Three Steps to Improving your B2B New Product Development

Are you launching one breakthrough new product after another? Or are your new products evoking yawns from customers? Research shows the most likely reason for the latter is failing to properly 1) uncover, 2) understand, and 3) prioritize market needs. Here’s how to correct this in your B2B new product development.

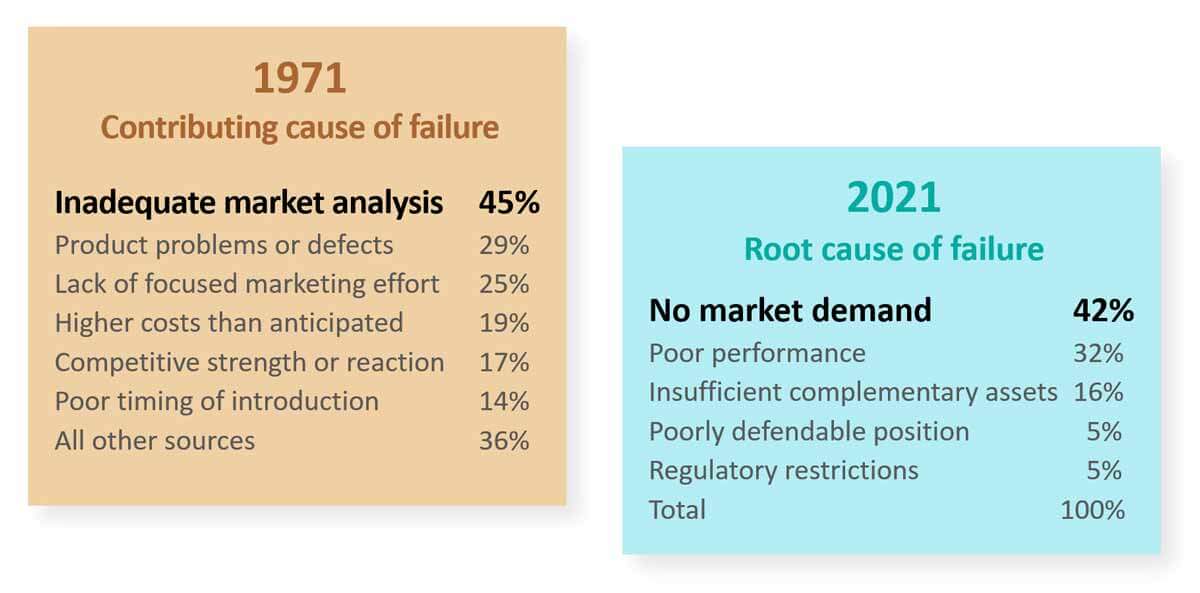

We shouldn’t be surprised to hear that misunderstanding customer needs is a problem in B2B new product development. As shown below, we’ve known this for five decades: It has consistently been the leading cause of new product failures.

