4 Steps to joining the Reliable Growth Club

Here’s the scene: You are a B2B business leader unhappy with your membership in the Shareholder Appeasement Club and its quarterly meetings. You want profitable, reliable growth so you are free to captain your ship, not some Wall Street analysts. But what should you do—not in the abstract—but in concrete, actionable steps?

Before exploring admission to the Reliable Growth Club, let’s talk about leaving the Shareholder Appeasement Club. You don’t have to publicly renounce your SAC membership; you can leave quietly. That’s good, because joining the RGC takes time, and you don’t want extra shareholder pressure while building your growth credentials. Once reliable growth is evident, you’ll attract the right investors. Warren Buffet explained, “Companies obtain the shareholder constituency that they seek and deserve.”

There are three reasons to put quarterly shareholder appeasement behind you. First, it encourages growth-dampening actions, e.g. travel bans, hiring delays, and spending freezes. Second, it distracts from the hard work we’ll cover here. Third, shareholder appeasement will decline, and you don’t want to be left behind. Thought leaders are increasingly calling for change.

Joining the Reliable Growth Club will take focused effort. If membership was easy, everyone would have joined by now. Typical initiatives won’t get you in, e.g., quality improvement, productivity improvement, global expansion, acquisitions, and sales training. (To see why, download What Drives B2B Organic Growth, p. 2)

It’s OK to keep the above initiatives, but—to paraphrase Gandolf—you need one goal to “rule them all.” This is it: Understand and meet customer needs better than others. Only this will provide profitable, reliable growth over the long haul.

Today you should focus more on the “understand customer needs” part of this goal than the “meet customer needs” part. Hiring more or smarter R&D product developers isn’t the best answer. Your low-hanging fruit is improved “understanding,” because most B2B customer insight today is simply awful… compared to what it could be. (See our research in Guessing at Customer Needs.) If you follow these four steps, you’ll enjoy competitive advantage and reliable growth for years or even decades.

Step 1: Build B2B customer insight skills

This step shouldn’t surprise you: What was the first action companies took when implementing six sigma, lean manufacturing, or consultative selling? They trained their people. In our case, new skills will lead to new customer insights… which will lead to exciting new products… which will provide you with reliable growth.

Consider these points:

- Your B2B customers have high knowledge, interest, objectivity, and foresight. They are willing and able to reveal incredible insights to drive your innovation… if you know how to tap this reservoir.

- If you are a large B2B company, your employees have thousands of interactions with these smart B2B customers every year…and are leaving with table scraps of insight instead of the feast that was available to them.

- Extracting voluminous, detailed, and valuable B2B customer insight is no longer a mystery. We know how and some companies are doing it today. (See www.aimcasestories.com)

Your employees are having thousands of customer interactions and leaving with table scraps of insight… instead of the feast available to them.

To the last point: Do we really have B2B customer insight figured out? Check out BlueHelp™, a searchable, reference library full of B2B-optimized customer insight practices. Examples include 3 ways to segment geographic markets, 7 steps to building interview skills, 6 tools for convincing customers to be interviewed, 9 common interviewing beginner’s errors, 5 things to look for during customer tours, 4 practices for interviewing customers’ customers, 12 suggestions for web-conference interviews, 19 tips for interviewing in Asia, 10 listening roadblocks to avoid, 3 questions to quantify customer value, 3 trigger maps to generate fresh customer thinking, 12 tips for gathering customers’ 1-to-10 outcome ratings, 7 strategies for analyzing Market Satisfaction Gap data, and 6 parts of a Market Case. (Blueprinting practitioners can access this at www.blueprintingcenter.com.)

Seem like a lot? The practices shown above represent a tiny slice of B2B customer insight skills available for adoption: It would take you many hours to read the entire BlueHelp library. These skills are practical and dangerous. Practical because each one increases the flow of customer insight into your company. Dangerous because competitors could use them to achieve reliable growth… which will diminish yours.

Check out BlueHelp to see all the B2B customer insights skills that can be learned.

2. Require Market Satisfaction Gaps

Let’s say your company has accomplished Step 1: You’ve got a critical mass of marketing, technical and sales people armed with strong B2B customer insight skills across your geographic regions. That’s good… but it’s not permanent. If the wrong person gets promoted or quarterly financial pressures get too great… poof… shareholder appeasement is in and reliable growth is out.

