With a high-certainty project, you can accurately predict your financial profits. With an uncertain project, you face significant potential downside and upside profits. In B2B markets, you can understand the downside very early. You’ll kill the project cheaply if the downside cannot be eliminated. And reap big upside profits if it can.

More in white paper, Innovating in Unfamiliar Markets (page 5)

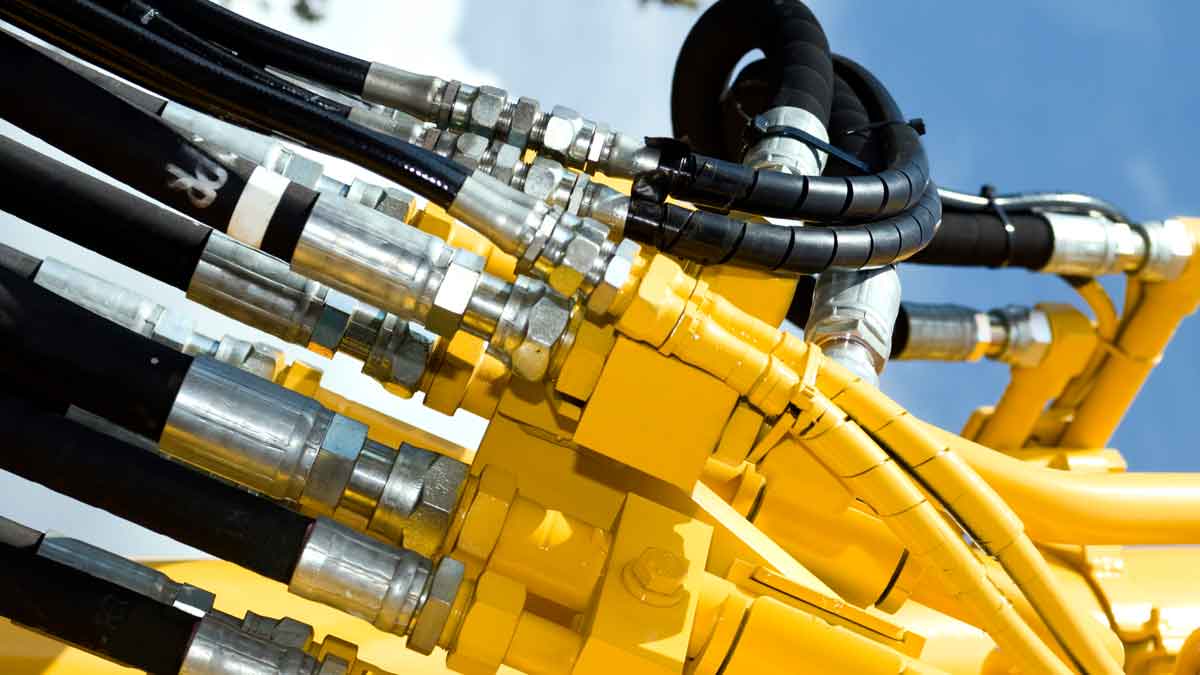

You can have an intelligent, peer-to-peer conversation about pressure ratings, fluid specifications, etc. And expect greater B2B interest vs. B2C, since your innovations can help the hydraulics engineer become a hero with his next new product. Without innovative suppliers like you, his path to recognition is a difficult one. The more you understand B2B vs. B2C, the more you can “take advantage of your B2B advantages.”

More in white paper, B2B vs. B2C

The “Build-Measure-Learn” cycle in Lean Startup begins with a hypothesis, and is great for B2C. End-consumers can seldom tell you what will amuse them or increase their sense of self-worth. But knowledgeable B2B customer can predict their desired outcomes. So start with a “Learn” pre-step. Customers will tell you all you need if you know how to ask.

More in white paper, Lean Startup for B2B (page 3)

B2B companies have huge advantages over B2C, but they may not be obvious. After all, didn’t the same fellow who bought a rail car of soda ash also buy a can of soda pop? Nope. He changed… a lot. B2B customers are more technically savvy, objective, supplier-dependent, and can predict their needs. Careful reflection of these differences leads to different approaches.

