Good questions demonstrate you’re more interested in the other person than yourself. What do you call someone who listens to you and seems fascinated by your responses? You call them a brilliant conversationalist. Think of it this way: Your customers have a hard time getting their boss to listen to them. They go home and their kids don’t listen to them. Now a supplier (you) is leaning forward and asking, “Really? Could you tell me more about that?” If you were the customer, wouldn’t you like to talk to such a person?

More in white paper, Everyday VOC at www.EVOCpaper.com

B2C companies seek to understand customer needs. B2B companies should do this and engage customers, priming them to buy later. If you interview ten customers that represent 20% or 50% of the market segment’s buying power, wouldn’t it be an incredible waste if you failed to engage these companies… so they wanted to work with you?

More in 2-minute video at 29. Engage your B2B customers

Every one of your B2B customers has needs… problems to be solved. What’s filtering them out, preventing your solution providers from understanding them? 1) Poor listening skills when your employees meet with them? 2) Few probing questions? 3) Haphazard call reports? 4) Weak CRM datamining? You can change all this when your customer-facing employees use Everyday VOC.

More in Everyday VOC white paper, www.EVOCpaper.com

It’s ironic: B2B customers have the only vote on whether our new product is any good. B2B customers want us to innovate on their behalf. B2B customers are eminently qualified to guide us. Yet many suppliers all but ignore B2B customers when developing their product concepts. Today, this malpractice is global and pervasive in nature. We can do much better.

More in white paper, www.guessingatcustomerneeds.com

It may be OK for consumer goods producers to guess their customers’ needs. After all, their product developers are end-consumers themselves. So if you’re an Apple engineer, you already know what consumers like you want in a mobile phone.

But your B2B customers know much more than you about their needs. If you make pigment, your customers know a lot more than you about the paper production it’s used in. Isn’t it silly to guess their needs when they’d love to tell you… if you asked the right way? That’s why you need to let the customer lead the interview, not you. Yep, you can put your questionnaire or interview guide away now.

