“What is P PC Balance?

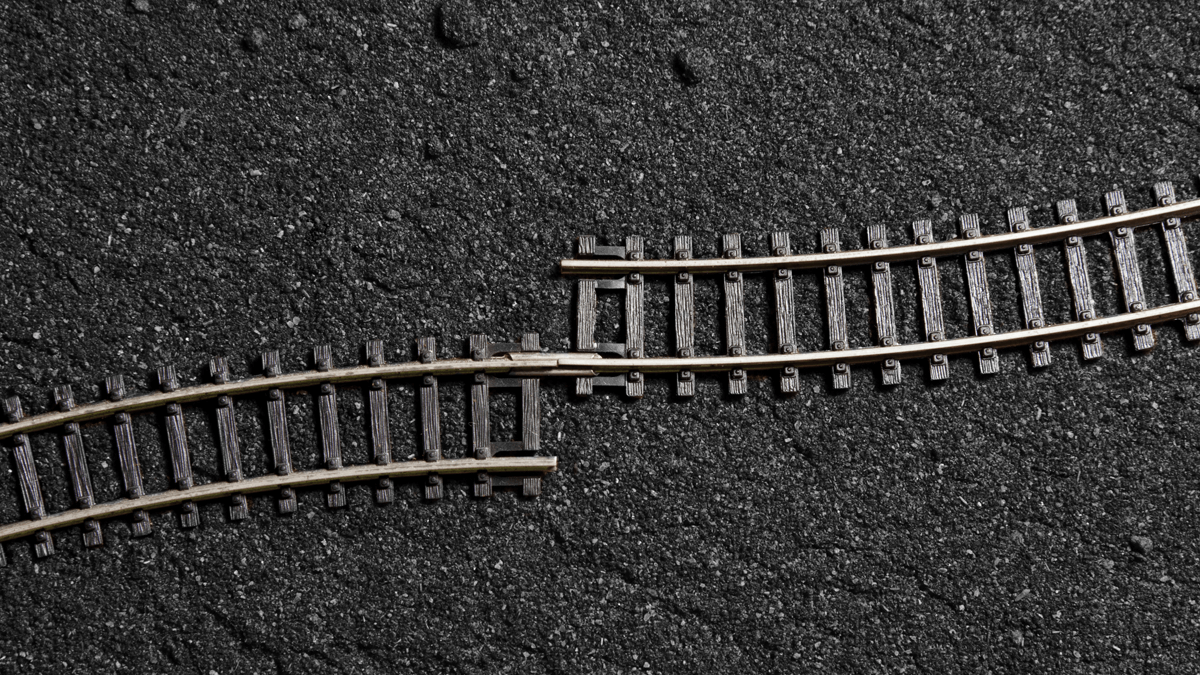

Decades ago, Stephen Covey explained we need to balance “P” (production) against “PC” (production capability). Today many companies just focus on this year’s results (P), without building the capabilities needed for future growth (PC).

Production Capabilities are the PC

There is a natural law of harvesting: sowing and reaping. And the sowing must come before the reaping. When we don’t understand this, the “P PC Balance” will make that profitable future difficult to achieve. Jeff Bezos has taught that this year’s profits have to do with the work done years ago. Further, we know that we need our PC to contain the core components of tools, processes, and people.

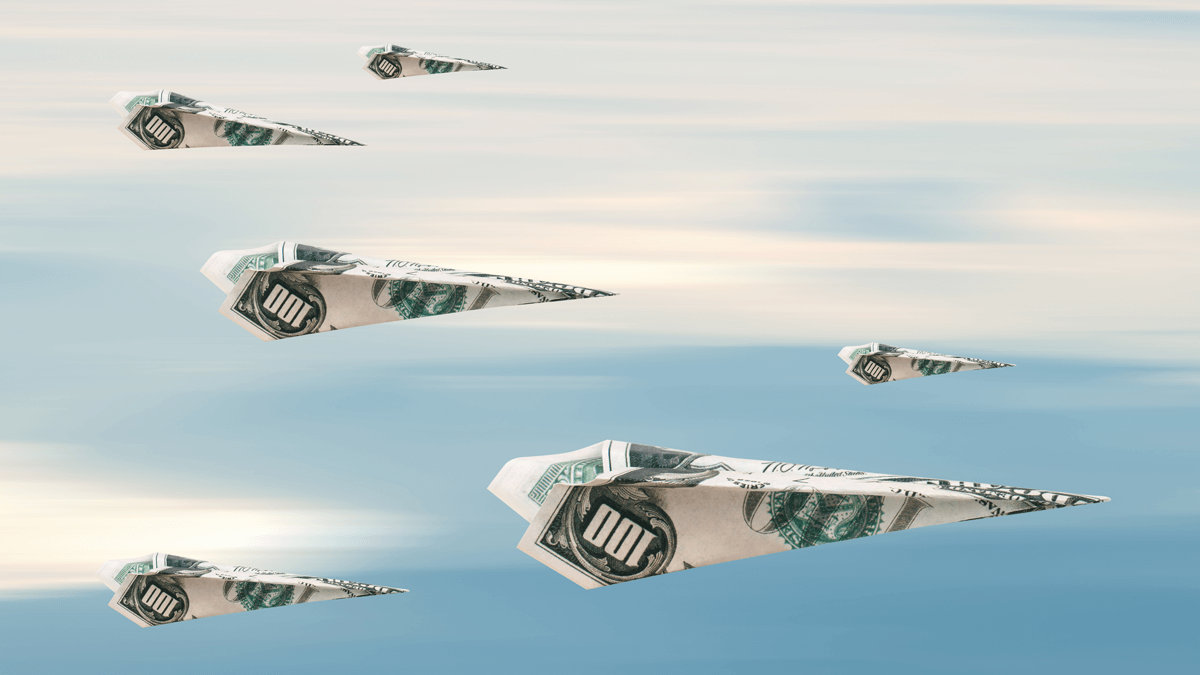

Tools are Production Capabilities

“P PC balance” must consider the tools required. Tools increase efficiencies. They reduce errors. The modern B2B firm must understand how to leverage tools to its advantage. From voice of the customer software to web conference services, this is not a place to pinch pennies. Let’s also get more sophisticated about the language of finance, which is how success is measured.

Processes are Production Capabilities

“P PC balance” must consider the processes. For example, we must know how to allocate resources. That is, we must optimize the risk between risk and reward with our portfolio management system. We need our stage-and-gate system to keep development marching along. And we need processes for pursuing riskier investments, or, we’ll look at our new initiatives – and find that they are all incremental in nature.

People are Production Capabilities

And last, but certainly not least, “P PC balance” must consider people. They are the most important assets a firm has. And yet, how often, during tough times, do we see massive layoffs? How often to we watch knowledge and experience literally walk out the door. Fail to maintain the talent level and bigger failures are sure to follow. And don’t just keep them, but invest in their learning and careers. There should be a high degree of alignment.

There is no doubt that there’s tremendous pressure on executives to perform. But don’t just hit the reset button and start over again every year. Sell the vision, sell the process! Build the future that you (and your firm’s investors) want.

More in article, B2B Leadership: Time for Greatness