How to take your Stage-Gate® process to the next level

We’ve teamed up with Stage-Gate® International to bring you a new e-book, 9 Actions to super-charge your Stage-Gate growth machine. In this article, we’ll explain some actions you can take right now to turn your gated process into the growth machine it was meant to be.

First, some credit where credit is due: Dr. Robert Cooper conceived the Stage-Gate new product development process over three decades ago. He then founded Stage-Gate® International, which amassed an astounding body of research into new product development success.

First, some credit where credit is due: Dr. Robert Cooper conceived the Stage-Gate new product development process over three decades ago. He then founded Stage-Gate® International, which amassed an astounding body of research into new product development success.

In our new e-book, we’ve had the pleasure of working with Stage-Gate® International Managing Partner, Colin Palombo. We’ll excerpt a few key points from the e-book in this article.

Download e-book at www.SuperchargeStageGate.com

Your Stage-Gate® new product development framework is your Growth Machine. And it’s the only such machine in your shop. The HR, Finance, Purchasing, and Accounting Machines cannot deliver growth. Even your big Manufacturing Machine just executes the orders that your Stage-Gate Growth Machine gives it.

That’s why Peter Drucker said, “The business enterprise has two–and only two–basic functions: marketing and innovation. All the rest are costs.” These two functions are combined in your Growth Machine to deliver market-facing innovation.

What if you supercharged your Stage-Gate Growth Machine to run even faster (more rapid new product revenue), with greater power (more profitable new products), and more reliably (sustained growth)?

And what if your competitors were still fixated on discussing their Growth Machines’ output during financial reviews? You instead, will work inside your Stage-Gate Growth Machine to boost its power. That’s the only reliable way to improve those financial results. Here are four key actions (out of nine in the e-book) to do this:

- Fixate your early Stages on market needs

- Drive out commercial risk in Stages 1 & 2

- Separate Opportunity Quality & Execution Quality

- Stop pushing the brake pedal

1. Fixate your early Stages on market needs

A Stage-Gate process is all about the new product you’ll develop, right? Well, that’s partially true. The early stages should actually focus on understanding customer needs in your target market segment, before real product development begins.

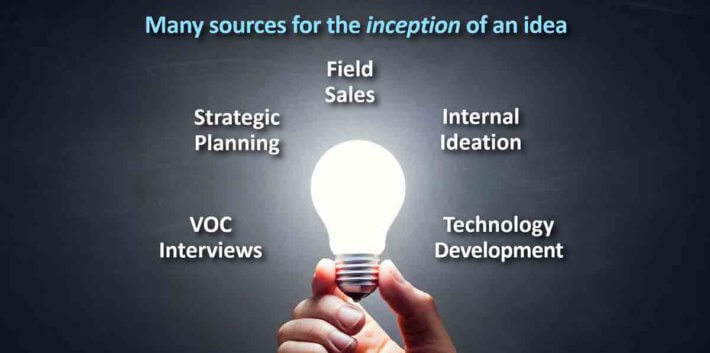

Please don’t get us wrong: The inception of your idea can come from anywhere:

- Voice of Customer interviews: Your interviews in a target market uncover needs.

- Strategic planning: Your business decides to pursue an attractive market.

- Field sales: Your sales force brings back an idea from a customer meeting.

- Internal ideation: Your employees brainstorm new-product concepts.

- Technology development: Your explorations lead to a new product idea.

The key word here is inception. Just coming up with an idea doesn’t mean you should doggedly pursue it through your Stage-Gate process. For example, don’t take your idea to customers and ask them how much they like it. Instead, use open-ended interviews to learn what they want. (See next section.)

Poorly designed Stage-Gate processes begin with “Idea Generation” that assumes an internally generated idea will become the final product… unless something goes wrong. Companies struggle with this partly because the language they use is confusing. Instead of terms like “ideas” and “needs,” we’ll use the following terms within the context of market-facing innovation:

- Opportunity: This is any concept that might lead to market-facing growth. It doesn’t matter if you have a new product concept or not: You must identify a target market segment to have an opportunity.

