Instead, ask the right questions about your customer’s problems. The consultative selling movement was given a major boost in 1988 with Neil Rackham’s ground-breaking research in SPIN Selling. By observing more than 35,000 sales calls, they established that the most successful salespeople ask great questions. Decades later, we had our own question: Are some questions more likely to drive sales? (The answer is “yes”!) We surveyed 396 B2B sales professionals with over 6,000 years of combined experience concerning 12 voice-of-customer skills.

Download AIM Institute research report, VOC Skills that Drive B2B Sales

Large businesses chalk up thousands of face-to-face customer meetings each year… as sales and technical service reps go about their normal duties. Why not train these people to become VOC experts? They’ve already gained customers’ trust, they know the customer’s language, they’ll get key information first-hand, and there’s no extra travel cost.

More in white paper, Everyday VOC

Every one of your B2B customers has needs… problems to be solved. What’s filtering them out, preventing your solution providers from understanding them? 1) Poor listening skills when your employees meet with them? 2) Few probing questions? 3) Haphazard call reports? 4) Weak CRM datamining? You can change all this when your customer-facing employees use Everyday VOC.

More in Everyday VOC white paper, www.EVOCpaper.com

Turns out that understanding market needs makes a big difference. In recent AIM Institute research, nearly 90% of survey respondents claiming a very poor understanding of market needs had new product success rates below 50%. This percentage dropped to less than 10% those for those claiming a good understanding of market needs. So understanding what customers want before you develop your new product is probably a good idea.

More in research report, www.b2bvocskills.com (page 7)

Some companies rely on a handful of internal VOC (voice-of-customer) experts to interview customers. You’ll do far better if you train a critical mass of employees—who routinely interact with customers anyway—to gather customer needs. Keep your VOC experts as coaches and trainers, but implement “VOC for the masses.”

This certainly applies to your sales team. Instead of being satisfied with just a “sales force,” why not also commission a “learning force”? That’s what happens when your sales professionals have strong voice-of-customer skills.

More in white paper, Everyday VOC at www.EVOCpaper.com

With apologies to Tolstoy’s Anna Karenina… all great voice-of-customer (VOC) interviews are alike in the same way: The customer is talking during most of the interview. And they are talking about those outcomes (desired end results) they want to talk about. Anything else is clutter, much of which leads to unhappiness.

For B2B voice-of-customer interviews, plan on two rounds of interview… first qualitative interviews (called Discovery), followed by quantitative interviews (called Preference). In both cases, the customers will be doing most of the talking… and about matters that interest them. They’ll be happy. You’ll be happy.

More in video, Reinventing VOC for B2B

If you sell into a concentrated B2B market (one with just a few customers), your voice-of-customer interviews should have two goals: “insight” plus “engagement.” The latter is important: You want these big customers to be impressed and eager to work with you, not your competitors.

These 10 approaches help you engage your customers when interviewing them to understand their needs: 1) Kill the questionnaire. 2) Let customers lead the interview. 3) Discuss their job-to-be-done. 4) Project your notes so they can see them. 5) Focus on customer outcomes. 6) Learn how to probe deeply. 7) Don’t sell or solve. 8) Get quantitative in your VOC. 9) Use triggers to generate fresh ideas. 10) Use B2B-optimized interview tools. (See the 2-minute video, Engage your B2B customers.)

These are explained in the article, The Missing Objective in Voice of Customer Interviews

In general, we do consider in-person interviews to be the gold standard. But there are 10 advantages of virtual VOC you shouldn’t overlook: 1) lower cost, 2) reaching dispersed customers, 3) viewable probing tips, 4) training for colleagues, 5) probing suggestions, 6) assistance for note-taker, 7) rapid de-briefing, 8) easier scheduling, 9) low-impact cancellations, and 10) greater project speed. To maximize effectiveness and efficiency, you’ll be wise to blend and balance both types of VOC. (See 2-minute video, Conduct virtual customer interviews.)

