We see three common shortcomings with B2B product launches: 1) Low-quality front-end work: Suppliers develop the wrong product, so even the best launch is just putting lipstick on a pig. 2) Poor linkage between stages: The launch is not driven by what was learned in the front end. 2) Out-dated promotional tools: This includes poor selection of the many traditional and digital tools available today. It helps to follow these 4 steps: The Right Product delivered to the Right Market using the Right Message through the Right Media.

More in 2-minute video, Launch new products with power

In our white paper, B2B vs B2C: Organic growth implications for B2B professionals, we cover 12 differences between suppliers to B2B vs. consumer goods markets. Is this just an academic exercise? Not at all. Every one of these differences has implications for organic growth. The news gets better if you’re a B2B supplier: Nearly all these differences are advantages in your favor. Of course, an advantage is no advantage if you don’t take advantage of it. This white paper will show you how.

Also see the 2-minute video, Understand your B2B advantages

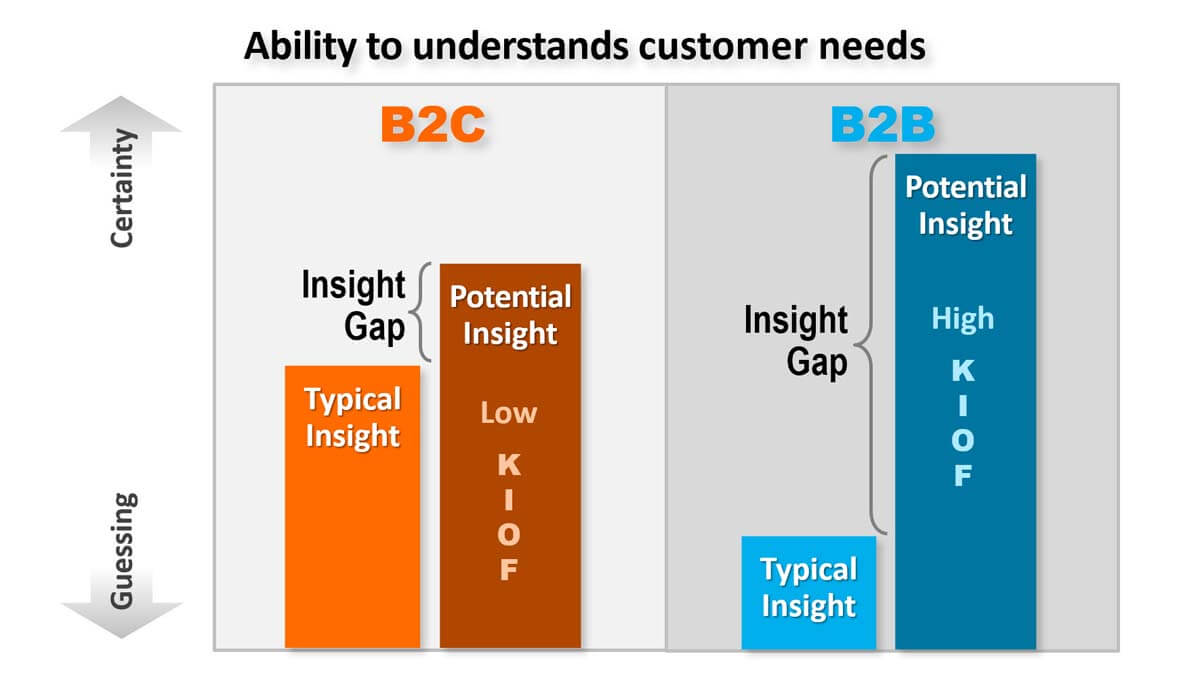

The Customer Insight Gap is the difference between what suppliers typically understand about customer needs… and what they could potentially understand. This Gap is usually small for consumer-goods suppliers (B2C): Typical insight is high since their employees are consumers themselves and understand customer needs. At the same time, potential insight is low, because end-consumers often struggle to articulate their true needs.

The Gap is huge for most B2B suppliers: They know less about their customers’ world, but these customers could tell them much, given their Knowledge, Interest, Objectivity & Foresight (KIOF in chart). For more, watch this 2-minute video, Understand your B2B advantages. If you learn how to close the large B2B Insight Gap, you’ll get an amazing competitive advantage.

