I believe the first duty of any business leader is this: “Leave your business stronger than you found it.” I’m unimpressed by leaders who prioritize short-term results and stock prices to the point of degrading growth capabilities and sacrificing the future. I’m mystified when companies enrich a business leader today who is working to impoverish the business tomorrow.

What your business really needs is a builder… someone who brushes aside financial gymnastics and business fads. Someone focused on created value for customers that delivers organic growth for their business. For more, see the 2-minute video, Be a business builder. Also consider a new metric, the Growth Driver Index, which measures how well a business leader is investing in long-term growth capabilities.

See white paper, New Innovation Metrics.

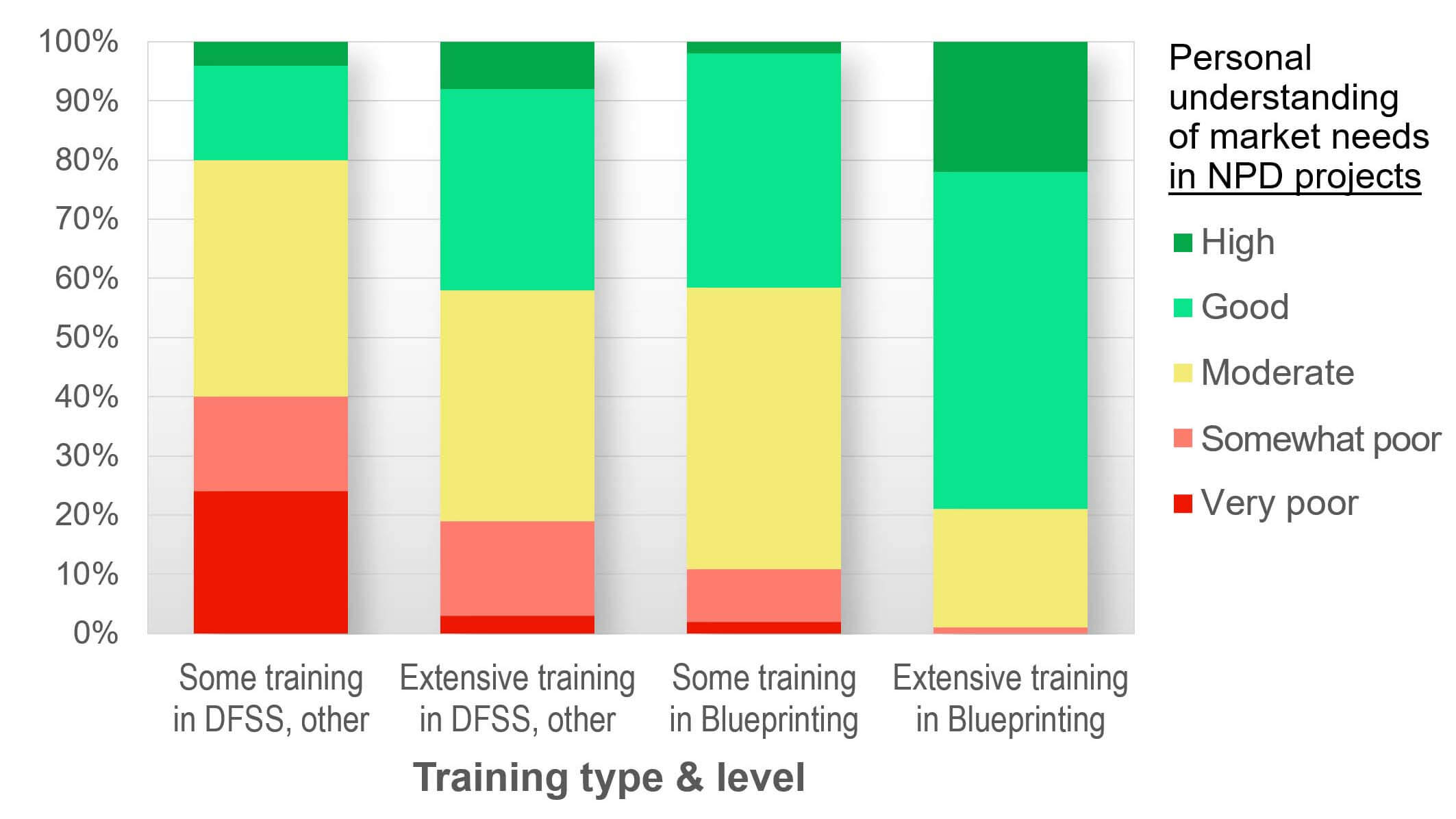

We studied this question in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. We grouped respondents into 4 groups depending on their type of training (New Product Blueprinting or Other) and level of training (Extensive or Some).