More in white paper, Virtual VOC

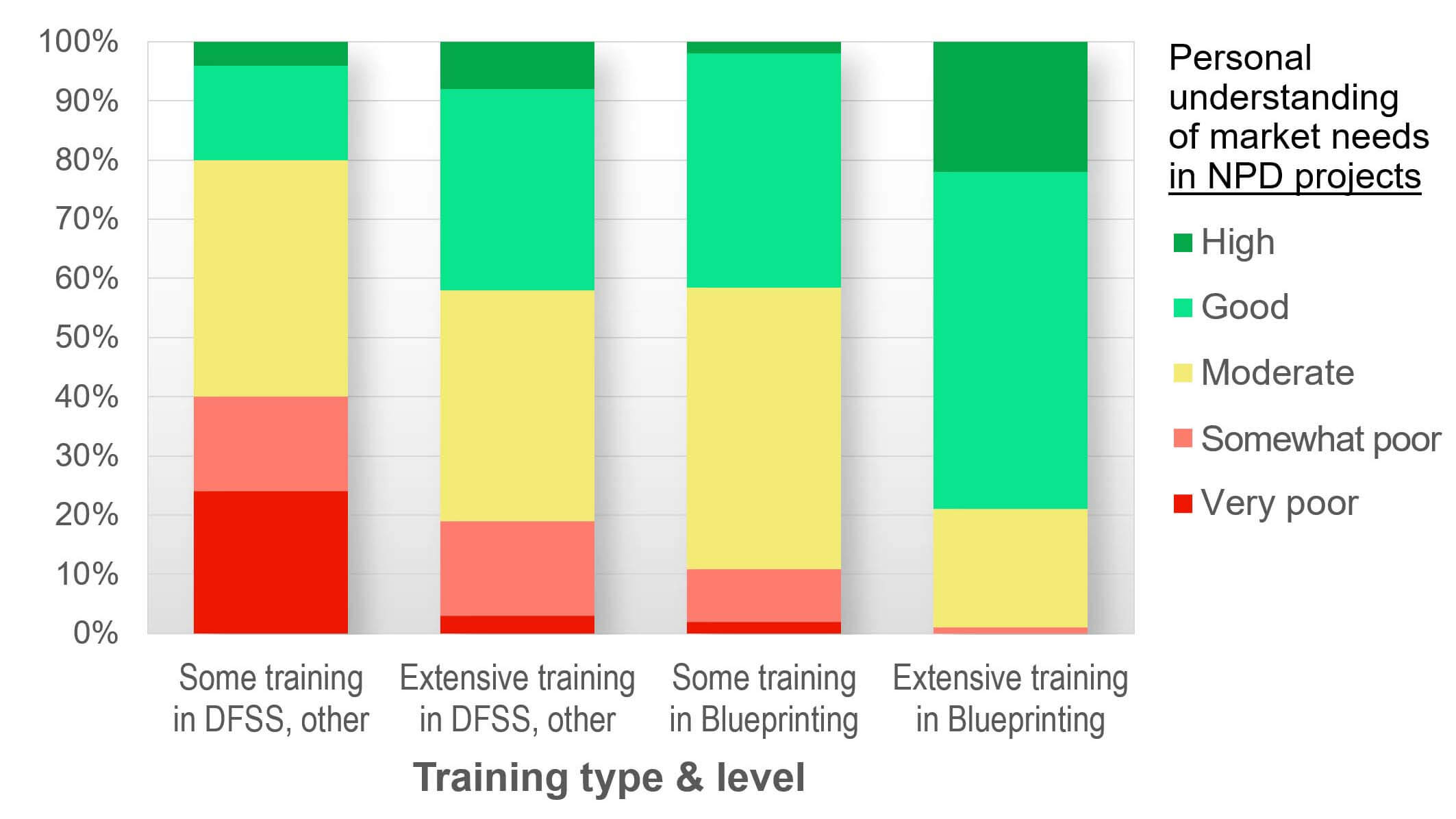

We studied this question in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. We grouped respondents into 4 groups depending on their type of training (New Product Blueprinting or Other) and level of training (Extensive or Some).

Respondents also reported their typical new product success rates: Only 20% of those with “Some” training in “Other” methods had new product success rates over 50% (green in chart). But 80% of those with “Extensive” New Product Blueprinting training were “in the green.” Just think: Instead of one-in-five employees having successful new product track records, you could move to four-in-five with such training.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

