The Front End of Innovation: How much is “too much”?

Our research asked B2B professionals what drives profitable, sustainable organic growth. The #1 answer was delivering strong, differentiated value propositions. And the #1 differentiator between the best and worst value-creating companies was superior front end of innovation work (www.whatdrivesb2borganicgrowth.com).

The Front End of Innovation – Key Steps

There are important front-end steps top-performing companies take to strengthen their value propositions. Consider seven steps using this lens: If you omit this step, how is your value proposition weakened? Do you have the tools to execute step well? As you might expect, not all steps are created equal. Some have a much higher impact on your value proposition than others.

If you omit this step, how is your value proposition weakened?

1. Market Segmentation

In this step, you target an attractive market segment… a cluster of customers with similar needs. Sometimes these segments are already well-known. In other cases, you must first conduct secondary market research.

What you miss: Skipping this exposes you to two risks. First, you’ll hear a hodgepodge of needs if customers are not in a well-defined common cluster… making it impossible to design a product satisfying all. Second, you’ll squander R&D resources if you don’t focus on the best market segment. One that is winnable and worth winning.

Advice: Our research shows top value-creators excel at market concentration… selecting an attractive market segment and disproportionately focusing their resources on it. You need to do this step and do it well.

2. Discovery Interviews

These are qualitative interviews that the customer—not you—leads. Ask for their desired outcomes, probe, and then ask, “What else?” Do not try to validate your solution or employ a boring questionnaire. The best interviewers project their notes, use special probing methods, and employ techniques to trigger fresh customer thinking.

What you miss: Without these divergent interviews, you can expect errors of omission… failing to uncover unarticulated customer needs. Are teams faulted for these errors? No, because no one realizes something was omitted. Another problem is the failure to engage. You miss the chance to impress customers as a supplier that listens to and meets their needs. Never forget that customer needs are the inputs to the front end of innovation.

Click here to learn more about training in New Product Blueprinting

Advice: Our research shows B2B customer interviews are in the top 3 (of 24) differentiators between the best and worst value-creators. These interviews let you discover what competitors have overlooked, perhaps leading to a game-changing new product. You’ll also enjoy near-term sales opportunities because customers want to work with a supplier interested in them.

