Product development strategy: 3 steps to ensure your new products win

Want a product development strategy that ensures your new products will consistently beat competitors’? Follow these three steps. The good news is your competitors are probably ignoring—or doing a sloppy job—of the first two. Better yet, we’ll present evidence these steps make a difference. We’ll close with several examples.

You can think of product development strategy in several ways:

- The Ansoff matrix, with four quadrants for existing vs. new markets and technologies.

- The stages and gates of a new product development process.

- The application of agile methods for new product development.

These are helpful ways to consider your product development strategy, but they’re unlikely to give you a competitive edge. Why? First, your competitors are already thinking along these lines. More important, these approaches focus too much on your business, and not enough on the customers your new products must please.

These approaches focus too much on your business, and not enough on customers.

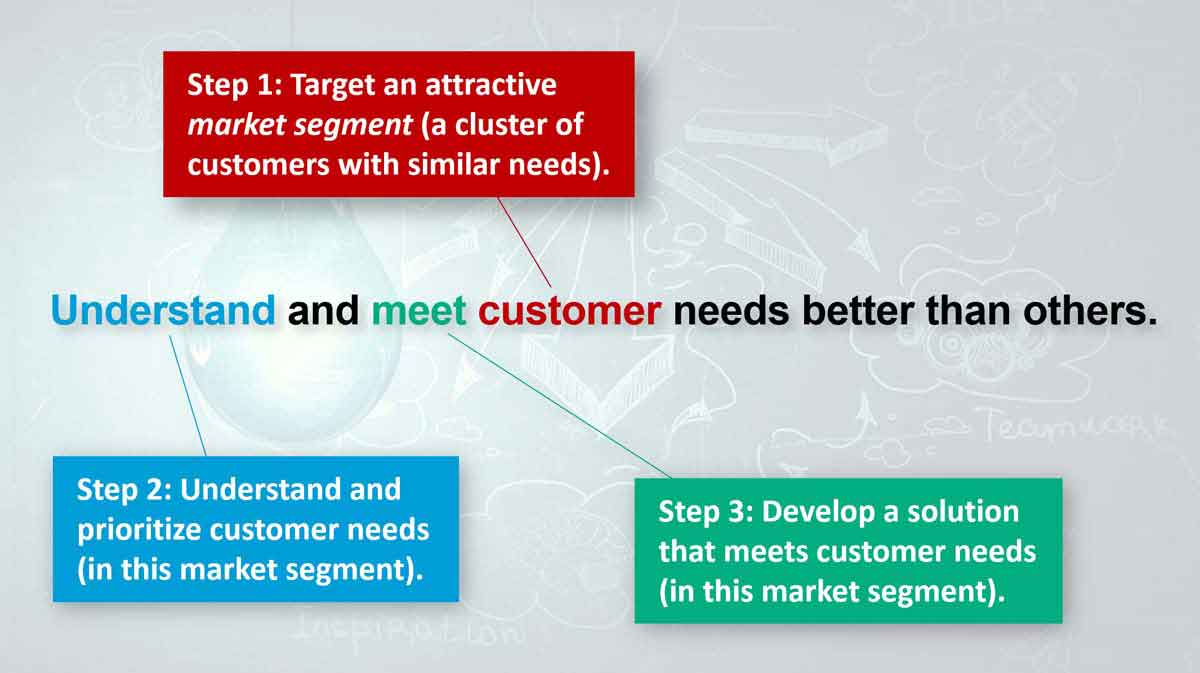

A winning product development strategy satisfies this simple goal: Understand and meet customer needs better than others. To consistently reach this goal, follow these three steps:

- Target an attractive market segment.

- Understand and prioritize customer needs (in this market segment).

- Develop a solution that meets customer needs (in this market segment).

So why are these three steps so important for your product development strategy? Let’s return to our goal: Understand and meet customer needs better than others.

The most important word in the above phrase is “customer.” If you don’t have a crystal-clear picture of who this is, your product development strategy is doomed. It’s like playing darts blindfolded. We’ll provide evidence to support this, and recommend ways to clarify your target market segment. A good definition of a market segment is, “a cluster of customers with similar needs.”

Second, your product development strategy must reveal precisely which needs customers want you to improve. Many B2B companies fail miserably here, as they use one of these approaches:

- They develop products based on their own ideas, and don’t bother interviewing customers in the front-end of innovation.

- They “validate” their own product concepts using customer interviews that lead the witness. (“You do like our idea, don’t you?”)

- They conduct qualitative customer interviews in the front end, but not quantitative interviews, and so succumb to confirmation bias.

Third, once you understand your target customers and their needs, you must develop a solution to meet these needs. Research shows most companies spend at least 90% of their new-product budget on these solutions (the right “answer”) and less than 10% on understanding customer needs (the right “question” to be answered). This is the hallmark of a faulty product development strategy.

