Technology development is science-facing and converts money into knowledge. Product development is market-facing and converts knowledge back into money. Both are critical, but don’t confuse them. And never do any product development until you have quantified, unbiased, unfiltered data on customer needs.

More in white paper, Commercialize technology in six foolproof steps

If your new product development process does not require customer interviews today, consider two questions: 1) Do I have competitors beating me to the new product punch because they are using such interviews to uncover market needs? 2) Could I leapfrog them by building a company-wide competency of B2B-optimized interviews?

More in e-book, www.reinventingvocforb2b.com

You have to deliver important value that customers cannot get anywhere else. If customers can get this same value from just one other supplier, they’ll use it as leverage for lower pricing. So the difference between delivering new value and matching existing value is the difference between raising and lowering market pricing.

More in white paper, Catch the Innovation Wave (page 8)

Three conditions must be met: 1) A market segment (cluster of customers with similar needs) is clearly defined. 2) The segment is worth winning in terms of size, growth, profit potential, etc. 3) The segment is winnable, i.e., it’s not defended by a well-entrenched competitor. Overlook these conditions and you’ll waste resources. Great market segmentation is key to successful innovation.

More in 2-minute video at 16. Segment by markets for innovation

Picture this: A customer tells your sales rep what they want, who hands it off to your R&D. This clever customer tells your competitors the same thing. Terrific. If more than one supplier crosses the finish line, you can forget any price premium. Try this: You choose the race conditions by targeting an attractive market, and exploring its needs better than competitors. This is one reason why market-facing innovation is superior to customer reactive innovation.

More in 2-minute video at 16. Segment by markets for innovation

Traditional VOC relies on questionnaires, tape recorders and post-interview analyses. That’s fine for B2C, but your B2B customers are insightful, rational, interested and fewer in number. They’re smart and will make you smarter if you engage them in a peer-to-peer fashion, take notes with a digital projector, skillfully probe, and let them lead you.

More in 2-minute video at 14. Understand your B2B advantages

After presenting conclusions from months of VOC research, a marketer’s boss said, “No… I think customers want this instead.” A terrible reaction, but why did it happen? The marketer had no hard data—just quotes, impressions and anecdotes. You’ll be more believable, confident and correct—with unfiltered, quantitative customer data.

More in 2-minute video at 27. Quantitative interviews are a must

Cross “interview guide” off your packing list and add “digital projector.” The former indicates you—not the customer—will be guiding the interview. Not good. Project your notes and let the customer tell you their next problem or ideal state: You’ll learn what you didn’t know you didn’t know, they’ll correct your notes, and they’ll be much more engaged.

More in 2-minute video at 29. Engage your B2B customers

Companies like to talk about the voice-of-the-customer, but most just listen to themselves as they create “conference room” products. The team gathers internally to decide for the customer what they’ll want in a new product. This team will always lose to the team that immerses itself in the customer experience, and designs a product to improve that experience.

More in 2-minute video at 22. Immerse your team in customer outcomes

Do you like to answer surveys at home? How about at work? How do you think customers feel about filling in your questionnaire? Forget your list of brilliant questions. Instead, learn to brilliantly probe whatever customers want to tell you. You’ll be rewarded by customers who actually want to talk to you.

More in e-book, www.reinventingvocforb2b.com (page 2)