More in e-book, Reinventing VOC for B2B

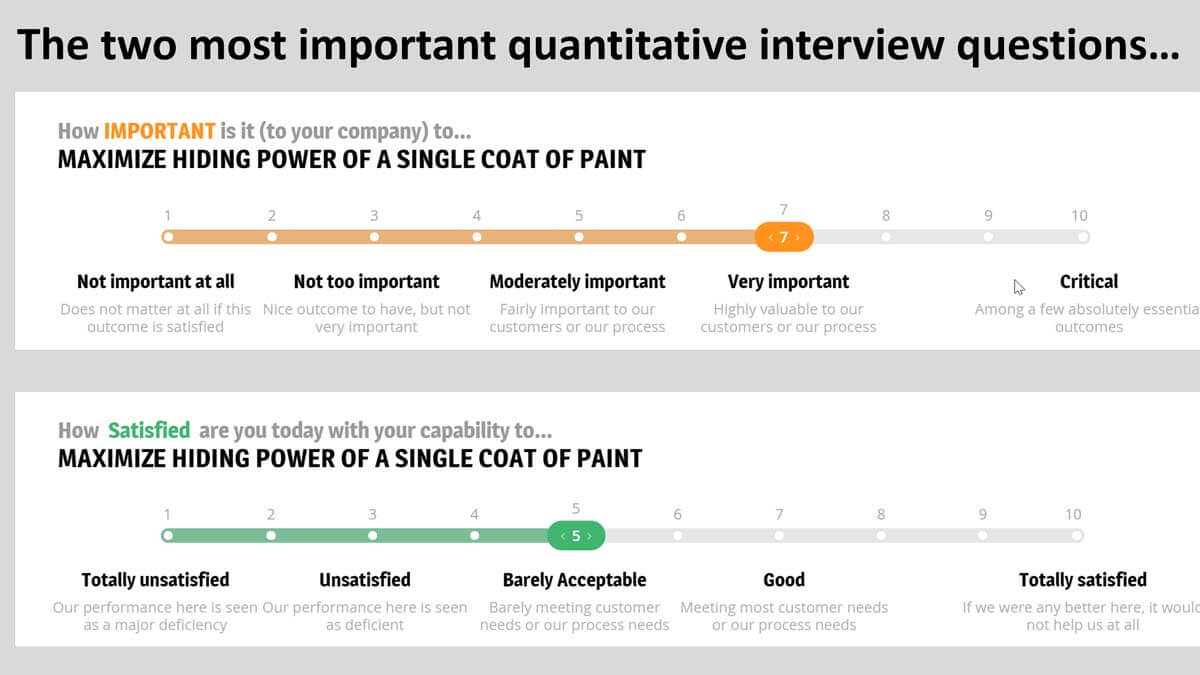

I think the biggest mistake is failing to use quantitative customer interviews. Why use quantitative questions for interviews, not just qualitative? Two reasons. First, qualitative interviews give you reams of customer quotes with no good way to prioritize customer needs. Sure, you could count the number of times customers cite a need, but frequency of remarks is a poor substitute for customer eagerness to improve.

More important, with only qualitative interviews you’ll succumb to confirmation bias… the tendency to hear and interpret information according to your preconceived notions. With quantitative questions for interviews, you’ll have hard data on customer needs that your team hasn’t filtered or skewed. You get 100% unadulterated insight straight from the customer.

More in 2-minute video, Quantitative interviews are a must

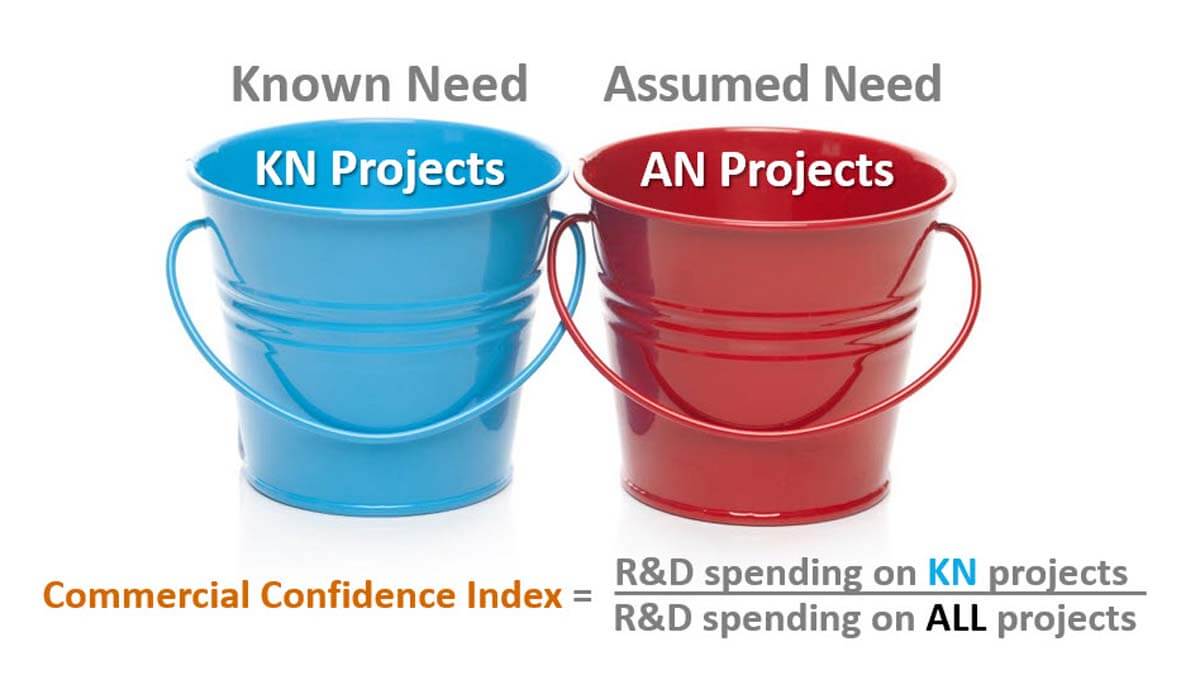

Yes, it’s called the Commercial Confidence Index (CCI), and it’s easy to calculate: Step 1: Record your annual R&D spending for each significant product development project. Step 2: For each project, ask if you have quantified evidence of customer needs, e.g. Market Satisfaction Gaps. If “yes,” the project goes in the “Known Need” bucket. All others go in the “Assumed Need” bucket. Step 3: The CCI is your annual R&D spending on Known-Need projects divided by annual spending on all product development projects.

