B2B Growth: Research on how to accelerate it

No one likes to be average—another word for mediocre—in something as important as growing their business. Of course, half of all businesses are below average in any given year. And few in the above-average ranks for B2B growth are confident they can stay there year after year.

This can change for your business. You can consistently achieve top-quartile growth for one simple reason: Most B2B companies are making dreadful, growth-limiting mistakes today. It will take focused and sustained effort by your leadership team, sure. But achieving impressive growth isn’t complicated. We’ll give you a clear roadmap for doing so as we cover these B2B growth topics:

- Why B2B growth seems hard

- Bad growth starts with a bad goal

- Good initiatives… or harmful distractions?

- Why the game changes for B2B vs. B2C

- Practical ways to understand B2B customer needs

- Saying goodbye to new-product commercial risk

- Research supporting better B2B customer insight

- New metrics for maintaining B2B growth

Most B2B companies are making dreadful, growth-limiting mistakes today.

Much of this article will focus on market-facing innovation, because this is central to rapid, profitable, sustainable B2B growth. If that was already obvious to you, don’t worry: We’ll explain how you can accomplish this… with complete confidence.

For many companies, innovation is like a medieval comet: rare, unexplained and unpredictable. That may remain the case for many consumer goods companies, but B2B companies can turn market-facing innovation into a repeatable science. We’ll explain how, but first we need to expose the faulty thinking that restrains growth.

1. Why B2B growth seems hard

If consistently delivering high B2B growth seems hard, it’s because you’re behaving like your competitors. Or—to put it less delicately—you’re making the same unforced errors as other B2B companies. Most companies compound this problem by adding a healthy dose of unhealthy optimism. Imagine the following.

Your leadership team is drafting next year’s operating plan and must forecast your growth for a market growing at 3%. Will your growth be less than, equal to, or higher than 3%? Higher, right? How about your competitors having similar meetings? Also higher than 3%? So all the suppliers serving a market will grow faster than the market? As TV psychologist, Dr. Phil, would say, “How’s that been working for you?”

And yet, leadership teams repeat this year after year without asking this critical question: Why do we think we can consistently beat our competition? Do we have brighter R&D… harder-working sales… more persuasive marketing?

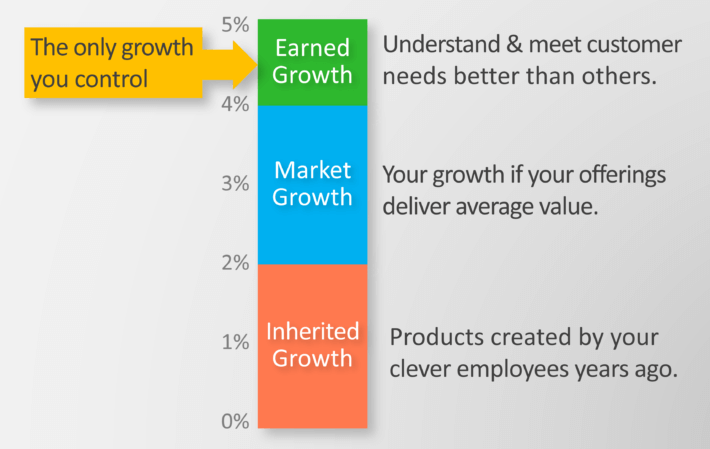

Underlying this misplaced optimism is a fundamental misunderstanding of B2B growth. Does this sound familiar: “Well, we grew at 5% last year, so let’s target 8% next year”? The leadership team didn’t realize only a small portion of that 5% growth was earned. You see, there are three components of growth concealed in financial statements:

- Inherited growth: This growth comes from products created long ago by your clever employees. Don’t count on this lasting forever.

- Market growth: This is the rising tide that lifts all boats. If a competitor creates a blockbuster, your tide goes out.

- Earned growth: This only occurs when you surpass competitors in meeting customer needs. This is the only B2B growth you can control.

Earned growth is often small, but you didn’t realize it because this reality was masked by unearned market and inherited growth. When you understand how small your earned growth is, it can be demoralizing. Indeed, B2B growth seems hard. But facing this hard truth and focusing on earned growth makes it easier to achieve real B2B growth.