More in 2-minute video at 15. Put your B2B advantages to work

Steve Jobs quoted Henry Ford, who said, “If I had asked people want they wanted, they would have said faster horses.’” But these men were end-consumers themselves, so they understood their markets. Most B2B suppliers, typically have much to learn about customer desired outcomes… and B2B customers are willing and able to tell them.

More in 2-minute video at 18. Avoid the faster horse fallacy

You can ask for pricing decisions using a survey, e.g. Van Westendorp. But it’s hard to get a straight answer in concentrated B2B markets: They know they’ll be negotiating prices later. Better to understand the customer’s world so well you can create a value calculator… to model their pricing decision-making. You’ll have longer-lasting insights vs. a one-time survey.

Traditional VOC relies on questionnaires, tape recorders and post-interview analyses. That’s fine for B2C, but your B2B customers are insightful, rational, interested and fewer in number. They’re smart and will make you smarter if you engage them in a peer-to-peer fashion, take notes with a digital projector, skillfully probe, and let them lead you.

More in 2-minute video at 14. Understand your B2B advantages

Within every new product initiative, we must create a product spec. As a result, engineers need to know what to “build to.” Meanwhile, modern innovation methods begin with customer needs as the input to the process, leaving an important, and too-often unanswered question, “How do we get from a customer need to a product specification?” ... Read More

Modern “Jobs-to-be-Done” (JTBD) thinking began with the most popular HBR article ever written: Ted Levitt’s “Marketing Myopia.” It begins this way: “Every major industry was once a growth industry. But some that are not riding a wave of growth enthusiasm are very much in the shadow of decline. Others, which are thought of as seasoned ... Read More

Research shows the best way to sell a product is to probe customers’ needs. But why wait until the product is developed? If you probe beforehand, you’ll create a better product and “pre-sell” your product. This isn’t practical for interviewing millions of B2C toothpaste buyers, but it is for concentrated B2B markets. B2B engagement skills aren’t difficult. Do you have them?

More in 2-minute video at 29. Engage your B2B customers

It may be OK for consumer goods producers to guess their customers’ needs. After all, their product developers are end-consumers themselves. So if you’re an Apple engineer, you already know what consumers like you want in a mobile phone.

But your B2B customers know much more than you about their needs. If you make pigment, your customers know a lot more than you about the paper production it’s used in. Isn’t it silly to guess their needs when they’d love to tell you… if you asked the right way? That’s why you need to let the customer lead the interview, not you. Yep, you can put your questionnaire or interview guide away now.

More in e-book, Reinventing VOC for B2B

What single new practice can drive your company’s long-term organic growth more than any other? Hint: Few companies do this today, but that’s changing… and someday this will likely be a common practice. The answer: The disciplined use of Market Satisfaction Gaps (MSG) as a required “admission ticket” for entering the costly product development stage. ... Read More

We see three common shortcomings with B2B product launches: 1) Low-quality front-end work: Suppliers develop the wrong product, so even the best launch is just putting lipstick on a pig. 2) Poor linkage between stages: The launch is not driven by what was learned in the front end. 2) Out-dated promotional tools: This includes poor selection of the many traditional and digital tools available today. It helps to follow these 4 steps: The Right Product delivered to the Right Market using the Right Message through the Right Media.

More in 2-minute video, Launch new products with power

In our white paper, B2B vs B2C: Organic growth implications for B2B professionals, we cover 12 differences between suppliers to B2B vs. consumer goods markets. Is this just an academic exercise? Not at all. Every one of these differences has implications for organic growth. The news gets better if you’re a B2B supplier: Nearly all these differences are advantages in your favor. Of course, an advantage is no advantage if you don’t take advantage of it. This white paper will show you how.

Also see the 2-minute video, Understand your B2B advantages