More than anything else, short time horizons restrain B2B organic growth. And this leads to “internal friction” in your growth machine, specifically in 4 areas: 1) available time, 2) required skills, 3) team motivation, and 4) organizational disruptions. ... Read More

Blog Category: Customer Insights (VOC)

Want to engage B2B customers? Here are 10 ways.

If you sell into a concentrated B2B market (one with just a few customers), your voice-of-customer interviews should have two goals: “insight” plus “engagement.” The latter is important: You want these big customers to be impressed and eager to work with you, not your competitors.

These 10 approaches help you engage your customers when interviewing them to understand their needs: 1) Kill the questionnaire. 2) Let customers lead the interview. 3) Discuss their job-to-be-done. 4) Project your notes so they can see them. 5) Focus on customer outcomes. 6) Learn how to probe deeply. 7) Don’t sell or solve. 8) Get quantitative in your VOC. 9) Use triggers to generate fresh ideas. 10) Use B2B-optimized interview tools. (See the 2-minute video, Engage your B2B customers.)

These are explained in the article, The Missing Objective in Voice of Customer Interviews

What are Voice of the Customer Tools?

Portfolio management links strategy with execution for new product development. A Voice of the Customer program maximizes ROI for all new product initiatives, whether incremental or breakthrough. ... Read More

Is Your Innovation Supplier-Centric… or Customer-Centric?

To move from supplier- to customer-centric innovation, B2B producers should shift their thinking in four areas: 1) new markets to new supplier, 2) validating hypotheses to uncovering outcomes, 3) competitive products to customer alternatives, and 4) competitive pricing to value creation. ... Read More

Are you taking advantage of these 7 Design Thinking benefits?

If you haven’t explored Design Thinking for your product development yet, I highly recommend you do. It brings seven important benefits: 1) stronger value propositions, 2) rapid customer insight, 3) improved customer engagement, 4) potential for transformational innovation, 5) less squandered R&D, 6) reduced commercial risk, and 7) the erosion of functional silos.

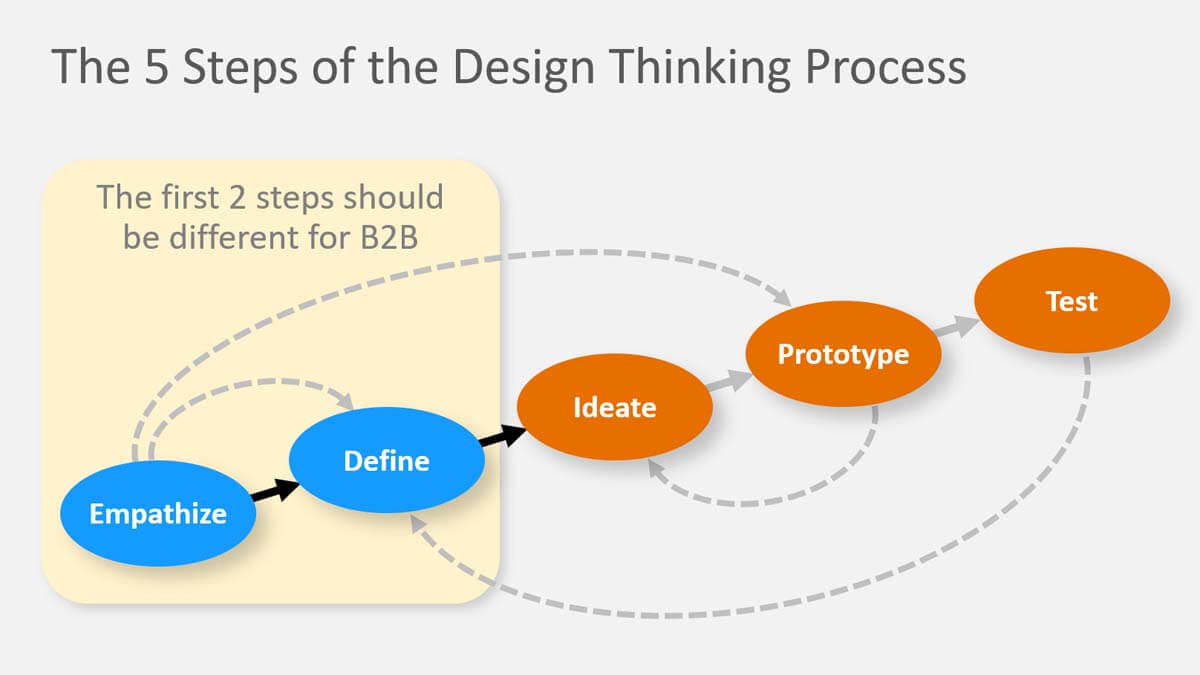

But if you’re a B2B company, don’t simply use Design Thinking as it’s taught in design schools. You can optimize it for B2B, especially the first two steps, “empathize” and “design”… using B2B-optimized Discovery and Preference interviews.

