast Pharm

zestril 2.5 mg: Lisin Express – how much is lisinopril 10 mg

https://lisinexpress.com/# lisinopril price

buy prednisone online without a script: buy prednisone with paypal canada – Pred Pharm Net

qas57t

over the counter amoxicillin canada AmOnlinePharm cost of amoxicillin prescription

Lisin Express: lisinopril brand name in usa – Lisin Express

https://predpharmnet.com/# Pred Pharm Net

lisinopril 20mg tablets cost: Lisin Express – Lisin Express

AmOnlinePharm: AmOnlinePharm – amoxicillin medicine over the counter

Clom Fast Pharm Clom Fast Pharm where can i get cheap clomid without insurance

https://lisinexpress.com/# Lisin Express

Lisin Express: lisinopril 20 mg price without prescription – Lisin Express

Clom Fast Pharm: Clom Fast Pharm – cost cheap clomid pills

amoxicillin 500mg tablets price in india: buy amoxicillin online with paypal – AmOnlinePharm

https://zithpharmonline.shop/# buy zithromax online

zithromax purchase online zithromax price south africa ZithPharmOnline

Lisin Express: online lisinopril – lisinopril 10 mg coupon

can you buy zithromax over the counter in mexico: cost of generic zithromax – ZithPharmOnline

https://clomfastpharm.shop/# Clom Fast Pharm

cheap prednisone 20 mg: Pred Pharm Net – prednisone 12 tablets price

medicine prednisone 5mg: Pred Pharm Net – Pred Pharm Net

http://zithpharmonline.com/# ZithPharmOnline

Clom Fast Pharm where can i get generic clomid without prescription Clom Fast Pharm

zithromax online usa: ZithPharmOnline – ZithPharmOnline

AmOnlinePharm: amoxicillin price without insurance – buying amoxicillin in mexico

https://zithpharmonline.shop/# ZithPharmOnline

buy medicines online in india: pharmacy website india – www india pharm

pharmacies in mexico that ship to usa Agb Mexico Pharm Agb Mexico Pharm

Agb Mexico Pharm: buying from online mexican pharmacy – Agb Mexico Pharm

canada rx pharmacy world: go canada pharm – pharmacy wholesalers canada

https://wwwindiapharm.com/# world pharmacy india

mexico drug stores pharmacies: medicine in mexico pharmacies – mexican rx online

canadian pharmacy meds: legitimate canadian online pharmacies – reliable canadian online pharmacy

https://agbmexicopharm.com/# Agb Mexico Pharm

п»їbest mexican online pharmacies mexican online pharmacies prescription drugs Agb Mexico Pharm

pharmacy website india: india pharmacy – indian pharmacy

canadian drug: canadian pharmacies that deliver to the us – canada pharmacy 24h

https://agbmexicopharm.shop/# mexican rx online

india pharmacy mail order: Online medicine home delivery – pharmacy website india

canada drugstore pharmacy rx canadian online pharmacy reviews maple leaf pharmacy in canada

indian pharmacy paypal: www india pharm – buy medicines online in india

www india pharm: www india pharm – buy prescription drugs from india

https://wwwindiapharm.shop/# www india pharm

п»їbest mexican online pharmacies: Agb Mexico Pharm – mexico drug stores pharmacies

pharmacy canadian superstore: go canada pharm – canadian drug prices

https://gocanadapharm.shop/# canadian world pharmacy

Agb Mexico Pharm: mexican mail order pharmacies – mexican mail order pharmacies

www india pharm www india pharm indian pharmacy

www india pharm: mail order pharmacy india – indianpharmacy com

canada drugs reviews: best canadian online pharmacy – canadian neighbor pharmacy

https://wwwindiapharm.shop/# india pharmacy

mexico pharmacies prescription drugs: buying prescription drugs in mexico – Agb Mexico Pharm

Agb Mexico Pharm: buying prescription drugs in mexico online – п»їbest mexican online pharmacies

online shopping pharmacy india mail order pharmacy india indian pharmacy

http://agbmexicopharm.com/# Agb Mexico Pharm

onlinepharmaciescanada com: go canada pharm – pet meds without vet prescription canada

canadian online pharmacy: go canada pharm – online canadian pharmacy

74lp43

https://wwwindiapharm.shop/# top online pharmacy india

mexican mail order pharmacies: Agb Mexico Pharm – medication from mexico pharmacy

buying prescription drugs in mexico online mexican pharmaceuticals online buying prescription drugs in mexico online

buying from online mexican pharmacy: Agb Mexico Pharm – Agb Mexico Pharm

http://wwwindiapharm.com/# indian pharmacy online

reputable mexican pharmacies online: buying from online mexican pharmacy – Agb Mexico Pharm

