New product failures: 6 root causes you can avoid

What if you could turn B2B product development into a science? What if you searched for the causes of new product failures as you would for problems in chemical reactions or manufacturing steps? Now you can. We’ll use our “triple diamond” of NPD to examine all 6 steps you must do well to ensure success. You may be entirely skipping some today.

Do you realize your brain is diverging and converging all the time?

- You diverge to all the clothes in your closet… and converge on one outfit.

- You diverge to all your breakfast menu choices… and converge on one.

- You diverge to all of today’s tasks-to-be-done… and converge to begin one.

And so your day goes. It should not come as a surprise that new product development also involves divergent and convergent steps, each of which holds the seeds of new product failures.

Wait, you say, “My ‘breakfast of champions’ is eating two jelly-filled donuts every morning, so I didn’t really diverge to multiple choices.” That’s true. But as we’ll see, the failure to employ your divergent and convergent thinking options is itself a cause of new product failures. Not thinking doesn’t pardon us from the consequences of not thinking.

Not thinking doesn’t pardon us from the consequences of not thinking.

The Triple Diamond: 6 possible causes of new product failures.

Good decision-making is rooted in this process of first diverging and then converging. In new product development, the diverging-and-converging process should occur three times, each with two possible causes (1. diverging and 2. converging) of new product failures. These three divergent-convergent “diamonds” are:

- Targeting the proper market segment and job-to-be-done.

- Prioritizing the outcomes this market wants improved.

- Designing solution(s) to improve these market outcomes.

Let’s examine each of these 6 steps to see which are leading to new product failures in your business.

Step 1: Diverge for Market JTBD

In this step you imagine all the possible market segments to which you might deliver innovation and value. A market segment is a “cluster of customers with similar needs.” Nearly all B2B innovators have multiple possible market segments. For example…

- Your hydraulic cylinders could control motion in garbage trucks, bulldozers, or dentist chairs.

- Your welding machines could bond auto chassis, boiler tubes, or submarines.

- Your corrugated boxes could package e-commerce products, pharmaceuticals, or frozen food.

Your market segment tells you which customers you’ll try to please with your new product. B2B customers in a market segment are typically in competition with each other. So if you supply plastic to the auto industry, your market segment would include Honda, General Motors, Ford, Tesla, and so on.

But it’s not enough to develop a better plastic for passenger car producers: You need to target their job to be done. After all, your improved plastic could be used for many different “jobs,” each of which has unique requirements:

- Exterior automotive body molding

- Automotive dashboards

- Under-the-hood liquid containment

In our experience, this first step (diverging to all possible market segments and jobs-to-be-done) is seldom the main cause of new product failures. Depending on your product and job responsibilities, you may have little or no “diverging” to do. But do give this enough thought to ensure you aren’t missing new opportunities.

Step 2: Converge to Market JTBD

Imagine you produce ingredients for wood coatings. How will you decide which market segment to pursue? After all, customers who produce kitchen cabinet coatings might want better grease resistance, while those making gym floor coatings require scuff resistance.

Better pick a single target market or your new product won’t please anyone. Trying to please multiple market segments—which by definition have different needs—is a common source of new product failures.

Too often, “the boss” decides which market segment to pursue. This primitive form of “converging” is a common source of new product failures. It’s better to have several brains using a thoughtful process in which the selection criteria are agreed upon.

In the example below, the possible market segments are shown as rows, while the selection criteria are displayed as columns: How big is the market, how fast is it growing, etc. The team assigns A, B, and C ratings to each cell. After vigorous discussion, the team selects a market segment heavily loaded with A’s.

Why does this approach reduce new product failures? First, you simply get better decision-making when a) the selection criteria are transparent and debated, and b) multiple points of view are offered and considered. Second, your new product team has much greater “buy-in” to the project when they helped select the project scope.

Step 3: Diverge for Market Outcomes

Steps 3 and 4 deal with market outcomes… the desired end-results that customers in your target market segment want improved to accomplish their job-to-be-done. If you’re a B2B producer, these two steps are probably causing most of your new product failures. Let’s take a closer look, beginning with the divergent step.

These two steps are probably causing most of your new product failures.

What do new product failures look like in Step 3? We call them errors of omission… failing to uncover unarticulated customer needs. Is a new product team ever faulted for such an error? No, at least not at the time, because no one knows they overlooked a customer outcome that could have led to a blockbuster new product feature.

The best way to avoid new product failures from this error is to conduct Discovery interviews within your target market segment. For this, a Moderator and Note-taker probe desired customer outcomes and record their notes for the customer to see. A packaging producer interviewing Amazon might record notes that look like this:

There are several keys to success with these qualitative interviews:

- Let the customer suggest the next outcome (problem or desired state).

- Don’t use a questionnaire… but instead skillfully probe each outcome.

- When possible, interview multiple customer job functions at the same time.

In addition to uncovering a wide range of desired customer insights, you’ll find customers love this highly engaging format. Who doesn’t want to be carefully listened to and asked for their opinion? For more on this, download the research report, Discovery Interviews.