See white paper, B2B vs. B2C.

Why would a company ever want to be a fast follower? I can only think of one reason: They want to reduce commercial risk, by coat-tailing a competitor’s market success. After all, fast-followers don’t reduce technical risk. This only increases, given the need to work around competitive patents. With B2B markets, you can eliminate most commercial risk through B2B-optimized voice-of-customer interviews. (See e-book, Reinventing VOC for B2B.) Turns out the fast-follower strategy is a misguided strategy for B2B.

More in article, Chasing the Fast Follower Myth

Did you buy home-owner insurance… even though it’s unlikely your house will burn down this year? How confident are you that you truly understand customer needs when you develop new products? Our research shows most companies do not. So why not have your teams trained in the latest B2B voice-of-customer insight methods? Think of it as insurance. Or better yet… as a strong preventative, like fire-proofing your house.

See video on B2B voice-of-customer at www.vocforb2b.com.

540 B2B professionals—with over 10,000 years of combined experience—responded to our research survey. Here’s what we learned: They were much more eager to improve growth drivers for understanding customer needs (e.g. customer interviews) than meeting customer needs (e.g. gate-review processes). Of 24 growth drivers, what were they most eager to improve? Market insight.

More in article, What Drives B2B Organic Growth? Now we know

The potentially-intrusive nature of consumer “big data” has already caused some mistrust of B2C marketers. Conversely, the best B2B marketers—especially in concentrated markets with fewer customers—are now developing powerful interviewing skills to listen closely to their customers. You can imagine the response: Who among us doesn’t want to be carefully listened to and understood?

More in e-book, Leader’s Guide to B2B Organic Growth (Lesson 15)

Each of your market segments has a unique nature, defined by five qualities of its customers: knowledge, interest, objectivity, foresight and concentration. If you treat all markets the same, you’ll seriously sub-optimize. Better to fine-tune your early-stage marketing (understanding customer needs) and late-stage marketing (promoting your solutions) to each market segment. Use this free service to calculate your market’s B2B Index (how B2B it is) and learn 15 customized marketing strategies.

Calculate your B2B Index at www.b2bmarketview.com

More than you might think. We asked nearly 400 people who had conducted over 1800 B2B-optimized Discovery interviews. Over half agreed or strongly agreed that they had gained unexpected interviews. Only 14% gained no unexpected information at all. (Most of the 1800+ interviews were in suppliers’ existing markets.)

More in white paper, Guessing at Customer Needs (page 6)

Developing B2B customer insight skills for this growth requires a commitment your competitors may be unwilling to make. Good. You need them to remain shortsighted. As you gain insights, you may enjoy a bonus: Customers are impressed with suppliers that listen to them… and often offer near-term adjacent opportunities.

More in white paper, Catch the Innovation Wave (page 15).

Many B2B producers are stuck at the 2nd of the 4 innovation maturity levels: Solution Validation. When they ask customers to validate their cool new idea, they think they are understanding market needs. They are not. They are simply understanding market reaction… to one idea… their idea. You’ll get far better results by reaching the 3rd maturity level: Market Insight.

More in white paper, Guessing at Customer Needs (page 7).

We now chuckle at how sales people used to rely on ABC (Always Be Closing) and manufacturers relied on end-of-line inspectors (vs. statistical quality control). But those will pale compared to the way today’s B2B companies test markets: by launching fully-developed products at their customers. When they could have learned customer needs first with some simple interviews. Funny stuff.

More in article, The Inputs to Innovation for B2B

More specifically, it’s learning what you didn’t know about the customer’s world in your target market. If you think it’s about “ideating” to come up with cool supplier ideas—which you’ll “validate” with customers—you’ve got it all wrong. Start with customers and their needs… not with you and your notions. Focus on your solutions after you understand what those who might buy them want.

Learn more about B2B innovation at theaiminstitute.com

In a whispered voice, a B2B business executive confided to me that his company seldom spent more than $10k on their product launches… even after spending hundreds of thousands developing the product. This isn’t launching a product. This is kicking it off the loading dock and hoping someone finds it.

More in article, Stop Squandering Your Product Launch Budget