Target Customer Needs and Win

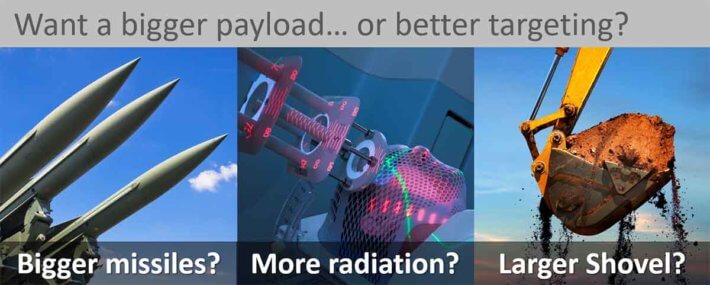

How critical is it to target customer needs? Imagine three situations where you might face the question of a bigger payload vs. a better targeting system: missiles, cancer treatment and gold mining. A bigger payload would be a larger warhead, radiation dosage and backhoe shovel. Better targeting would be more precise hits on enemy positions, cancer tumors and ore deposits.

A larger payload with poor targeting causes three problems… cost, waste and collateral damage:

- Bigger missiles cost more, much of the payload will do no good, and nearby civilians could be killed.

- More radiation requires more expensive equipment, much of the dosage is wasted, and healthy cells are damaged.

- A larger shovel requires a more expensive backhoe, wasted dirt transport, and unnecessary environmental damage.

Is it any different for an R&D department that fails to properly target customer needs? Not really. You need to support a larger, more expensive R&D staff, much of their valuable time is wasted, customers get tired of your feeble innovation attempts, and your R&D staff becomes demoralized. Cost, waste and collateral damage.

Simply increasing your payload leads to three problems… cost, waste and collateral damage.

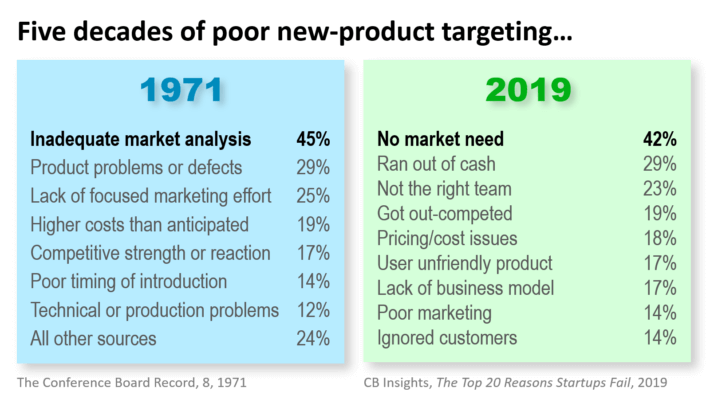

How big a problem is targeting customer needs?

If you like well-defined, long-lasting problems, you’ll love this: Failing to target customer needs well has been the major cause of new product failures for about 5 decades. In 1971, the leading cause of new product failures was found to be “inadequate market analysis.” In 2019, the leading cause of failures among startups was “no market need.”

OK, we don’t target customer needs well, but maybe a bigger R&D budget will fix this? Booz & Co. explored this question extensively. Their conclusion was, “spending more on R&D won’t drive results.” (The Global Innovation 1000: Why Culture Is Key, Winter 2011) Their multi-year research also pointed to excellent financial results when companies properly target customer needs.

How should you target customer needs?

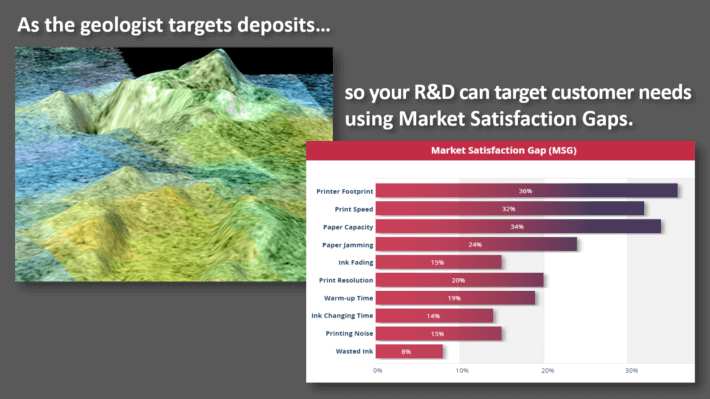

Your R&D targeting system should look like any other good targeting system. For a missile attack, you’d 1) survey all possible enemy positions, and then 2) isolate the high-value targets. A geologist might 1) use satellite imagery to search for all possible mineral deposits, and then 2) assay the most promising locations.