If you Google the phrase, “product development strategy,” you’ll mostly see suggestions on how you should improve your internal process. But it doesn’t matter how good your internal process is if you’re answering the wrong questions. You’ll continue to develop cures for no known diseases.

You’ll continue to develop cures for no known diseases.

Step 1. Target an attractive market segment

Last week we got a request from a B2B business executive to do voice-of-customer research for a new product. When I asked what market segment they were targeting, he seemed confused. After some discussion, he said their product needed to work for customers in hospitals, data centers, petrochemical facilities, and universities.

Whoa! Talk about a weak product development strategy. It’s highly unlikely this diverse group would have the same needs. Trying to satisfy several market segments with one product guarantees you’ll sub-optimize for them all. Consider our definition of a market segment: a cluster of customers with similar needs. If customers are in different market segments, they must have different needs.

Trying to satisfy several market segments with one product guarantees you’ll sub-optimize for them all.

What about developing a new product for a single customer? This can be a successful product development strategy for the right customer, perhaps one that is very large and an industry leader. But your first inclination should always be, “Which market segment—or cluster of customers—should I target?”

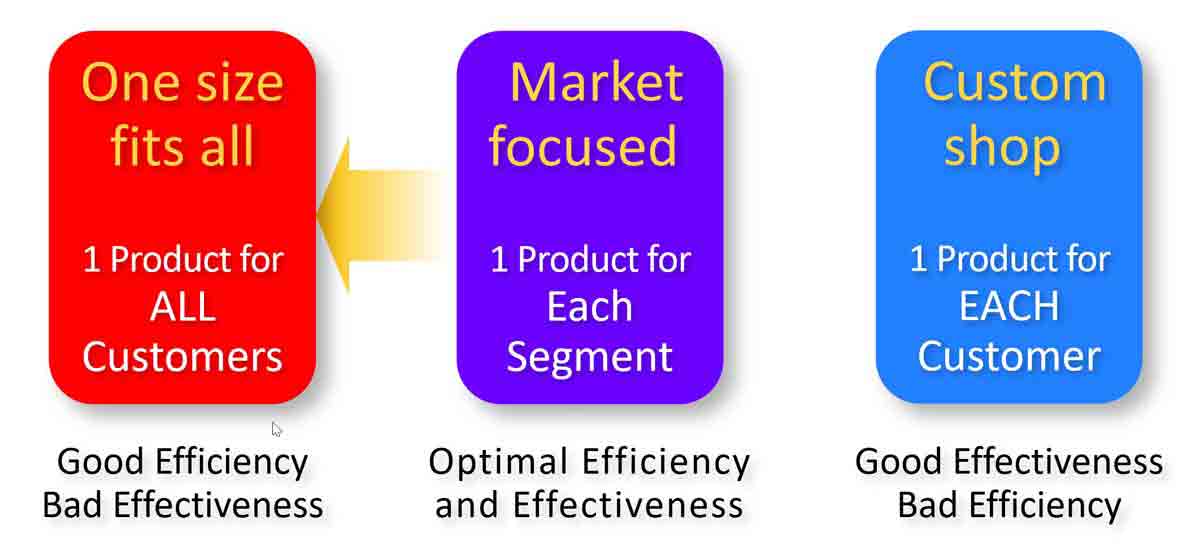

Let’s see why, using two extreme examples. In the first, your company makes a single “one-size-fits-all” product for all customers. This product development strategy would be very efficient, but terribly ineffective… since your product wouldn’t fully satisfy any customer.

In an opposing product development strategy, your company is a custom shop: Every single customer gets its own unique product from you. Very effective, but highly inefficient if you have clusters of customers with similar needs. If you do, each customer in a cluster doesn’t need its own unique product.

That’s why a market-focused product development strategy is best. You don’t sacrifice effectiveness by sub-optimizing your product: Since customers are in the same market segment, their needs are very similar. At the same time, you optimize your efficiency, because you haven’t developed multiple new products when one would have sufficed.

If you’re convinced market segmentation makes sense, let’s move on to market concentration. This is applying a disproportionately high level of resources to satisfying your most attractive markets.

Market concentration is applying a disproportionately high level of resources to satisfying your most attractive markets.