2. Bad growth starts with a bad goal

Is the primary goal of your business to maximize shareholder wealth? Please change it. This became popular in the 1970’s, but thought leaders are now abandoning it. Jack Welch even called it “the dumbest idea in the world.” The reason is simple: Maximizing shareholder wealth is a lovely result but a lousy goal.

Maximizing shareholder wealth is a lovely result but a lousy goal.

Any goal you give your employees should be inspiring and actionable. Maximizing shareholder wealth is neither. If I’m your employee, I yawn when I see earnings per share results. Tell me to raise EPS this quarter, and I’m stumped. But inspire me to deliver value to customers and I know what to do. Perhaps I’ll tell my grandkids about the breakthrough innovation I helped create.

A good goal is to understand and meet customer needs better than others. It doesn’t take an advanced degree in economics to see why. When you deliver more value to customers than your competitors, your prices, profits and sales outpace theirs. Do this year after year and you enjoy rapid, profitable, sustainable B2B growth.

Will the analysts on Wall street notice? Will your stock price be rewarded? You bet. Over 90% of your stock’s value today isn’t based on this year’s results. It’s based on market expectations of future profits. And you’ve just convinced investors you know how to grow profits faster than your peers.

Warning: Putting a new goal in your PowerPoint slides won’t get the job done if leadership behavior doesn’t change. Yes, you’ve got to pay attention to this quarter’s financial results. But if those near-term results are more important than sustaining full-throttle market-facing innovation, better get comfortable with mediocre B2B growth.

The essence of good strategy is making tradeoffs: You need to decide what your real goal is. Amazon went seven years before turning a profit, and Wall street rewarded it. Might this bother some Wall street spectators for a while? Sure. But as Warren Buffet said, “Companies obtain the shareholder constituency that they seek and deserve.”

3. Good initiatives… or harmful distractions?

What initiatives are you pursuing in your business right now? Productivity increases? Quality improvements? Sales training? New tools? These initiatives may be helpful, but they won’t deliver rapid profitable, sustainable B2B growth. Only one thing can do that: Understand and meet customer needs better than others.

Let’s see why each fails to deliver rapid, profitable, sustainable growth:

- Productivity increases can improve profitability, but this doesn’t impact top-line growth at all… and you eventually reach a point of diminishing returns.

- Quality improvement was a differentiator a few decades ago, but today is simply the price of entry… and has little impact on sales demand.

- Cost reductions are like productivity increase, but sometimes with damaging impact on long-term B2B growth.

- Sales training can boost your revenue and lead to better pricing. But if you don’t keep delivering new value to customers, this runs out of steam.

- Customer intimacy is akin to sales training. They may love you, but B2B customers need new value from their suppliers to compete.

- Global expansion hits the revenue line and may boost profits. But we’re running out of developing regions to expand into.

- Acquisitions will boost your revenue and perhaps profits. But if you don’t know how to grow the companies you acquire, you’re just building a house of cards.

The common shortfall is a lack of sustainable, we-can-count-on-this-year-after-year growth. Not so with market-facing innovation. If you understand and meet customer needs better than others… your B2B growth will be rapid, profitable and sustainable.

These initiatives may be helpful… but they won’t deliver rapid, profitable, sustainable B2B growth.

I’ve heard many business leaders say, “We’ve been cutting costs (or another initiative), and now it’s time to focus on our growth.” This is flawed thinking. The one thing you should always focus on is market-facing innovation and the B2B growth it delivers. As Stephen Covey said, “The main thing is to keep the main thing the main thing.”

Don’t abandon initiatives like sales training or acquisitions. Just be sure everyone understands that market-facing innovation is the most important and constant initiative. Now how do you become amazing at market-facing innovation? Start by understanding your special B2B advantages.

4. Why the game changes for B2B vs. B2C

Wonder why this article is focused on B2B growth? Why not include business-to-consumer? The reason has nothing to do with you, the B2B supplier, but rather the nature of your B2B customers.