Fortunately, there’s a simple way to fortify and embed the B2B customer insight you need for reliable growth. You require Market Satisfaction Gap charts before projects leave the front-end of innovation and enter the product development stage. To learn more about these charts, download the white paper, Market Satisfaction Gaps.

Here’s a quick description: Your teams each conduct a round of qualitative Discovery interviews to gather all customer needs… and then a round of quantitative Preference interviews. In the latter they ask customers to rate importance (IMP) and current satisfaction (SAT) for key needs on a 1-to-10 scale. Needs that are important and unsatisfied score high Market Satisfaction Gaps: MSG = IMP x (10 – SAT). Your R&D only pursues needs with high Gaps (~30% or more).

This is so simple and yet so powerful: Your R&D stops working on needs they think or hope customers have… and only pursue needs they know customers have. This wipes out most commercial risk, leaving your R&D to focus on what you pay them to do: tackle technical risk.

Seem a little too obvious? Wonder if future innovators will laugh at us for not doing this sooner? Here’s why this is slow to catch on: The financial analysts running the Shareholder Appeasement Club couldn’t create customer value to drive reliable growth if their bonuses depended on it. Companies only take this step when they decide it’s more important to serve their customers than Wall Street analysts.

Companies only take this step when they decide it’s more important to serve their customers than Wall Street analysts.

For more on this topic, read Makers and Takers by Rana Foroohar. She explains that finance used to work for business… but now business works for finance.

Step 3: Integrate into Stage-and-Gate

Imagine your company has completed Step 2 and all your projects (of a decent size) employ Market Satisfaction Gaps before development begins. What do you do now? Wait for your competitors to catch up?

No, your next step takes advantage of something you installed a long time ago… your stage-and-gate process. It’s doing a lot of things well, but here’s something it’s doing poorly: Your “fuzzy front end” is still too fuzzy.

