How critical is speed to new product innovation? Imagine a project that leads to new product sales of $5 million per year, with average profit margins. What’s the net present value of launching this product just one month earlier? $80,000! That’s $4000 per business day. Think we could use a little more urgency for new ... Read More

Blog Category: Innovation

What’s Your B2B Company’s Innovation Maturity Level?

There are 4 Innovation Maturity Levels: 1) Solution push, 2) Solution validation, 3) Market insight, and 4) Market scouting. Learn how to dramatically boost your B2B innovation just by reaching Level 3. ... Read More

Three B2B product launch problems to avoid.

We see three common shortcomings with B2B product launches: 1) Low-quality front-end work: Suppliers develop the wrong product, so even the best launch is just putting lipstick on a pig. 2) Poor linkage between stages: The launch is not driven by what was learned in the front end. 2) Out-dated promotional tools: This includes poor selection of the many traditional and digital tools available today. It helps to follow these 4 steps: The Right Product delivered to the Right Market using the Right Message through the Right Media.

More in 2-minute video, Launch new products with power

Four ways to accelerate your innovation.

Is your business looking for ways to accelerate its new product development? Here are four ways to do this: 1) Set clear design targets in the front-end. When the team knows what the customers wants early-on, it eliminates second-guessing, dead-end detours and hesitation. 2) Concentrate resources on fewer projects, staff them for speed, and kill any dead-end projects quickly. 3) Focus on “time-to-money” (not just “time to market”). If you engage customers throughout development, they’ll anticipate your new product and begin evaluating it sooner. 4) Eliminate “organizational friction”… travel bans, spending freezes, hiring delays, re-orgs, new initiatives, and so on.

More in 2-minute video, Pursue fast innovation

It’s Time for New Innovation Metrics

You’ve heard, “measure twice, cut once,” right? When it comes to market-facing innovation, most companies only measure after they’ve cut. They use the vitality index—a fine innovation metric developed by 3M in 1988 that’s simple to understand: percentage of gross revenue generated from products launched in the past three (or five) years. But if this ... Read More

Here are 4 rules for better innovation metrics.

The Vitality Index (% of sales from new products) is helpful, but it suffers from being a lagging indicator. So how would you supplement it? Any new innovation metric you adopt should satisfy 4 rules: 1) Leading: “If we do more of this it will lead to growth.” 2) Actionable: “Our employees can make this happen.” 3) Benchmarkable: “We can compare to others and year-to-year.” 4) Impactful: “Improvement will significantly drive growth.

Here are two new innovation metrics that satisfy all four rules: Growth Driver Index (GDI) and Commercial Confidence Index (CCI). These measure your growth capabilities and evidence-based customer insight, respectively. (See white paper, New Innovation Metrics.)

More in 2-minute video, Employ new growth metrics

What should your first step be when developing a new product?

If you want to develop a great new product, your first step should be to target a single market segment and job-to-be-done (JTBD) within that segment. A market segment is a “cluster of customers with similar needs.” If you develop one product for multiple market segments, your new product won’t satisfy any customers to the fullest extent. By definition, different market segments have different needs, right?

If your company makes colorants, your target market segment might by paint producers. But your project scope is still too broad: You need to target a specific job to be done by those paint producers. Their job might be, “production and sale of semi-gloss paint.” This is explained further in the article, Quantitative questions for interviews

More in 2-minute video, Begin with customers’ job to be done

Let’s stop the shell games at project reviews.

My golden rule of investment is, “Make your decision when you’ve gathered the most facts and spent the least money.” If you do it right, this point in time is the gate just before the costly development stage. Most companies are far too casual here, letting each team build and present its own unique PowerPoint slides. Human nature says teams will use these slides to talk about their project’s strong points, avoiding weak areas.

So management tries to guess what’s missing: “What about the competition? Are there more technical risks? Is the problem this? Is it something else?” This shell game is waste of time, money and self-respect. Better to have a standard business case everyone works from. Here’s a sample of an abbreviated business case called a Market Case: www.marketcasesample.com

More in 2-minute video, Build a front-end business case

6 Maturity Levels for B2B Market-Facing Innovation

What’s the key to accelerating your B2B business’s organic growth? The research is clear: Superior customer insight drives stronger new product value propositions… which in turn boosts organic growth. Now you can use this new Innovation Maturity Level chart to assess your current level… and plan your ascent all the way to Level 6. The ... Read More

Should you develop new products like Steve Jobs?