More in white paper, Design Thinking Optimized for B2B

Why Advanced Voice of Customer Matters

Far too many B2B customers are still using “Voice of Ourselves” for product development. Diagnose your VOO vs. VOC behavior in 10 areas: 1) interview scope, 2) interview objective, 3) types of questions, 4) note-taking, 5) interview skills, 6) observation skills, 7) companies interviewed, 8) deliverables, 9) engagement timeframe, and 10) interviewing staff. ... Read More

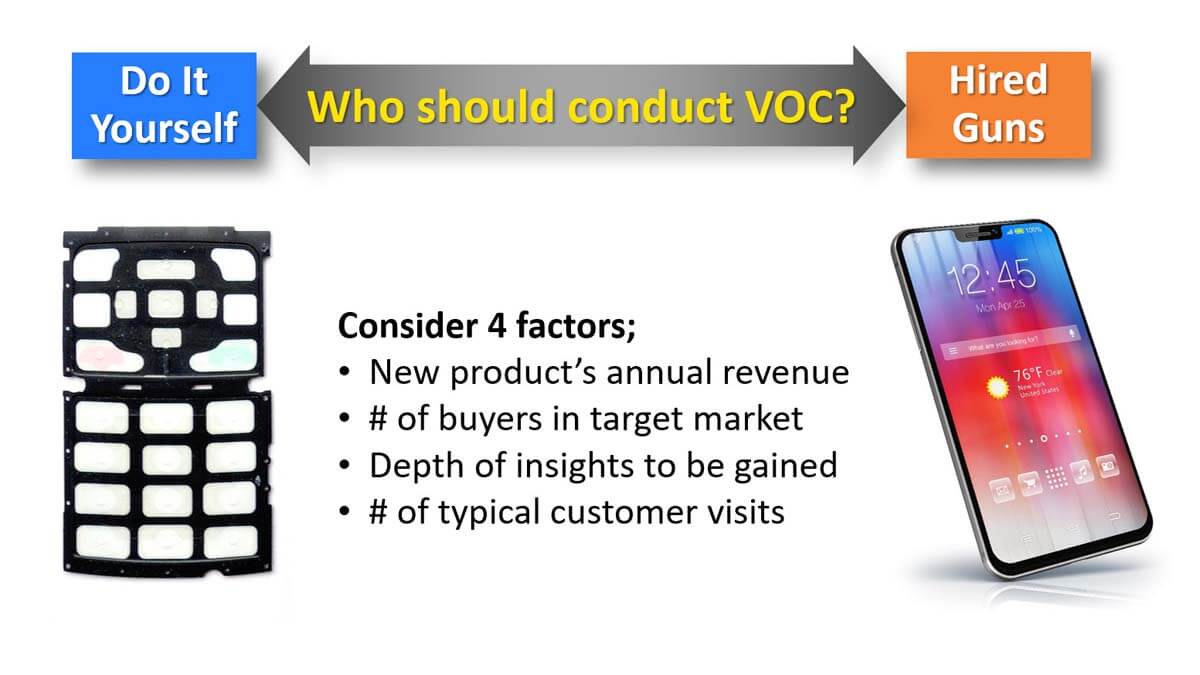

When should you use “hired guns” for customer interviews? Consider 4 factors.

Are there times when you should use an outside firm—”a hired gun”—to conduct your interviews? Consider 4 factors: 1) Hired guns work well if you have a big budget and success is all about this very large product launch. 2) If you have millions of prospects, outside expertise can manage the sophisticated surveys and statistics needed. 3) If you don’t need to gain deep, first-hand insights, a marketing firm’s report is fine. 4) If you’re not already spending much direct face-time with customers, let a marketing firm conduct this market research.

In general, though, when you’re serious about bringing real innovation to a targeted market segment, your people should do the heavy lifting. Understanding market needs is a competitive advantage you shouldn’t try to outsource.