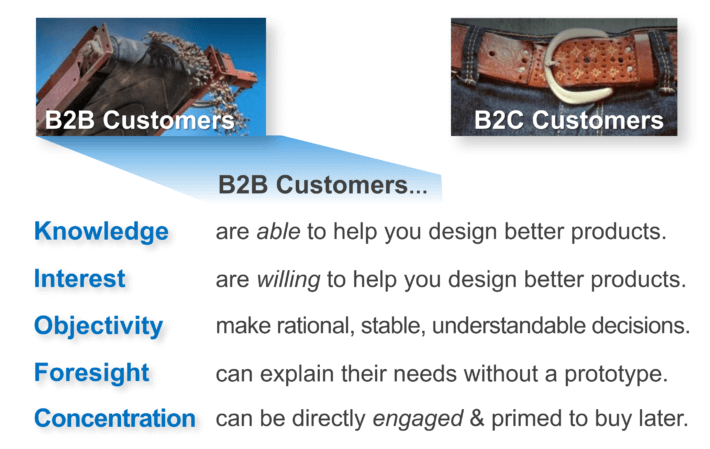

To understand this, observe the differences between developing conveyor belts for a company vs. dress belts for a consumer. B2B customers can usually offer more insight for five reasons.

- Knowledge: B2B customers—e.g., engineers, chemists, architects, and tradespeople—are knowledgeable, given their years of education, training, and time on the job.

- Interest: Your B2B customers know your new product could have a big financial impact, making them a hero at work. Consumer interest is so low you must pay them to attend your focus group.

- Objectivity: B2B buyers are usually rational, because they must be. They follow company procedures, make group decisions, and are held accountable for those decisions.

- Foresight: B2B customers are in business to make money, and can tell you the impact of increasing line speed, lowering labor costs, etc. They can explain the outcomes they want and why they want them.

- Concentration: B2B markets are more concentrated. A consumer-goods producer might have millions of buyers, but a B2B supplier has far fewer.

B2B buyers are usually rational, because they must be.

Why are these characteristics important to your innovation and B2B growth? If B2B customers are knowledgeable, they’re able to help you design better products. If interested, they’re willing to do so. If objective, they make rational, stable, understandable decisions. With foresight, they can discuss their needs before seeing your prototype. And if there are just a few customers, you can directly engage them… priming them to buy your product later.

If you’re trying to innovate and bring new value to a B2B market, these five advantages provide better customer insight and engagement. “Insight” means you can understand their needs before developing your new product. “Engagement” means customers will be eager to buy your new product, because they helped develop it.

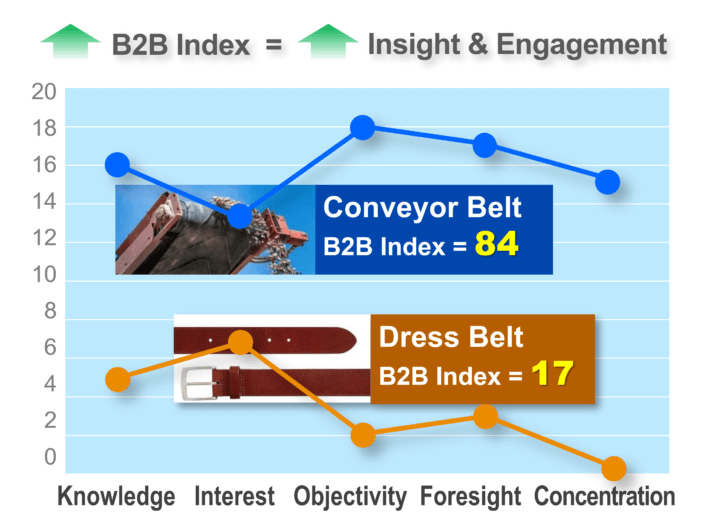

But just calling something B2B or B2C can be imprecise, and even misleading. If you ask me to buy a stapler for our office, it’s a B2B purchase. Yet my knowledge, interest, and objectivity will be quite low. Conversely, my knowledge and interest is high when I buy a new car as a B2C customer.