People sometimes ask, “Can’t I develop breakthrough products without talking to customers… like Steve Jobs did?” But they are missing some key distinctions between themselves and Steve Jobs… especially if they are B2B producers. ... Read More

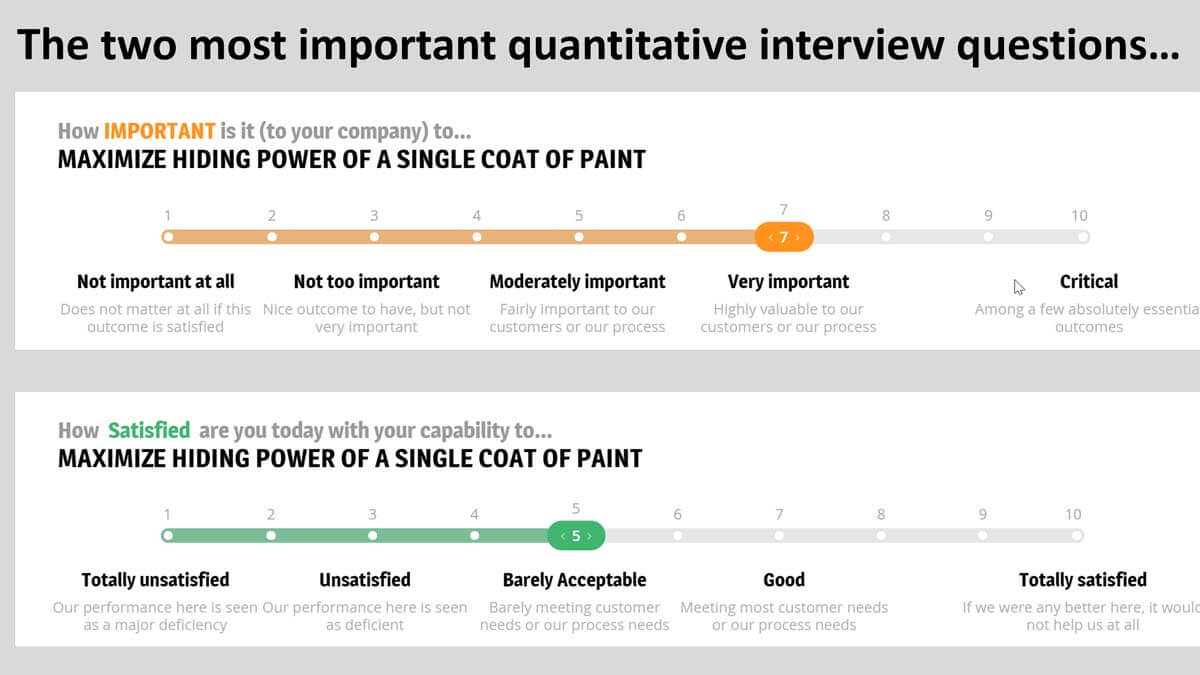

What’s the #1 mistake B2B companies make when developing new products?

I think the biggest mistake is failing to use quantitative customer interviews. Why use quantitative questions for interviews, not just qualitative? Two reasons. First, qualitative interviews give you reams of customer quotes with no good way to prioritize customer needs. Sure, you could count the number of times customers cite a need, but frequency of remarks is a poor substitute for customer eagerness to improve.

More important, with only qualitative interviews you’ll succumb to confirmation bias… the tendency to hear and interpret information according to your preconceived notions. With quantitative questions for interviews, you’ll have hard data on customer needs that your team hasn’t filtered or skewed. You get 100% unadulterated insight straight from the customer.