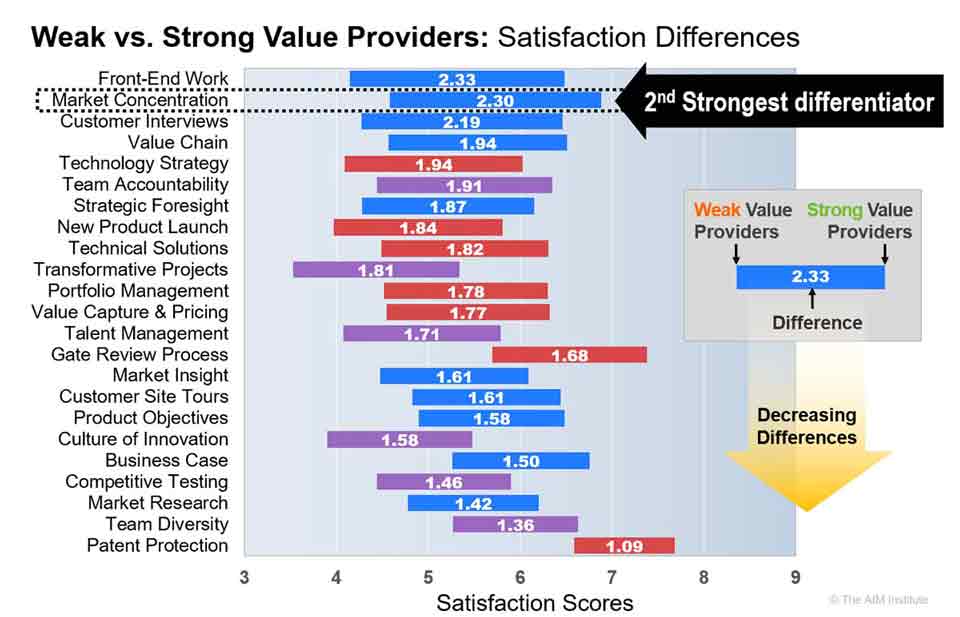

Does market concentration work? You bet it does. The AIM Institute conducted research with over 500 B2B professionals to understand the impact of 24 growth drivers on organic growth. (Download the research report, What Drives B2B Organic Growth?)

In this research, we separated the winners from the losers. Or more specifically, those respondents that said their company was or was not good at developing strong new product value propositions (which was the #1 driver of organic growth).

In this chart, the horizontal scale shows respondents’ satisfaction with their company’s capability in each growth driver. Each growth driver has a horizontal bar: Weak value providers are represented at the left side of each bar, and strong value providers at the right side. A wide bar indicates the growth driver is a strong differentiator between the winners and losers. The 24 growth drivers are arranged with the strongest differentiators (widest bars) on the top.

Note that Market Concentration is the second strongest differentiator out of 24. If you want a strong product development strategy, start with strong market concentration. In other words, segment your markets well, and pursue the most attractive market segments with gusto. Then, figure out what customers in that market segment really want. In other words, move to product development strategy Step 2.

Segment your markets well, and pursue the most attractive market segments with gusto.

Step 2. Understand and prioritize customer needs (in your target market segment)

Of our three product development strategy steps, Step 2 provides you with the longest lever. Especially for B2B companies. Nothing else will so effectively boost the success of your product development strategy. Before looking at the evidence for this, let’s explore what we mean by “understand and prioritize” customer needs.