- Outcome: This is what customers want, not how you’ll satisfy them. Think of outcomes as customers’ desired end results in your target market segment.

- Solution: This is your offering to satisfy customers’ important, unmet outcomes. If you’re in Product Development—not Technology Development—don’t work on solutions until you first understand what customers want you to work on.

Poorly designed Stage-Gate processes begin with “Idea Generation” that assumes an internally generated idea will become the final product.

Each project entering your Stage-Gate process begins with an opportunity. Your first funding decision starts with the team identifying an initial Opportunity Case. Keep it “light-weight” and devoid of probabilities of success, net present values, and other financial measures. You simply don’t know these yet.

If the Opportunity Case is approved, the team enters a Scoping and Feasibility Stage to gather evidence to assess and refine the Opportunity, with particular focus on market needs rather than the technical approach. This is usually the weakest part of B2B companies’ Stage-Gate process. Here you should clearly define:

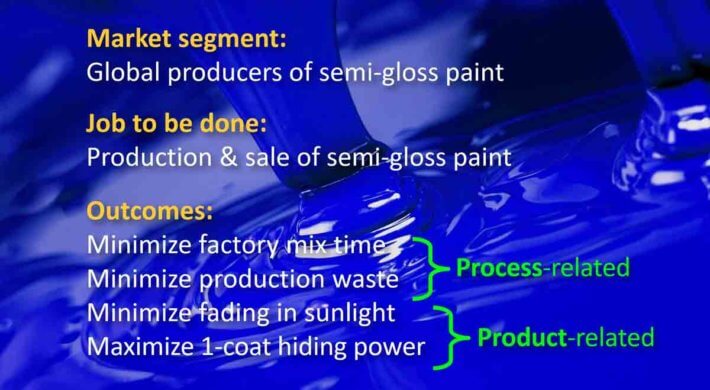

- Market segment: This includes an unambiguous description of the customer business type, geographic region, and point(s) in the value chain. Ideally, you provide evidence that customers in the market segment have similar needs.

- Job-to-be-done: What customer JTBD are you trying to improve? In B2B markets, you improve their process, and/or the products they sell. (See paint example below.) This JTBD provides the “boundaries” for your entire project.

- Outcomes: What’s preventing “perfection” in customers’ JTBD? These are the outcomes you might improve with your new product. You must uncover them, understand them, and prioritize the most important and unsatisfied ones.

- Value Proposition: A proper value proposition identifies which important, unsatisfied outcome(s) you’ll pursue with your new offering.

2. Drive out commercial risk in Stages 1 & 2

Your Stage-Gate process helps you reduce both technical and commercial risk. In B2B, your goal is to eliminate nearly all commercial risk before starting the Development Stage.

Imagine that all your projects had varying levels of technical risk, but virtually no commercial risk. Your R&D staff’s only question would be, “Can we find the technical means to achieve this product design target?” If they can, they’ll be confident of new product success, because they already know what customers want.

In B2B, your goal is to eliminate nearly all commercial risk before starting your development stage.

Is this farfetched? Perhaps it is for B2C. If you want to develop a new video game, snack food, or men’s suit, you’ll probably need to show customers a prototype. After they play with it, taste it or try it on, they’ll tell you what they liked and didn’t like.

But it’s completely different for B2B. Because B2B professionals have high knowledge, interest, objectivity and foresight, they can tell you their desired outcomes in an intelligent front-end conversation: “Help me speed up this production line… make my product more abrasion-resistant… lower labor costs here… reduce defect rates there.”