Online apotheek Nederland met recept: Apotheek online bestellen – online apotheek

https://apotekonlinerecept.shop/# Apotek hemleverans idag

Beste online drogist: Betrouwbare online apotheek zonder recept – ApotheekMax

https://apotekonlinerecept.com/# Apotek hemleverans recept

Beste online drogist: Apotheek online bestellen – Apotheek online bestellen

https://apotekonlinerecept.shop/# apotek online

Kamagra Oral Jelly: Kamagra kaufen – Kamagra online bestellen

Online apotheek Nederland met recept Apotheek Max Online apotheek Nederland met recept

https://apotekonlinerecept.shop/# apotek pa nett

kamagra: Kamagra kaufen ohne Rezept – Kamagra Original

1xapcz

http://kamagrapotenzmittel.com/# Kamagra kaufen

de online drogist kortingscode Betrouwbare online apotheek zonder recept Betrouwbare online apotheek zonder recept

Apotek hemleverans idag: apotek pa nett – apotek online

https://apotheekmax.shop/# Apotheek online bestellen

Apoteket online: Apoteket online – Apotek hemleverans idag

Apotheek online bestellen: de online drogist kortingscode – Apotheek Max

https://kamagrapotenzmittel.shop/# Kamagra Oral Jelly

Apoteket online: apotek pa nett – apotek online recept

apotek online apotek online apotek pa nett

https://kamagrapotenzmittel.shop/# Kamagra Original

t6af39

Online apotheek Nederland zonder recept: Online apotheek Nederland zonder recept – ApotheekMax

Apotek hemleverans recept: apotek online – apotek pa nett

http://kamagrapotenzmittel.com/# Kamagra Original

de online drogist kortingscode: Online apotheek Nederland met recept – Online apotheek Nederland met recept

Apotheek Max Betrouwbare online apotheek zonder recept online apotheek

Online apotheek Nederland zonder recept: Apotheek online bestellen – Betrouwbare online apotheek zonder recept

http://apotheekmax.com/# Betrouwbare online apotheek zonder recept

https://apotheekmax.shop/# Online apotheek Nederland met recept

Apotek hemleverans recept: Apotek hemleverans recept – Apotek hemleverans idag

Kamagra Gel: Kamagra online bestellen – Kamagra Oral Jelly kaufen

Kamagra online bestellen Kamagra kaufen Kamagra Gel

http://apotekonlinerecept.com/# Apotek hemleverans idag

Apotek hemleverans recept: apotek online – Apotek hemleverans idag

Apotek hemleverans idag: apotek online recept – Apoteket online

http://apotekonlinerecept.com/# Apoteket online

Apotek hemleverans recept: Apotek hemleverans recept – apotek pa nett

Apotek hemleverans recept: apotek online – apotek pa nett

kamagra Kamagra Oral Jelly Kamagra kaufen

https://kamagrapotenzmittel.com/# Kamagra online bestellen

0usjnk

Apotek hemleverans recept: Apoteket online – Apotek hemleverans recept

Kamagra kaufen ohne Rezept: Kamagra kaufen – Kamagra kaufen

buy generic 100mg viagra online Generic 100mg Easy buy generic 100mg viagra online

пин ап вход – pinup 2025

pinup 2025 – пин ап зеркало

pinup 2025 – пин ап вход

пин ап – пин ап зеркало

пин ап казино зеркало – пин ап казино

пин ап – пин ап казино зеркало

пин ап зеркало – пин ап казино

пин ап казино зеркало – пин ап казино зеркало

Generic100mgEasy buy generic 100mg viagra online Generic 100mg Easy

пин ап казино – пин ап казино

pinup 2025 – пин ап казино

pinup 2025 – пин ап вход

пин ап казино официальный сайт – пин ап казино официальный сайт

buy generic 100mg viagra online buy generic 100mg viagra online Generic100mgEasy

пин ап вход – пин ап

пин ап казино зеркало – пин ап казино

E2Bet Indonesia, situs judi online terbesar di Indonesia, aman, terpercaya,

dan inovatif, bonus menarik dan layanan pelanggan 24/7.