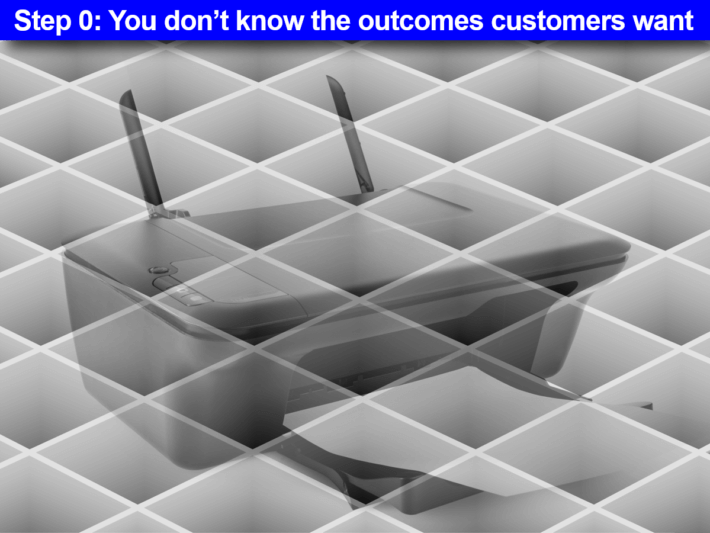

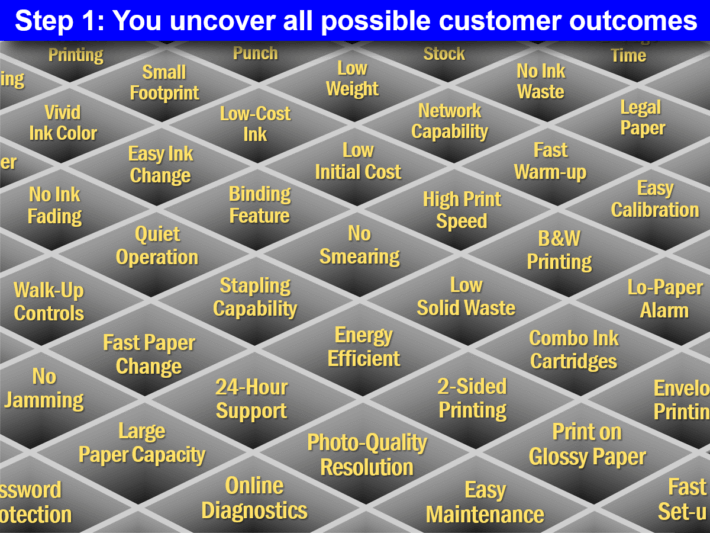

In the same way, “Step 1” for targeting customer needs should be a divergent process (explore all the possibilities) and “Step 2” a convergent one (focus on the most attractive). Imagine you want to develop a new office printer. We’ll use three “customer outcome grid” illustrations to help you visualize the best way to target customer needs.

Your Step 0 is rather depressing. If you try to plot all known customer outcomes (their needs or desired end-results) this grid would be empty at first. Sure, you might target customer needs you hope or think they have. But until you have the right types of conversations with enough of the right customers, you just have guesswork, not an effective targeting system.

In Step 1, you conduct qualitative, divergent customer interviews. Your goal is to uncover all possible customer outcomes in your target market. If that sounds difficult, keep in mind that you don’t do this in a single interview. Rather you interview different job functions at different companies, often at different points in the value chain. You’ll typically uncover many dozens of outcomes.

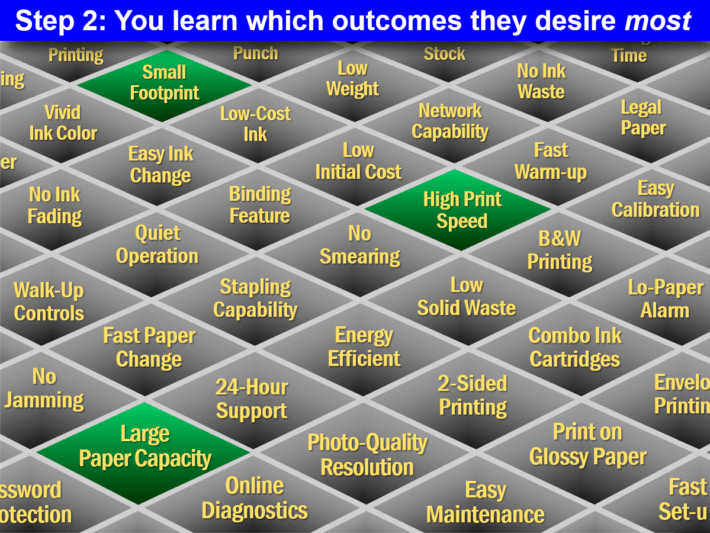

In Step 2, you learn which of these outcomes are worth pursuing… in this case, small footprint, high print speed and large paper capacity. How? You ask customers to rate outcomes for “importance” and “current satisfaction,” each on a 1-to-10 scale.