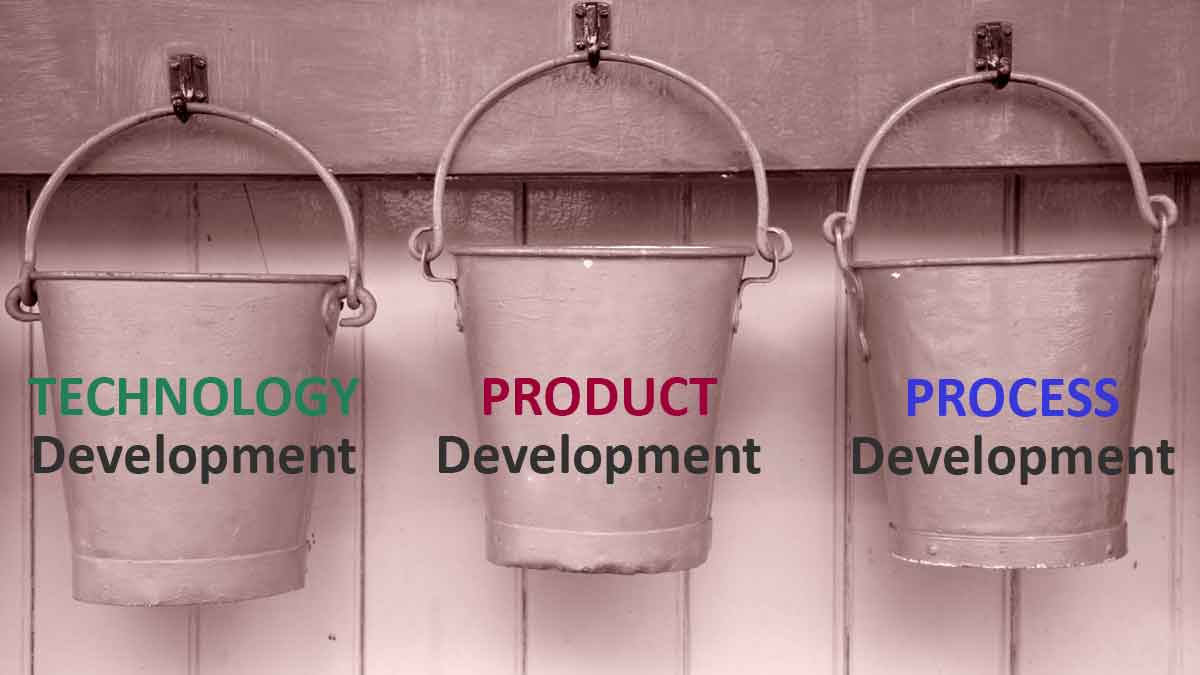

If you ran a zoo, you’d keep your jungle animals and farm animals in separate enclosures, right? Your technology development projects are untamed, jungle animals: You don’t completely understand them, and you’re not sure what they’ll do or where they’ll go next. Your product development projects are predictable farm animals. You know what they’re supposed to do, and who they’re supposed to do it for.

When you commercialize technology, you are “domesticating” wild animals for productive purposes. As a first step, you must be crystal clear which type of project your scientists or engineers are working on at any point in time. Remember, technology development turns money into knowledge; product development turns knowledge back into money. You can learn more from this white paper, Commercialize technology in 6 foolproof steps.

More in this 2-minute video, How to pursue transformational projects

Bucket #1 is Technology Development… science-facing innovation that turns money into knowledge. Bucket #2 is Product Development… market-facing innovation that turns knowledge back into money. Bucket #3 is Process Development… optimizing the production of existing products to make money more efficiently. Don’t focus on customer needs for Bucket #1 (it’s too early) or #3 (it’s too late)… but do this very well for Bucket #2. In the entire money-making process, this is your greatest point of leverage today.

More in article, Target Customer Needs and Win

Do you clearly distinguish between technology development and product development? Technology development is science-facing, while product development is market-facing. Technology development turns money into knowledge, and product development turns knowledge back into money. Keep technology and product development separate if you want to avoid confusion and inefficiency. Milestones on a Gantt chart are great for product development, but good luck scheduling technical breakthroughs in your lab.

More in article, Timing is Everything (p6).

Market Satisfaction Gaps (MSG) come from teams’ quantitative interviews, and are reliable evidence of which outcomes customer do—and do not—want “fixed.” When you require MSGs as the “admission ticket” for projects to enter the costly product development stage, 3 things go away: 1. Confusion (misunderstanding customer needs and their priorities), 2. Bias (altering customer needs to better fit our pre-conceived solutions), and 3. Filtering (cherry-picking customer needs to match those we hoped to hear.)

More in article, Market Satisfaction Gaps… your key to B2B organic growth