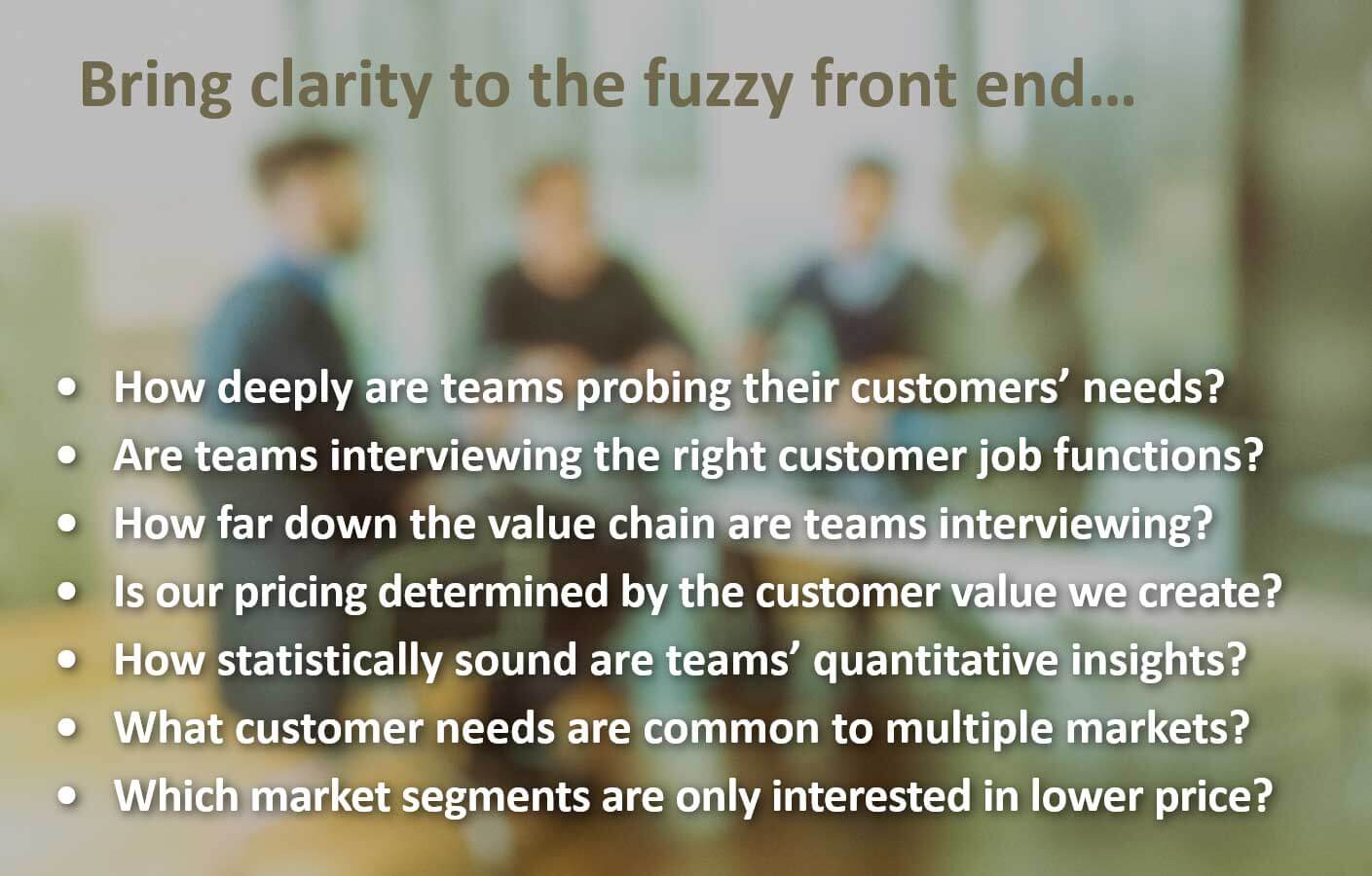

Now begin “interrogating” the front-end work of every team so your company can learn how to improve the front end… leading to even stronger and more reliable growth. Using new cloud-based technology (e.g. Blueprinter software), you can have all of this information—and more—at your fingertips within your stage-and-gate process:

This insight goes beyond making better products. This is learning how to get better at making better products. It turns a fuzzy art into a repeatable science. It also tells you which markets to focus on in your strategic planning, which practices to reinforce company-wide, and which people to promote.

This is learning how to get better at making better products.

Do you need to implement Step 3 today? Maybe not. Very few companies are now practicing Step 3, and chances are you’ll trounce your competitors today with just Step 2. But we include this to show that B2B customer insight can offer competitive advantage and reliable growth for a long time.

Step 4: Employ “Market Scouting”

To the best of our knowledge, no company is doing this today. Here’s the idea: Today you decide when to bring innovation to a given market, right? But what if the market decided this timing instead… by sending signals you could detect? This is a concept brought to us by Fran Behan of Corning. For a full description, please see the white paper, Timing is Everything.

With “market scouting,” you train your entire customer-facing organization—especially your sales professionals—in the deep B2B customer insight probing used in Steps 1-to-3. Whenever they hear an “outcome” (desired customer end-result) they log this as such in their contact report. You design your CRM (e.g. salesforce.com) to search for and analyze these outcomes across your entire company.

Think of this as an early warning system that tells you when to start an innovation project and what it should focus on. You’ll detect weak signals at first and monitor them as they get stronger. Examples from the past include:

- Coatings producers want to move from solvent- to water-based systems.

- Phone producers are interested in crack-resistance as glass displays get larger.

- Production lines need sensors that integrate data with the “internet of things.”

Implementing Step 4 won’t be difficult. But the reliable growth payoff for Steps 1-to-3 is far greater today, so you’re wise to firmly establish these practices first.

Your reliable growth journey…

Reliable growth is well… reliable… only because you’re doing something smart that your competitors are not doing. Once everyone does these same things, your growth will be drawn to the average. The good news is you now have a roadmap that can extend your lead for a decade or two. The bad news is your competitors could do this just as easily.

As with any roadmap, your next step depends on where you’re starting your journey. Here’s our advice for the two most common starting points:

1. We haven’t started yet: You can’t afford to be unaware of what’s possible. Check out New Product Blueprinting as well as other possibilities. Invest 9 minutes in these 3-minute videos to understand Blueprinting methods, training and software: www.NPBoverview.com, www.NPBtraining.com, and www.NPBsoftware.com. Then send someone to check out the full training at one of our open workshops.

You can’t afford to be unaware of what’s possible.

2. We’ve done some training (e.g. Blueprinting): Now start requiring Market Satisfaction Gaps from teams before allowing them to enter the development stage. Cloud-based Blueprinter software now includes MSG charts in a 2-page Market Case (see video)… so it’s easy to use these in your gate-reviews.

Regardless of your starting point, we’d like to help. Just contact us to discuss practical steps for joining the Reliable Growth Club.

Comments