For more, see 2-minute video, When to use “hired guns” for VOC

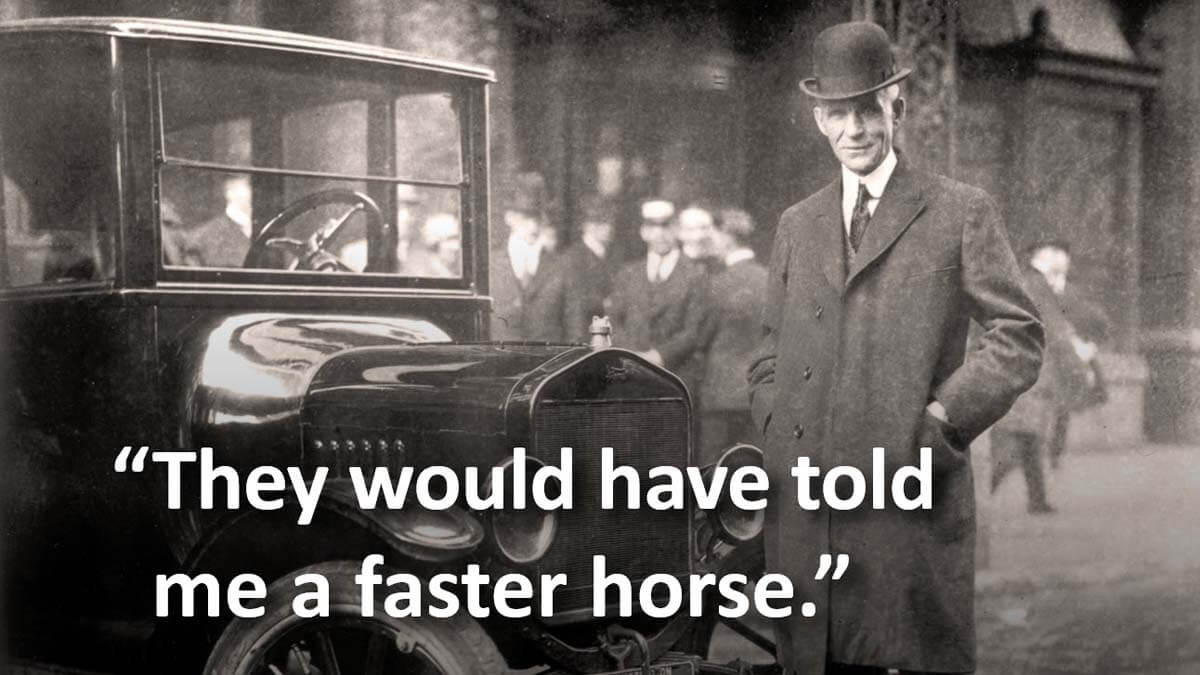

Beware the “Faster Horse” fallacy.

Henry Ford is often cited for a reason to not interview customers: “If I’d asked my customers what they wanted, they would have told me a faster horse.” But this is flawed thinking for B2B markets. There are indeed B2C cases where customers can’t tell you much about their needs. Ask me what I want in a video game, men’s suit, or snack food, and I’ll probably need to see a prototype. Then I can play with it, try it on, or taste it (hopefully in that order).

Besides, B2C company employees are end-consumers themselves… so they’ve already got a good idea what consumers want. Bottom line: Your B2B customer can absolutely tell you the outcomes they want (desired end results). Once you know the “what,” it’s up to you to figure out the “how” (your new product solution).

For more, see 2-minute video, Avoid the faster horse fallacy

Do you plan your new product development like a missile strike?

A missile strike? Well, that sounds a bit aggressive, doesn’t it? But consider the two targeting steps you’d take in the military, before firing those missiles: 1) survey all possible enemy positions, and then 2) isolate the high-value targets. You should do the same in the front-end of innovation, before the development stage: “Step 1” ... Read More

Want to optimize Design Thinking for your B2B business?

