Imagine your business stopped innovating, your profits declined, and it is now budgeting time. To salvage next year, you’ll likely cut long-term costs, e.g. R&D or marketing, further reducing your ability to create high-value products. Next year, you’ll have even fewer options. This results in death or irrelevancy. If you’ve started this spiral, pull out quickly.

More in 2-minute video at 9. Avoid the commodity death spiral

Of course, employees will be laughing; they’ve heard this one before. When satisfying the expectations of Wall Street analysts conflicts with building the firm’s long-term competitive strength, guess which usually wins? Any employee who’s been through travel restrictions, investment delays, hiring freezes, etc. knows the answer.

More in 2-minute video at 5. Shareholder wealth is a poor goal

I believe the first duty of any business leader is this: “Leave your business stronger than you found it.” I’m unimpressed by leaders who prioritize short-term results and stock prices to the point of degrading growth capabilities and sacrificing the future. I’m mystified when companies enrich a business leader today who is working to impoverish the business tomorrow.

What your business really needs is a builder… someone who brushes aside financial gymnastics and business fads. Someone focused on created value for customers that delivers organic growth for their business. For more, see the 2-minute video, Be a business builder. Also consider a new metric, the Growth Driver Index, which measures how well a business leader is investing in long-term growth capabilities.

See white paper, New Innovation Metrics.

Research published in Harvard Business Review showed companies exhibiting long-term behavior have higher revenue, earnings, job creation, and market capitalization. Clearly, the key to shareholder wealth is long-term behavior, not short-term. If you’re at a financial review discussing revenue, price and margins, you are engaged in a spectator sport. What if your meetings three years ago focused on developing blockbuster products? That was a participant sport, because your longer time horizon allowed you to impact future financial performance. Not just talk about it.

More in video, Leader’s Guide to B2B Organic Growth series, Video Lesson #7

Leadership is less about motivating employees to create value for customers… and more about equipping them with the tools, training, and environment for doing so. A good leader provides and clears the path for innovation. When employees gain customer-insight skills and are free to practice them, they “rise to the occasion.” Sadly, some leaders’ net impact on innovation is more negative than positive due to their short-term actions, e.g. travel bans, hiring delays and spending freezes. They would boost innovation by staying home.

More in e-book, Leader’s Guide to B2B Organic Growth

Some business leaders fixate on the short-term out of fear: They are cowed by Wall Street analysts’ reaction to their quarterly results. But others pump up near-term results to fatten their bonuses… even if it means crippling their company’s future capacity to grow. This is leadership larceny… stealing from the business’s tomorrow to benefit the leader’s today. The first rule of leadership is this: “Leave your business stronger than you found it.”

More e-book, Leader’s Guide to B2B Organic Growth

If you expect your business to be around in 10 years, why are you focusing so much of your energy on this quarter? Especially since less than 10% of your company’s stock value comes from current earnings… while the rest comes from the market’s expectations of your future earnings. Sure, this is what most leaders focus on… but not leaders like Jeff Bezos or Steve Jobs.

More in article, The Inputs to Innovation for B2B

I think this rule should be on every business leader’s desk, and perhaps stamped on their paychecks. Should we be impressed if they pumped up the stock price during their tenure? Not if they did it by mortgaging the company’s future with short-term moves, perhaps chasing away top talent in the process. Glory lies in building something of lasting significance… not in pillaging it.

