In this 3-part webinar series, Dan Adams from AIM will join Greg Coticchia (CEO, Sopheon) and Paul Heller (Chief Evangelist, Sopheon) to discuss how future gated development processes will incorporate customer insights for 21st-century product leaders During this discussion, presenters will cover: New 2022 research about the relationship between customer research and new product success ... Read More

Should you do in-person customer interviews… or use a web-conference? Consider these factors: 1) team interviewing experience, 2) level of existing customer relationship, 3) need for a tour, 4) qualitative vs. quantitative interview type, 5) scheduling difficulties, 6) travel costs, and 7) interviewing progress to-date.

For a full explanation, download our white paper at www.virtualvoc.com. Most likely, you’ll see that virtual voice-of-customer interviews can play a larger role in your customer insight work.

See 2-minute video, Conduct virtual customer interviews.

Lagging indicators can be useful, so long as too much time doesn’t pass between your correcting action and the result you want to measure. In this regard, the Vitality index–% of revenue from new products—fails miserably. Improvements you make in the front end of innovation could take years to register a significant impact on revenue.

Don’t discard your Vitality Index, but do supplement it with new metrics, such as the Growth Driver Index (GDI) and Commercial Confidence Index (CDI). Otherwise your new product “furnace” will stay cold far too long. This 2-minute video explains further: Employ new growth metrics.

More in white paper, New Innovation Metrics

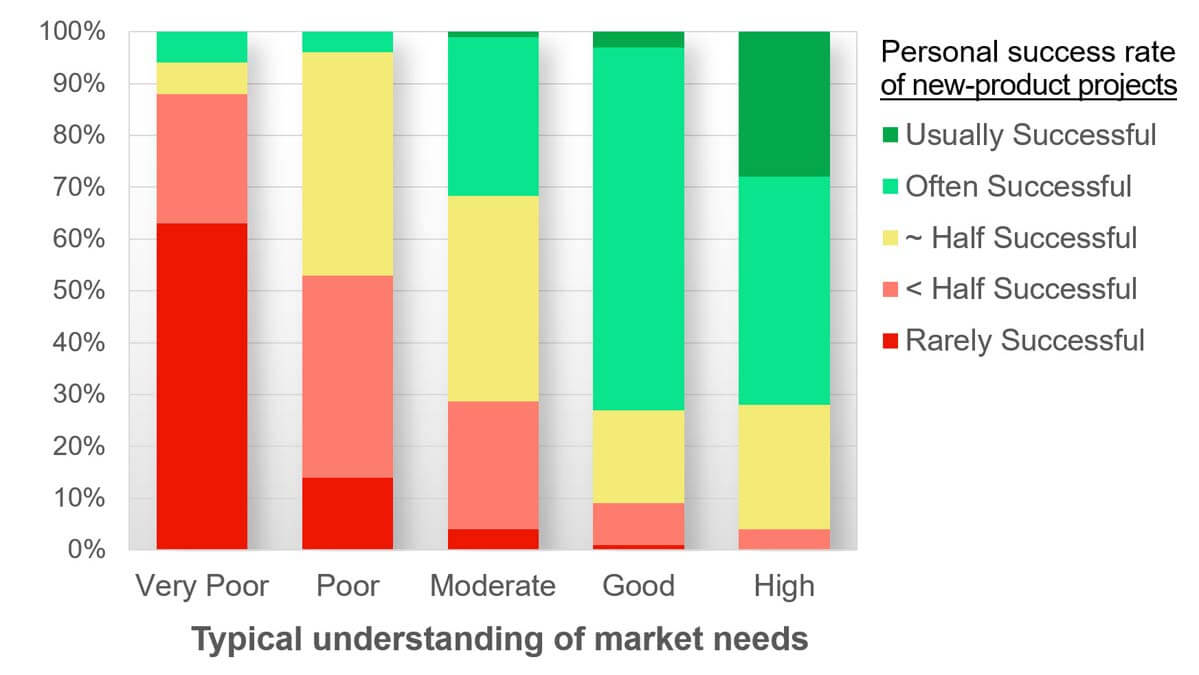

This was a question we studied in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. Some respondents reported a “poor” understanding of market needs while other reported a “good” understanding.

We were surprised at the difference in the two groups’ typical new product success rates: Only 5% of the former group (with poor market understanding) reported their new products were successful over half the time. But 70% of the “good market understanders” reported better than average new product success rates. So instead of hiring more R&D, your shortest path to successful new products might be to understand market needs better.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

If your R&D looks like a black box to management, you’ve probably noticed that their patience can run out rather quickly. But when you de-risk projects transparently with management, they are much more tolerant of unavoidable delays and setbacks.

You do this in three steps: 1) Generate assumptions… possible landmines that could “blow up” your project. 2) Rate assumptions… for likely impact and certainty. 3) Investigate assumptions… especially high-impact, low-certainty assumptions. This 2-minute video explains the process: How to pursue transformational projects.

More in article, How to de-risk projects and overcome management doubt.