Step 4: Converge to Market Outcomes

OK, you’ve conducted Discovery interviews and now have dozens of desired customer outcomes. How will you prioritize them? How will you decide which to pursue in your new product design? This step is the single greatest cause of new product failures for B2B producers… a claim we’ll back up with recent research.

This step is the single greatest cause of new product failures for B2B producers.

But first, what does this convergent step look like? We suggest you conduct quantitative Preference interviews with the customers in your target market segment. Imagine you finished conducting Discovery interviews with Amazon and several other e-commerce companies.

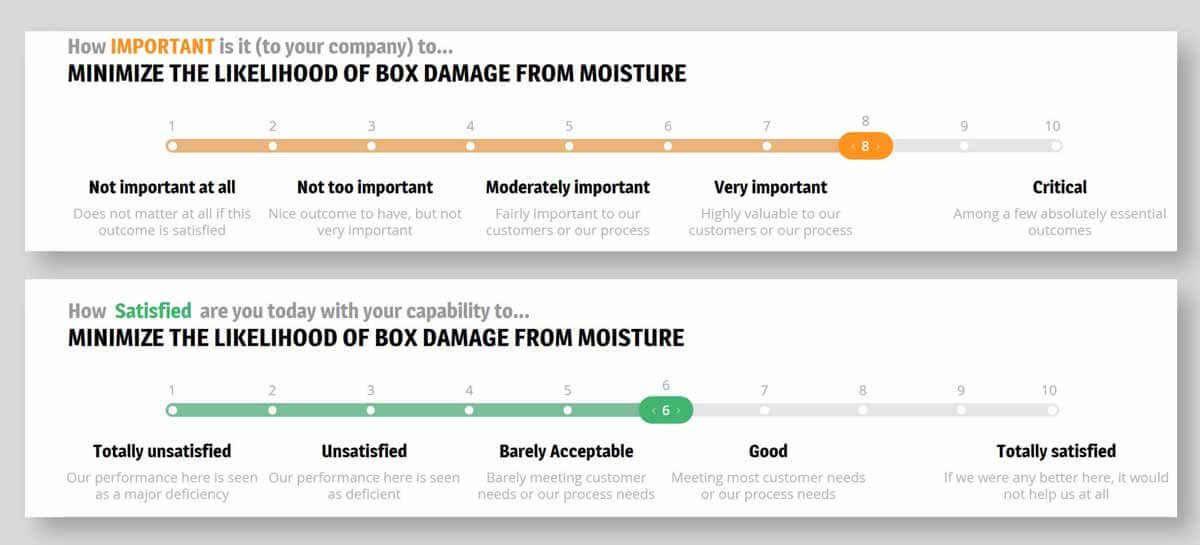

Now you return to each company for a Preference interview to get feedback on a short list of outcomes you heard in the Discovery interviews. Specifically, you ask them how important and how satisfied they are today with these outcomes using 1-to-10 scales.

After conducting several Preference interviews in your target market segment, you then calculate Market Satisfaction Gaps (MSG) for the market as follows:

- MSG = Avg. Importance x (10 – Avg. Satisfaction)

- MSG = 8 x (10 – 6) = 32%

The AIM Institute has worked with over a thousand teams globally in nearly every imaginable B2B market and found this: If an outcome has a Market Satisfaction Gap over 30%, it indicates the market is eager for improvement here. For more, download the white paper, Market Satisfaction Gaps.

Without this sort of quantitative evidence of customer needs, suppliers often allow their wishful thinking and confirmation bias to lead them astray. They commit errors of commission. That is, they prioritize the wrong outcomes to work on, and suffer unnecessary new product failures.