More in 2-minute video, Quantitative interviews are a must

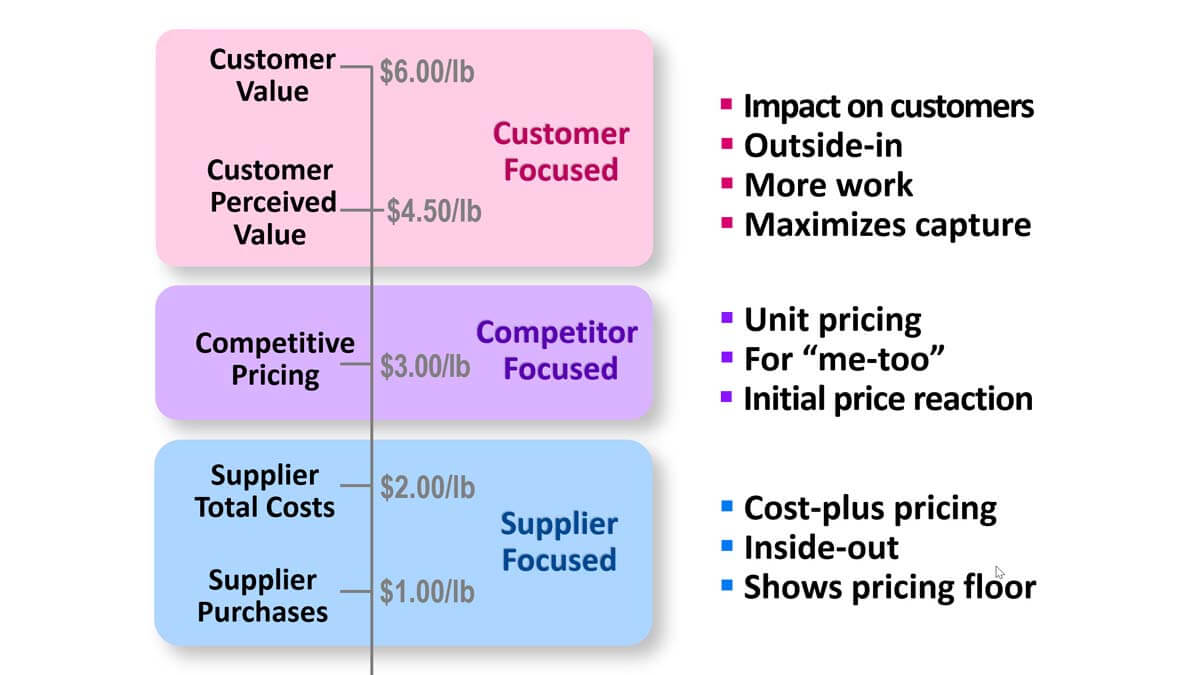

Is your pricing supplier-focused, competitor-focused, or customer-focused?

Your pricing could be supplier-focused, competitor-focused, or customer-focused. 1) Supplier-focused pricing is cost-plus pricing. It’s inside-out, leaves money on the table and only indicates your pricing floor. 2) Competitor-focused emphasizes unit pricing, and is only useful for me-too products and gauging initial price reaction. 3) Customer-focused pricing reflects the economic impact on customers. It’s outside-in and does require more work for you. But if you want to maximize value capture, it’s the only way.

More in 2-minute video, Use value calculators to establish pricing

Have you separated your “farm animals” from your “jungle animals”?

If you ran a zoo, you’d keep your jungle animals and farm animals in separate enclosures, right? Your technology development projects are untamed, jungle animals: You don’t completely understand them, and you’re not sure what they’ll do or where they’ll go next. Your product development projects are predictable farm animals. You know what they’re supposed to do, and who they’re supposed to do it for.

When you commercialize technology, you are “domesticating” wild animals for productive purposes. As a first step, you must be crystal clear which type of project your scientists or engineers are working on at any point in time. Remember, technology development turns money into knowledge; product development turns knowledge back into money. You can learn more from this white paper, Commercialize technology in 6 foolproof steps.

More in this 2-minute video, How to pursue transformational projects

Want to engage B2B customers? Here are 10 ways.

If you sell into a concentrated B2B market (one with just a few customers), your voice-of-customer interviews should have two goals: “insight” plus “engagement.” The latter is important: You want these big customers to be impressed and eager to work with you, not your competitors.

These 10 approaches help you engage your customers when interviewing them to understand their needs: 1) Kill the questionnaire. 2) Let customers lead the interview. 3) Discuss their job-to-be-done. 4) Project your notes so they can see them. 5) Focus on customer outcomes. 6) Learn how to probe deeply. 7) Don’t sell or solve. 8) Get quantitative in your VOC. 9) Use triggers to generate fresh ideas. 10) Use B2B-optimized interview tools. (See the 2-minute video, Engage your B2B customers.)

These are explained in the article, The Missing Objective in Voice of Customer Interviews