Here’s the test: When you look at projects in your new product pipeline, do some have sizeable commercial risk, not just technical risk? If so, you need to start conducting quantitative customer voice-of-customer interviews. These help you nearly eliminate commercial risk, based on Market Satisfaction Gaps. Here’s the point: If you’re a B2B supplier, there’s simply no reason to put up with much commercial risk once you move into the development stage. Check out over a dozen real-life examples of their use at www.aimcasestories.com.

More in white paper, Market Satisfaction Gaps

Web-conference based B2B customer interviews will likely continue to be popular… given the costs of in-person interviews in terms of a) travel expenses, and b) non-productive travel time. Our top recommendation is this: Make these visually interesting for your customers. For tips on how to do this with both qualitative and quantitative interviews, download our white paper at www.virtualvoc.com.

More in 2-minute video, Conduct virtual customer interviews

A model is a simplified reflection of reality… a stand-in for what will happen. Maps, recipes and budgets are all models. What if you could model customer needs, creating a map to guide your new-product design targets? You can if you start with proper B2B quantitative interviews, as described in this 2-minute video: Benchmark Competing Alternatives. Someday innovators will wonder why we guessed at B2B customer needs when we could have created these detailed maps to guide us… and eliminate most new product development commercial risk.

More in article, Predict the customer’s experience with modeling

The strongest value propositions examine key customer outcomes at 9 levels (the essence of New Product Blueprinting): 1) Uncover outcomes, 2) understand importance, 3) define & set direction, 4) prioritize outcomes, 5) learn how to measure, 6) identify satisfaction levels, 7) measure next best alternatives, 8) quantify value created, and 9) quantify value captured. ... Read More

For B2B companies I believe this practice is requiring quantitative, unbiased, unfiltered evidence of customer needs before starting to develop a new product. Today, wishful thinking and confirmation bias greatly distort suppliers’ views of what customers want in a new product. One way to change this? Require Market Satisfaction Gaps for all significant product development. These reveal which outcomes the market is most eager to see improved. Check out over a dozen real-life cases of their use at www.aimcasestories.com.

More in white paper, Market Satisfaction Gaps

We’ve teamed up with Stage-Gate® International to bring you a new e-book, 9 Actions to super-charge your Stage-Gate growth machine. In this article, we’ll explain some actions you can take right now to turn your gated process into the growth machine it was meant to be. First, some credit where credit is due: Dr. Robert ... Read More