Respondents also reported their typical new product success rates: Only 20% of those with “Some” training in “Other” methods had new product success rates over 50% (green in chart). But 80% of those with “Extensive” New Product Blueprinting training were “in the green.” Just think: Instead of one-in-five employees having successful new product track records, you could move to four-in-five with such training.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

Many B2B companies use prototypes to understand customer needs. But more advanced companies use customer-needs modeling. That is, they learn enough in front-end-innovation customer interviews to predict customer needs with great accuracy.

This yields 3 advantages: 1) Its cheaper and faster to perform “what if” mental experiments in the front-end of innovation than to create physical prototypes later. 2) This modeling lets you understand customers’ next best alternatives… to better price and promote your new product. 3) Your B2B customers will be more engaged when you seek their early advice vs. lobbing your prototypes at them. You can see how this works in this 2-minute video: Benchmark competing alternatives.

More in article, Predict the customer’s experience with modeling.

Should you do in-person customer interviews… or use a web-conference? Consider these factors: 1) team interviewing experience, 2) level of existing customer relationship, 3) need for a tour, 4) qualitative vs. quantitative interview type, 5) scheduling difficulties, 6) travel costs, and 7) interviewing progress to-date.

For a full explanation, download our white paper at www.virtualvoc.com. Most likely, you’ll see that virtual voice-of-customer interviews can play a larger role in your customer insight work.

See 2-minute video, Conduct virtual customer interviews.

Lagging indicators can be useful, so long as too much time doesn’t pass between your correcting action and the result you want to measure. In this regard, the Vitality index–% of revenue from new products—fails miserably. Improvements you make in the front end of innovation could take years to register a significant impact on revenue.

Don’t discard your Vitality Index, but do supplement it with new metrics, such as the Growth Driver Index (GDI) and Commercial Confidence Index (CDI). Otherwise your new product “furnace” will stay cold far too long. This 2-minute video explains further: Employ new growth metrics.

More in white paper, New Innovation Metrics

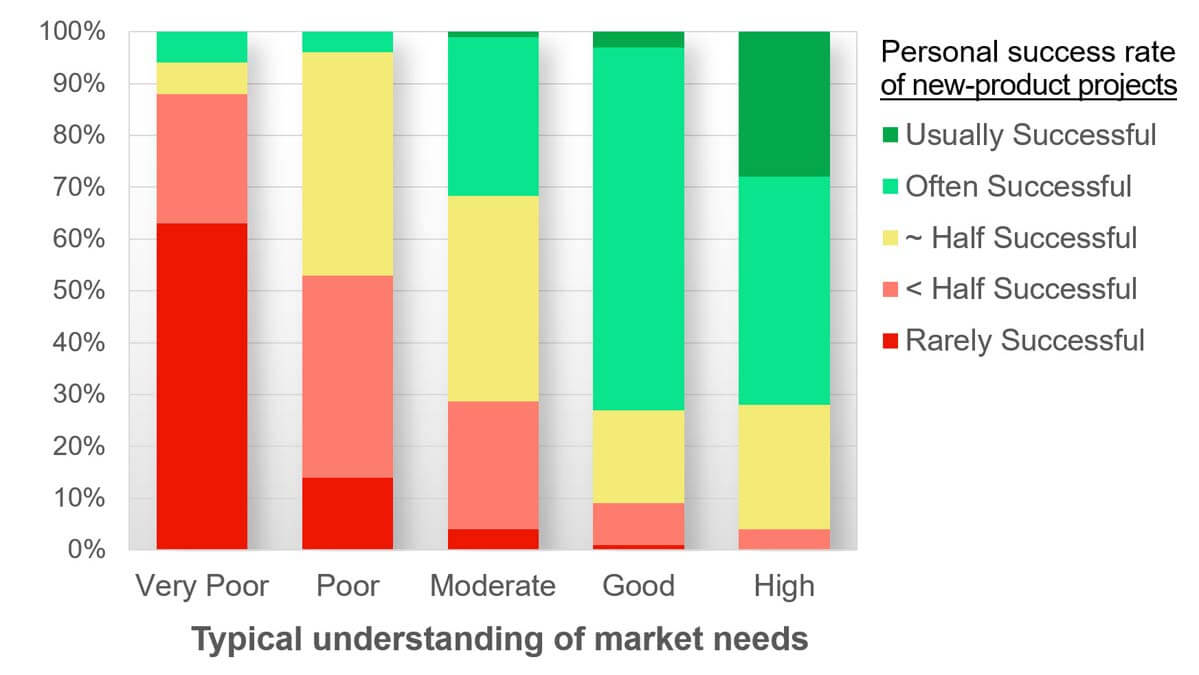

This was a question we studied in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. Some respondents reported a “poor” understanding of market needs while other reported a “good” understanding.