More in 2-minute video, Employ new growth metrics

For B2B companies I believe this practice is requiring quantitative, unbiased, unfiltered evidence of customer needs before starting to develop a new product. Today, wishful thinking and confirmation bias greatly distort suppliers’ views of what customers want in a new product. One way to change this? Require Market Satisfaction Gaps for all significant product development. These reveal which outcomes the market is most eager to see improved. Check out over a dozen real-life cases of their use at www.aimcasestories.com.

More in white paper, Market Satisfaction Gaps

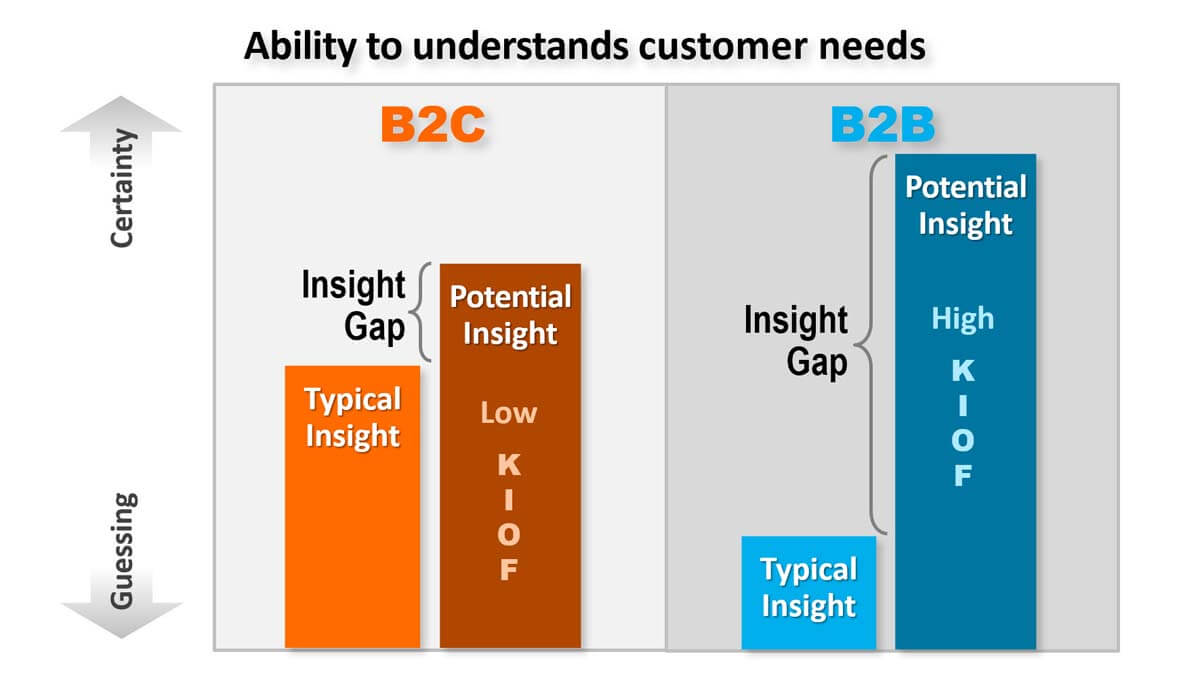

The Customer Insight Gap is the difference between what suppliers typically understand about customer needs… and what they could potentially understand. This Gap is usually small for consumer-goods suppliers (B2C): Typical insight is high since their employees are consumers themselves and understand customer needs. At the same time, potential insight is low, because end-consumers often struggle to articulate their true needs.

The Gap is huge for most B2B suppliers: They know less about their customers’ world, but these customers could tell them much, given their Knowledge, Interest, Objectivity & Foresight (KIOF in chart). For more, watch this 2-minute video, Understand your B2B advantages. If you learn how to close the large B2B Insight Gap, you’ll get an amazing competitive advantage.

See white paper, B2B vs. B2C.

