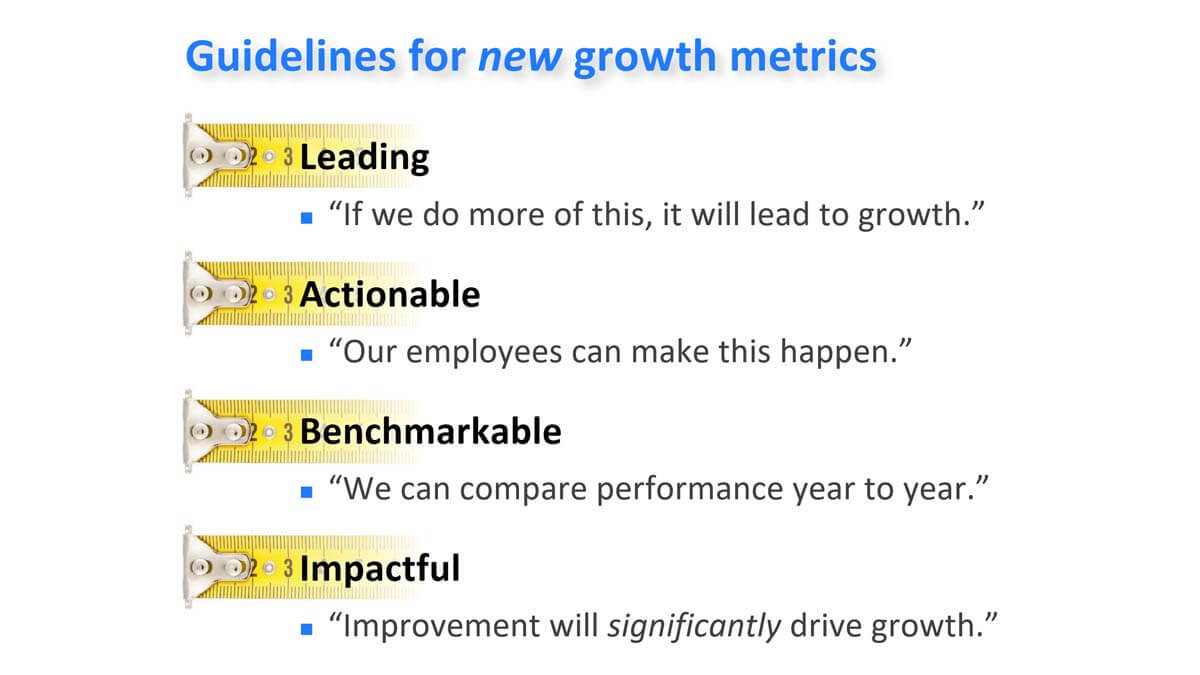

The Vitality Index (% of sales from new products) is helpful, but it suffers from being a lagging indicator. So how would you supplement it? Any new innovation metric you adopt should satisfy 4 rules: 1) Leading: “If we do more of this it will lead to growth.” 2) Actionable: “Our employees can make this happen.” 3) Benchmarkable: “We can compare to others and year-to-year.” 4) Impactful: “Improvement will significantly drive growth.

Here are two new innovation metrics that satisfy all four rules: Growth Driver Index (GDI) and Commercial Confidence Index (CCI). These measure your growth capabilities and evidence-based customer insight, respectively. (See white paper, New Innovation Metrics.)

More in 2-minute video, Employ new growth metrics

If you want to develop a great new product, your first step should be to target a single market segment and job-to-be-done (JTBD) within that segment. A market segment is a “cluster of customers with similar needs.” If you develop one product for multiple market segments, your new product won’t satisfy any customers to the fullest extent. By definition, different market segments have different needs, right?

If your company makes colorants, your target market segment might by paint producers. But your project scope is still too broad: You need to target a specific job to be done by those paint producers. Their job might be, “production and sale of semi-gloss paint.” This is explained further in the article, Quantitative questions for interviews

More in 2-minute video, Begin with customers’ job to be done

My golden rule of investment is, “Make your decision when you’ve gathered the most facts and spent the least money.” If you do it right, this point in time is the gate just before the costly development stage. Most companies are far too casual here, letting each team build and present its own unique PowerPoint slides. Human nature says teams will use these slides to talk about their project’s strong points, avoiding weak areas.