We were surprised at the difference in the two groups’ typical new product success rates: Only 5% of the former group (with poor market understanding) reported their new products were successful over half the time. But 70% of the “good market understanders” reported better than average new product success rates. So instead of hiring more R&D, your shortest path to successful new products might be to understand market needs better.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

If your R&D looks like a black box to management, you’ve probably noticed that their patience can run out rather quickly. But when you de-risk projects transparently with management, they are much more tolerant of unavoidable delays and setbacks.

You do this in three steps: 1) Generate assumptions… possible landmines that could “blow up” your project. 2) Rate assumptions… for likely impact and certainty. 3) Investigate assumptions… especially high-impact, low-certainty assumptions. This 2-minute video explains the process: How to pursue transformational projects.

More in article, How to de-risk projects and overcome management doubt.

The Vitality Index—% of revenue from new products—is a fine metric. But it is 1) not predictive… it’s a lagging indicator only revealing what’s already happened, 2) not prescriptive… it doesn’t say how to improve, and 3) not precise… often ill-defined and easily manipulated. Keep it, but supplement it with two new metrics, the Growth Driver Index and Commercial Confidence Index. These measure your progress on building growth capabilities and customer insight, respectively. Check out this 2-minute video to see how easy these metrics are to implement, Employ new growth metrics.)

More in white paper, New Innovation Metrics.

We researched this question with a survey of 300+ B2B professionals, examining these VOC skills: 1) Secure interviews, 2) Proper interviews, 3) Impress customers, 4) Uncover all needs, 5) Probe for meaning, 6) Probe for value, 7) Quantitative VOC, 8) Virtual VOC, 9) VOC debriefing, 10) Prioritize needs, 11) Segment market, and 12) Business case.

Can you guess which skill most differentiated the winners and losers in terms of new product development success? It was #10, Prioritize customer needs. The #2 skill wasn’t even close. So if you’re not conducting quantitative interviews to prioritize customer needs with confidence, you’ve got some serious “upside” to pursue. See 2-minute video, Quantitative interviews are a must.

More in white paper, Market Satisfaction Gaps.

The “fast follower” strategy seldom works, for a variety of reasons. One is that it’s often just an excuse for the lack of innovation, and isn’t supported by needed fast-follower capabilities. Next time a business leader touts this “strategy,” ask if they’ve invested heavily in a) early-warning competitive intelligence, b) robust patent minefield-avoidance competencies, and c) ultra-fast scale-up capabilities.

Unless they say “yes,” their fast-follower claim was just an excuse for avoiding Job #1: Understand and meet customer needs better than others. When you excel at Job #1, you’ll grow faster, more profitably, and more consistently than those shuffling along behind you trying to catch up.

More in article, Chasing the Fast Follower Myth

Want a product development strategy that ensures your new products will consistently beat competitors’? Follow these three steps. The good news is your competitors are probably ignoring—or doing a sloppy job—of the first two. Better yet, we’ll present evidence these steps make a difference. We’ll close with several examples. You can think of product development ... Read More

Extruder Die: This “output” represents your financial results. Fast-moving, high-quality output is like top-line growth and profitability. Feed Hopper: These are market-facing innovation projects supported by customer insight. Drive Screw: This is the work needed to transform the feed into high-value products, done by skilled, focused people.

The only way to get better extruder die output is to focus on the feed hopper input and drive screw horsepower. Watching the extruder die is just a spectator sport. Which is precisely what you’re engaged in during financial reviews. Wouldn’t you rather be in a participant sport? Then go to your feed hopper, and work on new products customers will love. See 2-minute video, Extend your time horizon.

More in article, B2B Organic Growth: 8 top lessons for leaders.

In my experience, VOO is much more common than VOC among B2B companies today. This will surely change, given the huge advantages of B2B-optimized VOC. (See e-book, Reinventing VOC for B2B.) You can learn your position on the VOO-vs.-VOC spectrum by diagnosing 10 factors: 1) interview scope, 2) interview objective, 3) types of questions, 4) note-taking, 5) interview skills, 6) observation skills, 7) companies interviewed, 8) deliverables, 9) engagement timeframe, and 10) interviewing staff.

For descriptions of all 10, see article, Why Advanced Voice of Customer Matters

I suspect you’d rather look at a map first, and then start your journey. So why do many B2B companies develop a new product and then show it to customers? With intelligent B2B voice-of-customer interviews (see e-book, Reinventing VOC for B2B), your customers are drawing a map for you: “Yes, go here and work on this outcome. No, that outcome isn’t important so don’t bother.” Granted, it’s more “daring” to ignore a map. But if you want to get to the right destination as quickly and efficiently as possible, it’s better to talk to your cartographers first.

See 2-minute video, Stop leading with your solutions