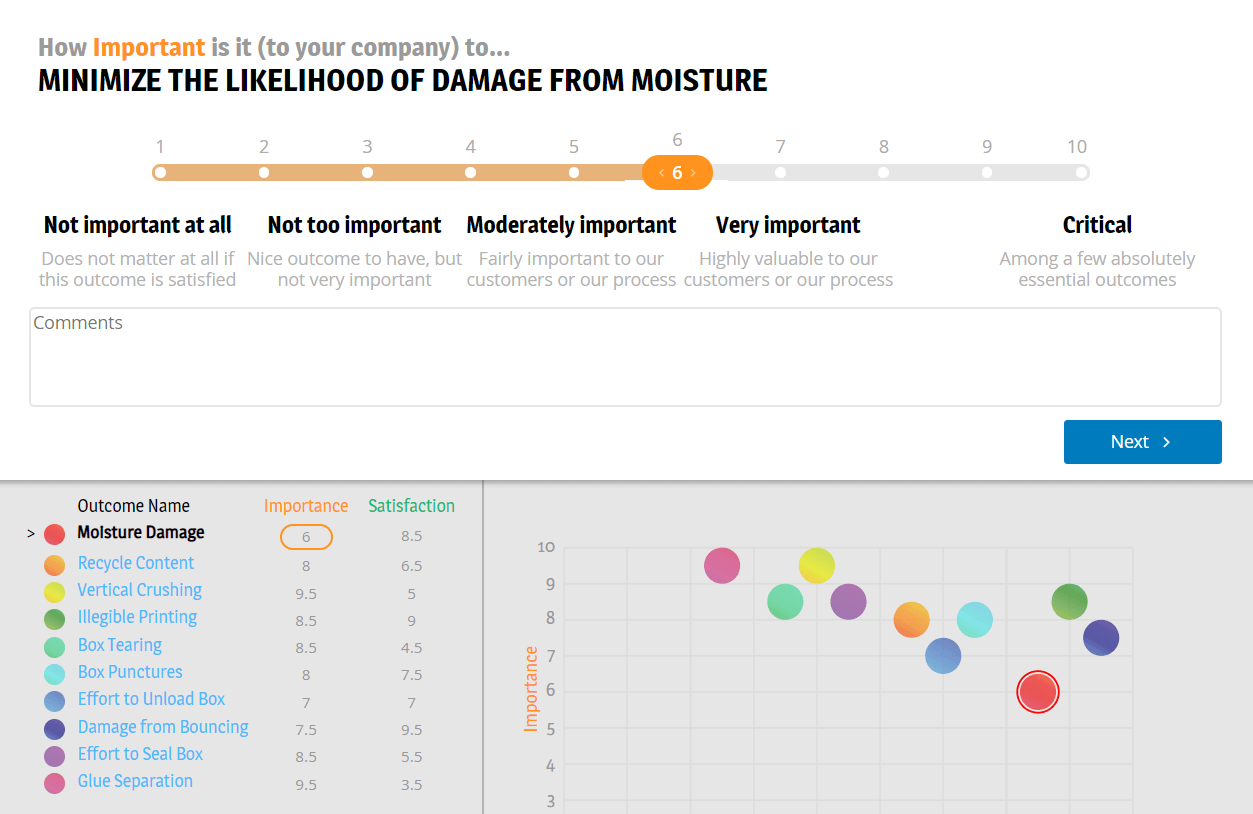

3. Preference Interviews

During these quantitative interviews you ask customers to rate the importance and current satisfaction of several outcomes. Also ask them how they would test for each outcome… and how good is “good enough” for each outcome test.

What you miss: Without these convergent interviews, you’re essentially “guessing” what customers want. I know this sounds harsh, but you cannot trust qualitative data alone. Customers may tell you what you want to hear, and you’ll surely hear what you want to hear. This is called “confirmation bias,” and the only antidote is asking customers to think hard in a structured manner and give you quantitative data in an unfiltered fashion.

Advice: Want one step that puts your front end of innovation success rate head-and-shoulders above competitors? This is it. Don’t do any substantial product development work without this quantitative data. Then your R&D will be laser-focused on only those product designs customers want.

Want one step that puts your innovation success rate head-and-

shoulders above competitors?

4. Side-by-side Testing for the Front End of Innovation

Here you benchmark competitive products—and perhaps your current products—using the test methods you gleaned from Preference interviews.

What you miss: Expect two problems if you omit front end of innovation step. First your new product prototypes can “miss the mark” because your test methods measured success differently than customers. Second you won’t set an optimized new product price… which is driven by the value you deliver beyond customers’ next-best alternative. You need to quantitatively measure alternatives using the same outcomes and test methods customers employ.

Advice: The first three steps are the most important for any project. For larger, high-impact projects, add this step to optimize both your product design and pricing.