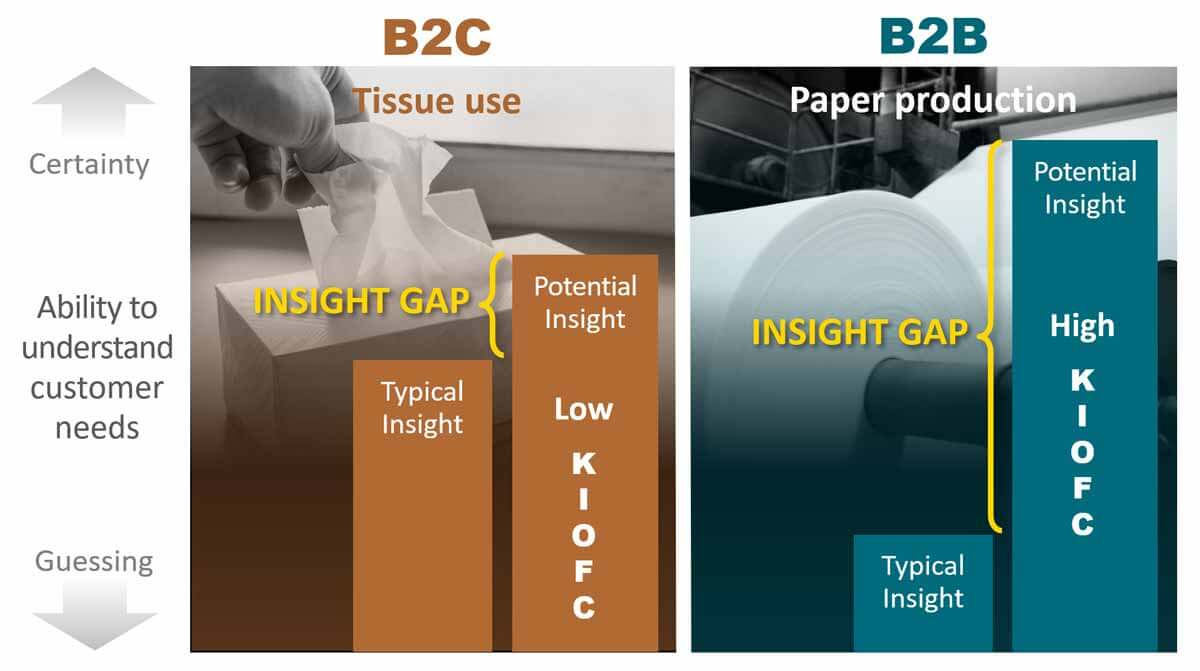

While that’s a shame for any company, it’s particularly alarming for B2B new product development due to something I call the “insight gap.” Contrast the market insights of a tissue producer selling to consumers (B2C) with a pigment producer selling to paper producers (B2B). In the following illustration, we plot their ability to understand customer needs, from “guessing” to “certainty.”

The B2B Advantage

The B2C tissue producer has rather high typical insight. Since tissue designers are consumers themselves, they have a decent understanding of customer needs. Also, B2C market research budgets tend to be high, boosting typical insight. But the tissue producer has limited potential insight, due to low customer knowledge, interest, objectivity, foresight, and concentration (KIOFC). For more on this, download the white paper, B2B vs. B2C.

The B2B pigment producer has low typical insight: This producer knows little about the paper-making business. Most market research budgets for B2B new product development are low which also contributes to a low typical insight. The B2B pigment producer’s potential insight, however, is high given the knowledge, interest, and so on of paper producers.

The insight gap is the difference between typical and potential market insight… and it’s much greater for the B2B company. For B2B new product development, this large insight gap should shout one thing—Opportunity! You and your competitors know much less about customer needs than you could know. Close this gap before competitors, and you’ll turbocharge your profitable, sustainable growth.

For B2B new product development, this large insight gap should shout one thing—Opportunity!

How do you do this? You must a) uncover, b) understand, and c) prioritize market needs.

1. How to UNCOVER market needs

Your first step is to uncover market needs. Your customers certainly have many needs, often in the form of unresolved problems. And if you work for a large company, your sales, technical and customer support employees have thousands of annual conversations with customers. What’s preventing these needs from presenting themselves to your solution providers? Why aren’t these problems “front and center” when you embark on B2B new product development?

Any of the following factors could be causing these needs to be “filtered out” before they become the focus of your B2B new product development:

-

- Poor listening skills

- Weak probing questions

- Haphazard call reports

- Weak data-mining

How do you fix this? Most companies need to be more intentional about training their market-facing staff. One approach for doing this is Everyday VOC training, which builds their skills in listening to customers, probing with good questions, and entering what’s been learned into their CRM system in an intelligent, searchable fashion.

It’s helpful to refer to customer needs, problems, desires, etc. as “outcomes”—a term for their desired end-result. Outcomes do not include “solutions.” Think of an outcome is what the customer wants to have happen, while a solution is how it happens. This may seem like semantics, but good things happen when your entire organization uses customer “outcomes” as the unit of market insight. You a) avoid the garbage-in-garbage-out problem plaguing many CRM systems, and b) provide focus to your B2B new product development.

Good things happen when your entire organization uses customer “outcomes” as the unit of market insight.

But successful B2B new product development requires more than uncovering market needs. You also need to understand these needs and properly prioritize them.

2. How to UNDERSTAND market needs

Imagine your sales and technical support professionals are uncovering many, many market needs, and you’re able to data-mine your CRM to see an increasing frequency of certain market needs. Should you now enter the lab to pursue your B2B new product development?

Not so fast. Now you must launch the “front end” of your B2B new product development. Unlike the fragmented “Everyday VOC” above, this effort is concentrated…

-

- on a single market segment,

- for a single customer job-to-be-done,

- over a short time period,

- by a defined B2B new product development team

For this “understand” part, you’ll conduct qualitative customer interviews. For B2B new product development, these are often referred to as “Discovery” interviews.

A few tips for these:

- Project your notes: Display customers’ comments on a screen or during a web-conference, so they can see them, make corrections, and “own” the conversation. They’ll be much more engaged this way.

- Forget your questionnaire: Never bore customers with a questionnaire. Instead, let the customers lead the discussion. (See how in this 5-minute video.) After they give you a desired outcome (and you’ve probed to understand it), simply ask “What else?” This lets your customer discuss outcomes they care about.

