Do your sales and tech support reps make hundreds of customer calls annually? Why not train them to probe deeply and capture customer needs uniformly in your CRM? You’ll gain unprecedented market insight when you turn your sales force into a learning force—to help you develop better future products. And with Everyday VOC probing, they’ll ... Read More

Blog Category: Product Development

My first rule of battles: You can’t win one you don’t know you are in.

In the 1970’s, Detroit automakers didn’t realize they were in a battle for quality. but Toyota did. In later years, the battle moved from quality to productivity improvements. But those were both last century’s battles. Today the battle is over innovation… to deliver more value to customers than your competitors.

Does your business leadership team know it’s in a battle for innovation? One way to find out is to wait until a competitor upends your market with a blockbuster new product. A better approach is to start building innovation capabilities earlier and strong than those competitors. More in white paper, Catch the Innovation Wave

Also see 2-minute video, Catch the innovation wave

Market Satisfaction Gaps… your key to B2B organic growth

What single new practice can drive your company’s long-term organic growth more than any other? Hint: Few companies do this today, but that’s changing… and someday this will likely be a common practice. The answer: The disciplined use of Market Satisfaction Gaps (MSG) as a required “admission ticket” for entering the costly product development stage. ... Read More

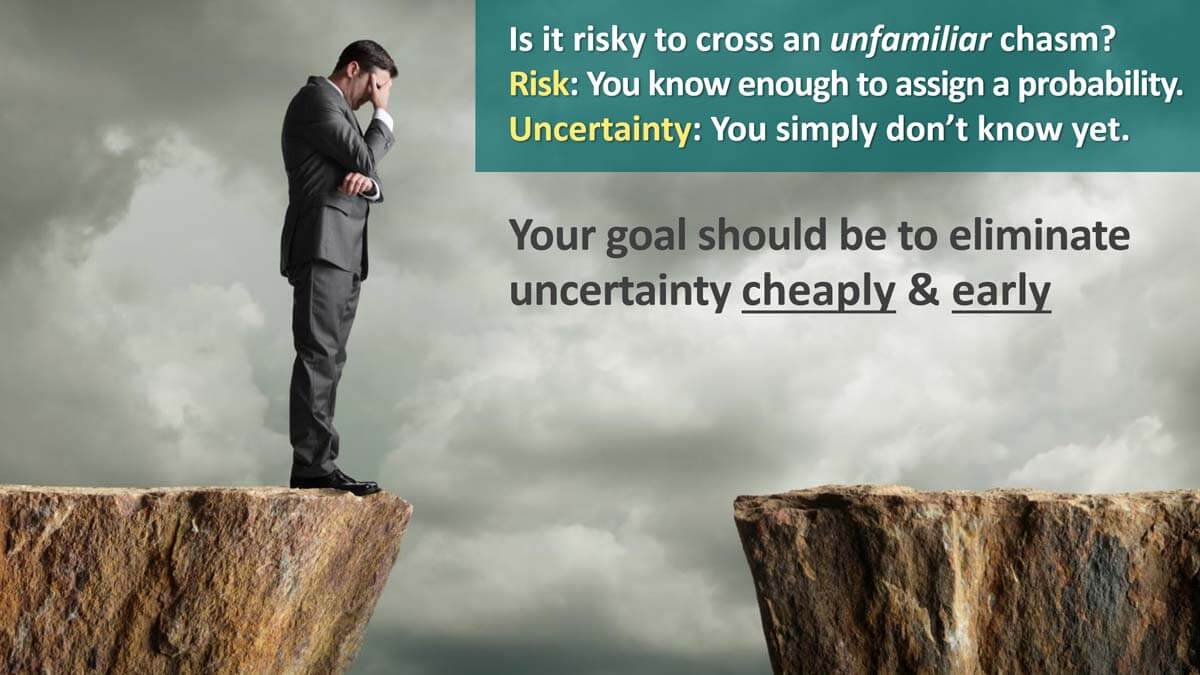

Does your management understand the difference between risk and uncertainty?

You’ll have much better project reviews if they understand this difference. You can only assign a level of risk if you know the probability of an unfavorable event, e.g., 40% chance of a thunderstorm. It’s pointless—even misleading—to assign probabilities of success, net present values, and so forth in a project’s early phase. That comes later, after your team drives dozens of assumptions from uncertainty to certainty. The methodology for doing this isn’t difficult: Check out this 2-minute video at Why risk and uncertainty are different.