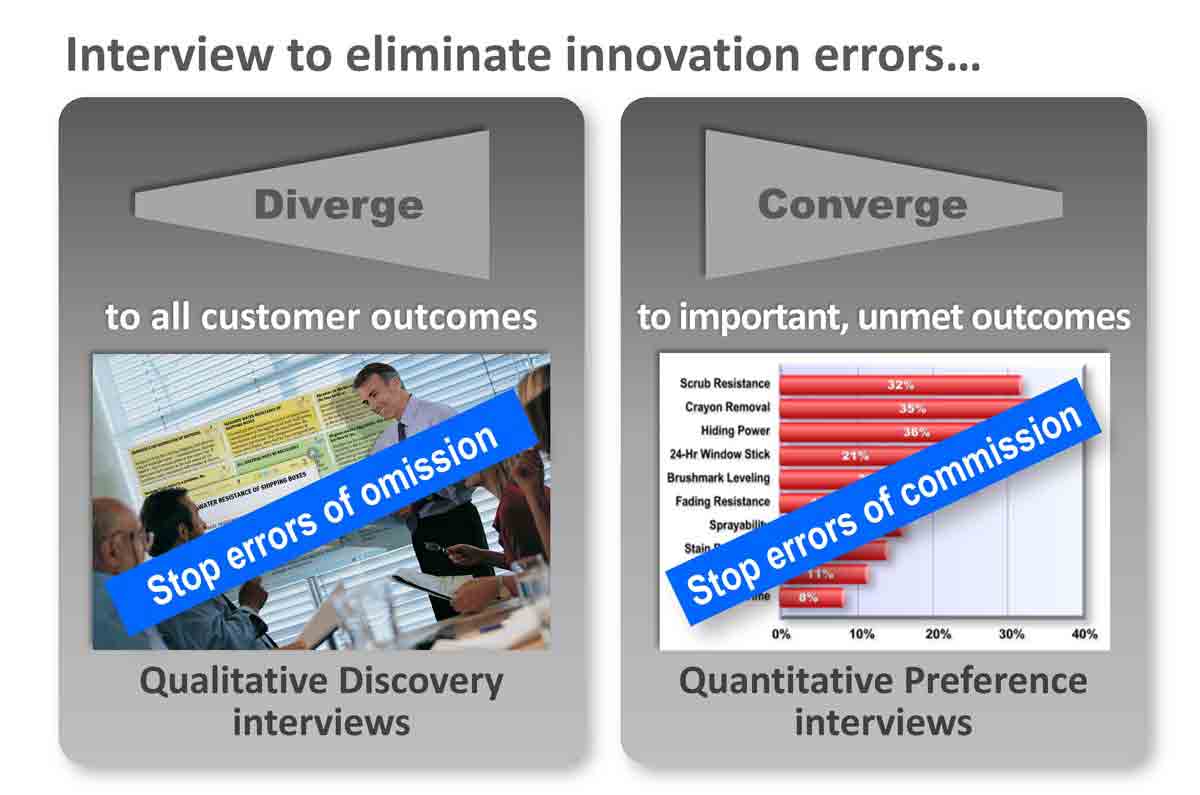

Once you’ve identified your target market segment, you should conduct two types of customer interviews.

- You begin with qualitative Discovery interviews. You uncover and understand as many customer outcomes—their desired end results—as possible.

- You return for quantitative Preference interviews. You ask customers to rate outcomes on a scale of 1-to-10 for importance and current satisfaction.

For a short video example of both types of interviews, see Reinventing VOC for B2B. Why two rounds of interviews? They accomplish very different things, all of which you need in your product development strategy:

- Discovery interviews let you diverge to all customer outcomes. Preference interviews help you converge on the outcomes you should pursue.

- Discovery interviews let you avoid errors of omission (failing to uncover unarticulated needs). Preference interviews avoid errors of commission (targeting the wrong needs).

- Discovery interviews help you understand customer needs. Preference interviews let you prioritize customer needs.

Discovery interviews help you understand customer needs. Preference interviews let you prioritize customer needs.