So here at the The AIM Institute we’ve created the B2B Index to measure your customer’s knowledge, interest, objectivity, foresight, and market concentration. The dress belt market might have a B2B Index (total score) of only 17. The market for conveyor belts might be 84, making it “very B2B.”

Why should you be pleased to serve a market with a high B2B index? You can have intelligent conversations to understand customer needs and “prime” them to buy your new product… both key to strong B2B growth. You can calculate your own market’s B2B Index by answering a few questions at www.b2bmarketview.com.

5. Practical ways to understand B2B customer needs

Do you agree you must understand and meet customer needs better than others to drive impressive B2B growth? If so, you might want to build capabilities in two areas:

- Understand customer needs: This is the work you do in the front-end of innovation. It’s learning the problem to be solved… the disease to be cured… the question to be answered with your new product.

- Meet customer needs: You do this work in the development stage, perhaps in a lab with R&D staff. Now you’re working on the solution to the problem… the cure for the disease… the answer to the question.

You need to be adept at both understanding and meeting customer needs, but where should you focus today? Easy. To maximize B2B growth, focus on understanding customer needs for two reasons:

First, it’s difficult to gain a competitive edge by meeting customer needs better than others… unless you think you can hire brighter R&D staff, or want to spend more on R&D. Since most B2B companies do an abysmal job of understanding customer needs today, they can quickly make huge upgrades here.

Second, you’re squandering your R&D investment if you haven’t first understood customer needs. Why develop a cure for no known disease? Get the “understanding” part right, and you automatically boost the efficiency and effectiveness of the “meeting” part.

Why develop a cure for no known disease?

So what do you actually do to understand customer needs, drive innovation, and boost B2B growth? You conduct B2B-optimized customer interviews. You do two rounds of these in each market segment you’ve targeted for innovation.

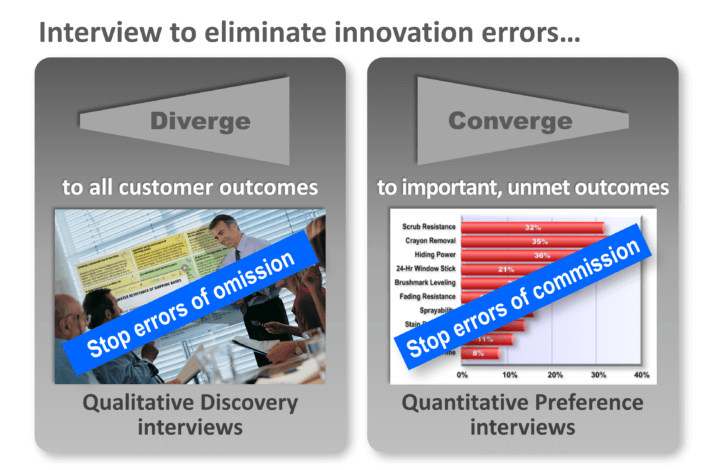

First you conduct divergent, qualitative Discovery customer interviews with several companies. Your goal is to uncover as many customer outcomes, or “desired end-results” as possible. You don’t know which outcomes to pursue yet. You just don’t want to overlook any.

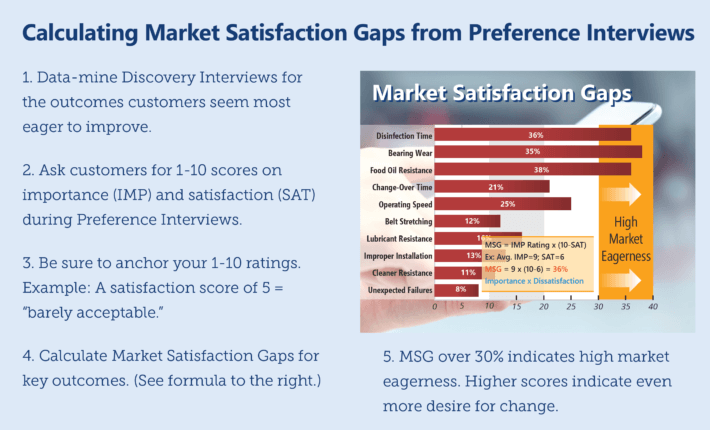

Then you conduct a round of convergent, quantitative Preference interviews. You’ll ask customers to rate several outcomes on a 1-to-10 scale for a) importance and b) their current level of satisfaction. You hope to find outcomes both important and unsatisfied today. This is all customers might pay a premium for, so you’ll focus on these outcomes in your new product design.