You want to target customer needs that score high in importance and low in current satisfaction. After all, they’ll only pay a premium for something important they don’t get today.

They’ll only pay a premium for something important they don’t get today.

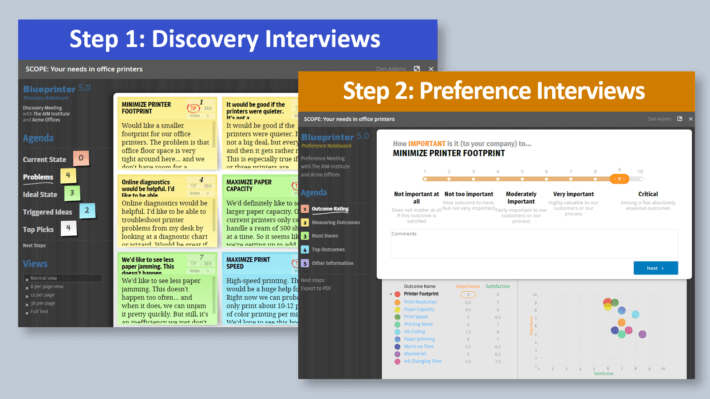

Is it difficult to target customer needs with these interviews? Not at all: We’ve been teaching clients how to interview since 2005. We call the first interview a “Discovery” interview, and the second a “Preference” interview. You can interview using any tools you’d like, but we found it helpful to create Blueprinter software that can be displayed for

the customers to see (see illustration).

The Discovery interview employs “sticky notes,” and the meeting takes on the tone of a brainstorming session (with outcomes instead of solutions). What’s important is that the customers—not you—generate the ideas you type into these sticky notes. In the second round of interviews (Preference) customers tell you how far to move the 1-to-10 slider scale for each outcome’s importance and current satisfaction. Both interviews are highly visual in nature… and very easy to conduct via web-conference.

Once you complete these interviews, you still need to map out your targets. You won’t use satellite images or mineral assays: You’ll target customer needs using Market Satisfaction Gaps. The more important and less satisfied an outcome, the higher the Market Satisfaction Gap. (For details, see white paper, Market Satisfaction Gaps).

You want to pursue only those customer outcomes with Market Satisfaction Gaps over 30%. This is how you target customer needs with confidence. For over a dozen case stories with Market Satisfaction Gap charts, see www.aimcasestories.com.

With Market Satisfaction Gaps, you target customer needs with confidence.

When do we target customer needs?

Your R&D staff is probably conducting three types of work right now. You only need to target customer needs for the second type:

- Technology Development: Technology development is different than product development. The former turns money into knowledge and the latter turns knowledge back into money. With technology development, you’re building capabilities that could be applied to multiple markets. Since you are not yet focused on any single market segment, it would be premature to target customer needs for technology development.

- Product Development: Now you are pursuing a target market segment—a cluster of customers with similar needs. This is where you need to do a better job than competitors in targeting customer needs. Don’t do any lab-work on the new product until you’ve completed your targeting work. Why? This would be like firing test missiles into enemy territory before you know their positions. (Of course, it’s fine to do lab-work in the technology development phase… before you’ve targeted a specific market segment.)

- Process Development: When your R&D is working on process development, it’s often to optimize the process for a product you’re already selling into the market. Or if it’s for a new product, you’ve hopefully already established firm specifications for the product. So it’s really too late to target customer needs during process development.

Bottom line: Look at your R&D efforts and carefully delineate the work between technology development, product development, and process development. It’s too early to target customer needs for technology development and too late for process development. But it’s exactly the right time to target customer needs for product development.

It’s too early to target customer needs for technology development and too late for process development.

What happens when we target customer needs well?

If you are a B2B supplier, I have good news: When you target customer needs well, you eliminate most commercial risk. This puts you at an enormous competitive advantage, because most companies don’t resolve commercial risk until they launch their new product. You know this is true if you’ve ever heard this conversation:

Q: “How’s your new product project going?

A: “Guess we’ll find out next month when we launch it.”

When you innovate for a B2B market, nearly everything needed to eliminate commercial risk is “knowable” in the front end of innovation, before you step into the lab. That’s because your B2B customers have high knowledge, objectivity, interest and foresight. (See www.b2bmarketview.com to generate a B2B Index and determine “how B2B” your market is.)

Start improving how you target customer needs…

Within a few months, you can dramatically improve the way you target customer needs: It’s simply not that hard. Here are some steps you can take to get started:

- Check out this short video to see how Discovery and Preference interviews are done.

- Download this e-book, Reinventing VOC for B2B, which is loaded with tips for B2B-optimized VOC.

- Join us at one of our open New Product Blueprinting workshops. Details are at blueprintingworkshop.com

- Contact us at this link for a consultation.

Keep your existing payload—your R&D resources—but develop a superior targeting system. There’s simply no better way to get much more out of your R&D investment.

Comments