More in article, How to become a great business leader

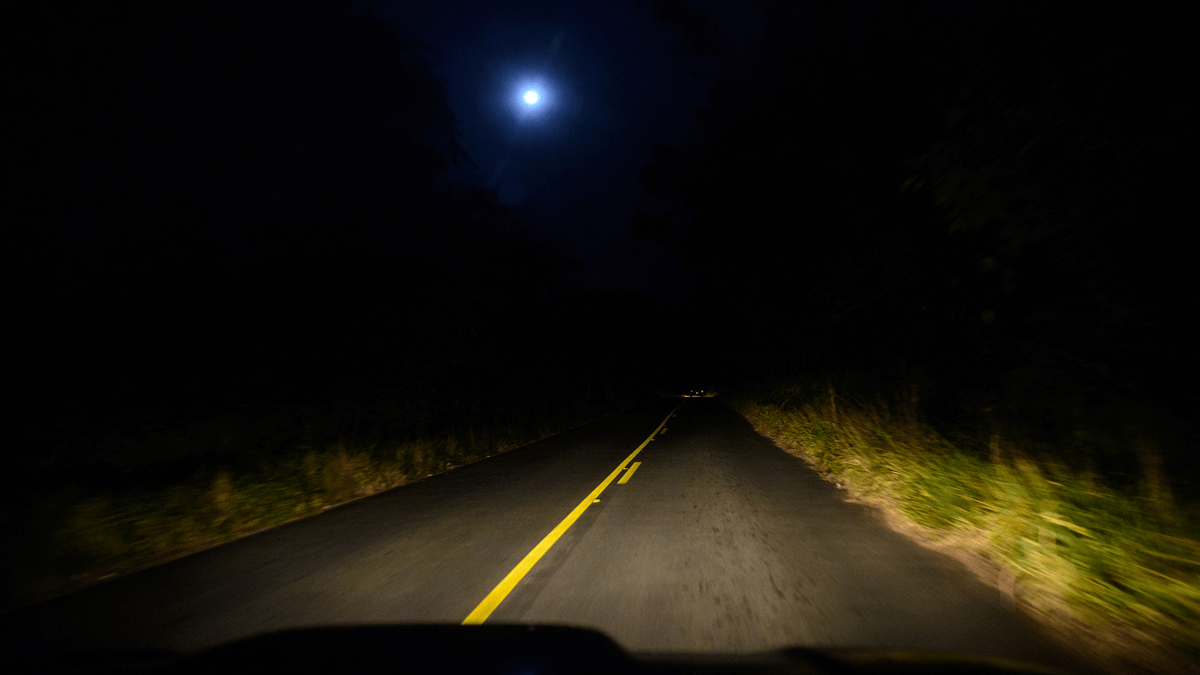

When you drive at night with just your low-beam lights on, you may observe small animals as you run over them. But you can’t avoid them. To do that, you need to have your high-beams on. Same with all those short-term financial reviews: You can only observe the bad results. To change the results, you’d need to build growth capabilities for the future. Run your business with your high-beams on.

More in e-book, Leader’s Guide to B2B Organic Growth (Lesson 7)

In the long-term stockholder and employee interests align. This is also true of customer and community interests. In the long-term, it’s in the best interests of everyone—except your competitors—for your business to develop high-value products, sustain strong growth, provide stable employment, and increase market capitalization. Given this alignment, doesn’t it seem odd that many business leaders seem so fixated on the near-term?

More in e-book, Leader’s Guide to B2B Organic Growth (Lesson 30)

Don’t let your future be “that time you’ll wish you’d done what you’re not doing now.” You’ll be thankful later if you recalibrate your time horizon now… diverting some of your short-term attention to the future of your business. Besides, what you do this quarter is largely a spectator sport. The prices, profits and margins we wring our hands about during financial reviews were determined years ago by the new products created then for customers.

More in e-book, Leader’s Guide to B2B Organic Growth (Lesson 7).

Business leaders focused on the short term are just showing up. They compete for market share this year, hit the reset button, and repeat the process next year. No serious, long-term capability-building. Count yourself fortunate if you compete against such companies. They’re easy to beat with the right time horizon.

More in article, Build Growth Muscles at Your Company (Originally published in B2B Organic Growth Newsletter).

In a now-obscure 1972 HBR article, Richard Vancil complained long-term product development expenses were buried within annual operating plans… allowing short-sighted managers to raid them. Shocking, I know. Divide your budget into short-term and long-term benefit buckets. And make sure someone is guarding the long-term bucket.

More in article, The Commodity Death Spiral (Originally published in B2B Organic Growth newsletter).

Imagine your business stopped innovating, your profits declined, and it is now budgeting time. To salvage next year, you’ll likely cut long-term costs, e.g. R&D or marketing, further reducing your ability to create high-value products. Next year, you’ll have even fewer options. This results in death or irrelevancy. If you’ve started this spiral, pull out quickly.

More in article, The Commodity Death Spiral (Originally published in B2B Organic Growth Newsletter).