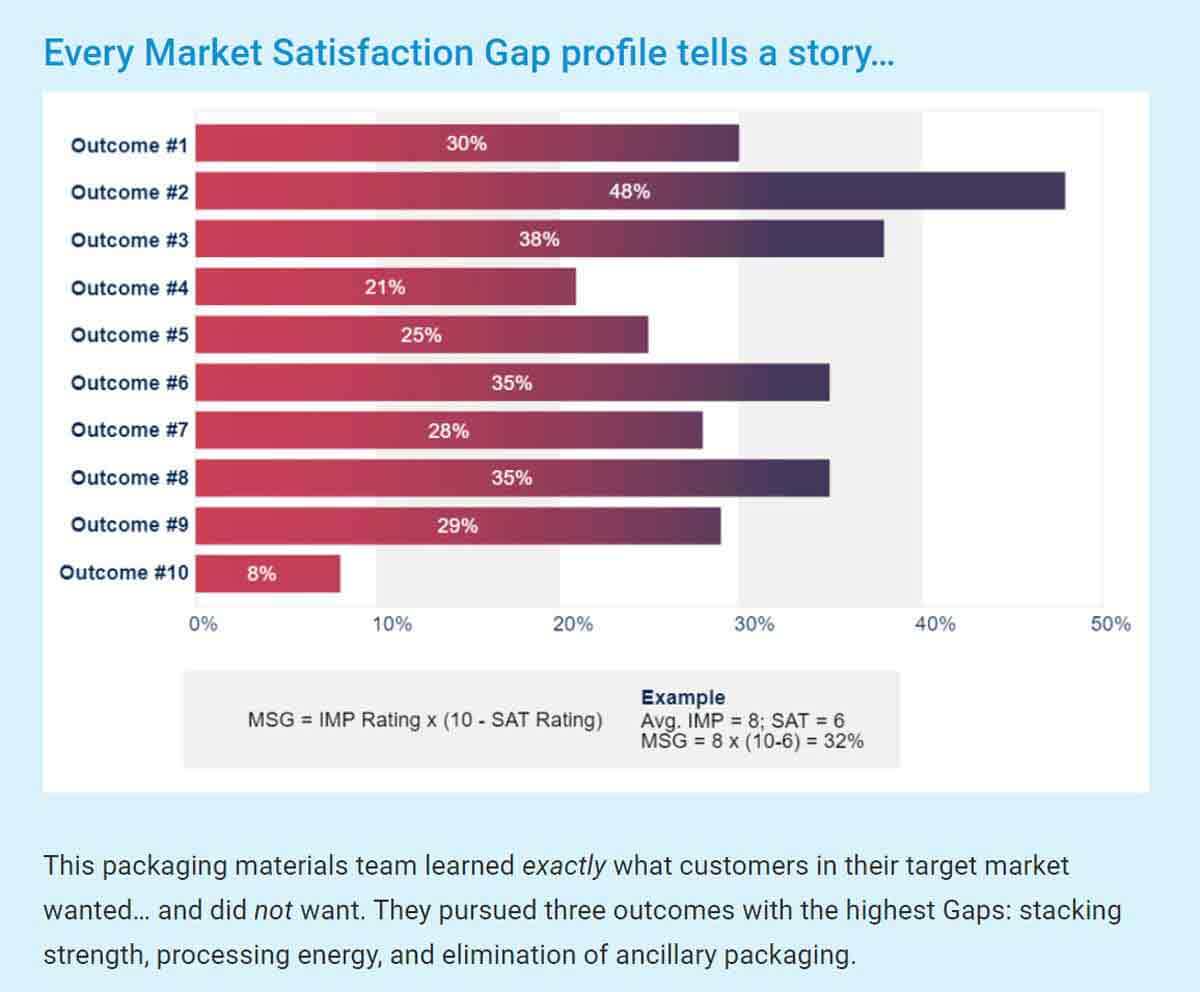

To the last point, it’s not enough to simply understand customer needs. You must prioritize these needs. Quantitative Preference interviews generate a Market Satisfaction Gap chart, which reveals the outcomes customers are most eager to see improved. This should be central to your product development strategy because it overcomes confirmation bias… the tendency to seek and accept information that agrees with our preconceived notions.

How important is prioritizing customer needs? We conducted research into 12 B2B VOC (voice of customer) skills, captured in the report, B2B VOC Skills. This one skill—prioritizing customer needs—was paramount. Among all 12 VOC skills, it was rated as…

- The most important by all respondents.

- The skill that unskilled respondents were most eager to improve.

- The biggest differentiator in understanding market needs.

- The biggest differentiator in new product success.

- The skill that improves the most with VOC training.

We were surprised by how much this skill “stood out.” And pleased. In many years of training B2B professionals to conduct interviews, we’ve seen how Preference interviews support a sound product development strategy. Over and over, product development teams have changed their original product design concepts because of what these interviews taught them.

We were surprised by how much this skill “stood out.” And pleased.