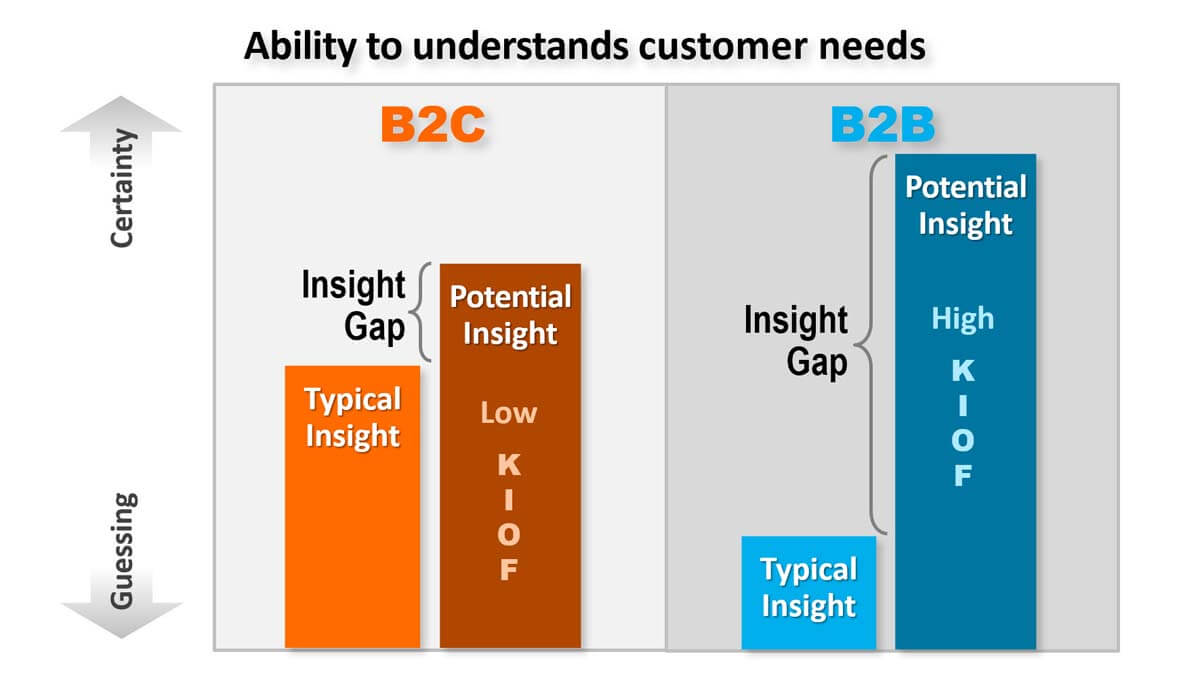

The Customer Insight Gap is the difference between what suppliers typically understand about customer needs… and what they could potentially understand. This Gap is usually small for consumer-goods suppliers (B2C): Typical insight is high since their employees are consumers themselves and understand customer needs. At the same time, potential insight is low, because end-consumers often struggle to articulate their true needs.

The Gap is huge for most B2B suppliers: They know less about their customers’ world, but these customers could tell them much, given their Knowledge, Interest, Objectivity & Foresight (KIOF in chart). For more, watch this 2-minute video, Understand your B2B advantages. If you learn how to close the large B2B Insight Gap, you’ll get an amazing competitive advantage.

See white paper, B2B vs. B2C.

