In our white paper, B2B vs B2C: Organic growth implications for B2B professionals, we cover 12 differences between suppliers to B2B vs. consumer goods markets. Is this just an academic exercise? Not at all. Every one of these differences has implications for organic growth. The news gets better if you’re a B2B supplier: Nearly all these differences are advantages in your favor. Of course, an advantage is no advantage if you don’t take advantage of it. This white paper will show you how.

Also see the 2-minute video, Understand your B2B advantages

Here’s the test: When you look at projects in your new product pipeline, do some have sizeable commercial risk, not just technical risk? If so, you need to start conducting quantitative customer voice-of-customer interviews. These help you nearly eliminate commercial risk, based on Market Satisfaction Gaps. Here’s the point: If you’re a B2B supplier, there’s simply no reason to put up with much commercial risk once you move into the development stage. Check out over a dozen real-life examples of their use at www.aimcasestories.com.

More in white paper, Market Satisfaction Gaps

Web-conference based B2B customer interviews will likely continue to be popular… given the costs of in-person interviews in terms of a) travel expenses, and b) non-productive travel time. Our top recommendation is this: Make these visually interesting for your customers. For tips on how to do this with both qualitative and quantitative interviews, download our white paper at www.virtualvoc.com.

More in 2-minute video, Conduct virtual customer interviews

A model is a simplified reflection of reality… a stand-in for what will happen. Maps, recipes and budgets are all models. What if you could model customer needs, creating a map to guide your new-product design targets? You can if you start with proper B2B quantitative interviews, as described in this 2-minute video: Benchmark Competing Alternatives. Someday innovators will wonder why we guessed at B2B customer needs when we could have created these detailed maps to guide us… and eliminate most new product development commercial risk.

More in article, Predict the customer’s experience with modeling

For B2B companies I believe this practice is requiring quantitative, unbiased, unfiltered evidence of customer needs before starting to develop a new product. Today, wishful thinking and confirmation bias greatly distort suppliers’ views of what customers want in a new product. One way to change this? Require Market Satisfaction Gaps for all significant product development. These reveal which outcomes the market is most eager to see improved. Check out over a dozen real-life cases of their use at www.aimcasestories.com.

More in white paper, Market Satisfaction Gaps

The Vitality Index measures the percent of revenue from new products. But you should also track the Profit Vitality index… your percent of gross profits from new products. It avoids the problem of people gaming the Vitality Index by calling a product “new” when it’s just a “tweak’ that delivers no added value.

It’s immaterial what you think of your new product. All that matters is what your customers think of it. If they see new value, they’ll pay a premium and you’ll see higher profit margins. If you’re truly innovating, your profit vitality index will be higher than your revenue vitality index. If that’s not the case, your newer products are providing less differential value to customers than your older products. Probably something you should know, right? See the white paper, New Innovation Metrics.

More in 2-minute video, Employ new growth metrics.

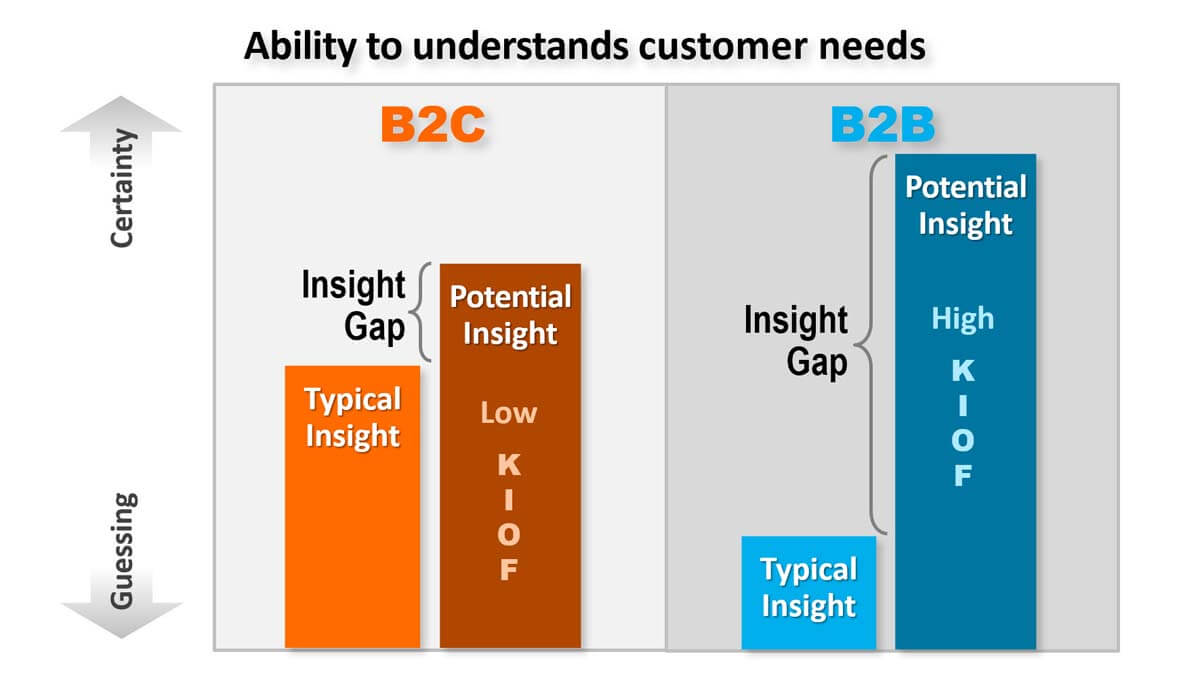

The Customer Insight Gap is the difference between what suppliers typically understand about customer needs… and what they could potentially understand. This Gap is usually small for consumer-goods suppliers (B2C): Typical insight is high since their employees are consumers themselves and understand customer needs. At the same time, potential insight is low, because end-consumers often struggle to articulate their true needs.

The Gap is huge for most B2B suppliers: They know less about their customers’ world, but these customers could tell them much, given their Knowledge, Interest, Objectivity & Foresight (KIOF in chart). For more, watch this 2-minute video, Understand your B2B advantages. If you learn how to close the large B2B Insight Gap, you’ll get an amazing competitive advantage.

See white paper, B2B vs. B2C.