Many companies think they have learned about customer needs when they visit customers to validate their hypothesis or potential solution. They have not. They have learned about market reaction. To a single idea. Their idea. On top of this, it’s likely this customer reaction was distorted by confirmation bias.

More in white paper, www.b2btimingiseverything.com (page 15)

Every one of your B2B customers has needs… problems to be solved. What’s filtering them out, preventing your solution providers from understanding them? 1) Poor listening skills when your employees meet with them? 2) Few probing questions? 3) Haphazard call reports? 4) Weak CRM datamining? You can change all this when your customer-facing employees use Everyday VOC.

More in Everyday VOC white paper, www.EVOCpaper.com

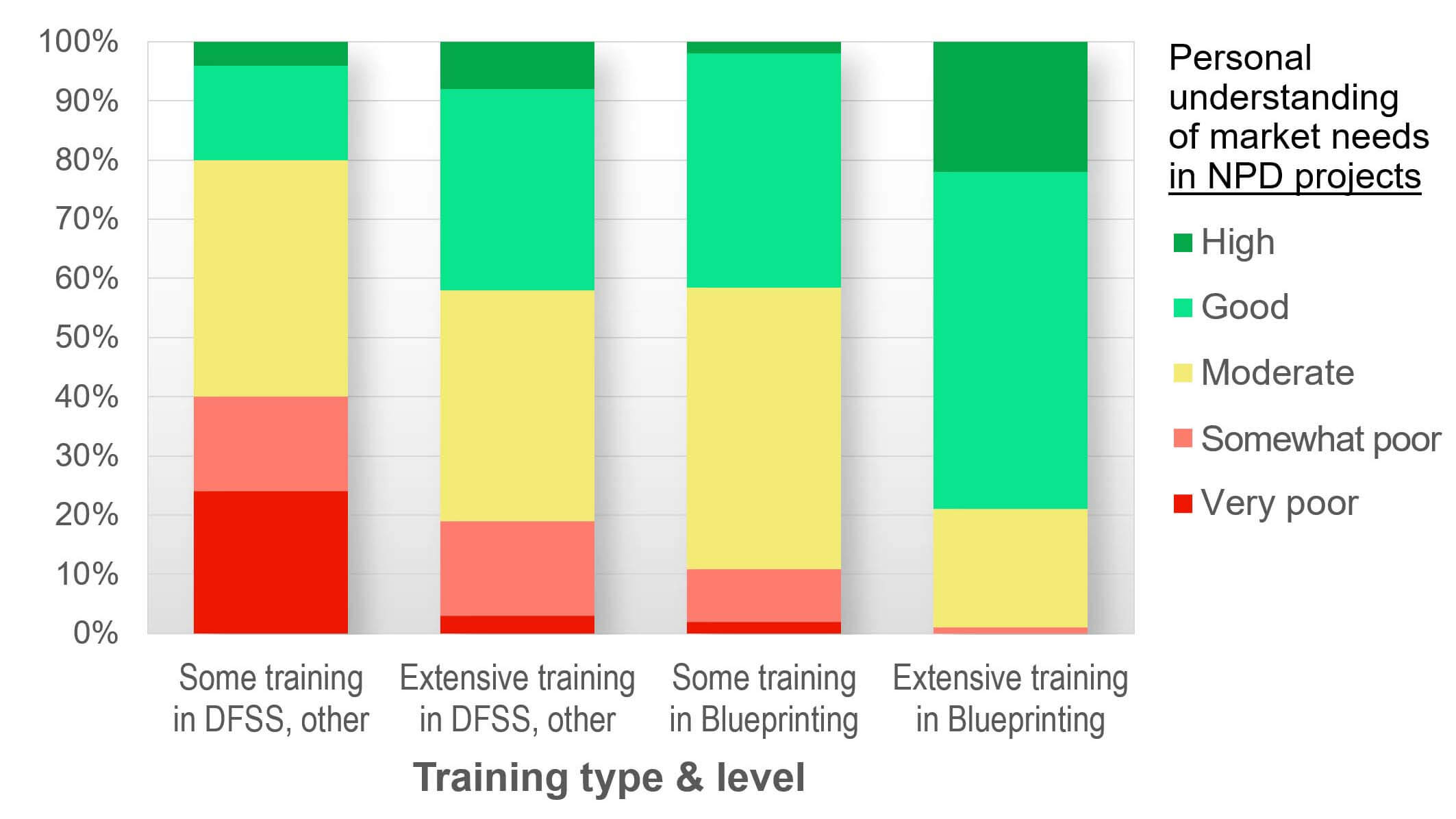

We studied this question in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. We grouped respondents into 4 groups depending on their type of training (New Product Blueprinting or Other) and level of training (Extensive or Some).

