When recruiting John Sculley from Pepsi, Steve Jobs asked, “Do you want to sell sugar water for the rest of your life, or do you want to come with me and change the world?” Most employees paid no attention to your last quarter’s earnings-per-share. But they’ll tell the next generation how their new product turned an industry upside-down.

More in 2-minute video at 5. Shareholder wealth is a poor goal

With a high-certainty project, you can accurately predict your financial profits. With an uncertain project, you face significant potential downside and upside profits. In B2B markets, you can understand the downside very early. You’ll kill the project cheaply if the downside cannot be eliminated. And reap big upside profits if it can.

More in white paper, Innovating in Unfamiliar Markets (page 5)

Customers will help you set prices before—but not after—you launch your new product. They want you to develop innovative new products and services that deliver value to them… so they’ll give you insights to make this happen. These same insights allow you to establish optimal pricing. Do you know how to do this? It will be too late after you launch your product.

More in 2-minute video at 34. Use value calculators to establish pricing

If you want to develop a great new product, your first step should be to target a single market segment and job-to-be-done (JTBD) within that segment. A market segment is a “cluster of customers with similar needs.” If you develop one product for multiple market segments, your new product won’t satisfy any customers to the fullest extent. By definition, different market segments have different needs, right?

If your company makes colorants, your target market segment might by paint producers. But your project scope is still too broad: You need to target a specific job to be done by those paint producers. Their job might be, “production and sale of semi-gloss paint.” This is explained further in the article, Quantitative questions for interviews

More in 2-minute video, Begin with customers’ job to be done

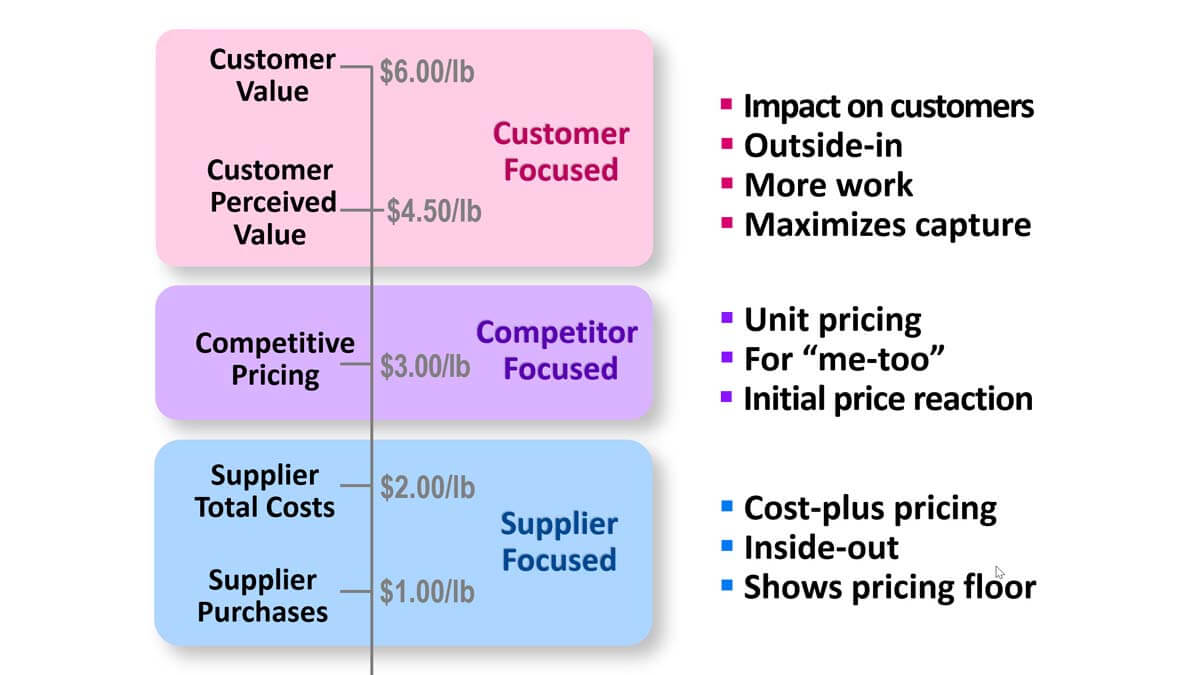

Your pricing could be supplier-focused, competitor-focused, or customer-focused. 1) Supplier-focused pricing is cost-plus pricing. It’s inside-out, leaves money on the table and only indicates your pricing floor. 2) Competitor-focused emphasizes unit pricing, and is only useful for me-too products and gauging initial price reaction. 3) Customer-focused pricing reflects the economic impact on customers. It’s outside-in and does require more work for you. But if you want to maximize value capture, it’s the only way.