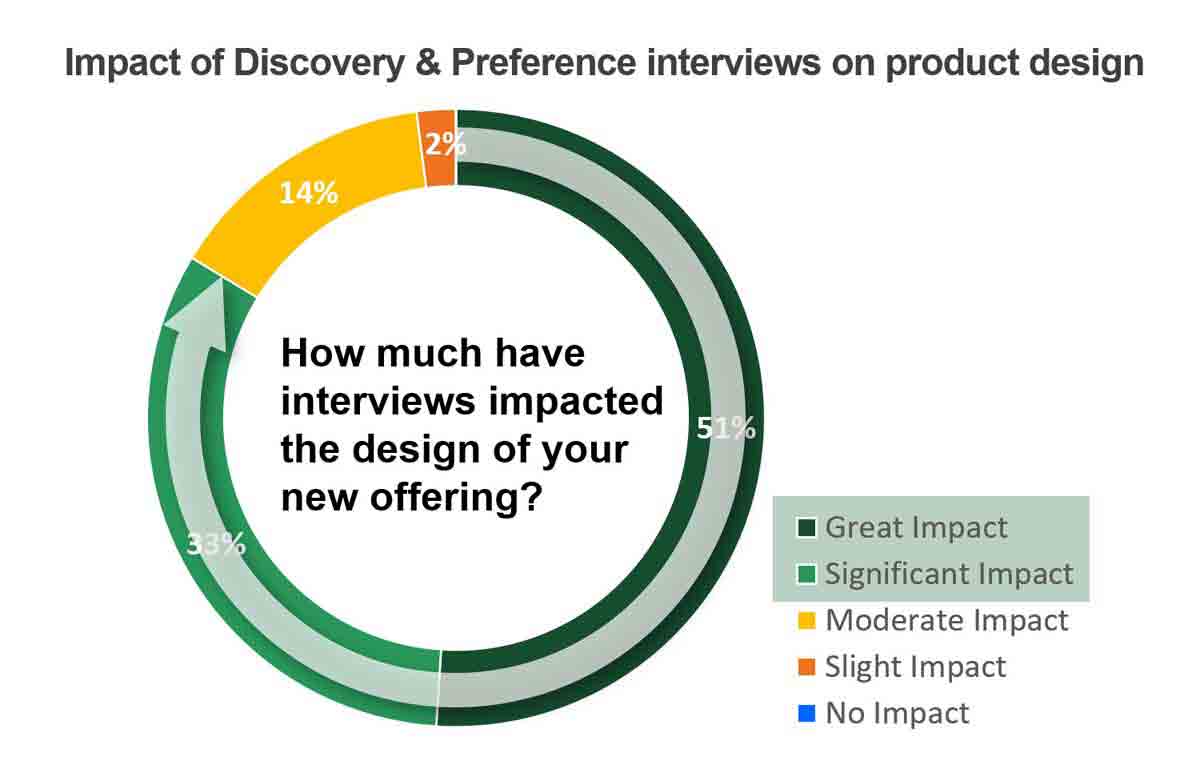

Here’s evidence from one of our research projects. We followed 50 teams that used both Discovery and Preference interviews. We asked them how much these interviews impacted their new product design.

About 16% of the teams said the impact of these interviews was “moderate” or “slight.” These teams were probably on the right track in their initial new product concept. But 84%—five out of six—said the impact was “great” or “significant.”

Is there good reason to believe the product development teams in your company are different? If not, five out of six teams are probably having the same experience. Most of your teams will keep chasing the wrong customer needs without these interviews.

Most of your teams will keep chasing the wrong customer needs without these interviews.

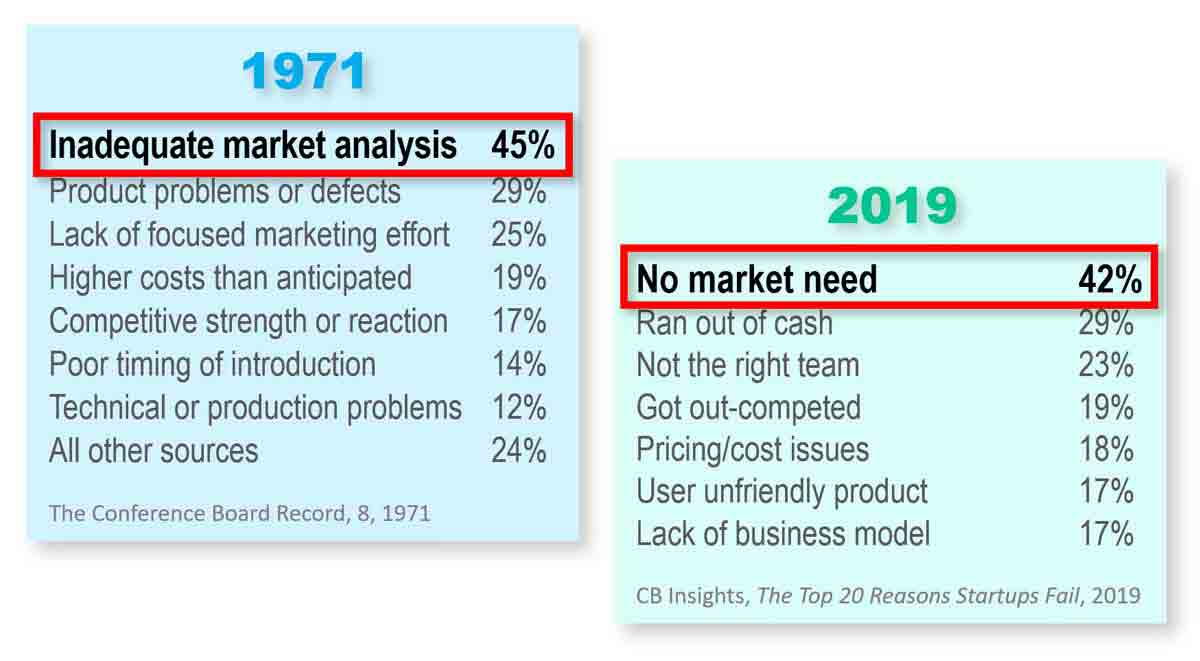

Let’s look at two more indicators that “understanding and prioritizing customer needs” (Step 2) is critical for your product development strategy. In 1971, the number one cause of new product failure was “inadequate market analysis.” Nearly five decades later, research shows this is still the leading cause of failure.