Respondents also reported their typical new product success rates: Only 20% of those with “Some” training in “Other” methods had new product success rates over 50% (green in chart). But 80% of those with “Extensive” New Product Blueprinting training were “in the green.” Just think: Instead of one-in-five employees having successful new product track records, you could move to four-in-five with such training.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

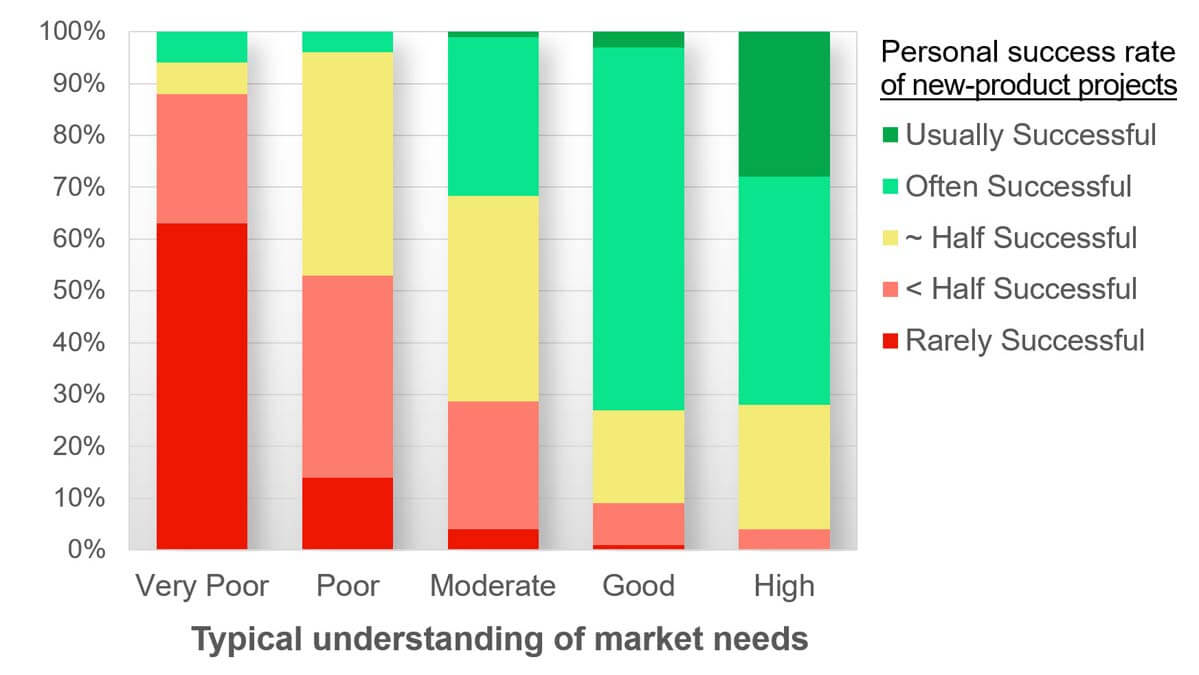

This was a question we studied in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. Some respondents reported a “poor” understanding of market needs while other reported a “good” understanding.

We were surprised at the difference in the two groups’ typical new product success rates: Only 5% of the former group (with poor market understanding) reported their new products were successful over half the time. But 70% of the “good market understanders” reported better than average new product success rates. So instead of hiring more R&D, your shortest path to successful new products might be to understand market needs better.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

Do you want to think only about your next move, or think five moves ahead? Here’s a 5th order plan to maximize shareholder wealth: 1st Order: Develop superior customer insight capabilities. 2nd Order: Understand market needs better than competitors. 3rd Order: Develop high-value products focused only on these needs. 4th Order: Sustain superior growth from these products. 5th Order: Impress shareholders with your proven growth track.

More in article, Stop Stifling B2B Organic Growth with 2nd Order Effects

Imagine you just launched your new product and the market responded with… one big collective yawn. Was it a poorly orchestrated launch? Perhaps, but it’s more likely your launch was doomed a couple of years earlier by poor front-end work. Our research shows five of six B2B product development teams lack a clear understanding of market needs before conducting B2B-optimized VOC. Without this insight, your launch might be putting lipstick on a pig.

More in article, B2B Product Launch: How to get it right

Many companies think they have learned about customer needs when they visit customers to validate their hypothesis or potential solution. They have not. They have learned about market reaction. To a single idea. Their idea. On top of this, it’s likely this customer reaction was distorted by confirmation bias.

More in white paper, Timing is Everything (page 15).

Problem 1—What’s the right question?—focuses on market needs. Problem 2—What’s the right answer?—is all about your solutions. Most companies put 90+% of project spending into Problem2, yet Problem 1 causes most new product failures. Hmmm… are you sensing a possible competitive advantage here? Will you explore it further? Will you seize it?

More in white paper, Catch the Innovation Wave (page 4).