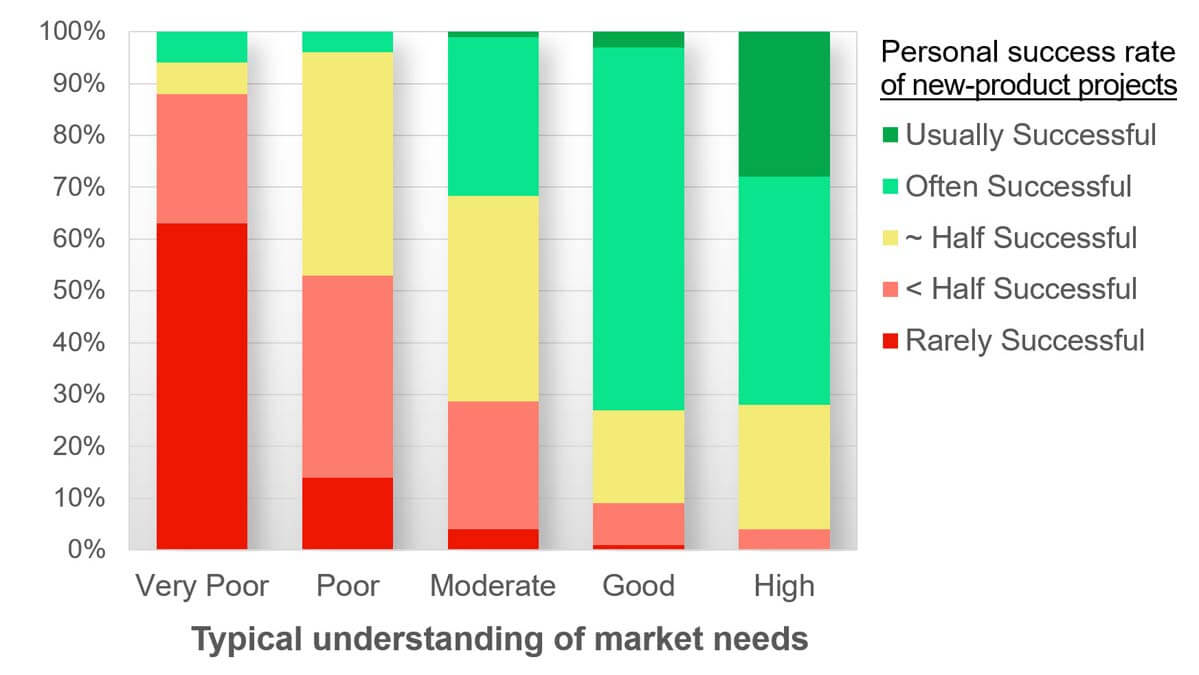

This was a question we studied in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. Some respondents reported a “poor” understanding of market needs while other reported a “good” understanding.

We were surprised at the difference in the two groups’ typical new product success rates: Only 5% of the former group (with poor market understanding) reported their new products were successful over half the time. But 70% of the “good market understanders” reported better than average new product success rates. So instead of hiring more R&D, your shortest path to successful new products might be to understand market needs better.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

In my experience, VOO is much more common than VOC among B2B companies today. This will surely change, given the huge advantages of B2B-optimized VOC. (See e-book, Reinventing VOC for B2B.) You can learn your position on the VOO-vs.-VOC spectrum by diagnosing 10 factors: 1) interview scope, 2) interview objective, 3) types of questions, 4) note-taking, 5) interview skills, 6) observation skills, 7) companies interviewed, 8) deliverables, 9) engagement timeframe, and 10) interviewing staff.

For descriptions of all 10, see article, Why Advanced Voice of Customer Matters

I suspect you’d rather look at a map first, and then start your journey. So why do many B2B companies develop a new product and then show it to customers? With intelligent B2B voice-of-customer interviews (see e-book, Reinventing VOC for B2B), your customers are drawing a map for you: “Yes, go here and work on this outcome. No, that outcome isn’t important so don’t bother.” Granted, it’s more “daring” to ignore a map. But if you want to get to the right destination as quickly and efficiently as possible, it’s better to talk to your cartographers first.

See 2-minute video, Stop leading with your solutions

If you bring a prototype to a customer, this is “concept testing”… which is different than voice of the customer research. Prototypes are fine later in the process, but for many companies this is their first discussion with customers. B2B concept testing should occur after front-end voice-of-customer interviews. If you start with concept testing, you’ll incur confirmation bias, less-engaged customers, and the false impression you’ve acted in a customer-centric fashion. See 2-minute video, Stop leading with your solutions.

More in article, Don’t Confuse Concept Testing With VoC

Surely nobody would brag about using VOO to develop new products. But if you aren’t having intelligent conversations with B2B customers before developing your new products, isn’t this what you’re doing? A good test is to add up your hours of internal conversations and compare with your voice-of-customer (VOC) hours. If you are not happy with the ratio, this might explain why customers are not happy with your new products.

More in e-book, Reinventing VOC for B2B