More in video, Project de-risking with Minesweeper® software

Accelerate New Product Innovation

How critical is speed to new product innovation? Imagine a project that leads to new product sales of $5 million per year, with average profit margins. What’s the net present value of launching this product just one month earlier? $80,000! That’s $4000 per business day. Think we could use a little more urgency for new ... Read More

Four ways to accelerate your innovation.

Is your business looking for ways to accelerate its new product development? Here are four ways to do this: 1) Set clear design targets in the front-end. When the team knows what the customers wants early-on, it eliminates second-guessing, dead-end detours and hesitation. 2) Concentrate resources on fewer projects, staff them for speed, and kill any dead-end projects quickly. 3) Focus on “time-to-money” (not just “time to market”). If you engage customers throughout development, they’ll anticipate your new product and begin evaluating it sooner. 4) Eliminate “organizational friction”… travel bans, spending freezes, hiring delays, re-orgs, new initiatives, and so on.

More in 2-minute video, Pursue fast innovation

It’s Time for New Innovation Metrics

You’ve heard, “measure twice, cut once,” right? When it comes to market-facing innovation, most companies only measure after they’ve cut. They use the vitality index—a fine innovation metric developed by 3M in 1988 that’s simple to understand: percentage of gross revenue generated from products launched in the past three (or five) years. But if this ... Read More

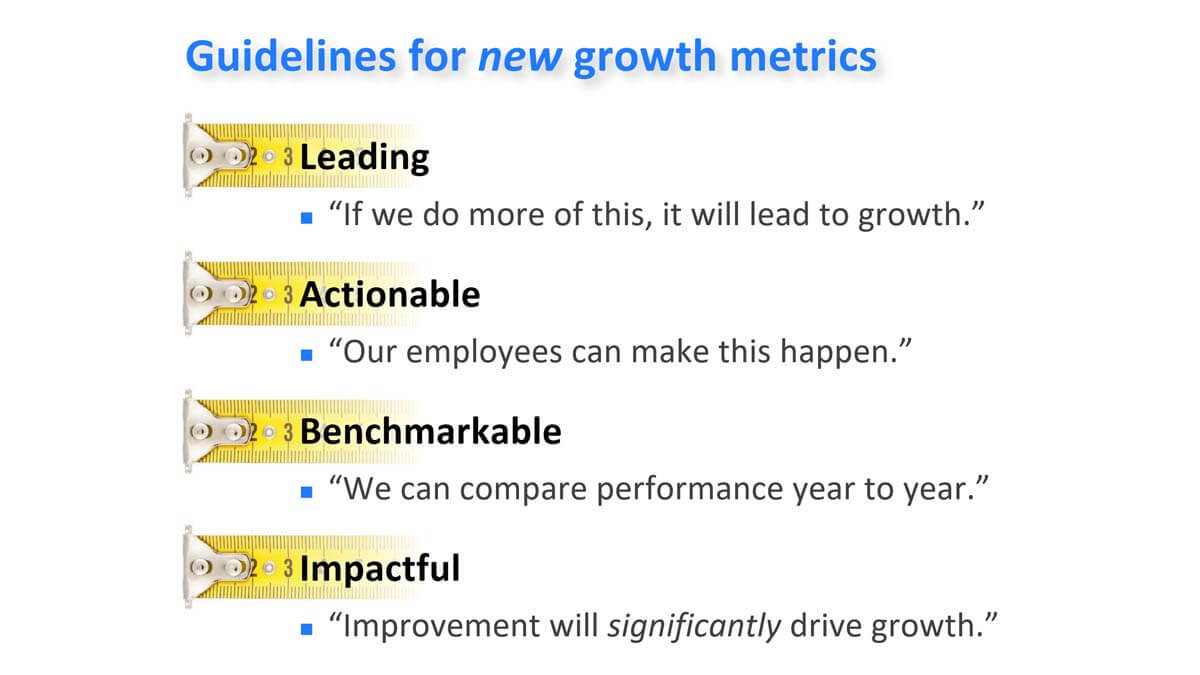

Here are 4 rules for better innovation metrics.

The Vitality Index (% of sales from new products) is helpful, but it suffers from being a lagging indicator. So how would you supplement it? Any new innovation metric you adopt should satisfy 4 rules: 1) Leading: “If we do more of this it will lead to growth.” 2) Actionable: “Our employees can make this happen.” 3) Benchmarkable: “We can compare to others and year-to-year.” 4) Impactful: “Improvement will significantly drive growth.

