If your new product development process does not require customer interviews today, consider two questions: 1) Do I have competitors beating me to the new product punch because they are using such interviews to uncover market needs? 2) Could I leapfrog them by building a company-wide competency of B2B-optimized interviews?

More in e-book, www.reinventingvocforb2b.com

Many suppliers ask “low-lumen” questions that neither illuminate nor engage customers. They may be biased, close-ended or too complex. Beware requesting sensitive information, or asking, “What would you pay for this?” When you ask for problems, don’t try to “help” with examples. Instead, let the customer choose the next topic to discuss.

More in white paper, Everyday VOC

Good questions demonstrate you’re more interested in the other person than yourself. What do you call someone who listens to you and seems fascinated by your responses? You call them a brilliant conversationalist. Think of it this way: Your customers have a hard time getting their boss to listen to them. They go home and their kids don’t listen to them. Now a supplier (you) is leaning forward and asking, “Really? Could you tell me more about that?” If you were the customer, wouldn’t you like to talk to such a person?

More in white paper, Everyday VOC at www.EVOCpaper.com

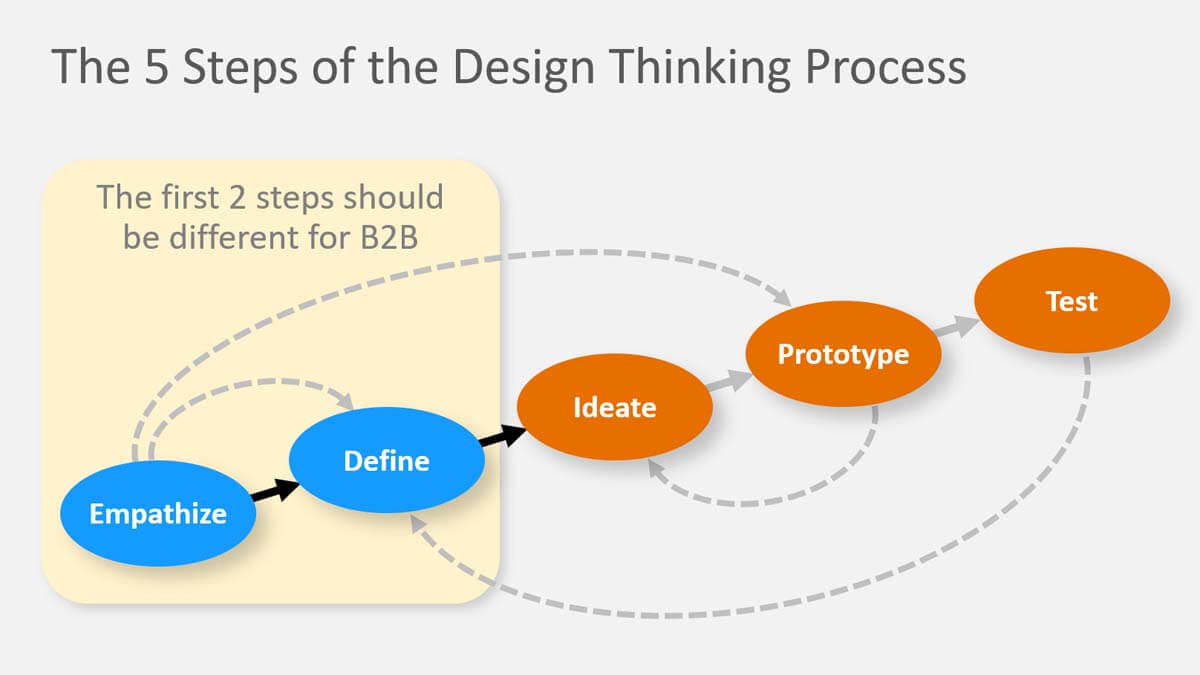

Design thinking is a powerful methodology for solving “wicked problems.” Unlike the well-stated problems we were given to solve in engineering school, these require figuring out what to work on, not just how to solve the problem. This perfectly describes real-world new product innovation, where we need to first understand customer needs.

As this diagram shows, the first two steps are “empathize” and “define.” Here’s the good news for B2B producers: You can do this much more effectively that B2C counterparts by using Discovery interviews (for “empathize”) and Preference interviews (for “define”). Check out this white paper to see why… and how: Design Thinking for B2B

More than you might think. We asked nearly 400 people who had conducted over 1800 B2B-optimized Discovery interviews. Over half agreed or strongly agreed that they had gained unexpected interviews. Only 14% gained no unexpected information at all. (Most of the 1800+ interviews were in suppliers’ existing markets.)

More in white paper, Guessing at Customer Needs (page 6)

First, how interested are they in this topic? Second, how confident are they that this supplier can help them? The first condition puts a premium on your ability to find the right people in the right companies. The second requires you to demonstrate serious intent and—if possible—past successes in market-facing innovation.

More in article, Better B2B Customer Recruiting for Market Research

We now chuckle at how sales people used to rely on ABC (Always Be Closing) and manufacturers relied on end-of-line inspectors (vs. statistical quality control). But those will pale compared to the way today’s B2B companies test markets: by launching fully-developed products at their customers. When they could have learned customer needs first with some simple interviews. Funny stuff.