#E2Bet #E2BetIndonesia #Indonesia

пин ап вход – pinup 2025

пин ап казино официальный сайт – пин ап вход

Kamagra Kopen kamagra jelly kopen Kamagra

https://kamagrakopen.pro/# Officiele Kamagra van Nederland

http://tadalafileasybuy.com/# Tadalafil Easy Buy

https://kamagrakopen.pro/# KamagraKopen.pro

Generic100mgEasy: Generic 100mg Easy – Generic100mgEasy

https://kamagrakopen.pro/# kamagra gel kopen

Generic 100mg Easy Cheap Sildenafil 100mg Generic 100mg Easy

https://generic100mgeasy.com/# Sildenafil 100mg price

http://generic100mgeasy.com/# best price for viagra 100mg

Generic100mgEasy: Generic 100mg Easy – Generic100mgEasy

https://kamagrakopen.pro/# Kamagra

https://tadalafileasybuy.shop/# Buy Tadalafil 10mg

kamagra jelly kopen: KamagraKopen.pro – kamagra kopen nederland

kamagra 100mg kopen kamagra gel kopen KamagraKopen.pro

buy generic 100mg viagra online: Generic 100mg Easy – Generic 100mg Easy

http://generic100mgeasy.com/# Generic 100mg Easy

https://kamagrakopen.pro/# kamagra gel kopen

c97so0

Kamagra: Officiele Kamagra van Nederland – kamagra jelly kopen

https://kamagrakopen.pro/# Officiele Kamagra van Nederland

https://tadalafileasybuy.com/# Tadalafil Easy Buy

Kamagra Kopen Online kamagra kopen nederland kamagra 100mg kopen

Buy Tadalafil 10mg: TadalafilEasyBuy.com – Generic Cialis without a doctor prescription

https://generic100mgeasy.shop/# Cheap Viagra 100mg

http://generic100mgeasy.com/# Generic 100mg Easy

cheapest cialis: cialis without a doctor prescription – TadalafilEasyBuy.com

Generic 100mg Easy buy generic 100mg viagra online Generic 100mg Easy

https://kamagrakopen.pro/# Officiele Kamagra van Nederland

https://kamagrakopen.pro/# Officiele Kamagra van Nederland

Cialis 20mg price: cialis without a doctor prescription – TadalafilEasyBuy.com

https://tadalafileasybuy.com/# Generic Tadalafil 20mg price

https://generic100mgeasy.shop/# Generic100mgEasy

kamagra kopen nederland kamagra jelly kopen kamagra gel kopen

kamagra gel kopen: kamagra kopen nederland – KamagraKopen.pro

http://tadalafileasybuy.com/# Tadalafil Easy Buy

https://kamagrakopen.pro/# kamagra gel kopen

http://generic100mgeasy.com/# Generic100mgEasy

Kamagra Kopen: KamagraKopen.pro – kamagra kopen nederland

https://tadalafileasybuy.com/# cialis without a doctor prescription

buy generic 100mg viagra online sildenafil online buy generic 100mg viagra online

http://indiamedfast.com/# india online pharmacy store

safe online pharmacies in canada

https://mexicanpharminter.com/# Mexican Pharm Inter

ordering drugs from canada: Inter Pharm Online – canadianpharmacymeds

s2s3ws

https://mexicanpharminter.com/# mexican pharmacy online

canadian valley pharmacy

https://interpharmonline.com/# canada discount pharmacy

india pharmacy without prescription online pharmacy india India Med Fast

http://indiamedfast.com/# IndiaMedFast

best canadian pharmacy online

https://mexicanpharminter.com/# buying from online mexican pharmacy

usgwy2

ttdbj2

buying prescription drugs from india IndiaMedFast.com buying prescription drugs from india

https://interpharmonline.shop/# canadian king pharmacy

canadian pharmacies

https://indiamedfast.com/# buying prescription drugs from india

reputable canadian online pharmacies: highest rated canadian online pharmacy – onlinecanadianpharmacy

https://indiamedfast.shop/# india online pharmacy store

canadian 24 hour pharmacy

https://interpharmonline.shop/# legit canadian pharmacy

cheapest online pharmacy india order medicines online india IndiaMedFast

india online pharmacy store: online medicine shopping in india – lowest prescription prices online india

https://interpharmonline.com/# canada drugs online

best canadian pharmacy online

https://mexicanpharminter.com/# mexican drug stores online

cheapest online pharmacy india: online medicine shopping in india – order medicines online india

https://mexicanpharminter.com/# mexican pharmacy online order

canadian pharmacy ratings

http://interpharmonline.com/# canadian pharmacy meds review

vipps canadian pharmacy legitimate canadian pharmacies online canada ed drugs

https://interpharmonline.com/# canadian pharmacy no scripts

best online canadian pharmacy

online medicine shopping in india: buying prescription drugs from india – online medicine shopping in india

alo789hk: 789alo – alo 789 dang nh?p

opaxqc

a3h1mf

y8svhv

rie6m1

bducxh

tuo7rl

2whq86

Η γνώση είναι μαγική δύναμη! ΜΑΓΟΣ ΓΙΑ ΠΑΡΤΥ