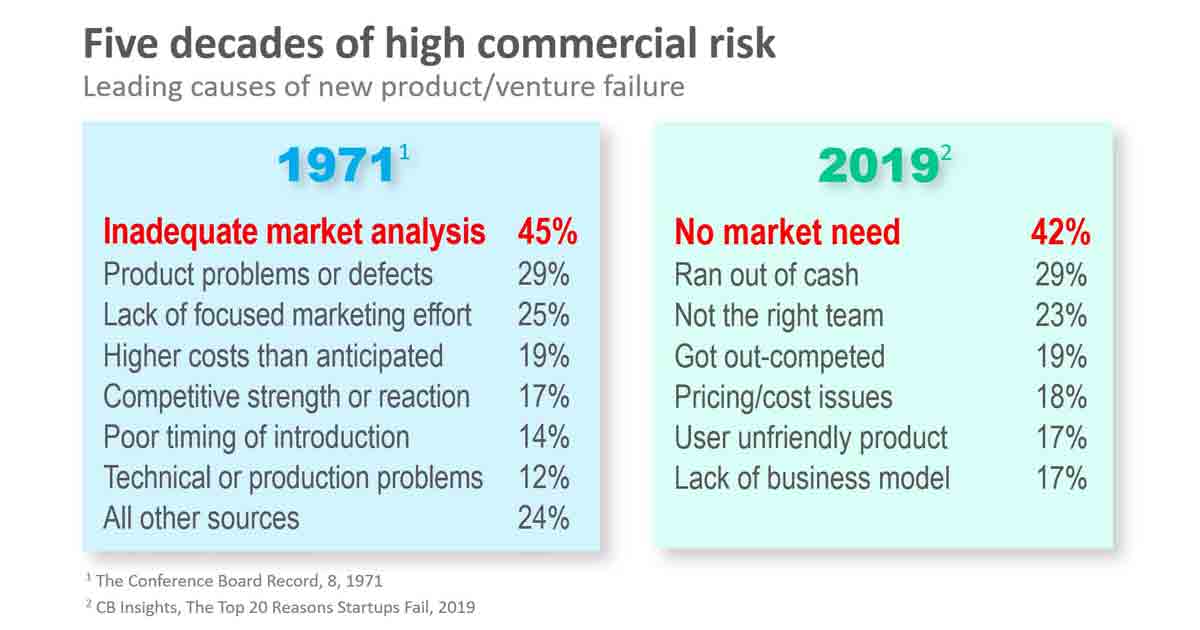

If B2B customers can tell you what they want very early in your Stage-Gate process, you don’t need to face much commercial risk, right? This is great news, because high commercial risk has plagued product development for at least five decades.