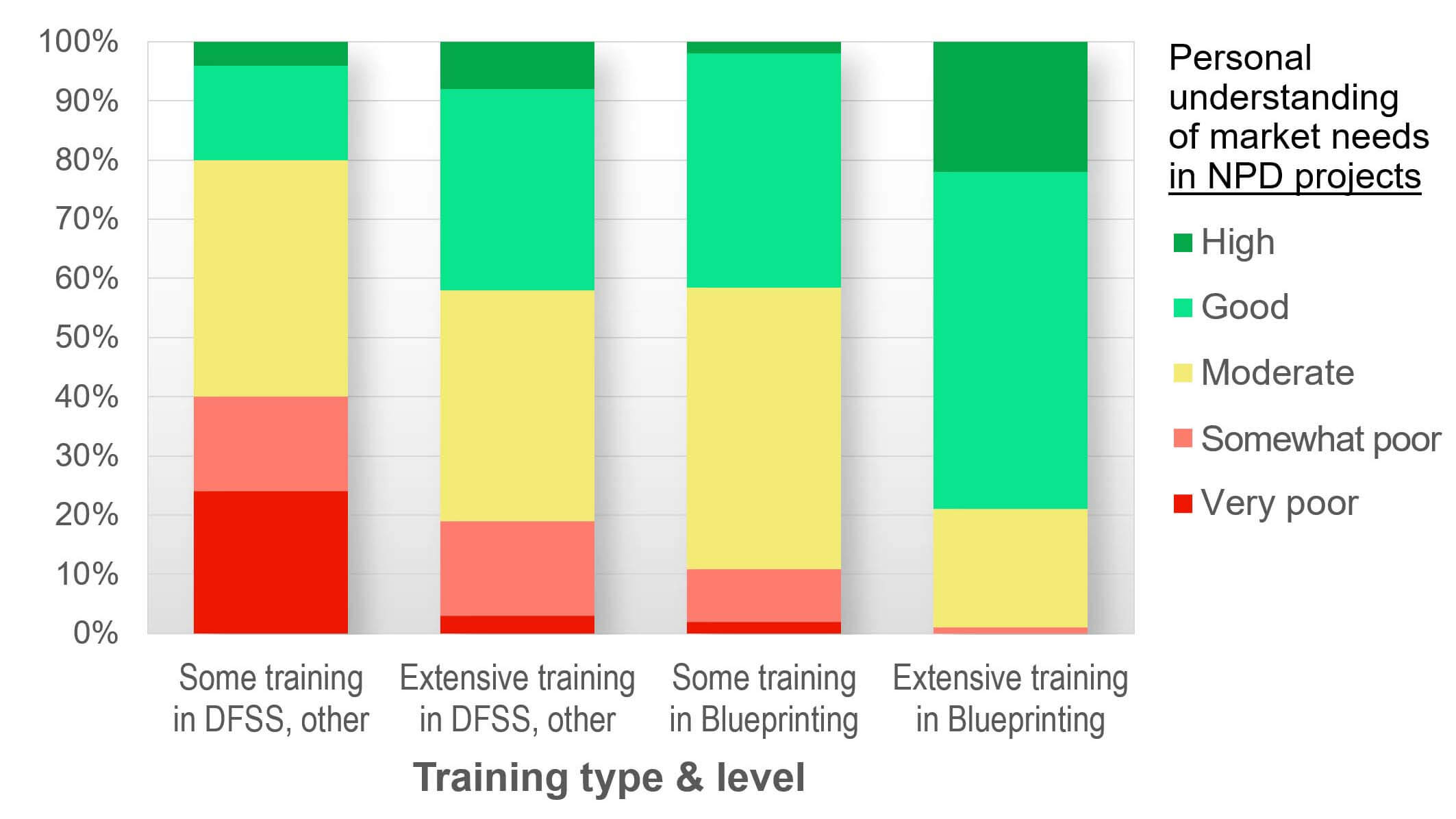

We studied this question in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. We grouped respondents into 4 groups depending on their type of training (New Product Blueprinting or Other) and level of training (Extensive or Some).

Respondents also reported their typical new product success rates: Only 20% of those with “Some” training in “Other” methods had new product success rates over 50% (green in chart). But 80% of those with “Extensive” New Product Blueprinting training were “in the green.” Just think: Instead of one-in-five employees having successful new product track records, you could move to four-in-five with such training.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

Many B2B companies use prototypes to understand customer needs. But more advanced companies use customer-needs modeling. That is, they learn enough in front-end-innovation customer interviews to predict customer needs with great accuracy.

This yields 3 advantages: 1) Its cheaper and faster to perform “what if” mental experiments in the front-end of innovation than to create physical prototypes later. 2) This modeling lets you understand customers’ next best alternatives… to better price and promote your new product. 3) Your B2B customers will be more engaged when you seek their early advice vs. lobbing your prototypes at them. You can see how this works in this 2-minute video: Benchmark competing alternatives.

More in article, Predict the customer’s experience with modeling.

Should you do in-person customer interviews… or use a web-conference? Consider these factors: 1) team interviewing experience, 2) level of existing customer relationship, 3) need for a tour, 4) qualitative vs. quantitative interview type, 5) scheduling difficulties, 6) travel costs, and 7) interviewing progress to-date.

For a full explanation, download our white paper at www.virtualvoc.com. Most likely, you’ll see that virtual voice-of-customer interviews can play a larger role in your customer insight work.

See 2-minute video, Conduct virtual customer interviews.

We researched this question with a survey of 300+ B2B professionals, examining these VOC skills: 1) Secure interviews, 2) Proper interviews, 3) Impress customers, 4) Uncover all needs, 5) Probe for meaning, 6) Probe for value, 7) Quantitative VOC, 8) Virtual VOC, 9) VOC debriefing, 10) Prioritize needs, 11) Segment market, and 12) Business case.

Can you guess which skill most differentiated the winners and losers in terms of new product development success? It was #10, Prioritize customer needs. The #2 skill wasn’t even close. So if you’re not conducting quantitative interviews to prioritize customer needs with confidence, you’ve got some serious “upside” to pursue. See 2-minute video, Quantitative interviews are a must.

More in white paper, Market Satisfaction Gaps.

The “fast follower” strategy seldom works, for a variety of reasons. One is that it’s often just an excuse for the lack of innovation, and isn’t supported by needed fast-follower capabilities. Next time a business leader touts this “strategy,” ask if they’ve invested heavily in a) early-warning competitive intelligence, b) robust patent minefield-avoidance competencies, and c) ultra-fast scale-up capabilities.

Unless they say “yes,” their fast-follower claim was just an excuse for avoiding Job #1: Understand and meet customer needs better than others. When you excel at Job #1, you’ll grow faster, more profitably, and more consistently than those shuffling along behind you trying to catch up.

More in article, Chasing the Fast Follower Myth

Want a product development strategy that ensures your new products will consistently beat competitors’? Follow these three steps. The good news is your competitors are probably ignoring—or doing a sloppy job—of the first two. Better yet, we’ll present evidence these steps make a difference. We’ll close with several examples. You can think of product development ... Read More

In my experience, VOO is much more common than VOC among B2B companies today. This will surely change, given the huge advantages of B2B-optimized VOC. (See e-book, Reinventing VOC for B2B.) You can learn your position on the VOO-vs.-VOC spectrum by diagnosing 10 factors: 1) interview scope, 2) interview objective, 3) types of questions, 4) note-taking, 5) interview skills, 6) observation skills, 7) companies interviewed, 8) deliverables, 9) engagement timeframe, and 10) interviewing staff.

For descriptions of all 10, see article, Why Advanced Voice of Customer Matters