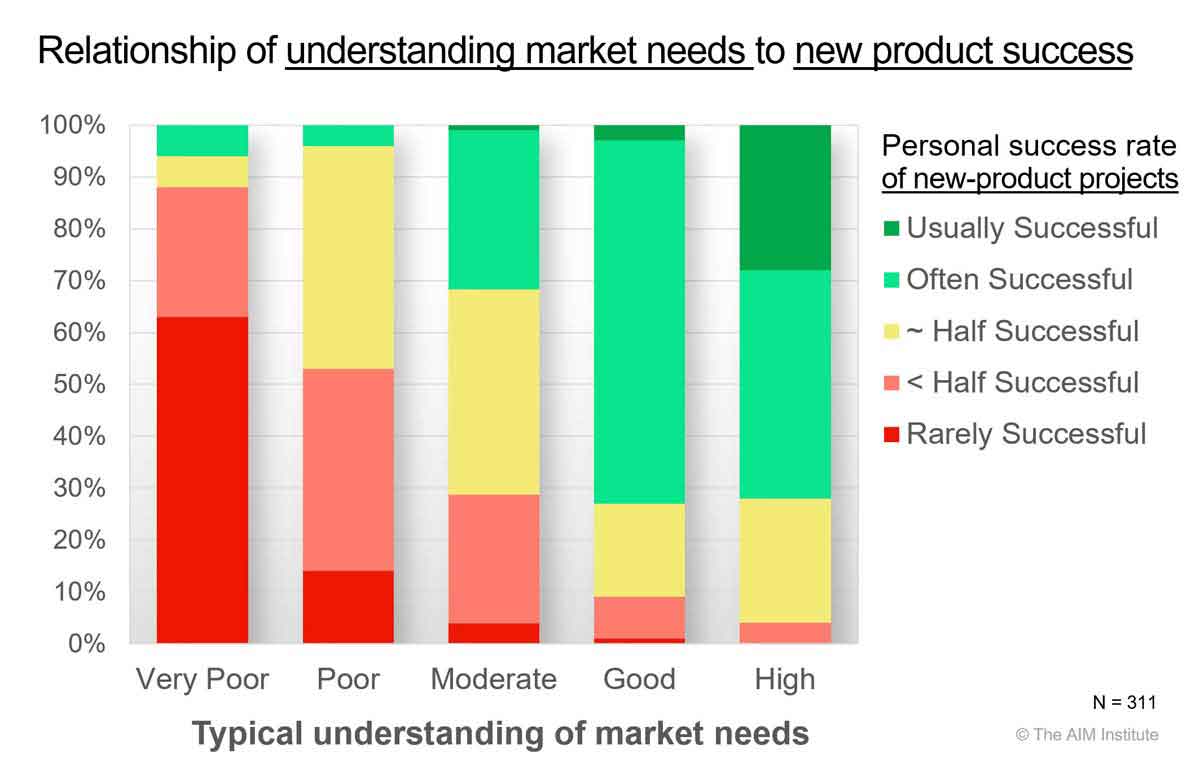

More recent research also supports the importance of understanding customer needs to your product development strategy. As detailed in the research report, B2B VOC Skills, over 300 B2B respondents were asked to describe a) their typical understanding of customer needs, and b) the typical new product success rate of projects they were personally involved in.

In this chart’s legend, you’ll see that green identifies respondents with “winning” new product track records: They were successful over half the time. Those marked red had losing track records (successful less than half the time).

You see a strong correlation between understanding market needs and new product success. Most respondents with a very poor or poor understanding of needs (two left columns) had a losing new-product track record. About 70% of those with a good or high understanding (two right columns) had winning track records. Do you seek a powerful product development strategy, in which most employees have winning new product success rates? Focus on Step 2, understanding market needs.

