The Vitality Index measures the percent of revenue from new products. But you should also track the Profit Vitality index… your percent of gross profits from new products. It avoids the problem of people gaming the Vitality Index by calling a product “new” when it’s just a “tweak’ that delivers no added value.

It’s immaterial what you think of your new product. All that matters is what your customers think of it. If they see new value, they’ll pay a premium and you’ll see higher profit margins. If you’re truly innovating, your profit vitality index will be higher than your revenue vitality index. If that’s not the case, your newer products are providing less differential value to customers than your older products. Probably something you should know, right? See the white paper, New Innovation Metrics.

More in 2-minute video, Employ new growth metrics.

We’ve teamed up with Stage-Gate® International to bring you a new e-book, 9 Actions to super-charge your Stage-Gate growth machine. In this article, we’ll explain some actions you can take right now to turn your gated process into the growth machine it was meant to be. First, some credit where credit is due: Dr. Robert ... Read More

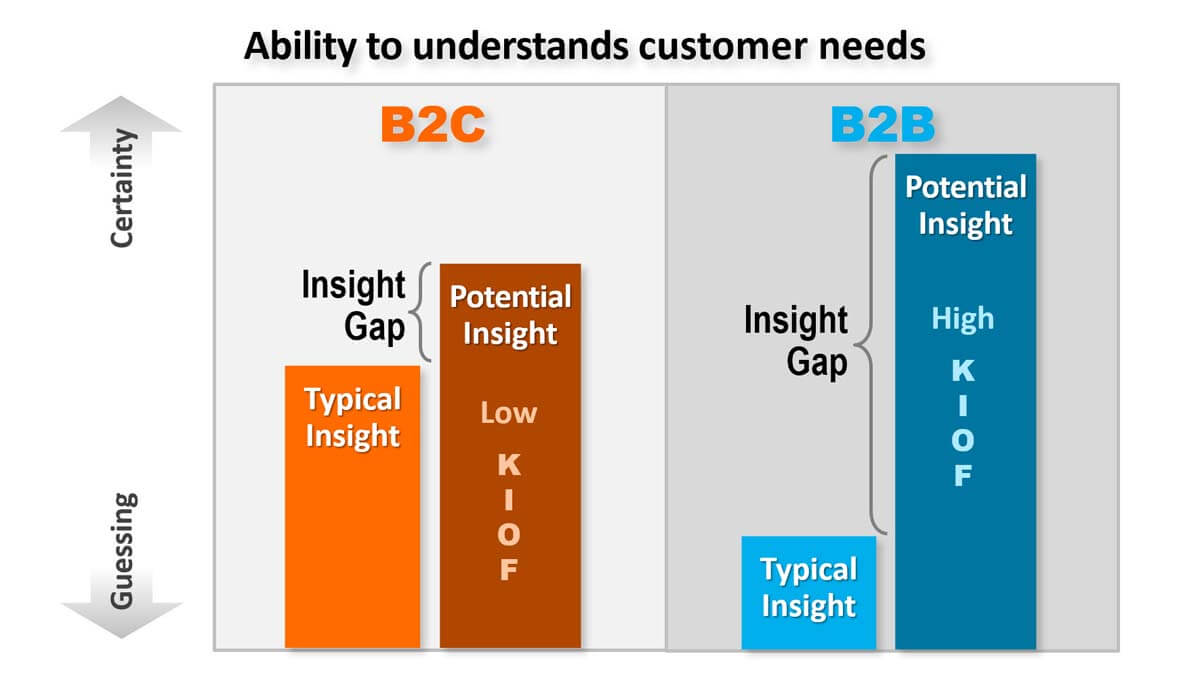

The Customer Insight Gap is the difference between what suppliers typically understand about customer needs… and what they could potentially understand. This Gap is usually small for consumer-goods suppliers (B2C): Typical insight is high since their employees are consumers themselves and understand customer needs. At the same time, potential insight is low, because end-consumers often struggle to articulate their true needs.

The Gap is huge for most B2B suppliers: They know less about their customers’ world, but these customers could tell them much, given their Knowledge, Interest, Objectivity & Foresight (KIOF in chart). For more, watch this 2-minute video, Understand your B2B advantages. If you learn how to close the large B2B Insight Gap, you’ll get an amazing competitive advantage.

See white paper, B2B vs. B2C.

I believe the first duty of any business leader is this: “Leave your business stronger than you found it.” I’m unimpressed by leaders who prioritize short-term results and stock prices to the point of degrading growth capabilities and sacrificing the future. I’m mystified when companies enrich a business leader today who is working to impoverish the business tomorrow.

What your business really needs is a builder… someone who brushes aside financial gymnastics and business fads. Someone focused on created value for customers that delivers organic growth for their business. For more, see the 2-minute video, Be a business builder. Also consider a new metric, the Growth Driver Index, which measures how well a business leader is investing in long-term growth capabilities.

See white paper, New Innovation Metrics.