These interviews help you eliminate errors of omission and commission. An error of omission is failing to uncover unarticulated customer outcomes. No team is faulted for these, because they aren’t even noticed. And yet this error routinely suppresses B2B growth.

An error of commission is choosing the wrong customer outcome(s) to pursue in your new product design. We’ve worked with thousands of new-product teams around the world and have seen how incredibly common this error is. In the next section, we’ll explain how to confidently avoid it.

Consumer goods producers have certainly been known to conduct qualitative and quantitative interviews. But you can do much more in your B2B interviews, given the knowledge, interest, objectivity and foresight of those you’re interviewing. Here are some characteristics of B2B-optimized interviews:

1) Use your own team: Don’t send “hired guns” to interview. Take your own interview team and include a technical representative, so customers know they’re talking to someone who can innovate for them. Besides, you want your people to have these skills, since they have many routine customer visits every year.

2) Project your notes: Display customers’ comments on a screen or wall (or during a web-conference), so they can make corrections and “own” the conversation. You may want to use Blueprinter® software or similar with sticky notes that connote “idea generation.”

3) Drop the questionnaire: Never bore customers with a questionnaire or survey. How excited are you when someone comes to your front door asking you to complete a survey?

4) Let customers lead: After customers give you a desired outcome (a problem to be fixed or something they’d like to see), ask probing questions to understand it. Record their comments on a sticky note, and then ask, “What else?” as you move to the next note. This lets your customer discuss outcomes they care about.

5) Focus on the customer: Discuss only the customer’s job-to-be-done and their desired outcomes within this job… not your products.

6) Don’t discuss hypotheses: Don’t “lead the witness” to validate your concepts. Customers will sense you’re more interested in confirming your ideas than understanding their needs.

7) Trigger more ideas: Spark fresh thinking with “trigger maps.” For example, a map could display trends potentially impacting the customer’s future. This helps generate more outcomes.

8) Listen & probe skillfully: Signal your interest and learn more by recapping, appreciating silence, making affirming comments, asking open-ended questions and probing thoughtfully.

6. B2B growth means saying goodbye to new product commercial risk

Are you a risk taker… a thrill-seeker who loves to gamble with millions of R&D dollars? If not, you can easily eliminate most unwarranted risk and “aim” your R&D better for stronger B2B growth.

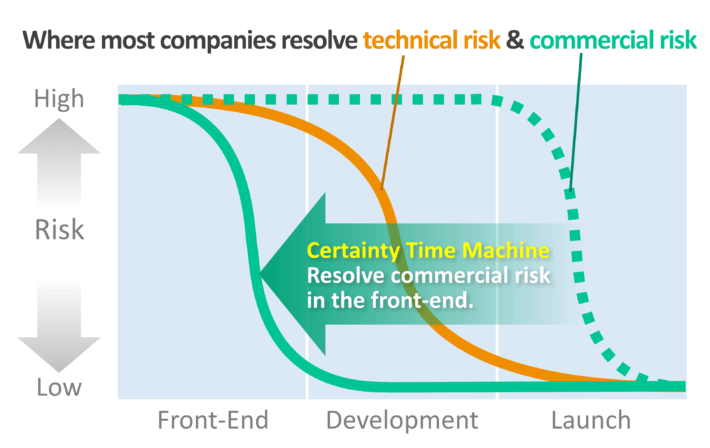

Consider two types of risk… technical and commercial. Which causes most new product failures? For five decades, research has provided the same answer: The leading cause of new product failure is inadequate understanding of market needs. Commercial risk is probably your biggest block to innovation success and B2B growth.

