This can super-charge your organic growth: Don’t let your R&D conduct any product development work without unbiased, unfiltered data on what customers do and do not want. Market Satisfaction Gaps—based on importance and satisfaction scores for customer outcomes—provide this. You’ll free up enormous resources by working on only what matters.

More in white paper, Catch the Innovation Wave (page 13).

Imagine you spent two years developing a new product, and have just executed your B2B product launch. You’re waiting to tell your boss about exciting new sales… and waiting. As the months go by and you get more feedback from the field, you realize the market has responded to your launch with one big, collective… ... Read More

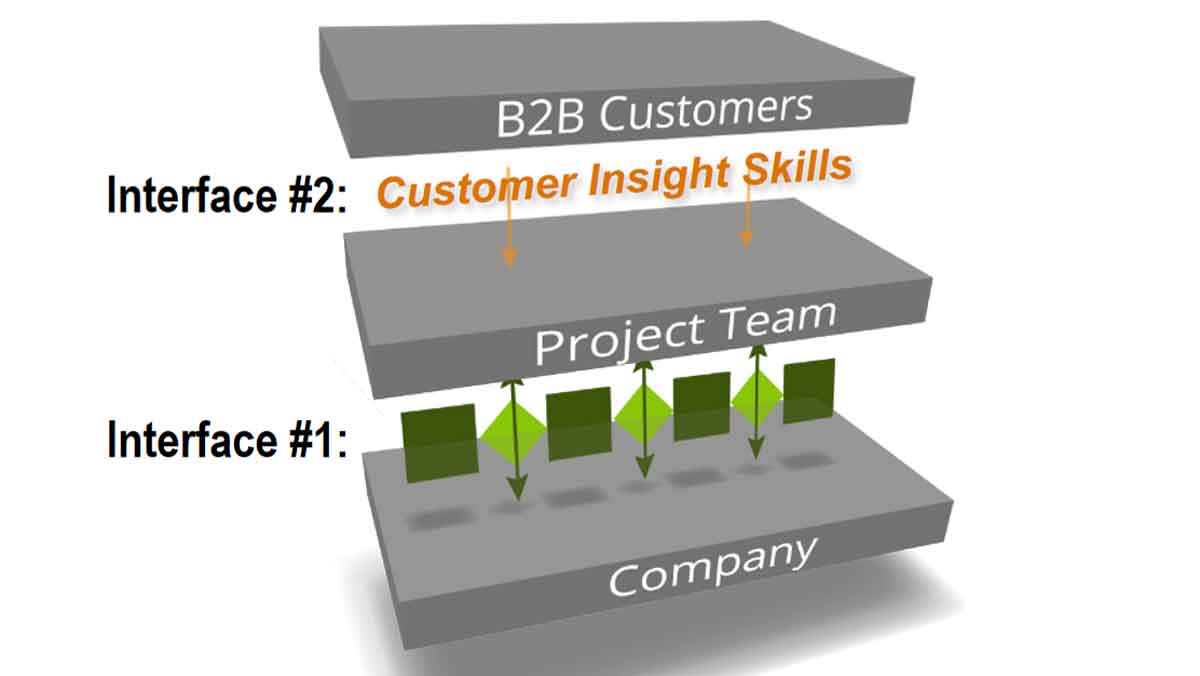

Your stage-and-gate process is the interface between your company and project teams… doing vital work like preventing mistakes, planning resources, and creating portfolio views. Keep it, but add another interface on top… between the teams and customers. This interface is “customer insights skills.” Together they’re a dynamic duo.

More in white paper, Guessing at Customer Needs (page 9).

This is what product developers call the Ansoff Matrix quadrant where you pursue an unfamiliar market with unfamiliar technology. A great place to kill your career. But you can enter it with confidence when you apply new methods for de-risking transformational projects… moving from uncertainty to certainty to defuse potential “landmines.”

More in article, De-Risking Innovation: How to Thrive in the Suicide Quadrant

In the front end of innovation, though, there are just two ways to fail. An error omission is failing to uncover an unarticulated customer need. An error of commission is choosing the wrong customer need to work on. Funny thing about errors of omission: No one knows you erred… until a competitor launches a blockbuster product.

More in white paper, Guessing at Customer Needs (page 5).

A new product development process with stages and gates provides helpful discipline. But most suffer from two limitations: 1) Internal focus… talking to ourselves instead of customers. 2) Analytical thinking… promoting a checklist mentality. You also need discovery thinking, with a focus on learning. Unlike analytical thinking, this is fragile and must be nurtured.

More in article, Should Your Stage-Gate® Get a No-Go?

In both cases models are used to predict future behavior. Barometric pressure and other data are the “raw material” for weather models. For you, it’s quantitatively measuring key customer outcomes in the front-end of innovation. Your model lets you replicate the customer experience… so you can know with confidence how they’ll react to any of your product designs.

More in article, How to model customer needs (Originally published in B2B Organic Growth newsletter).

For example, do you have a serious discussion about customers’ next best alternatives? What do we know about these alternatives, how do we know this to be true, how do customers measure their satisfaction, and how is our new product design stacking up? Without such insight, you’ll have to guess at your new-product pricing.

More in article, Four Steps Needed for New Product Differentiation

I love it when our clients have cool technology and clever ideas. But don’t mention these to customers during VOC interviews. From the customer’s perspective, the interview should look exactly the same whether or not you’ve got a great hypothesis. Give your hypothesis the silent treatment for now. Simply listen to the customer.

More in article, Give your Hypothesis the “Silent Treatment” (Originally published in B2B Organic Growth).

If any process in your company should be customer-driven, it should be the one developing products for customers, right? So try this at your next review: Ask team members how many hours they spent talking to customers… and how many hours working internally. You may be surprised at how little time was spent understanding customer needs.

More in article, Should Your Stage-Gate® Get a No-Go?

When you validate your new product concept with customers, they may tell you if it’s a dud. Great… you’ve avoided the error of commission. But what about the error of omission? If you first enter the customer’s world with B2B divergent interviews, you might learn of unexpected needs that lead to a blockbuster.

More in white paper, Lean Startup for B2B (page 9).

Innovating companies that directly engage their customers have operating income growth rates three times higher than those that do not. When you see a gulf of 3X, it should scream “opportunity!” Gaining customer insight in an engaging manner may be commonplace in the future, but today it’s a competitive advantage. Will you seize it?

More in article, Why Maximizing Shareholder Value is a Flawed Goal

Consider two new-product success modes. In Success Mode A you launch a well-protected, premium-priced product. In Success Mode B, you thoroughly search the market segment, but find no unmet needs you can address. So you walk. May not sound heroic, but it’s the only way to ensure enough resources for more Success Mode A.

More in article, Are You Maximizing Your Profits?

Surprises in quality or cost control are unpleasant. But innovation relies on surprises. Without “non-obviousness,” an invention cannot even be patented. When a previously-hidden customer outcome becomes known, the discovering supplier has the luxury of seeking solutions in a competition-free environment.

More in white paper, Catch the Innovation Wave (page 10).