Here are two new innovation metrics that satisfy all four rules: Growth Driver Index (GDI) and Commercial Confidence Index (CCI). These measure your growth capabilities and evidence-based customer insight, respectively. (See white paper, New Innovation Metrics.)

More in 2-minute video, Employ new growth metrics

What should your first step be when developing a new product?

If you want to develop a great new product, your first step should be to target a single market segment and job-to-be-done (JTBD) within that segment. A market segment is a “cluster of customers with similar needs.” If you develop one product for multiple market segments, your new product won’t satisfy any customers to the fullest extent. By definition, different market segments have different needs, right?

If your company makes colorants, your target market segment might by paint producers. But your project scope is still too broad: You need to target a specific job to be done by those paint producers. Their job might be, “production and sale of semi-gloss paint.” This is explained further in the article, Quantitative questions for interviews

More in 2-minute video, Begin with customers’ job to be done

6 Maturity Levels for B2B Market-Facing Innovation

What’s the key to accelerating your B2B business’s organic growth? The research is clear: Superior customer insight drives stronger new product value propositions… which in turn boosts organic growth. Now you can use this new Innovation Maturity Level chart to assess your current level… and plan your ascent all the way to Level 6. The ... Read More

What’s the #1 mistake B2B companies make when developing new products?

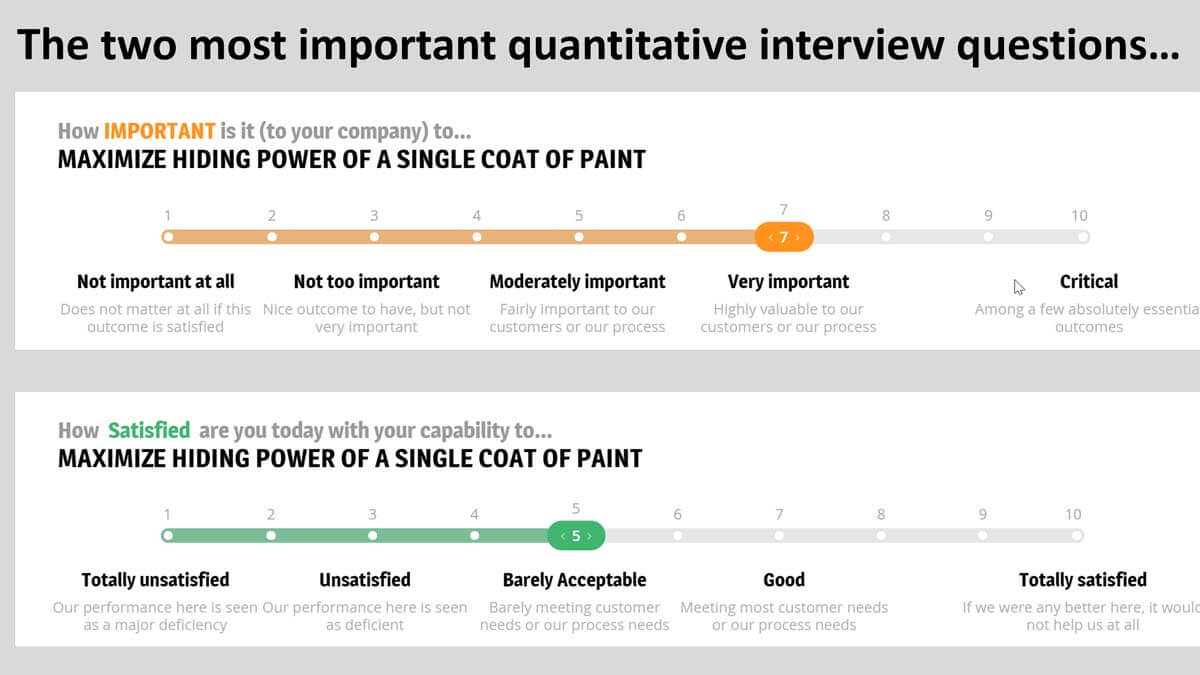

I think the biggest mistake is failing to use quantitative customer interviews. Why use quantitative questions for interviews, not just qualitative? Two reasons. First, qualitative interviews give you reams of customer quotes with no good way to prioritize customer needs. Sure, you could count the number of times customers cite a need, but frequency of remarks is a poor substitute for customer eagerness to improve.

More important, with only qualitative interviews you’ll succumb to confirmation bias… the tendency to hear and interpret information according to your preconceived notions. With quantitative questions for interviews, you’ll have hard data on customer needs that your team hasn’t filtered or skewed. You get 100% unadulterated insight straight from the customer.