The leading cause of new product failure is inadequate understanding of market needs.

When do you lower technical risk… in the front-end, development or launch stage? Your R&D does this in the development stage, right? After all, you wouldn’t launch your product hoping it works.

How about commercial risk? Most companies don’t resolve this until the launch stage. They launch their product at customers, hoping they’ll buy it. Not sure about that? Perhaps you’ve heard this conversation:

Q: “Hey, Joe, how’s your new product looking?”

A: “Don’t really know yet. We’ll launch it next month and find out.”

You can do much better. You can eliminate most commercial risk in the front-end. You do this by conducting deep, B2B-optimized customer interviews before the development stage. It’s like building a “certainty time machine.” Virtually everything you need for eliminating commercial risk is as knowable in the front-end of innovation as it is later.

If you’re serious about eliminating this commercial risk, you must conduct quantitative interviews, such as Preference interviews. You ask customers to provide a 1-to-10 rating for importance and current satisfaction. You average these results for your target market and calculate Market Satisfaction Gaps for outcomes as shown below.

If you don’t do this, you’re inviting unwanted confirmation bias… the tendency to seek and interpret data in a manner that supports your preconceived views. This is death to successful innovation and B2B growth, as team members hear what they want to hear, and business leaders favor their pet projects.

7. Research supporting better customer insight for B2B growth

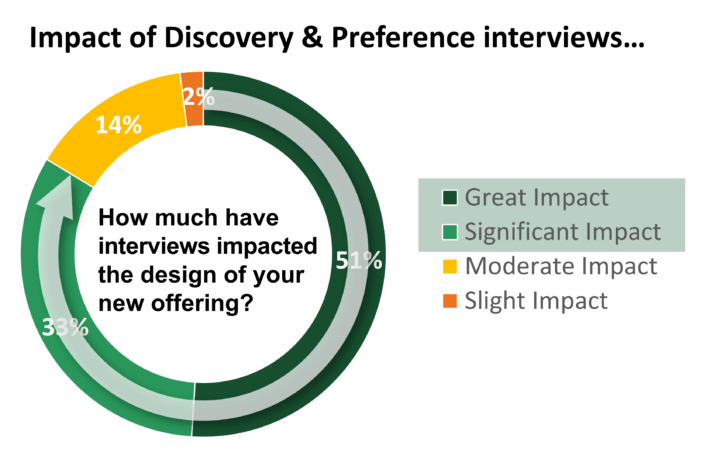

Our research shows just how impactful these B2B-optimzed interviews can be: 50 new-product teams began their projects with ideas of what their markets wanted. Then they conducted Discovery and Preference interviews. Our research question was, “How much have these interviews impacted the design of your new offering?”

We were surprised to see 84% said the impact was great or significant. Without these interviews, the teams would have probably developed different products, offerings less responsive to real market needs. Think of it this way: Today five out of six of your teams probably don’t fully understand market needs.

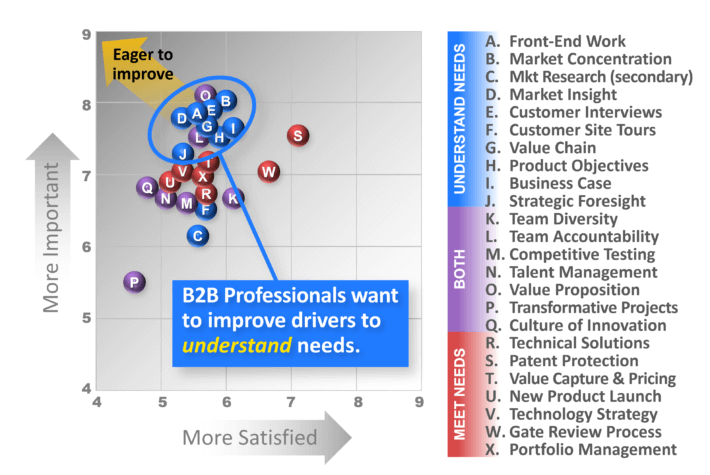

We’ve made a big deal out of understanding customer needs to drive B2B growth. Is this view shared by others? In fact, our research shows it is. We surveyed 540 B2B professionals with over 10,000 years of combined experience. We asked them to rate 24 growth drivers for promoting profitable, sustainable B2B growth.