- Focus on the customer: Discuss only the customer’s desired outcomes, not your products or hypotheses. It’s all about them and their needs at this point in your B2B new product development. And never “sell” or “solve” during the interview.

- Probe skillfully: Signal your interest and learn more by recapping, making affirming comments, and probing with “what” and “why” questions.

Never bore customers with a questionnaire. Instead, let the customers lead the discussion.

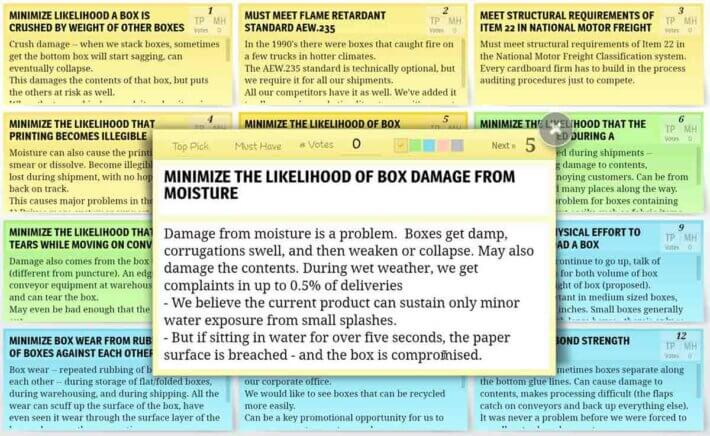

The last point on “what” and “why” questions is critical to the “understanding” part of your B2B new product development. Imagine you make corrugated boxes and you interview Amazon about their needs. Display your notes and record one customer outcome per sticky note and probe well with…

- “What” questions: Can you describe this problem? When does this happen? How often does this happen? Where does it occur?

- “Why” questions: Why is this a problem? Who does it impact?

After each outcome ask, “Any other problems?” You’ll have no idea what the next sticky note will hold. Your customer leads the interview—not you—so you’ll learn much more than with a questionnaire.

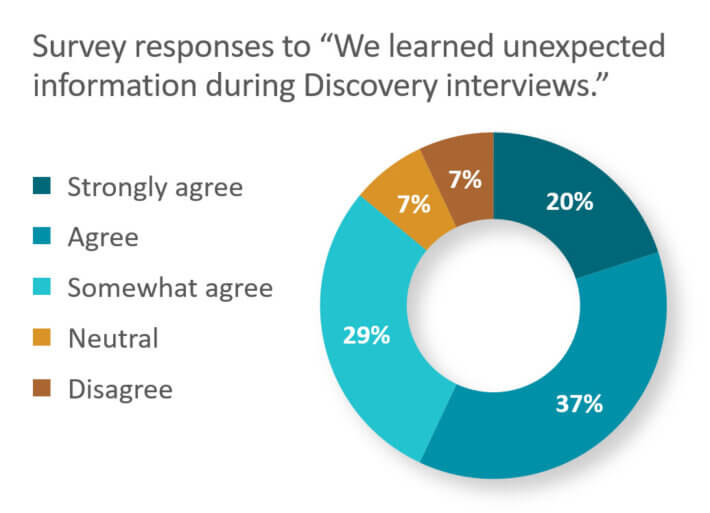

When you conduct these Discovery interviews, be prepared to be surprised. In many business endeavors—installing software or traveling on business—you don’t want to be surprised. But you do for B2B new product development because it can provide you with design targets your competitors have missed.

We queried 397 practitioners who had been trained in Discovery interviews and had conducted over 1800 such interviews during their B2B new product development. As shown below, most of them encountered unexpected information. Better yet, they also reported they were able to probe and understand these customer outcomes well.

3. How to PRIORITIZE market needs for B2B New Product Development

Most companies have plenty of room to improve the first two steps—uncovering and understanding customer needs. But most completely ignore the third—prioritizing customer needs—in their B2B new product development.