More in 2-minute video, Quantitative interviews are a must

Design Thinking plus New Product Blueprinting = B2B Design Thinking

Design Thinking vs. New Product Blueprinting? They are highly complementary, with design thinking going further in some areas… and Blueprinting going further in other areas. Bottom line: Think of Blueprinting as a type of design thinking… essentially a roadmap for front-end of B2B Design Thinking. ... Read More

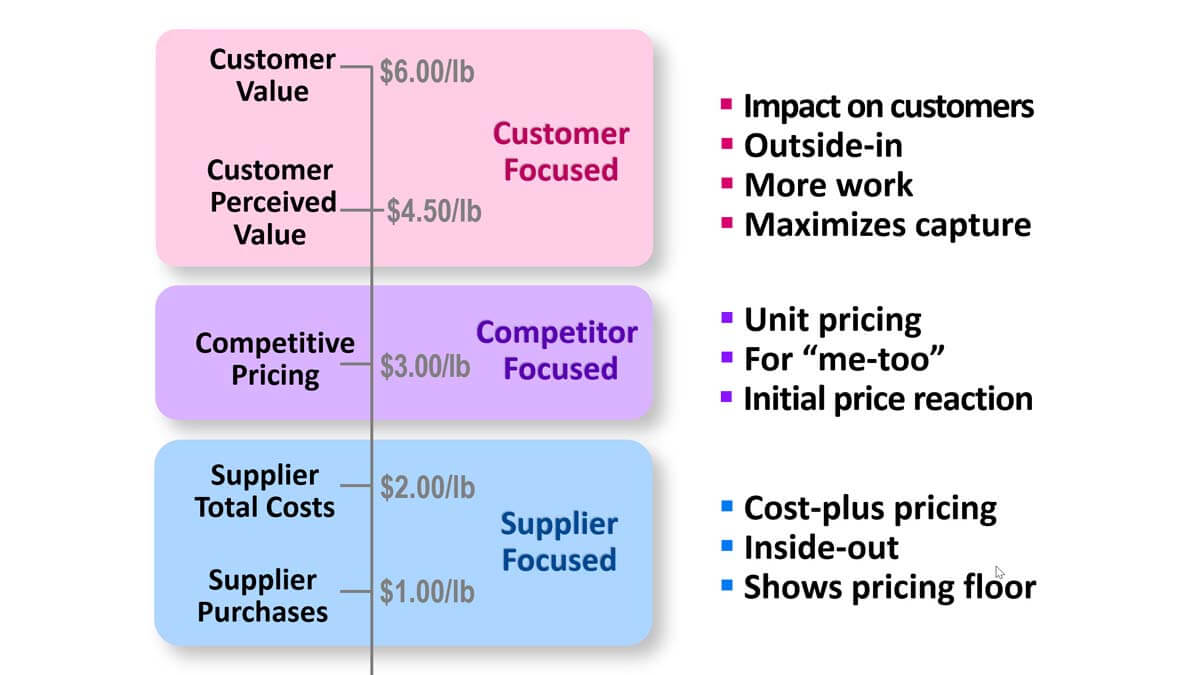

Is your pricing supplier-focused, competitor-focused, or customer-focused?

Your pricing could be supplier-focused, competitor-focused, or customer-focused. 1) Supplier-focused pricing is cost-plus pricing. It’s inside-out, leaves money on the table and only indicates your pricing floor. 2) Competitor-focused emphasizes unit pricing, and is only useful for me-too products and gauging initial price reaction. 3) Customer-focused pricing reflects the economic impact on customers. It’s outside-in and does require more work for you. But if you want to maximize value capture, it’s the only way.

More in 2-minute video, Use value calculators to establish pricing

Have you separated your “farm animals” from your “jungle animals”?

If you ran a zoo, you’d keep your jungle animals and farm animals in separate enclosures, right? Your technology development projects are untamed, jungle animals: You don’t completely understand them, and you’re not sure what they’ll do or where they’ll go next. Your product development projects are predictable farm animals. You know what they’re supposed to do, and who they’re supposed to do it for.

When you commercialize technology, you are “domesticating” wild animals for productive purposes. As a first step, you must be crystal clear which type of project your scientists or engineers are working on at any point in time. Remember, technology development turns money into knowledge; product development turns knowledge back into money. You can learn more from this white paper, Commercialize technology in 6 foolproof steps.

More in this 2-minute video, How to pursue transformational projects