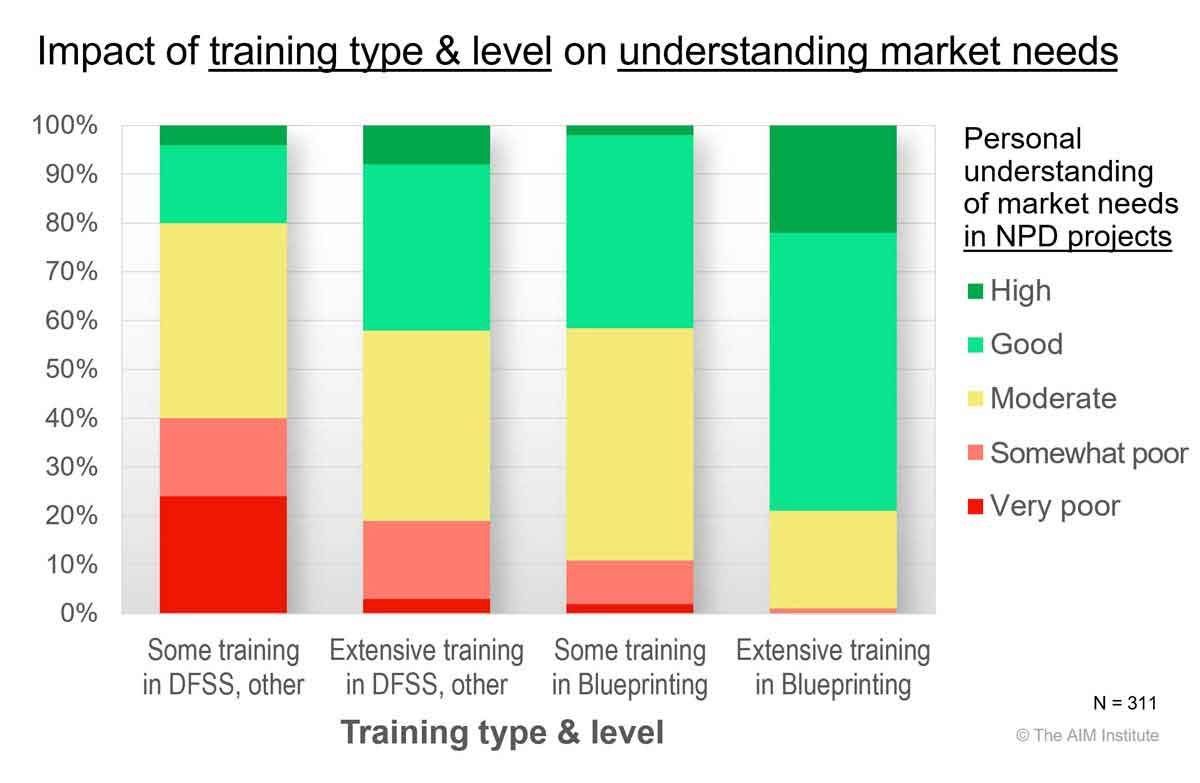

Before we move on to the next step, we should ask, “How difficult is it to understand market needs?” The same research was encouraging on this point as well.

For respondents citing “some” training in voice-of-customer methods (e.g., DFSS or Design for Six Sigma), only about 20% have a high or good understanding of market needs. But for extensive training in New Product Blueprinting (the method that employs Discovery and Preference interviews), 80% of the respondents had a high or good understanding.

Such training just takes a few months, as teams apply new interviewing skills to their real new-product project. (See www.NPBtraining.com) But the impact is large: Instead of one-in-five employees having a strong understanding of market needs, you’ll have four-in-five. That enables a winning product development strategy.

Step 3. Develop a solution that meets customer needs (in your target market segment)

Let’s imagine you’ve done a good job of Steps 1 and 2 in your product development strategy. Your teams have a clear understanding of their target market segments and the needs of customers in those segments. What does this mean when your teams enter the costly development stage? They’ll still need to deal with technical risk: “Can we create a new product that meets the design criteria?”

But your teams will now have very little commercial risk. After all, they’ve targeted an attractive market segment (Step 1): It’s large enough, growing fast enough, has an acceptable competitive landscape, etc. And they know exactly which outcomes the customers in this segment do and do not want improved (Step 2).

Your teams will now have very little commercial risk.

This puts your business in an ideal position for Step 3 in its product development strategy: developing a solution for customer needs. Most companies still have room for improving this step. Some ways to improve include:

- Accelerate product development by pursuing fewer projects, and concentrating more resources on the these.

- Improve the governance process in the stage-and-gate process, streamlining where relevant.

- Identify all key assumptions at the onset, and quickly investigate those that could become project-killing “landmines.”

- Halt the “innovation friction” that delays projects, e.g., spending freezes, travel bans, hiring delays, rapid reorganizations, etc.

But let’s be clear: Hiring more or brighter R&D and getting them to work more efficiently is not your longest lever in your product development strategy. It’s Steps 1 and 2: Target an attractive market segment; then understand and prioritize the needs of its customers.

Some examples…

Want to improve Steps 1 and 2 of your product development strategy? Let’s close with some examples of companies that have done a good job of understanding and prioritizing customer needs in their target market segment. Here are a dozen case stories I think you’ll find enlightening.

For each, you’ll see a brief story and then a Market Satisfaction Gap chart. The chart for “Packaging Materials” is shown below. Remember Preference interviews, where customers rate outcomes on a 1-to-10 scale for importance and satisfaction? The more important and less satisfied the market is with an outcome, the higher the Gap. Market Satisfaction Gaps over 30% tell you the market is eager to improve this outcome.

Market Satisfaction Gaps over 30% tell you the market is eager to improve this outcome.

We’re sometimes asked if one single action can boost the success of a product development strategy above all others. Yes! Don’t allow any significant development-stage work unless you have quantitative data… direct from the customer… unfiltered in any way… and free of confirmation bias.

You can learn more in this short overview video at www.newproductblueprinting.com, or by viewing all our training options at www.blueprintingtraining.com.

As with most strategies, your product development strategy success will come from doing different things better than your competitors. Don’t abandon Step 3… but put serious energy into Steps 1 and 2 to consistently deliver exciting new products to your customers.

Comments