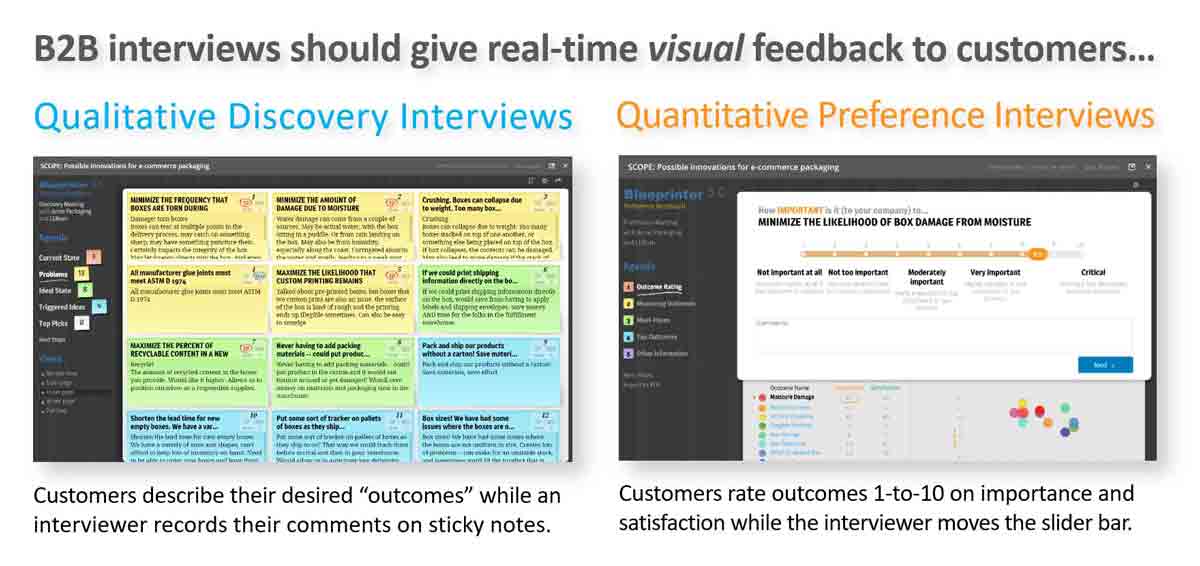

But how do you transfer these valuable customer insights from their brains into yours? First, conduct a round of qualitative Discovery interviews with customers. In this divergent phase, your goal is to find as many customer outcomes (desired end-results) as possible. You ask them to describe their problems and “ideal world.”

After you probe an outcome (on a sticky note you display for customers to see), you ask, “What else?” and move to the next one. Since you have no idea what they will say next, customers are leading the interview, not you. These interviews help you avoid errors of omission… failing to uncover unarticulated needs.

Since you have no idea what they will say next, customers are leading the interview, not you.

Then you conduct a round of quantitative Preference interviews, recording customers’ 1-to-10 importance and satisfaction ratings on key outcomes. This lets you converge on those outcomes customers are most eager to see improved… those rated high in importance and low in satisfaction. This helps you avoid errors of commission… choosing the wrong outcomes to pursue.

Your Preference interview data delivers a Market Satisfaction Gap chart. The more important and unsatisfied an outcome, the higher the Gap. Customers especially want outcomes improved with Gaps over 30%. For more, download Market Satisfaction Gaps.

This leads to our #1 recommendation for your B2B Stage-Gate process: Don’t start major development Stage work without evidence of customer needs. Without unbiased, unfiltered, quantitative evidence, you’ll continue to suffer unwarranted commercial risk.

You get to decide how much commercial risk to take on in your Stage-Gate projects. To incur very high commercial risk, simply guess what customers want. Is this nuts? Sure, but it happens all the time. Fortunately, you can do better.

For a little less commercial risk, ask your sales reps what customers want. As shown in this illustration, a range of behaviors follows, with each lowering commercial risk a bit more. The ultimate commercial-risk reducer is employing quantitative Preference interviews and their resulting Market Satisfaction Gaps.

Instead of “choose your own adventure,” this is “choose your own commercial risk.” Most B2B companies choose far too much commercial risk in their Stage-Gate projects, squandering valuable R&D resources and lowering new product success rates.

Instead of “choose your own adventure,” this is “choose your own commercial risk.”

Are these interviews worth the effort? Research by The AIM Institute shows they “greatly” or “significantly” impact teams’ product designs in five out six projects. Without these interviews, most teams would have developed very different products. For more, download the white paper, Guessing at Customer Needs.

3. Separate Opportunity Quality & Execution Quality

Imagine two project teams are holding their Stage-Gate Business Case reviews on the same day. The morning team gets a “no-go” decision for entering the Development Stage because Market Satisfaction Gaps from Preference interviews were all very low: Customers didn’t have any important-and-unsatisfied outcomes for the team to pursue.

The afternoon team gets a “no-go”, or “recycle” decision for very different reasons. They had a few customer discussions, but they were informal affairs with little probing depth. Furthermore, the team only met with familiar contacts at existing customers. They failed to interview customers’ customers, where the real action takes place in their market.

The morning team’s project was halted due to low Opportunity Quality, while the afternoon team was stopped due to low Execution Quality. Congratulate the morning team and reward them with the next important new project. Train the afternoon team.

Does your Stage-Gate process distinguish between these two no-go decisions today? It should.

Congratulate the morning team. Train the afternoon team.

You can develop metrics to display Opportunity Quality and Execution Quality for improved Stage-Gate decision-making. As shown above, management can quickly assess these for each team. On the left and right sides are examples of data you can capture in the front-end. By shining the light on Execution Quality metrics, you encourage continuous process improvement in your Stage-Gate process. Very few companies measure Execution Quality today.