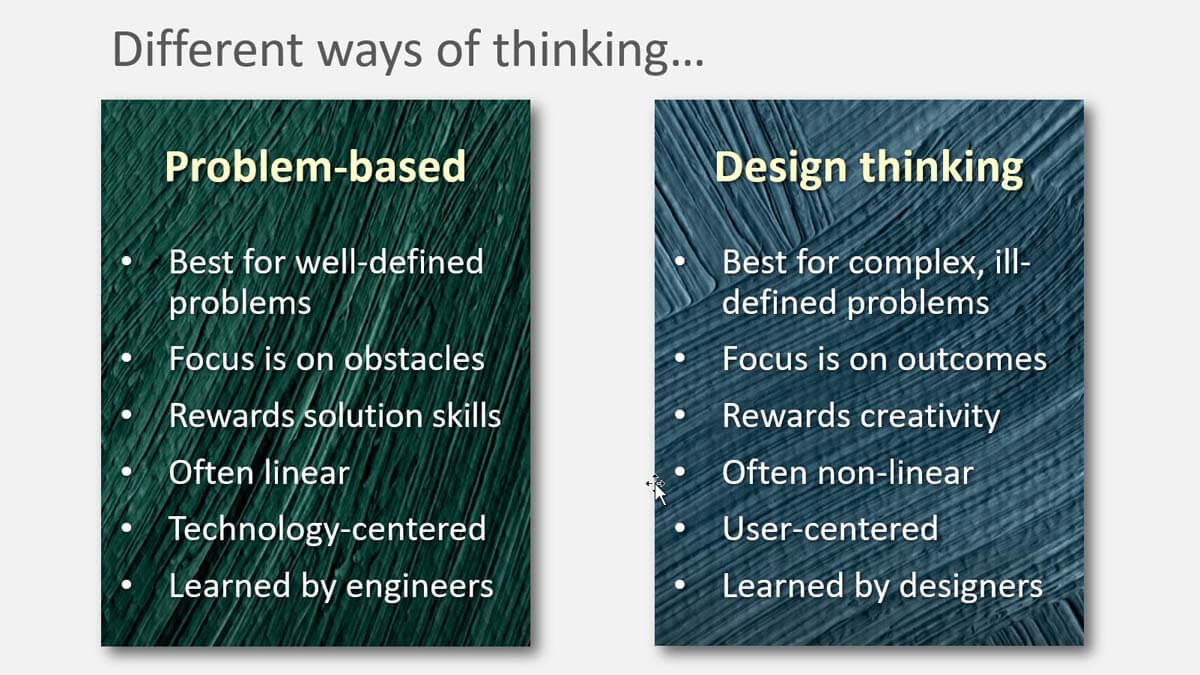

Design thinking is a powerful methodology for solving “wicked problems.” Unlike the well-stated problems we were given to solve in engineering school, these require figuring out what to work on, not just how to solve the problem. This perfectly describes real-world new product innovation, where we need to first understand customer needs.

As this diagram shows, the first two steps are “empathize” and “define.” Here’s the good news for B2B producers: You can do this much more effectively that B2C counterparts by using Discovery interviews (for “empathize”) and Preference interviews (for “define”). Check out this white paper to see why… and how: Design Thinking for B2B

Is in-person voice-of-customer superior to virtual VOC?

In general, we do consider in-person interviews to be the gold standard. But there are 10 advantages of virtual VOC you shouldn’t overlook: 1) lower cost, 2) reaching dispersed customers, 3) viewable probing tips, 4) training for colleagues, 5) probing suggestions, 6) assistance for note-taker, 7) rapid de-briefing, 8) easier scheduling, 9) low-impact cancellations, and 10) greater project speed. To maximize effectiveness and efficiency, you’ll be wise to blend and balance both types of VOC. (See 2-minute video, Conduct virtual customer interviews.)

More in white paper, Virtual VOC

Target Customer Needs and Win

How critical is it to target customer needs? Imagine three situations where you might face the question of a bigger payload vs. a better targeting system: missiles, cancer treatment and gold mining. A bigger payload would be a larger warhead, radiation dosage and backhoe shovel. Better targeting would be more precise hits on enemy positions, ... Read More

Constraints to Organic Growth

Most B2B companies struggle with organic growth because they don't rationally deal with these 5 harsh realities. This article compares the futility of “penny pinching” in the front end of innovation… to the way DuPont invested in New Product Blueprinting training. ... Read More

Design thinking… a great mindset for innovators focused on customer needs.

Design thinking isn’t new: The concept was first introduced by Nobel Prize laureate Herbert A. Simon in his 1969 book, The Sciences of the Artificial. It’s been “catching on” more and more in new product development circles, which is a very good thing. My favorite part is that it doesn’t start with well-defined problems, like the ones we were handed in engineering school. Rather, it’s a user-center process that encourages us to enter the customers’ world and understand it better. Especially their desired outcomes. This graphic shows the differences.

More in white paper, Design Thinking Optimized for B2B