The Product Quest Podcast follows the trek of Jonathan Edwards, Yann Wermuth and AIM’s own Scott Burleson as they explore how to improve their ability to innovate and create new products. According to Burleson, “The podcast is a vehicle for us to connect with the best out there. The best practitioners, the best academics, the ... Read More

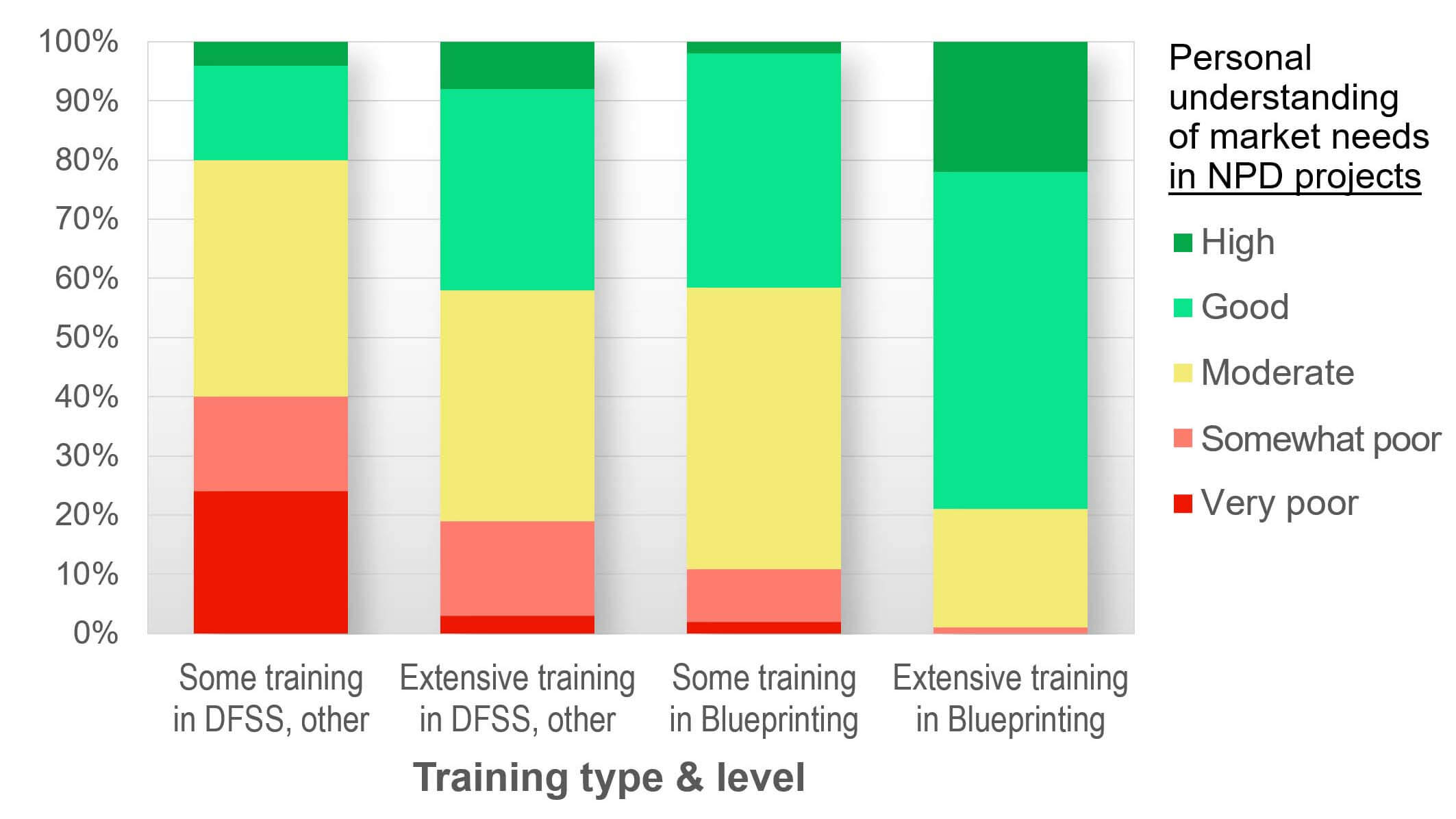

We studied this question in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. We grouped respondents into 4 groups depending on their type of training (New Product Blueprinting or Other) and level of training (Extensive or Some).

Respondents also reported their typical new product success rates: Only 20% of those with “Some” training in “Other” methods had new product success rates over 50% (green in chart). But 80% of those with “Extensive” New Product Blueprinting training were “in the green.” Just think: Instead of one-in-five employees having successful new product track records, you could move to four-in-five with such training.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

Many B2B companies use prototypes to understand customer needs. But more advanced companies use customer-needs modeling. That is, they learn enough in front-end-innovation customer interviews to predict customer needs with great accuracy.

This yields 3 advantages: 1) Its cheaper and faster to perform “what if” mental experiments in the front-end of innovation than to create physical prototypes later. 2) This modeling lets you understand customers’ next best alternatives… to better price and promote your new product. 3) Your B2B customers will be more engaged when you seek their early advice vs. lobbing your prototypes at them. You can see how this works in this 2-minute video: Benchmark competing alternatives.

More in article, Predict the customer’s experience with modeling.