More in article, The Inputs to Innovation for B2B

In Asia, for instance, people are especially mindful of the feelings of peers and bosses. And if customers are accustomed to a trading culture—not “consultative selling”—they’ll expect visiting suppliers to “sell us something.” Patience is needed, but thankfully the desire to be understood is universal.

More in e-book, Reinventing VOC for B2B (page 27).

You want to get the right B2B interviewees in the room, but setting up great interviews can be tough. Interviewees may think… “I’m too busy… I don’t want to discuss confidential information… I can’t be bothered by a boring survey… I’ll bet they just want to sell me something.” Knowing how to overcome objections is as important a competitive edge as the interviewing skills themselves.

More in article, 9 Best Practices for Recruiting Customers

Imagine a fellow on a date that talks about himself for an hour. His only questions are, “What’s your income? What’s your educational level?” Then he closes with, “Will you marry me?” Does this sound like an old-fashioned “qualify-and-then-close” sales call? As in a good date, you should be genuinely interested by your customer and their needs.

Learn more about B2B innovation at theaiminstitute.com

We asked this question of new-product teams that had conducted a total of 875 B2B-optimized customer interviews. 96% said these interviews would have a moderate, significant or great impact on their company’s organic growth rate. Only 4% said the impact would be “slight.” About the same amount also felt such interviews would positively impact their company’s culture.

More in white paper, Guessing at Customer Needs (page 10).

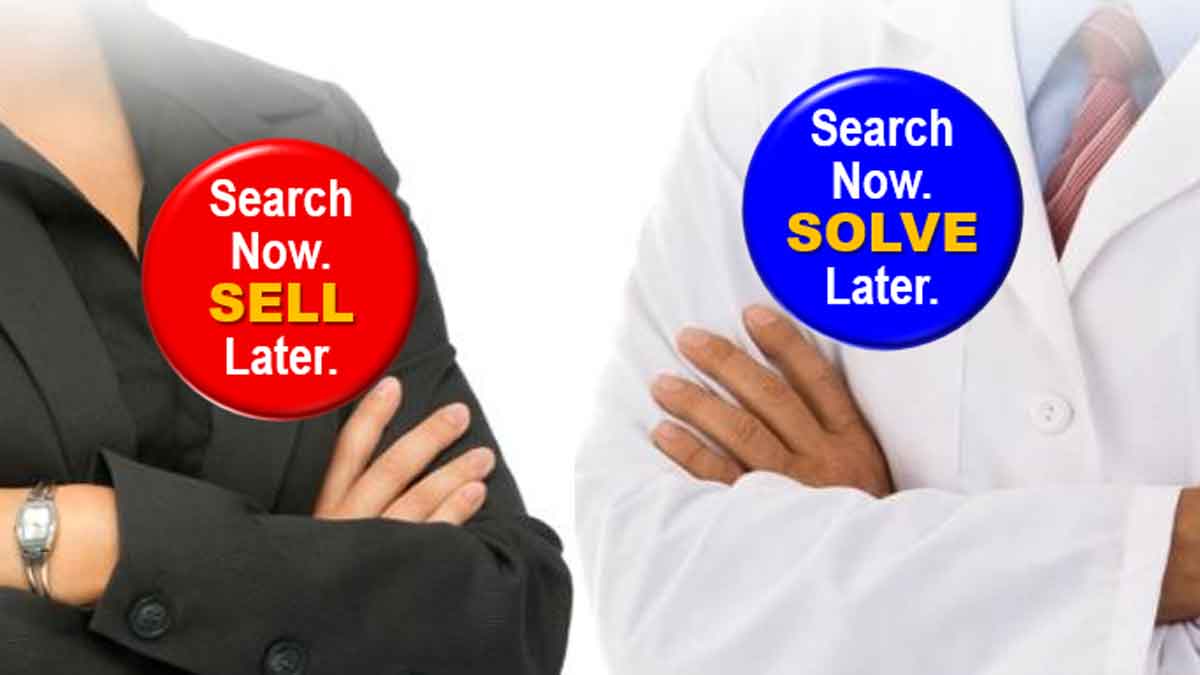

Send commercial-technical teams on interviews… but don’t let them sell or solve. If you sell during voice-of-customer sessions, customers know you’re not really interested in them. If you solve, you’re jeopardizing your intellectual property. In either case, you’re wasting precious time better used to understand customer needs.

More in e-book, Reinventing VOC for B2B (page 24).

After qualitative interviews, seek customer ratings on key outcomes: “How important is abrasion resistance on a 1-10 scale? And how satisfied are you today with abrasion resistance on a 1-10 scale?” This lets you converge with confidence on only those outcomes customers care about… those with Market Satisfaction Gaps over 30% (important and unsatisfied).

More in white paper, Catch the Innovation Wave (page 11).

I love it when our clients have cool technology and clever ideas. But don’t mention these to customers during VOC interviews. From the customer’s perspective, the interview should look exactly the same whether or not you’ve got a great hypothesis. Give your hypothesis the silent treatment for now. Simply listen to the customer.

More in article, Give your Hypothesis the “Silent Treatment” (Originally published in B2B Organic Growth).