Where else do you invest tens of millions of dollars in personnel, so that many can work diligently on answers to the wrong questions? If your firm is like most, one-half of your product development resources are working on projects that will be cancelled or fail to yield an adequate return. You can stop this innovation malpractice with the science of B2B customer insight. Specifically, you must stop projects from entering the development stage unless you have data-driven evidence of customer needs.

More in 2-minute video at 35. Insist on data-driven innovation

In concentrated B2B markets, the top ten buying accounts may represent 50-100% of the buying potential. Unlike B2C—with deep pools of potential prototype testers—B2B suppliers can wear out their welcome by lobbing sloppy “minimum viable products.” If you use Lean Startup, be sure to begin with proper B2B customer interviews.

More in white paper, www.leanstartupforb2b.com (page 7)

Years from now, we’ll think it quite strange that B2B companies explored market needs by launching products to see if anyone would buy them. In the future, B2B companies will have a complete understanding of market needs before they begin developing their products, let alone launch them. Want to start before your competitors?

More in white paper, www.b2btimingiseverything.com (page 5)

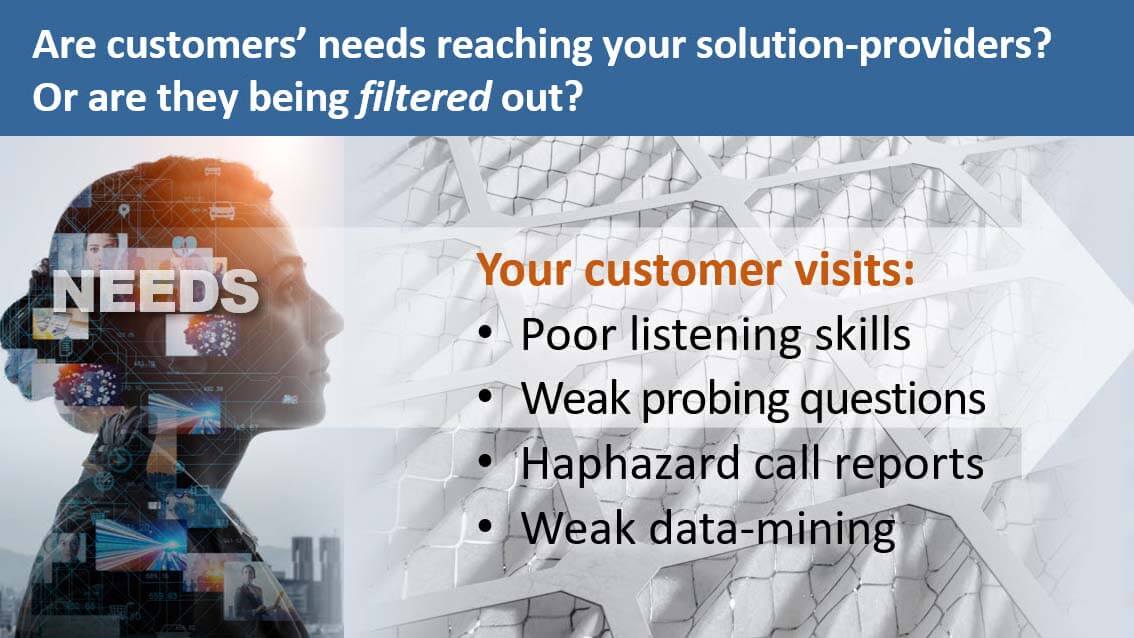

Every one of your B2B customers has needs… problems to be solved. What’s filtering them out, preventing your solution providers from understanding them? 1) Poor listening skills when your employees meet with them? 2) Few probing questions? 3) Haphazard call reports? 4) Weak CRM datamining? You can change all this when your customer-facing employees use Everyday VOC.

More in Everyday VOC white paper, www.EVOCpaper.com

Clever companies realize they’ll “hear what they want to hear” without quantitative VOC. To do it right, B2B companies should weight responses based on customer buying power. And don’t just ask for importance ratings: Ask for satisfaction ratings as well. The only hope for premium pricing is pursuing needs that are both important and unsatisfied. You can use something called Market Satisfaction Gaps to point you in the right direction.

More in white paper, www.marketsatisfactiongaps.com

If a stock’s P/E ratio is 20-to-1, then only 5 percent of a firm’s value is driven by this year’s earnings. Put another way, 95 percent of shareholder value is driven by investors’ expectations of the future. Executives with rich stock options have “motive and opportunity” to manipulate these expectations… in ways that often damage the firm’s long-term health.

More in 2-minute video, 5. Shareholder wealth is a poor goal

Think your VOC work is done if you can splash some pithy customer quotes on a PowerPoint slide? Nope. You must conduct quantitative interviews to isolate the important, unsatisfied outcomes (using 1-10 scales). We all “hear what we want to hear”… so unfiltered customer data is needed. Never spend development dollars until someone “shows you the numbers.” The most important numbers are something called Market Satisfaction Gaps.

More white paper, www.marketsatisfactiongaps.com