So management tries to guess what’s missing: “What about the competition? Are there more technical risks? Is the problem this? Is it something else?” This shell game is waste of time, money and self-respect. Better to have a standard business case everyone works from. Here’s a sample of an abbreviated business case called a Market Case: www.marketcasesample.com

More in 2-minute video, Build a front-end business case

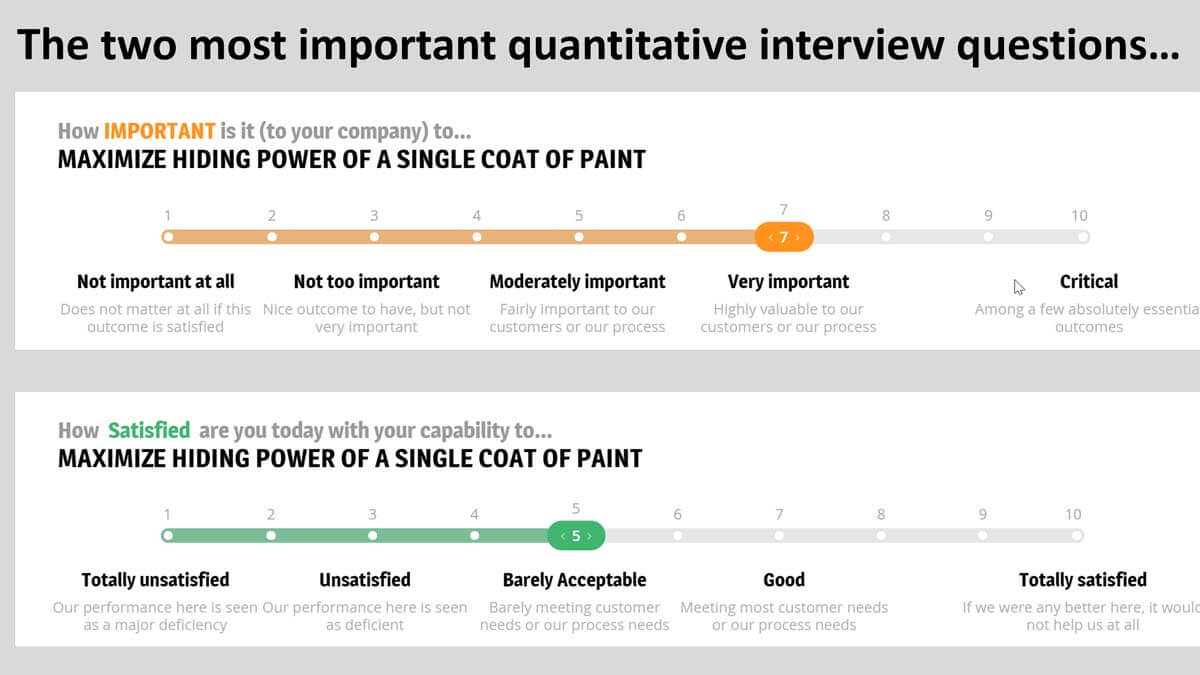

I think the biggest mistake is failing to use quantitative customer interviews. Why use quantitative questions for interviews, not just qualitative? Two reasons. First, qualitative interviews give you reams of customer quotes with no good way to prioritize customer needs. Sure, you could count the number of times customers cite a need, but frequency of remarks is a poor substitute for customer eagerness to improve.

More important, with only qualitative interviews you’ll succumb to confirmation bias… the tendency to hear and interpret information according to your preconceived notions. With quantitative questions for interviews, you’ll have hard data on customer needs that your team hasn’t filtered or skewed. You get 100% unadulterated insight straight from the customer.