We surveyed 540 B2B professionals with over 10,000 years of combined experience.

The results are shown below. The more important and less satisfied these professionals were with their company’s proficiency, the more eager they were to improve a growth driver. As you see, they overwhelmingly want to improve growth drivers that help their company understand customer needs (blue markers).

These results were consistent for management, marketing, technical and sales functions alike. And they didn’t change for large vs. small companies, public vs. private, or even type of B2B industry. You can download this research report at www.whatdrivesb2borganicgrowth.com. You can also benchmark your own business against others on these same 24 growth drivers at www.b2bgrowthdiagnostic.com.

8. New metrics for maintaining B2B growth

If what we’ve covered seems logical, even obvious, you might wonder why B2B companies struggle so much. The main problem is short-termism. Business leaders are under intense pressure to deliver short-term results, which distracts them from building the capabilities needed for healthy B2B growth.

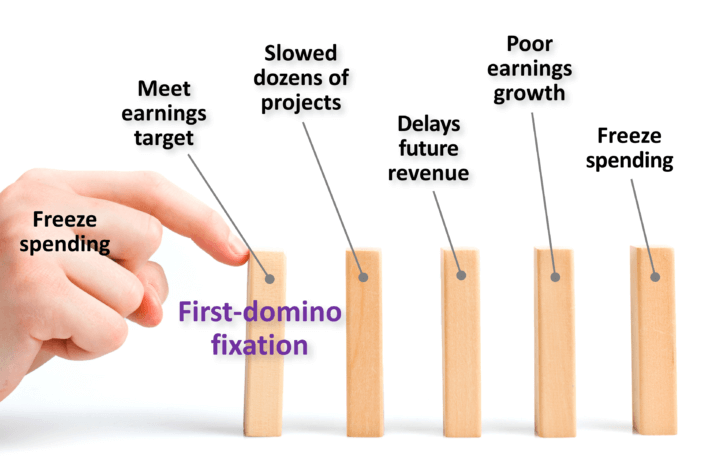

Not only that, but many of their short-term actions are at odds with long-term growth. To “make the numbers” this quarter, they institute travel bans, hiring delays, spending freezes and so on. Unfortunately, any first-order effect will always have a second-order effect. So you may think you’re tipping just one domino, but there are always more dominos about to tumble.

Imagine you freeze discretionary spending. Great, you meet this quarter’s earnings target. But this slowed dozens of new-product projects as teams waited to run outside lab tests, hire a technician, interview customers, and so on. Product launches are pushed back, which delays future revenue, leading to poor earnings growth. Now what do you do? How about freezing discretionary spending?

The greatest suppression of a business’s growth is often the prior handiwork of its leaders.

Business leaders who are otherwise quite clever often suffer from first-domino fixation. And most don’t learn from their experience. Let’s say you’re lamenting your poor earnings growth. Have you ever heard someone say, “Well the problem is all those crazy spending freezes the last few years”? I call this first-domino amnesia. Turns out the greatest suppression of a business’s growth is often the prior handiwork of its leaders. Truly, some businesses would grow faster if their leaders stayed home.

The top priority of any business leader should be this: Leave your business stronger than you found it. Short-term financial results and stock price increases matter not if a leader degrades his or her business’s ability to grow in a healthy fashion. And while many might agree with this, we need more than good intentions to overcome the tyranny of the urgent near-term. We need new metrics to ensure behavior leading to rapid, profitable, sustainable B2B growth.

Truly, some businesses would grow faster if their leaders stayed home.