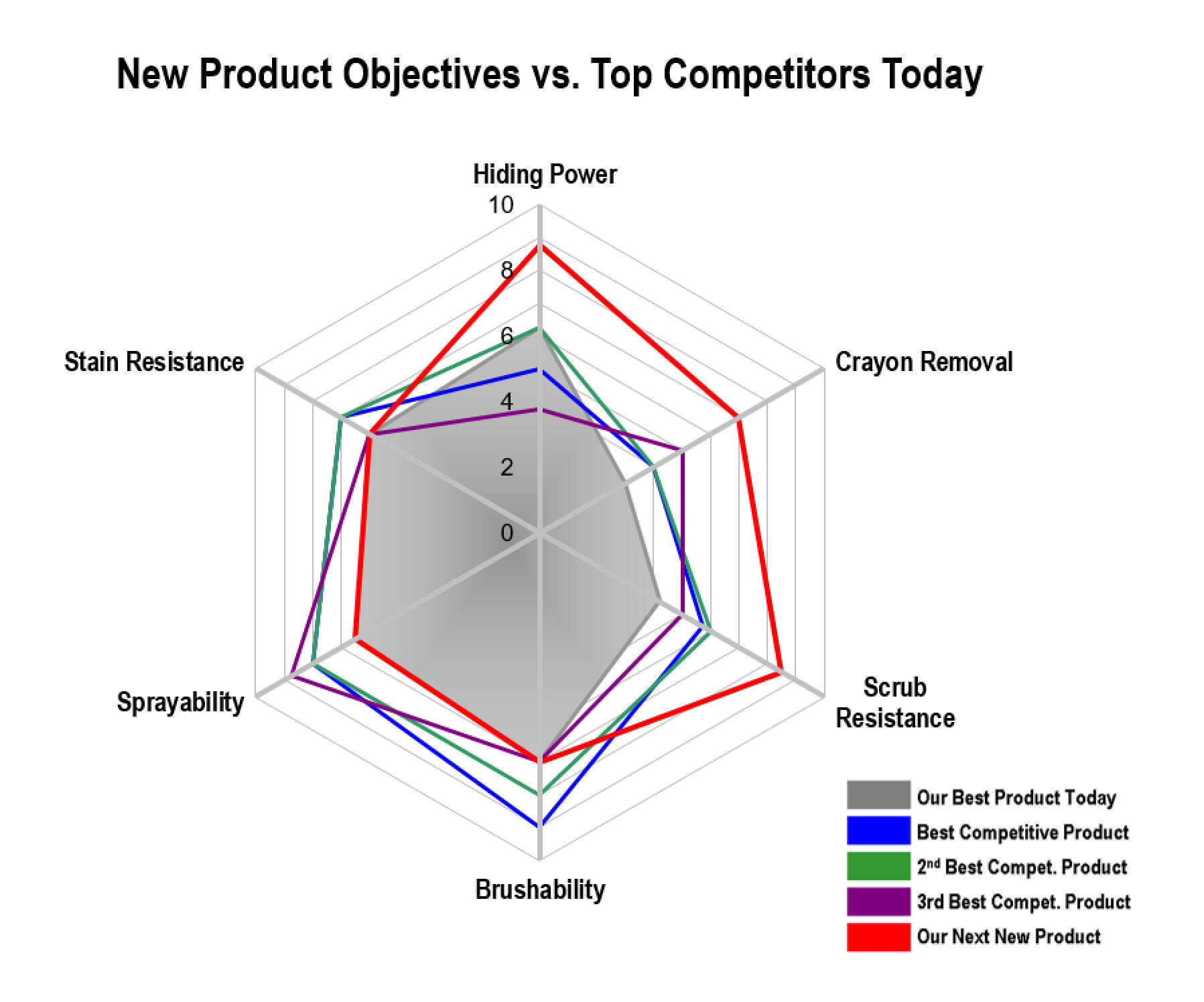

5. Product Objectives

The front end of innovation should be driven with data. When done with rigor, you set specific product design targets a) for the outcomes customers care most about, b) using their test methods, c) bounded by their points of “barely acceptable” and “totally satisfied,” and d) plotted against the best competitive products.

What you miss: Skip this and you’ll enter the development stage without crystal-clear design targets… leading to inefficiencies in this high “burn rate” stage. You’ll also omit trade-off analysis, a powerful part of this step (beyond the scope of this article).

Advice: You’ll certainly set some product objectives in the front-end, so this is a matter of degree. Your rigor should increase with rising project complexity, R&D costs, and market impact.

6. Technical Brainstorming

Until now, your team has focused on customer outcomes. Now you conduct technical brainstorming sessions for possible solutions, one session for each customer outcome you wish to improve.

What you miss: When you present a business case to management, you want to impress them with your understanding of market needs. But if they ask how you’ll address those needs, you shouldn’t say, “We don’t have a clue.” Some technical brainstorming lets you explain the technical paths you’ll take in the development stage.

Advice: This front end of innovation step is not mission-critical. But it does allow for more productive gate-reviews and a faster start in the development stage.