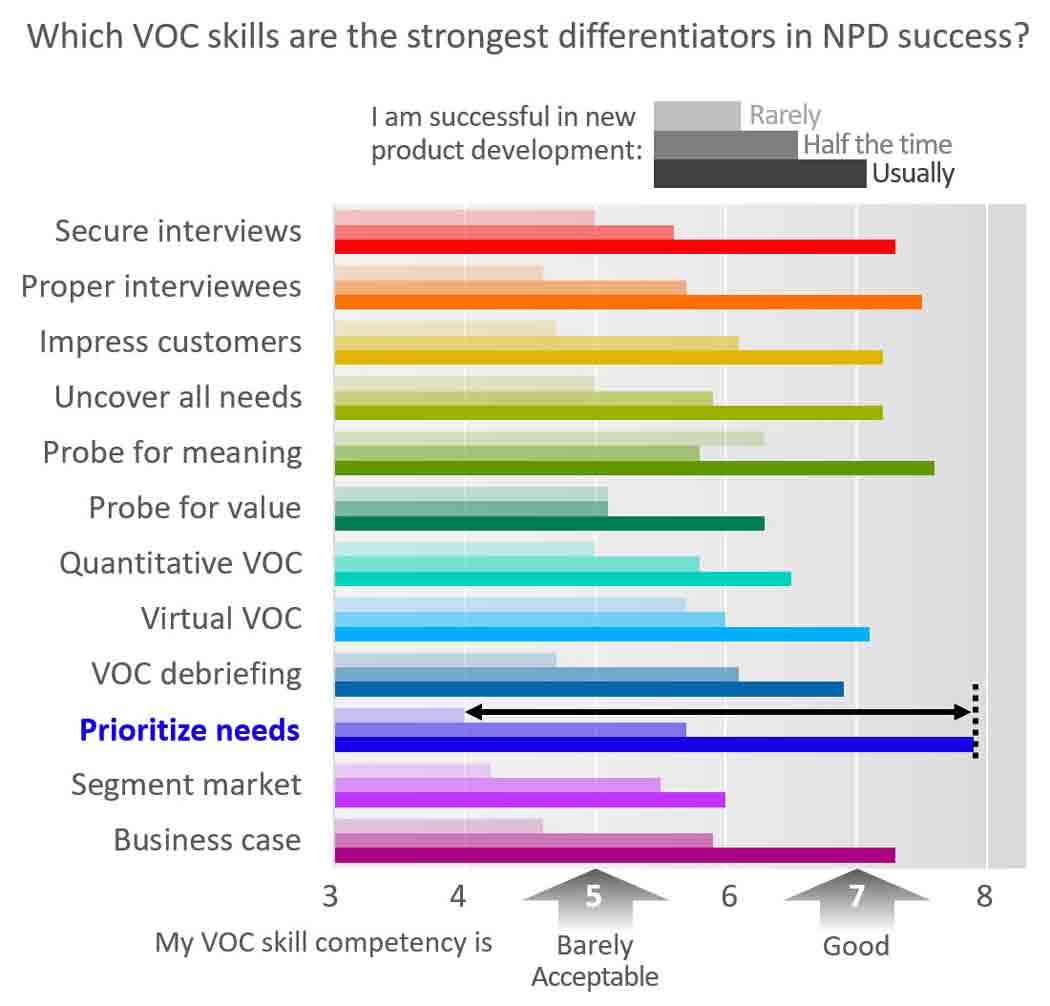

Is this a problem? Absolutely! Our research shows prioritizing market needs is the single strongest voice-of-customer skill for successful B2B new product development. But before examining this research, what do we even mean by “prioritizing” market needs?

Our research shows prioritizing market needs is the single strongest voice-of-customer skill for successful B2B new product development.