More in 2-minute video, Quantitative interviews are a must

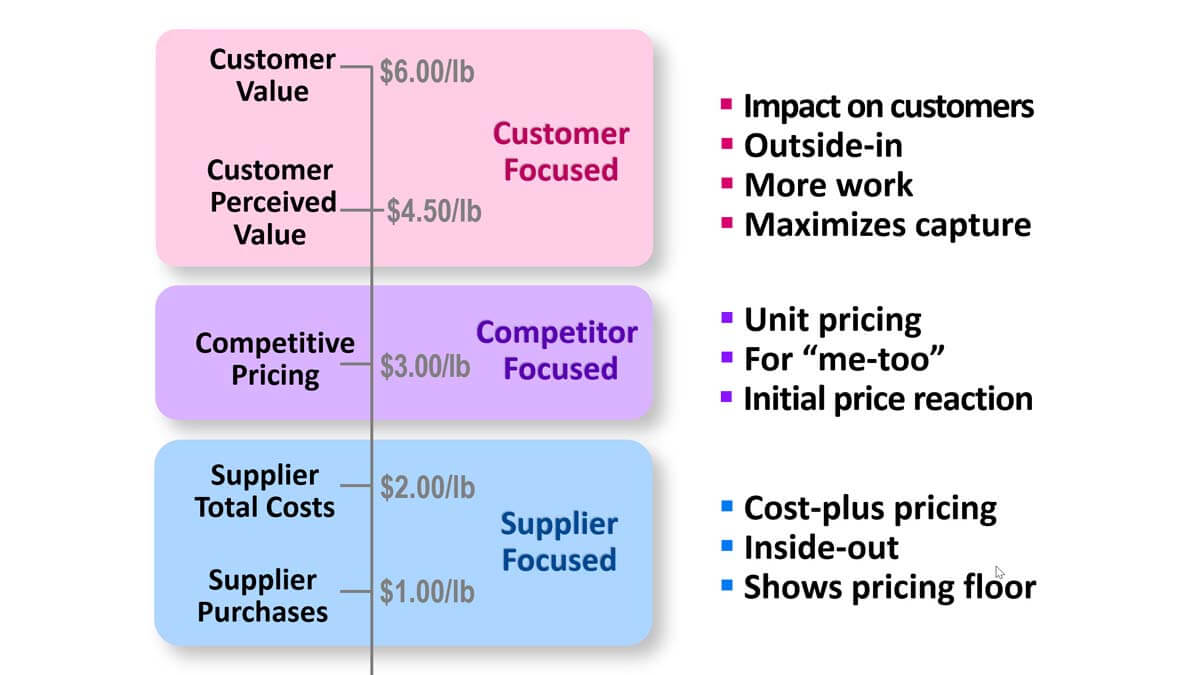

Your pricing could be supplier-focused, competitor-focused, or customer-focused. 1) Supplier-focused pricing is cost-plus pricing. It’s inside-out, leaves money on the table and only indicates your pricing floor. 2) Competitor-focused emphasizes unit pricing, and is only useful for me-too products and gauging initial price reaction. 3) Customer-focused pricing reflects the economic impact on customers. It’s outside-in and does require more work for you. But if you want to maximize value capture, it’s the only way.

More in 2-minute video, Use value calculators to establish pricing

If you ran a zoo, you’d keep your jungle animals and farm animals in separate enclosures, right? Your technology development projects are untamed, jungle animals: You don’t completely understand them, and you’re not sure what they’ll do or where they’ll go next. Your product development projects are predictable farm animals. You know what they’re supposed to do, and who they’re supposed to do it for.

When you commercialize technology, you are “domesticating” wild animals for productive purposes. As a first step, you must be crystal clear which type of project your scientists or engineers are working on at any point in time. Remember, technology development turns money into knowledge; product development turns knowledge back into money. You can learn more from this white paper, Commercialize technology in 6 foolproof steps.

More in this 2-minute video, How to pursue transformational projects

If you sell into a concentrated B2B market (one with just a few customers), your voice-of-customer interviews should have two goals: “insight” plus “engagement.” The latter is important: You want these big customers to be impressed and eager to work with you, not your competitors.

These 10 approaches help you engage your customers when interviewing them to understand their needs: 1) Kill the questionnaire. 2) Let customers lead the interview. 3) Discuss their job-to-be-done. 4) Project your notes so they can see them. 5) Focus on customer outcomes. 6) Learn how to probe deeply. 7) Don’t sell or solve. 8) Get quantitative in your VOC. 9) Use triggers to generate fresh ideas. 10) Use B2B-optimized interview tools. (See the 2-minute video, Engage your B2B customers.)

These are explained in the article, The Missing Objective in Voice of Customer Interviews