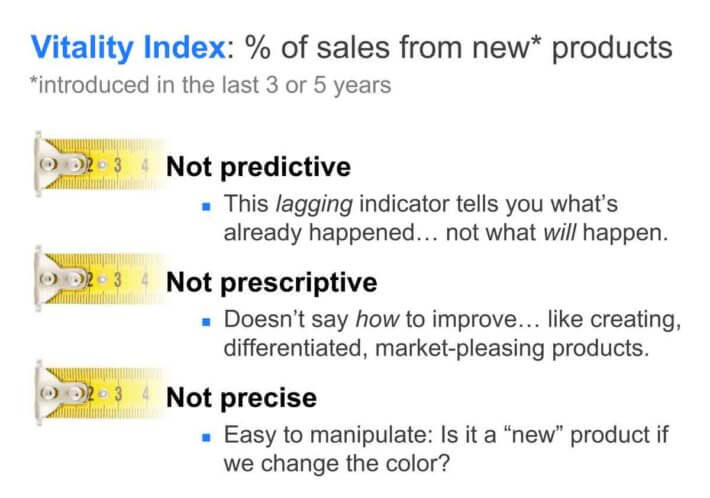

Today the most common innovation metric is the Vitality Index… the percent of sales derived from new products. But it has shortcomings: As shown below, it’s not predictive, prescriptive or precise.

Don’t supplant your Vitality Index. Supplement it. What you need is a metric that is…

- Leading… doing more of this leads to growth.

- Actionable… something that employees can make happen.

- Benchmarkable… letting you compare year over year, and to other companies.

- High Impact… where improvement will significantly drive growth.

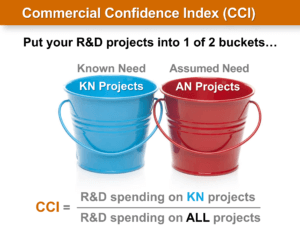

We suggest a new metric to drive B2B growth we call the Commercial Confidence Index: It helps you stop squandering R&D due to unwarranted commercial risk. As discussed earlier, Market Satisfaction Gaps tell you which outcomes customers want you to work on. If a project team has Market Satisfaction Gap data, it’s a “Known-Need” project… because you’ve eliminated confirmation bias, guessing, and internal filtering.

To calculate your CCI, put all your R&D projects into one of two buckets: 1) “Known-Need” projects, and 2) everything else, which we’ll call “Assumed Need” projects. Your CCI is simply your R&D spending on Known-Need projects divided by all R&D spending.

Let’s try an example. Your R&D product development spending this year is $10 million. You have Market Satisfaction Gap data on four of these projects, each of which consumes $1 million of R&D. Your CCI is 40%. Can you imagine the dialogue that occurs when you first introduce this?

- Comment: “But I have no idea what my CCI is!”

- Response: “So you’re not sure if customers really want what you’re spending millions on?”

- Comment: “OK, I’ve figured out my CCI now, but it’s… uhmm… zero.”

- Response: “I understand, but what will it be next year, and the year after?”

- Comment: “This is going to take extra resources to figure out Market Satisfaction Gaps.”

- Response: “Could you use some resources now being wasted when you guess at customer needs?”

As this metric takes root in your company, it will become obvious which businesses are guessing at customer needs and which know customer needs. It won’t happen overnight, but more and more emphasis will be placed on understanding customer needs… so you can meet them far better.

There’s no shortcut to rapid, profitable, sustainable B2B growth. But it’s not complicated either. All the methods described here have been learned and applied by others. Eventually most B2B companies will conduct business this way, or at least try to. But like the earlier quality and productivity waves, this could take decades. Just as Toyota out-competed Chrysler in the quality wave, so you can take the lead in market-facing innovation in your industry. That’s how you get top-quartile B2B growth.

We’ve covered a lot of ground in this article. But there’s even more for those who wish to master B2B growth. We’ve created a complimentary e-book for business leaders called the Leader’s Guide to B2B Organic Growth, which covers 30 lessons. You can even sign up to receive a new lesson each week in a 2-minute video format at www.leadersguidevideos.com.

It’s an exciting time to lead a B2B business. While it may seem odd to revel in how poorly B2B growth is handled today, it gives you an opportunity to stand out. To deliver the B2B growth that says you’ve mastered your craft. Growth that more than satisfies investors. And most important in my view, growth that provides stable and rewarding careers for your employees. That’s the kind of growth I wish for you.

Comments