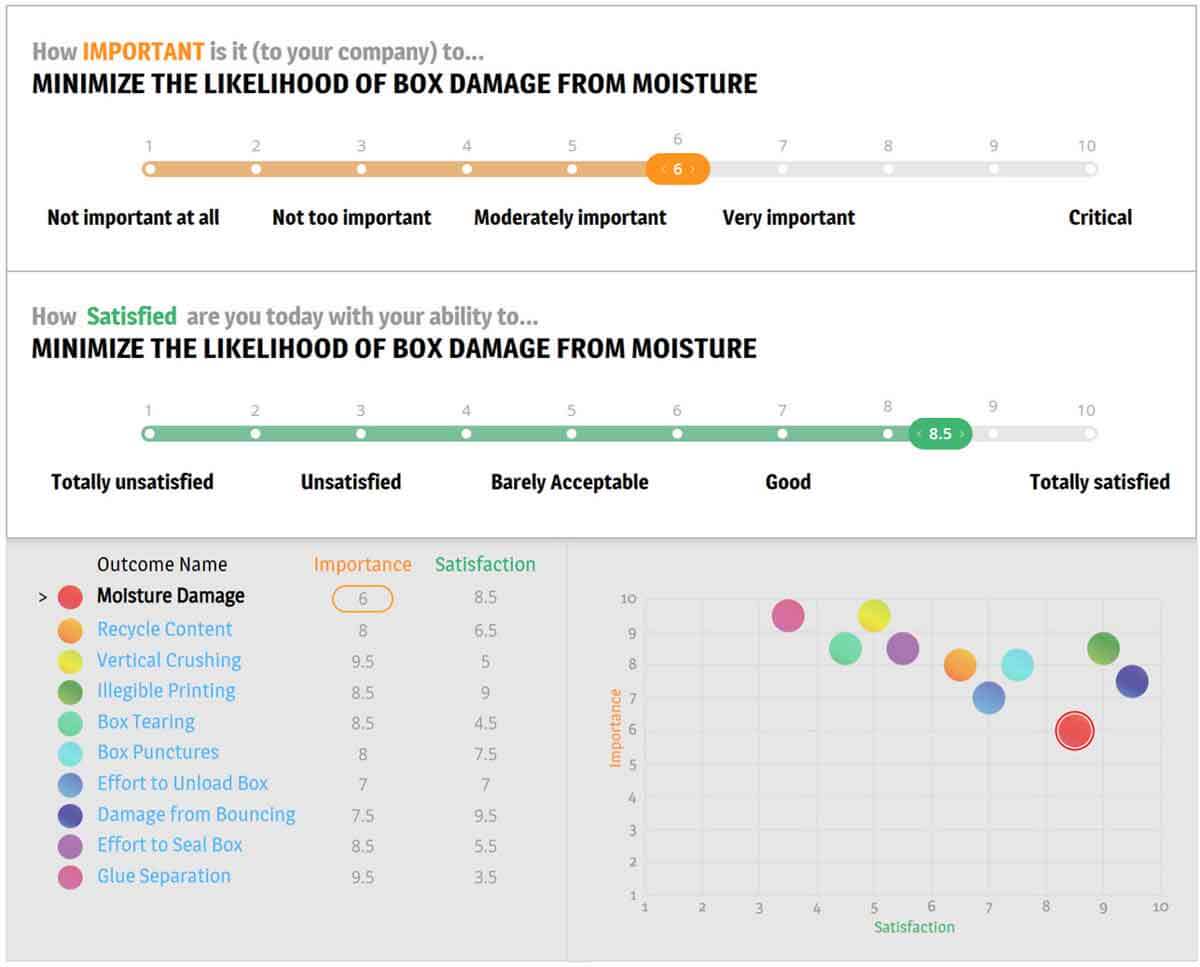

In the realm of B2B new product development, “prioritizing” usually refers to a second round of customer interviews in the target market segment called “Preference” interviews. These are quantitative interviews. Returning to our example of interviewing companies like Amazon, you would ask for 1-to-10 ratings on several outcomes as shown below… for both their importance and current satisfaction.

As with your earlier Discovery interviews, you should display your notes on a screen or during a web-conference. After you’ve interviewed several key customers and prospects in your target market, your next B2B new product development step is to analyze your results.

A Data-Driven Path

You do this by creating a Market Satisfaction Gap profile. Market Satisfaction Gaps—introduced by The AIM Institute in 2005—have helped thousands of teams confidently create product designs. They are calculated based on the market-averaged 1-to-10 importance (IMP) and satisfaction (SAT) ratings gathered in preference interviews:

MSG = Average IMP x (10 – Average SAT)

If the market’s IMP rating is 9 and SAT rating is 6, the Market Satisfaction Gap for this outcome is

9 x (10 – 6) = 36 percent

The market is eager to see improvement in outcomes with Gaps of ~30 percent or more. In the example below for corrugated packaging, the supplier would know good design targets for B2B new product development will include the outcomes between Moisture Damage and Recycle Content.

We published B2B VOC Skills research in 2022 that showed this prioritization of market needs was the single greatest differentiator between successful and unsuccessful B2B new product development. In the chart below, the top, light bars show the responses of those who said they were “rarely” successful in B2B new product development. The bottom, dark bars represent those who were “usually” successful in B2B new product development. As you can see, the ability to prioritize market needs was the greatest differentiator between these two groups of respondents.

This same research revealed that prioritizing customer needs surpassed the other eleven VOC skills in other areas of B2B new product development as well. It was rated as:

- The most important by all respondents.

- The one unskilled respondents were most eager to improve.

- The biggest differentiator in understanding market needs.

- The skill that improved the most with VOC training.

Learning more about B2B New Product Development

If you’re keen to boost your B2B new product development success rate, consider which of these three steps to begin improving:

- Uncover market needs: Consider attending a 4-hour public Everyday VOC workshop to see how these skills can be easily learned and applied.

- Understand and Prioritize market needs: Both steps are included in New Product Blueprinting training. You can check out this 5 minute video (www.VOCforB2B.com) or attend a public Blueprinting workshop to learn more.

The good news is there’s likely a great deal of upside for you to capture in your B2B new product development!

Comments