7. Business Case

This is sometimes called the “money gate” in within the front end of innovation. Here you tell management why this project should proceed into the costly development stage.

What you miss: Some companies let projects quietly “drift” into the development stage. If your business isn’t demanding rigor—especially quantitative evidence of customer needs—it’s a good bet your R&D is being wasted developing products customers never wanted.

Advice: In one of our research studies, we found that five of six teams changed their product designs greatly or significantly with proper B2B customer interviews (Guessing at Customer Needs). If only one of six teams is on the right track, maybe your process gate needs a sturdier latch.

Maybe your process gate needs a sturdier latch.

Front End of Innovation: 3 Takeaways for Innovation Success

Let’s close with three takeaways. First, you can give an enormous boost to your front end of innovation success by simply conducting the initial three steps above. We’ve recently introduced a six-point “Market Case” that captures this needed information. Fill out the form below and we’ll send you a free sample.

Second, you’re not running a solo race. We’ve seen many clients use these steps to grow much faster than the markets they serve. This means their competitors will grow slower… and not even realize why. It’s worth asking if your company is poised to win or lose these races.

Third, this always boils down to management commitment. That’s why we’ve recently published the e-book, Leader’s Guide to B2B Organic Growth. I invite you to download this at www.leadersguidetogrowth.com and get it in the right hands. For 2-minute videos on the same 30 lessons, visit www.leadersguidevideos.com.

Someday, you may have to do all seven steps very well to win your races. Today, you need to get started on the most important.

пин ап – pinup 2025

пин ап казино официальный сайт: https://pinupkz.life/

пин ап вход – пин ап зеркало

пин ап казино зеркало – пин ап казино официальный сайт

Generic100mgEasy Buy Viagra online cheap Generic Viagra for sale

пин ап зеркало: https://pinupkz.life/

пин ап зеркало – пин ап казино

пин ап казино официальный сайт – пин ап вход

https://kamagrakopen.pro/# kamagra pillen kopen

TadalafilEasyBuy.com: TadalafilEasyBuy.com – cialis without a doctor prescription

https://generic100mgeasy.shop/# buy generic 100mg viagra online

Generic 100mg Easy order viagra Generic 100mg Easy

kamagra pillen kopen: kamagra 100mg kopen – Officiele Kamagra van Nederland

https://tadalafileasybuy.shop/# TadalafilEasyBuy.com

Kamagra: kamagra kopen nederland – Officiele Kamagra van Nederland

http://generic100mgeasy.com/# Generic 100mg Easy

https://kamagrakopen.pro/# Kamagra Kopen Online

TadalafilEasyBuy.com: Tadalafil Easy Buy – Tadalafil Easy Buy

Tadalafil Easy Buy: cialis without a doctor prescription – cialis without a doctor prescription

http://tadalafileasybuy.com/# cialis without a doctor prescription

Tadalafil Easy Buy cialis without a doctor prescription Tadalafil Easy Buy

https://kamagrakopen.pro/# Kamagra Kopen Online

Generic100mgEasy: buy viagra here – buy viagra here

https://tadalafileasybuy.shop/# TadalafilEasyBuy.com

kamagra 100mg kopen: kamagra pillen kopen – Kamagra Kopen

http://generic100mgeasy.com/# Generic100mgEasy

kamagra gel kopen: kamagra kopen nederland – kamagra jelly kopen

https://kamagrakopen.pro/# Kamagra Kopen

Kamagra Kopen KamagraKopen.pro kamagra gel kopen

kamagra 100mg kopen: kamagra pillen kopen – Kamagra Kopen

kamagra 100mg kopen: kamagra kopen nederland – kamagra pillen kopen

http://tadalafileasybuy.com/# cialis without a doctor prescription

https://kamagrakopen.pro/# KamagraKopen.pro

Generic100mgEasy: Generic100mgEasy – buy generic 100mg viagra online

TadalafilEasyBuy.com: Generic Tadalafil 20mg price – cialis without a doctor prescription

