If you see a business that has steadily grown over the years in size, profitability and stature… whose products have surpassed competitors’… that grinds through the hard work of delivering real customer value… that brushes aside fads, downturns and criticisms… look for the builder. If this is you, we can show you some power-tools for your next project.

More in article, Are You a Builder or a Decorator?

If your new product development process starts with your ideas—instead of B2B customers’ desired outcomes—your new product may be an answer to the wrong question(s). You’ll likely a) miss important customer outcomes, or b) misinterpret the importance of the customer outcomes you have identified.

More in white paper, Timing is Everything.

If all customer outcomes in a market are either unimportant or already satisfied, you’ll see low Market Satisfaction Gaps. This is an over-served market, and there’s only one thing that makes these customers happy: Dropping your price. Race to more attractive markets and hope your competitors waste resources here. Have you identified your over-served markets yet?

More in article, Customer Interviews—By the Numbers (Originally published in B2B Organic Growth Newsletter).

Where else do you invest tens of millions of dollars in personnel, so that many can work diligently on answers to the wrong questions? If your firm is like most, one-half of your product development resources are working on projects that will be cancelled or fail to yield an adequate return. You can stop this innovation malpractice with the science of B2B customer insight.

More in white paper, Catch the Innovation Wave (page 5).

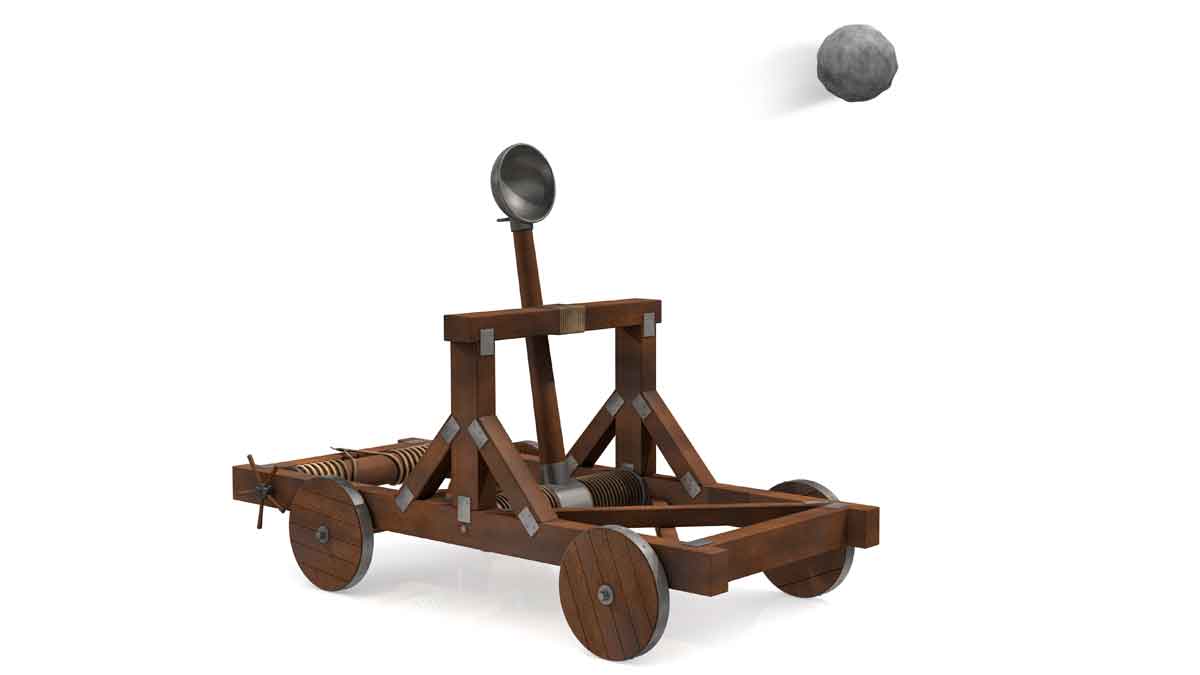

In concentrated B2B markets, the top ten buying accounts may represent 50-100% of the buying potential. Unlike B2C—with deep pools of potential prototype testers—B2B suppliers can wear out their welcome by lobbing sloppy “minimum viable products.” If you use Lean Startup, be sure to begin with proper B2B customer interviews.

More in white paper, Lean Startup for B2B (page 7).

Companies think they know how good competitors’ products are. But when they conduct customer-centric side-by-side testing, they’re often shocked by this unfiltered view of where they really stand. Like a beautiful theory being attacked by a brutal gang of facts. Not pretty, but better than launching a dud. Doing this properly isn’t that hard… but is very uncommon.

More in article, 5 Growth Risks You Can Stop Taking (Originally published in B2B Organic Growth Newsletter).

Years from now, we’ll think it quite strange that B2B companies explored market needs by launching products to see if anyone would buy them. In the future, B2B companies will have a complete understanding of market needs before they begin developing their products, let alone launch them. Want to start before your competitors?

More in white paper, Catch the Innovation Wave (page 5).

A fine innovation metric is the vitality index… % of total sales from new products (usually launched in the last 3 or 5 years). But it doesn’t tell you why your % is going up or down, does it? Sure, you can see which new products contributed… but you need to uncover the underlying reasons driving results. Otherwise you’re just watching from the bleachers.

More in article, 3 Problems with Innovation Metrics (Originally published in B2B Organic Growth Newsletter).

Clever companies realize they’ll “hear what they want to hear” without quantitative VOC. To do it right, B2B companies should weight responses based on customer buying power. And don’t just ask for importance ratings: Ask for satisfaction ratings as well. The only hope for premium pricing is pursuing needs that are both important and unsatisfied.

More in article, Constraints to Organic Growth

Two conditions must be present to capture maximum value in product pricing. Condition A: Your product provides a benefit the customer values greatly. Condition B: The customer is unable to get this value elsewhere. If you only interview customers, you learn A, but not B. You need rigorous side-by-side testing for B. Few companies do this correctly. Do you?

More in article, 5 Growth Risks You Can Stop Taking (Originally published in B2B Organic Growth Newsletter).

If a stock’s P/E ratio is 20-to-1, then only 5 percent of a firm’s value is driven by this year’s earnings. Put another way, 95 percent of shareholder value is driven by investors’ expectations of the future. Executives with rich stock options have “motive and opportunity” to manipulate these expectations… in ways that often damage the firm’s long-term health.

More in article, Why Maximizing Shareholder Value is a Flawed Goal (Originally published in B2B Organic Growth Newsletter).

Think your VOC work is done if you can splash some pithy customer quotes on a PowerPoint slide? Nope. You must conduct quantitative interviews to isolate the important, unsatisfied outcomes (using 1-10 scales). We all “hear what we want to hear”… so unfiltered customer data is needed. Never spend development dollars until someone “shows you the numbers.”

More in article, Why Advanced VOC Matters (Originally published in B2B Organic Growth Newsletter).

If your new product development process begins with “idea generation,” is it your idea… or your customers’? If you start with your idea, you probably won’t understand customer needs until the end… by seeing if they buy your new product. Why not flip your approach and start with customer needs? Unless you’d rather your R&D kept guessing at customer needs.

More in e-book, Reinventing VOC for B2B (page 4).

Traditional VOC relies on questionnaires, tape recorders and post-interview analyses. That’s fine for B2C, but your B2B customers are insightful, rational, interested and fewer in number. They’re smart and will make you smarter if you engage them in a peer-to-peer fashion, take notes with a digital projector, skillfully probe, and let them lead you.

More in executive briefing, Seven Mistakes that Stunt Organic Growth.