One reason for this failure is that most companies don’t fully integrate their front-end work into the rest of their Stage-Gate process. Even if they conducted high-quality customer interviews, many of their valuable insights are unavailable in the rest of the process. When you fully integrate, though, three benefits become obvious:

- Improved search engine optimization (SEO): Consider product launches at the end of your Stage-Gate process. Today your product must be “findable” by prospects in internet searches. And this SEO in turn relies on selecting the right keywords to focus on. If you can quickly search your front-end customer interviews for the actual language they used, you’ll be more successful.

- Better portfolio decisions: How do you estimate technical and commercial risk when you decide which Stage-Gate projects to heavily resource? It’s a mistake to assess commercial risk by saying, “We think customers want this.” Better to have hard data from your front-end interviews, such as:

-

- Market Satisfaction Gap levels (indication of Market Needs)

- Number and type of customer interviews (indication of Insight Breadth)

- Interview time duration and probing word count (indication of Insight Depth)

- Greater team efficiency: If you connect front-end software tools (e.g. Blueprinter® software) to the software used in the rest of your Stage-Gate process, your teams will only have to enter data once. Most teams waste time with this double-entry work. They waste even more time preparing reports and presentations from scratch. Better to use well-designed tools that ensure your teams’ time is spent on high-value work only they can do.

4. Stop pushing the brake pedal

At the risk of sounding harsh, some business leaders could accelerate growth by staying home. The actions taken by these leaders are akin to pumping a car’s brakes, or—returning to our Stage-Gate Growth Machine analogy—deliberating adding sand to slow the gears. These leaders focus on first-order effects, and neglect second-order and subsequent effects.

Some business leaders could accelerate growth by staying home.

Maybe you’ve seen this: A business leader is worried about meeting the quarterly earnings target (first-order effect) and freezes spending. He or she fails to consider subsequent effects: Dozens of projects are slowed as teams wait to run tests, hire technicians, interview customers, etc.

This delays product launches and revenue streams, which leads to poor earnings growth. Now what does the business leader do? Freeze spending again?

Otherwise-clever business leaders repeat this over and over, tipping the first domino and ignoring the rest. They succumb to first-domino fixation, thinking only about immediate financial results. Sadly, most don’t learn from their experience.

In addition to first-domino fixation, leaders suffer from first-domino amnesia. Let’s say your business is struggling with poor earnings growth. How many times have you heard someone say, “Well the real problem is all those crazy spending freezes we did the last few years”? Never? This is first-domino amnesia.

In addition to first-domino fixation, leaders suffer from first-domino amnesia.

There are many ways a business leader can throw sand into their Stage-Gate Growth Machine. Collectively, you can think of this as “innovation friction”—the actions that turn exciting innovation into a slog.

Innovation friction includes travel bans… spending freezes… hiring delays… re-organizations… adding new assignments to over-worked employees… too many new initiatives… rapid-fire strategy changes… and so on.

This behavior makes no sense. Who needs competitors to slow us down when we do it to ourselves? For many companies, simply sheltering teams from innovation friction will dramatically improve organic growth from their Stage-Gate process.

Who needs competitors to slow us down when we do it to ourselves?

These are just four of the actions recommended in our e-book, 9 Actions to Supercharge your Stage-Gate® Growth machine. Truly, there is much potential to take your Stage-Gate process to the next level.

Learning more…

In the early 1980’s, Dr. Robert Cooper invented the Stage-Gate process, and later founded Stage-Gate® International (SGI). Who better to call on today when you’re ready to overhaul your Stage-Gate process? Consider the following ways SGI can help:

- For unrivaled research on new product development, visit Thought Leadership page.

- To see the many ways SGI can help you, visit their Professional Services page.

- Contact SGI to set up a private phone- or web-conference.

Since 2005, The AIM Institute has taught tens of thousands of professionals in the world’s largest B2B companies how to optimize the front end of innovation for B2B. Use these resources to move your company to greater market-facing innovation and growth:

- Visit www.newproductblueprinting.com & www.deriskprojects.com for videos & more.

- See how we train B2B professionals in VOC skills at www.blueprintingtraining.com.

- Contact AIM to set up a private phone- or web-conference.

Comments