Initially, you are aware of the first three, but completely unaware of the fourth—surprises. When you begin your project, list the first three, and try to convert A’s and Q’s into F’s. Then uncover the surprises through customer interviews, tours and observation. Seek to understand the first three, and discover the last one.

More in white paper, Innovating in Unfamiliar Markets (page 12)

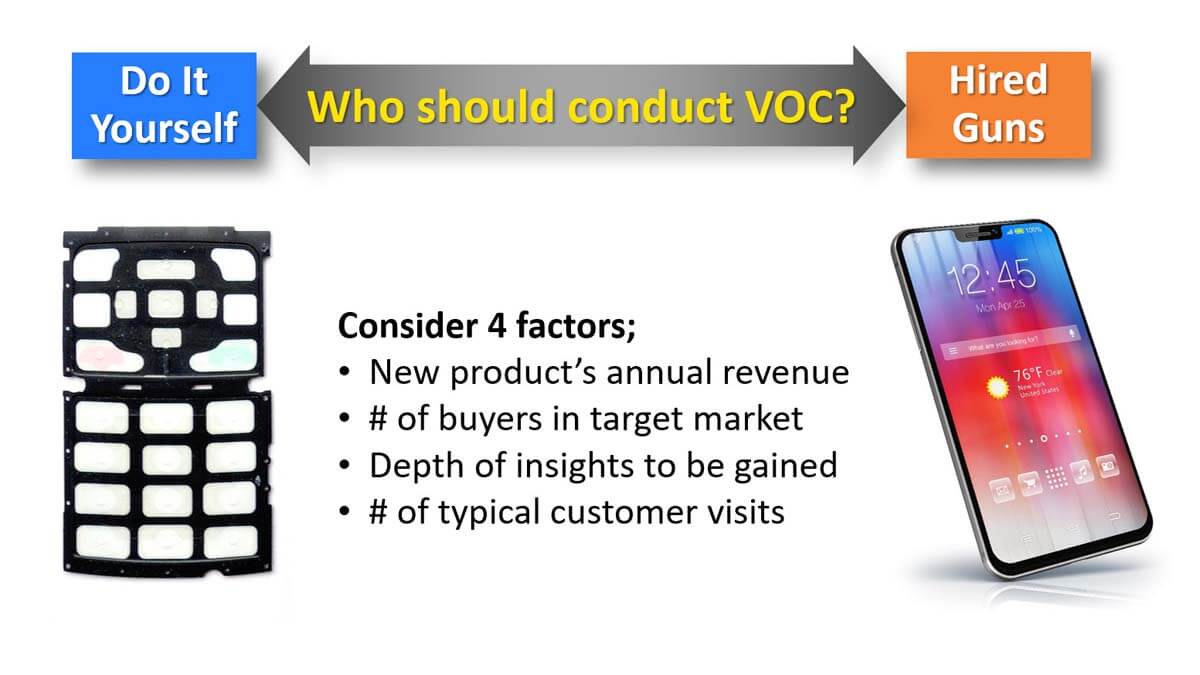

Are there times when you should use an outside firm—”a hired gun”—to conduct your interviews? Consider 4 factors: 1) Hired guns work well if you have a big budget and success is all about this very large product launch. 2) If you have millions of prospects, outside expertise can manage the sophisticated surveys and statistics needed. 3) If you don’t need to gain deep, first-hand insights, a marketing firm’s report is fine. 4) If you’re not already spending much direct face-time with customers, let a marketing firm conduct this market research.

In general, though, when you’re serious about bringing real innovation to a targeted market segment, your people should do the heavy lifting. Understanding market needs is a competitive advantage you shouldn’t try to outsource.

For more, see 2-minute video, When to use “hired guns” for VOC

Here’s the test: When you look at projects in your new product pipeline, do some have sizeable commercial risk, not just technical risk? If so, you need to start conducting quantitative customer voice-of-customer interviews. These help you nearly eliminate commercial risk, based on Market Satisfaction Gaps. Here’s the point: If you’re a B2B supplier, there’s simply no reason to put up with much commercial risk once you move into the development stage. Check out over a dozen real-life examples of their use at www.aimcasestories.com.

More in white paper, Market Satisfaction Gaps

You conduct front-end-of-innovation customer interviews so you can design a great new product, right? Well yes, but… if you do these well, you’re doing more. You’re also 1) learning the unknown unknowns, 2) unlearning the things you do know that simply aren’t true, 3) aligning your development team for action, 4) making better decisions through improved market intuition, and 5) building stronger relationships for near-term sales opportunities.

For more download e-book, Reinventing VOC for B2B

Want to build an amazing customer interview team in a stress-free manner? Gradually increase the “stakes” of the interview by starting with easier, safer interviews. You might follow this six-step progression: 1) industry experts you pay to interview, 2) sales colleagues, 3) other departments/experts in your company, 4) your distributors, 5) smaller, safer customers, and finally, 6) larger, high-stakes customers. By the time you reach the later group, you’ll have one highly-polished and confident interview team.

More in article, Virtual VOC: 10 Advantages and 7 tips

Our research shows “strong value propositions” are the #1 driver of B2B organic growth: The ability to develop such value propositions separates the “winners” and “losers.” Here are the 3 growth drivers (out of 24) that show the greatest competency differences between these winners and losers: #1 Front-end Work (creating a compelling business case), #2 Market Concentration (disproportionately focusing resources on attractive market segments), and #3 Customer Interviews: (gaining the insights needed to establish your value proposition).

More in research report, What Drives B2B Organic Growth?

Initially, you are aware of the first three, but completely unaware of the fourth—surprises. When you begin your project, list the first three, and try to convert A’s and Q’s into F’s. Then uncover the surprises through customer interviews, tours and observation. Seek to understand the first three, and discover the last one.

More in white paper, Innovating in Unfamiliar Markets (pages 12-13).