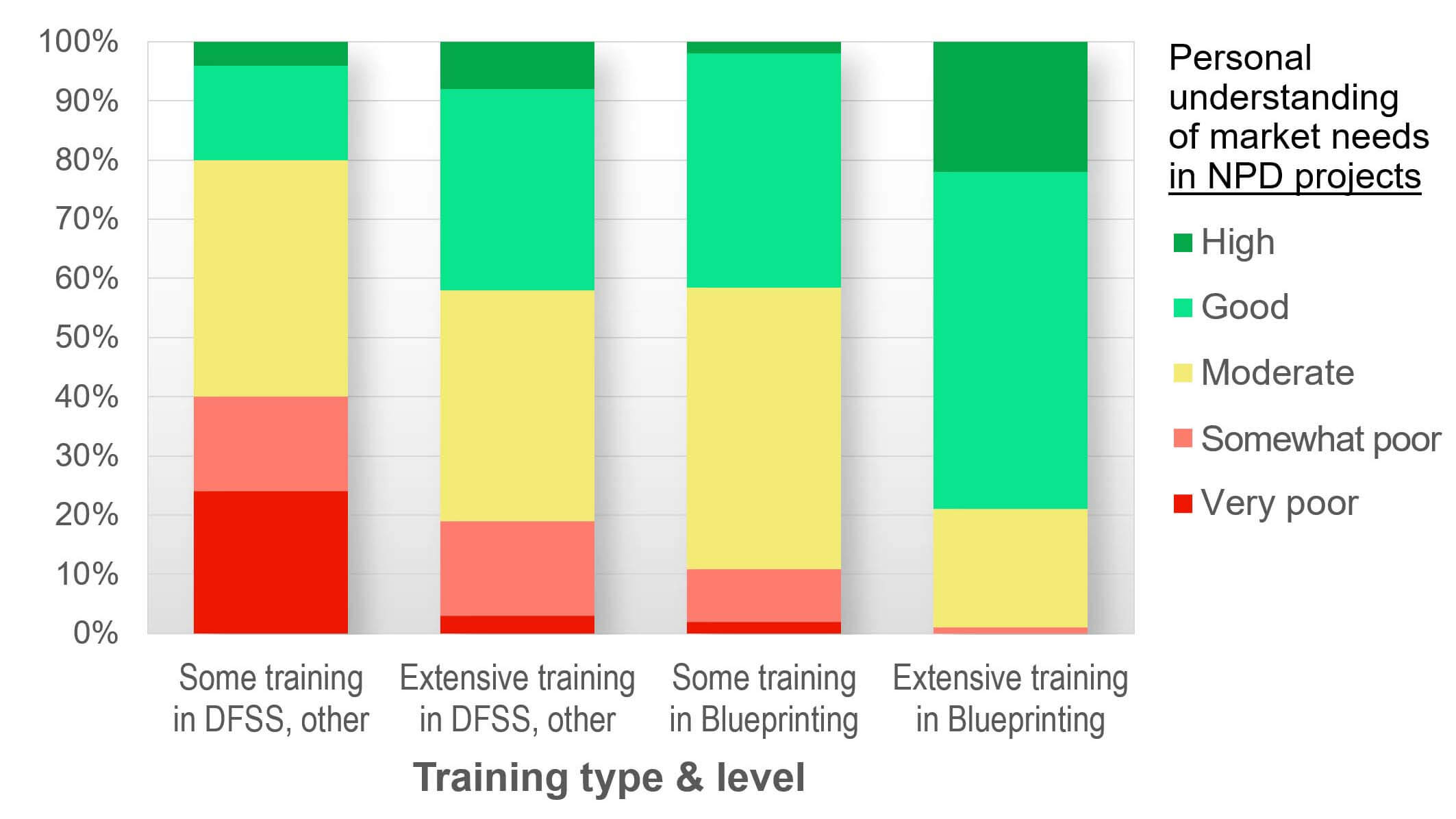

We studied this question in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. We grouped respondents into 4 groups depending on their type of training (New Product Blueprinting or Other) and level of training (Extensive or Some).

