Of course, employees will be laughing; they’ve heard this one before. When satisfying the expectations of Wall Street analysts conflicts with building the firm’s long-term competitive strength, guess which usually wins? Any employee who’s been through travel restrictions, investment delays, hiring freezes, etc. knows the answer.

More in 2-minute video at 5. Shareholder wealth is a poor goal

Some business leaders fixate on the short-term out of fear: They are cowed by Wall Street analysts’ reaction to their quarterly results. But others pump up near-term results to fatten their bonuses… even if it means crippling their company’s future capacity to grow. This is leadership larceny… stealing from the business’s tomorrow to benefit the leader’s today. The first rule of leadership is this: “Leave your business stronger than you found it.”

More e-book, Leader’s Guide to B2B Organic Growth

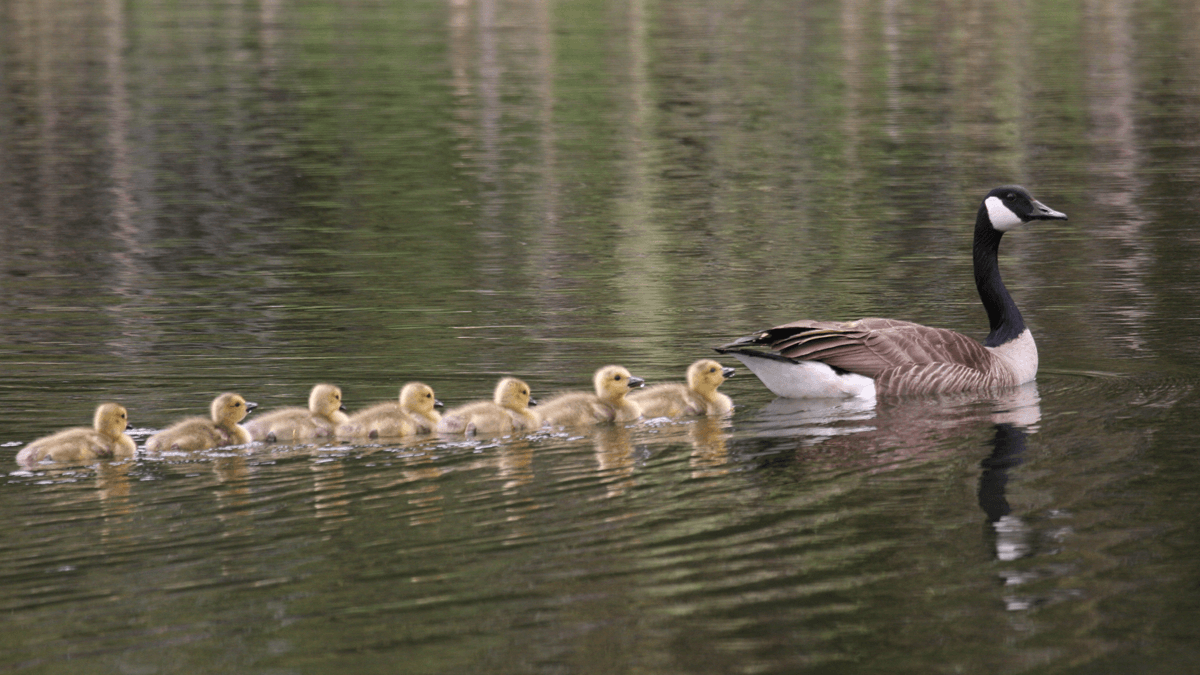

Increasing shareholder value is simply the result… the “effect.” What’s the “cause”? It’s profitable, sustainable, organic growth. Demonstrate this and stock prices will follow like goslings after their mother. Quit performing for Wall Street analysts, who have never created real value and couldn’t do so if their bonuses depended on it. Instead, work for customers who will appreciate and reward the value you create for them.

More in article, B2B Leadership: Time for Greatness

Of course, employees will be laughing; they’ve heard this one before. When satisfying the expectations of Wall Street analysts conflicts with building the firm’s long-term competitive strength, guess which usually wins? Any employee who’s been through travel restrictions, investment delays, hiring freezes, etc. knows the answer.

More in article, Why Maximizing Shareholder Value is a Flawed Goal (Originally published in B2B Organic Growth Newsletter).