More in 2-minute video, Use value calculators to establish pricing

Lagging indicators can be useful, so long as too much time doesn’t pass between your correcting action and the result you want to measure. In this regard, the Vitality index–% of revenue from new products—fails miserably. Improvements you make in the front end of innovation could take years to register a significant impact on revenue.

Don’t discard your Vitality Index, but do supplement it with new metrics, such as the Growth Driver Index (GDI) and Commercial Confidence Index (CDI). Otherwise your new product “furnace” will stay cold far too long. This 2-minute video explains further: Employ new growth metrics.

More in white paper, New Innovation Metrics

How do you know if you’re accepting too much commercial risk in your new product development? You know if Joe answers, “Not sure. Guess we’ll find out next month when we launch it.” Future B2B innovators will think this is nuts. When you innovate for a B2B market, nearly everything needed to eliminate commercial risk is “knowable” in the front end of innovation, before development begins. That’s because your B2B customers have high knowledge, objectivity, interest and foresight (as explained in 2-minute video, Understand your B2B advantage.).

More in article, Target Customer Needs and Win

You conduct front-end-of-innovation customer interviews so you can design a great new product, right? Well yes, but… if you do these well, you’re doing more. You’re also 1) learning the unknown unknowns, 2) unlearning the things you do know that simply aren’t true, 3) aligning your development team for action, 4) making better decisions through improved market intuition, and 5) building stronger relationships for near-term sales opportunities.

For more download e-book, Reinventing VOC for B2B

Exhibit A is an attractive market and Exhibit B is a documented need within this market. Most companies do OK with Exhibit A… identifying a market segment that is winnable and worth winning. But most are terrible at Exhibit B. This is being sure of which customer outcomes (desired end-results) companies will be rewarded for satisfying with a new product. Increasingly, companies are using Market Satisfaction Gaps to do this. (See 12 case stories)

More in white paper, Market Satisfaction Gaps

“Proven right” breeds confirmation bias; “be right” inspires a search for truth. In new product development, “proven right” seeks to validate the supplier’s ideas; “be right” explores customers’ worlds seeking what others have missed. “Proven right” results in squandered R&D spending and missed opportunities; “be right” in delighted customers, premium pricing, and pleasant financial review meetings.

More in e-book, Leader’s Guide to B2B Organic Growth

Imagine you just launched your new product and the market responded with… one big collective yawn. Was it a poorly orchestrated launch? Perhaps, but it’s more likely your launch was doomed a couple of years earlier by poor front-end work. Our research shows five of six B2B product development teams lack a clear understanding of market needs before conducting B2B-optimized VOC. Without this insight, your launch might be putting lipstick on a pig.

More in article, B2B Product Launch: How to get it right

Keep using the vitality index… new product revenue as % of total revenue. But understand three limitations: 1) It’s not predictive; it only tells you what has already happened. 2) It’s not prescriptive; it doesn’t suggest how to improve. 3) It’s not precise; is it a new product if we just change its color? Supplement the vitality index with 2 newer metrics: Growth Driver Index (GDI), and Commercial Confidence Index (CCI).

More in Leader’s Guide Videos Lesson 29, Employ leading growth metrics

The difference between speed and velocity is that only velocity has a direction associated with it. Many in business are focused on going as fast as they can… in any direction. Avoiding solid front-end-of-innovation work because you want to develop your new product faster is a prime example. Sure, you launched your product quickly… but no one bought it, because you failed to first understand customers’ needs.

More in e-book, Reinventing VOC for B2B

1) It should be leading: Doing more of this will result in growth. 2) It should be actionable: Our employees can make this happen. 3) It should be benchmarkable: We can compare year-over-year and to our peers. 4) It should be high impact: If we improve these things, it will significantly impact growth. These two metrics pass all four tests: The Growth Driver Index (GDI) and the Commercial Confidence Index (CCI).

More in article, Beyond the Vitality Index: Two Metrics to Truly Assess Innovation Potential