Respondents also reported their typical new product success rates: Only 20% of those with “Some” training in “Other” methods had new product success rates over 50% (green in chart). But 80% of those with “Extensive” New Product Blueprinting training were “in the green.” Just think: Instead of one-in-five employees having successful new product track records, you could move to four-in-five with such training.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

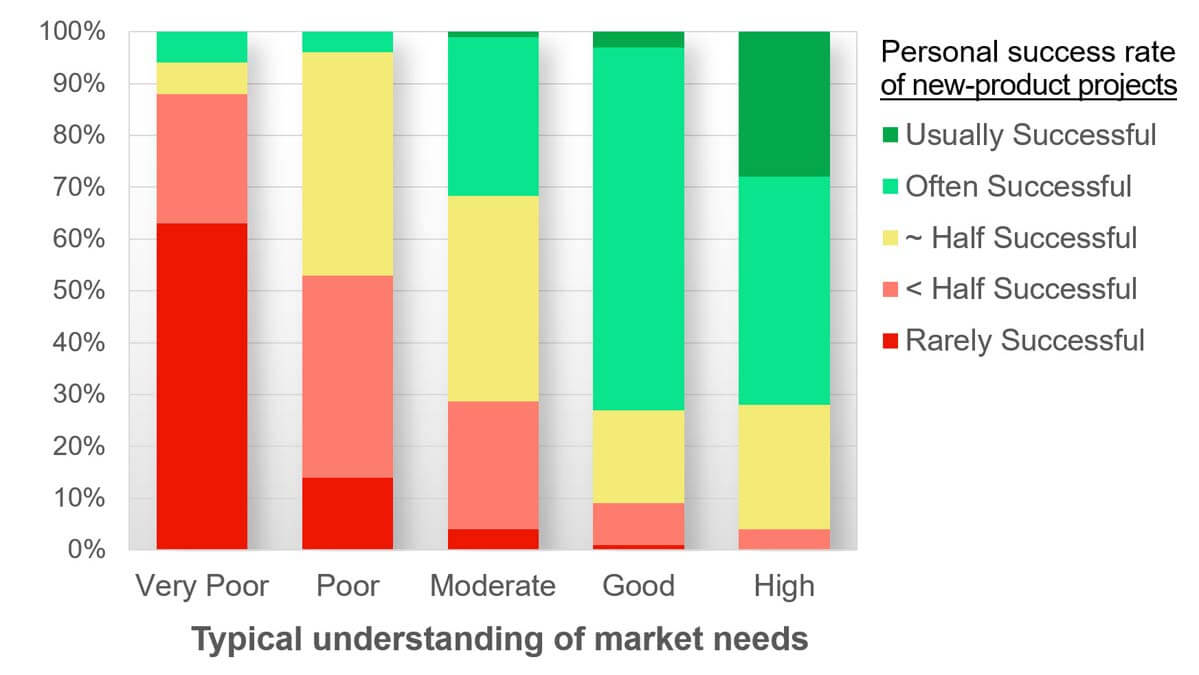

This was a question we studied in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. Some respondents reported a “poor” understanding of market needs while other reported a “good” understanding.

We were surprised at the difference in the two groups’ typical new product success rates: Only 5% of the former group (with poor market understanding) reported their new products were successful over half the time. But 70% of the “good market understanders” reported better than average new product success rates. So instead of hiring more R&D, your shortest path to successful new products might be to understand market needs better.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

Bucket #1 is Technology Development… science-facing innovation that turns money into knowledge. Bucket #2 is Product Development… market-facing innovation that turns knowledge back into money. Bucket #3 is Process Development… optimizing the production of existing products to make money more efficiently. Don’t focus on customer needs for Bucket #1 (it’s too early) or #3 (it’s too late)… but do this very well for Bucket #2. In the entire money-making process, this is your greatest point of leverage today.

More in article, Target Customer Needs and Win

The best research says we’ve struggled for about five decades now. In 1971, the leading cause of new-product failure was “inadequate market analysis” (45%, with the next cause at 29%). In 2019, the leading cause was “No market need” (42%, with the next cause at 29%). After five decades, maybe it’s time to get serious about understanding customer needs before developing new products? Not that we need to rush into this, of course.

More in article, Target Customer Needs and Win

Reliable growth boils down to three linked principles. 1) Your company’s only path to profitable, sustainable organic growth is to create customer value. 2) You only create customer value when you satisfy customer needs that were important and unmet. 3) You must first understand customer needs. You cannot efficiently, effectively improve that which you do not fully comprehend. So it’s time to stop thinking about voice-of-customer as just “one more initiative.” It’s much more. It’s the first link in the growth you want.

More in article, Predict the customer’s experience with modeling.