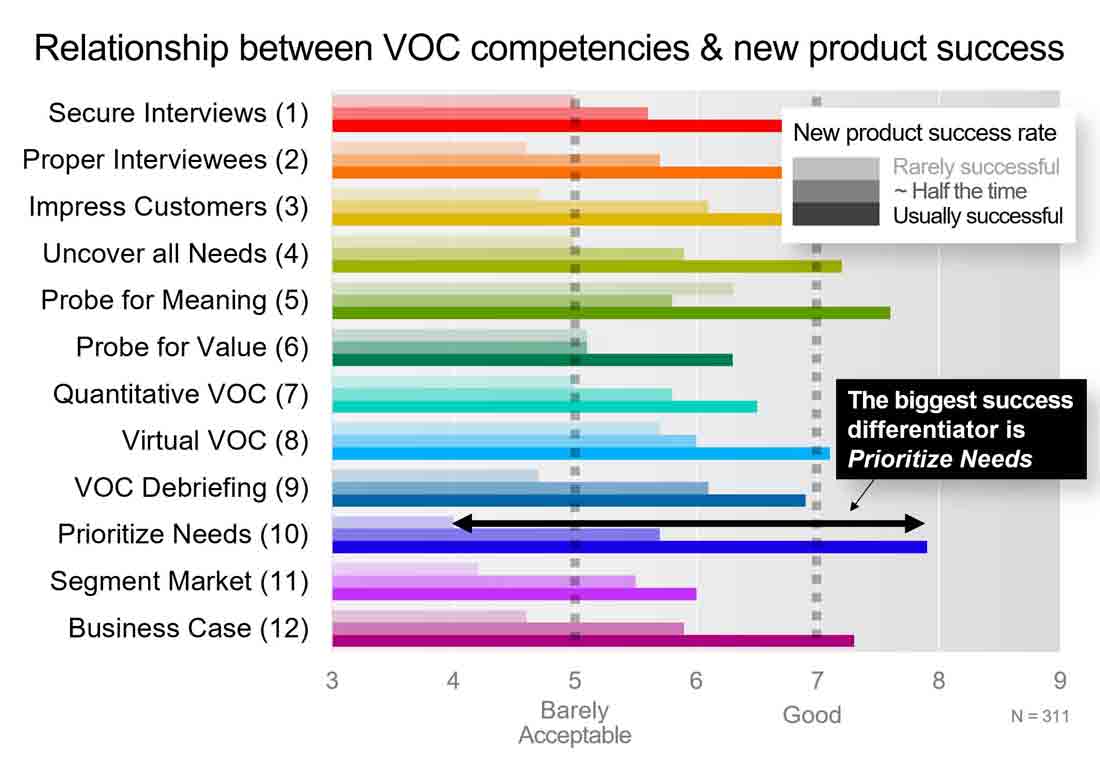

We know this from research conducted by The AIM Institute on B2B voice-of-customer skills. What is the strongest differentiator between companies that have high vs. low levels of new product success? Of 12 VOC skills studied, it was this ability to prioritize customer needs.

Many leading B2B companies no longer allow their NPD teams to enter the development stage until they have prioritized customer needs based on Market Satisfaction Gaps. This allows them to eliminate most commercial risk—the chief cause of new product failures—so they can focus on technical risk.

This allows them to eliminate most commercial risk, so they can focus on technical risk.

Step 5: Diverge for Solution Design

Let’s do a process check: Your team has selected an attractive, high-value target market segment and job-to-be-done. And within this job-to-be-done, you know precisely which outcomes customers are most eager to see you improve.

Congratulations! You’re well ahead of the vast majority of B2B product development teams. You’ve overcome today’s most common sources of new product failures. Now it’s time to diverge to all possible solution designs, and then converge on the most promising.

Many companies do a fine job with these two solution steps: It’s unlikely these are your greatest source of new product failures. Still, there are several things you can do to ensure you’ve properly diverged:

- Solution brainstorming: Invite team members, internal colleagues, and external experts to rich brainstorming sessions to diverge to many possible solutions.

- TRIZ: This methodology helps you develop solutions based on overcoming contradictions, by considering 40 principles that have proven successful elsewhere.

- Technical Advisory Boards: Invite university professors, technical consultants, and others to help you develop solutions.

- Patent searches: There’s no need to invent it all yourself. Perhaps others have already done the heavy lifting and you can in-license their technology.

- Yet2.com: This is a technology scouting resource that helps you define your problem, scout for solution providers, filter, and engage them.

Step 6: Converge to Solution Design

Most companies do this last step well: converging on their solution. In fact, they do it too well. Or at least, they do it too early. You’ll notice that this is the last step in the new product development process. Wouldn’t it be silly if companies did the last step first?

Wouldn’t it be silly if companies did the last step first?

And this is precisely what most B2B companies do. They have internal “ideation” sessions to dream up solutions they hope customers want. And then they’re surprised by their new product failures… when those pesky customers don’t love their new product.

Think about that for a moment. If you had a series of chemical reactions that you tried to run in reverse, would you be surprised when you didn’t get the desired results? If you were designing a production process, would it start with packing and loading your finished products onto trailers?

Eventually, B2B innovators will look back at today’s typical approach and in puzzlement ask… “Really?” Sort this out before others in your industry and you’ll have an impressive competitive advantage.

Reducing your new product failures

I invite you to review these 6 steps with your business colleagues. Challenge these steps. Are they all necessary? Are they in the right order? And especially, ask which steps you’re currently underperforming in today.

If yours is like many other B2B companies, you need to become less inside-out in your thinking and more outside-in. Specifically, you need to do a better job with steps 3 and 4: diverging to all possible customer outcomes and then converging to the ones they really care about.

You need to become less inside-out in your thinking and more outside-in.

The Discovery and Preference interviews mentioned earlier were developed as part of the New Product Blueprinting process in 2005. You can learn more in this short overview video at www.newproductblueprinting.com, or by viewing all the training options at www.blueprintingtraining.com.

Regardless of which steps you seek to improve, you can be confident of this: Most companies have enormous potential for reducing their new product failures. This can happen for your business when you use these 6 steps to turn new product development into a science.

Comments