https://generic100mgeasy.com/# buy generic 100mg viagra online

Generic 100mg Easy buy generic 100mg viagra online Cheap Sildenafil 100mg

https://tadalafileasybuy.shop/# cialis without a doctor prescription

Kamagra Kopen: kamagra jelly kopen – kamagra kopen nederland

kamagra gel kopen: kamagra 100mg kopen – KamagraKopen.pro

http://tadalafileasybuy.com/# Tadalafil Easy Buy

Buy Cialis online: TadalafilEasyBuy.com – Tadalafil Easy Buy

http://generic100mgeasy.com/# Generic 100mg Easy

TadalafilEasyBuy.com Tadalafil Easy Buy Cialis over the counter

Generic100mgEasy: Generic100mgEasy – Generic100mgEasy

https://tadalafileasybuy.shop/# Tadalafil Easy Buy

https://tadalafileasybuy.shop/# cialis without a doctor prescription

Kamagra: kamagra pillen kopen – Kamagra Kopen

Kamagra Kopen: kamagra kopen nederland – Kamagra

https://generic100mgeasy.com/# Generic100mgEasy

https://kamagrakopen.pro/# kamagra pillen kopen

buy generic 100mg viagra online buy generic 100mg viagra online sildenafil over the counter

TadalafilEasyBuy.com: Tadalafil Easy Buy – TadalafilEasyBuy.com

KamagraKopen.pro: Officiele Kamagra van Nederland – kamagra pillen kopen

http://generic100mgeasy.com/# Generic 100mg Easy

https://generic100mgeasy.com/# buy Viagra over the counter

https://indiamedfast.shop/# india pharmacy without prescription

online medicine shopping in india cheapest online pharmacy india IndiaMedFast

canadian pharmacy prices: Pharmacies in Canada that ship to the US – recommended canadian pharmacies

mexican pharmacy online store: Mexican Pharm International – MexicanPharmInter

https://indiamedfast.com/# online medicine shopping in india

canada drugs

https://interpharmonline.shop/# canadian pharmacy antibiotics

https://indiamedfast.shop/# online pharmacy india

safe online pharmacies in canada

reliable mexican pharmacies: MexicanPharmInter – MexicanPharmInter

northwest canadian pharmacy: InterPharmOnline – canadian pharmacy price checker

Mexican Pharm Inter Mexican Pharm International mexican pharmacy online store

https://interpharmonline.com/# ed meds online canada

https://mexicanpharminter.com/# mexican drug stores online

canadian compounding pharmacy

canadianpharmacyworld com: InterPharmOnline.com – safe canadian pharmacies

https://indiamedfast.shop/# order medicines online india

https://indiamedfast.shop/# online medicine shopping in india

safe online pharmacies in canada

online medicine shopping in india: IndiaMedFast.com – lowest prescription prices online india

mexican drug stores online MexicanPharmInter Mexican Pharm Inter

https://indiamedfast.com/# cheapest online pharmacy india

https://interpharmonline.shop/# canadian pharmacies compare

canadian pharmacy

canadapharmacyonline: legitimate canadian pharmacies online – reddit canadian pharmacy

canadian family pharmacy: canadian drugstore online no prescription – safe online pharmacies in canada

http://indiamedfast.com/# India Med Fast

https://interpharmonline.com/# canada drugs reviews

canadian pharmacy scam

cheapest online pharmacy india cheapest online pharmacy india IndiaMedFast

canadian pharmacy meds reviews: fda approved canadian online pharmacies – canadian pharmacy antibiotics

reliable mexican pharmacies: Mexican Pharm Inter – mexican drug stores online

http://mexicanpharminter.com/# mexican pharmacy online store

http://interpharmonline.com/# canadian pharmacy in canada

my canadian pharmacy review

lowest prescription prices online india: order medicines online india – online medicine shopping in india

reliable mexican pharmacies: reliable mexican pharmacies – mexican pharmacy online

lowest prescription prices online india buying prescription drugs from india cheapest online pharmacy india

https://interpharmonline.com/# best mail order pharmacy canada

trusted canadian pharmacy

alo789hk: 789alo – alo 789 dang nh?p