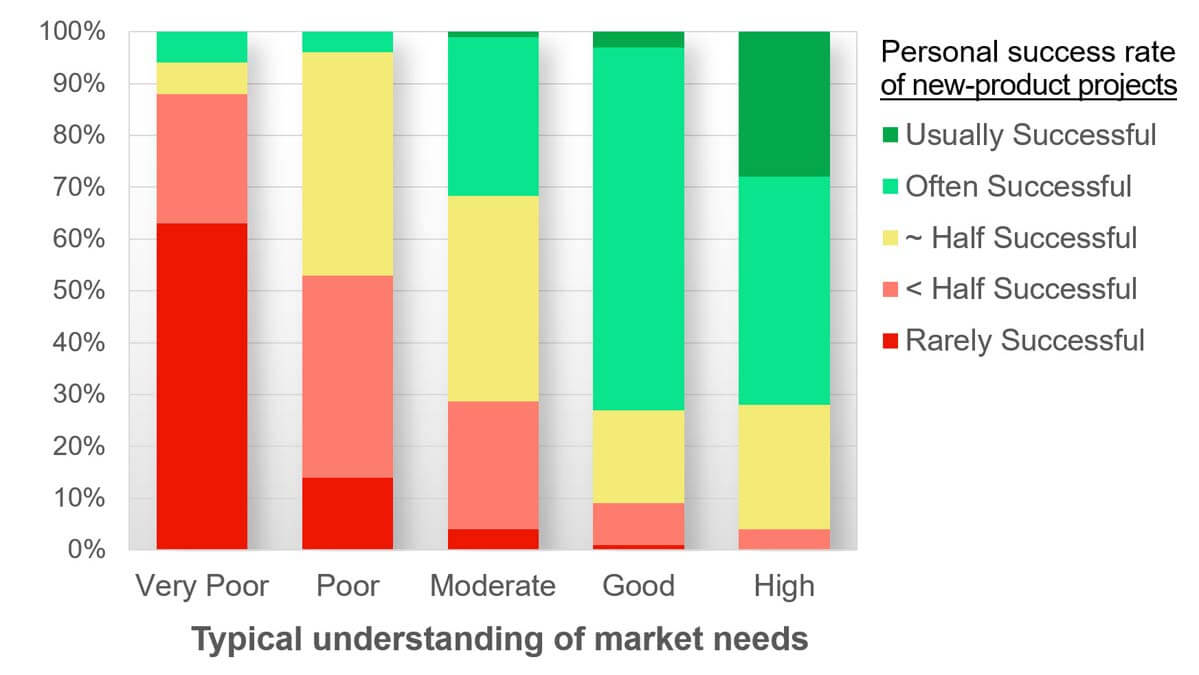

This was a question we studied in our research on B2B VOC skills, which included a survey of 300+ B2B professionals. Some respondents reported a “poor” understanding of market needs while other reported a “good” understanding.

We were surprised at the difference in the two groups’ typical new product success rates: Only 5% of the former group (with poor market understanding) reported their new products were successful over half the time. But 70% of the “good market understanders” reported better than average new product success rates. So instead of hiring more R&D, your shortest path to successful new products might be to understand market needs better.

More in research report, B2B VOC Skills: Research linking 12 VOC skills to new product success

If your R&D looks like a black box to management, you’ve probably noticed that their patience can run out rather quickly. But when you de-risk projects transparently with management, they are much more tolerant of unavoidable delays and setbacks.

You do this in three steps: 1) Generate assumptions… possible landmines that could “blow up” your project. 2) Rate assumptions… for likely impact and certainty. 3) Investigate assumptions… especially high-impact, low-certainty assumptions. This 2-minute video explains the process: How to pursue transformational projects.

More in article, How to de-risk projects and overcome management doubt.

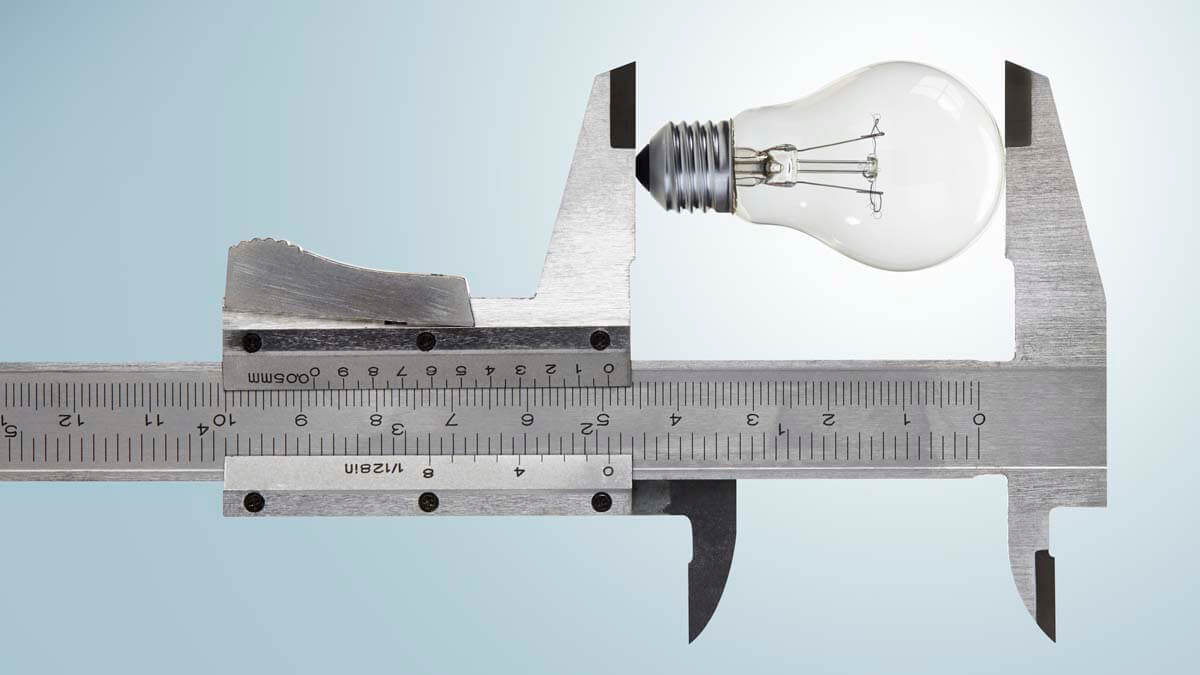

The Vitality Index—% of revenue from new products—is a fine metric. But it is 1) not predictive… it’s a lagging indicator only revealing what’s already happened, 2) not prescriptive… it doesn’t say how to improve, and 3) not precise… often ill-defined and easily manipulated. Keep it, but supplement it with two new metrics, the Growth Driver Index and Commercial Confidence Index. These measure your progress on building growth capabilities and customer insight, respectively. Check out this 2-minute video to see how easy these metrics are to implement, Employ new growth metrics.)

More in white paper, New Innovation Metrics.

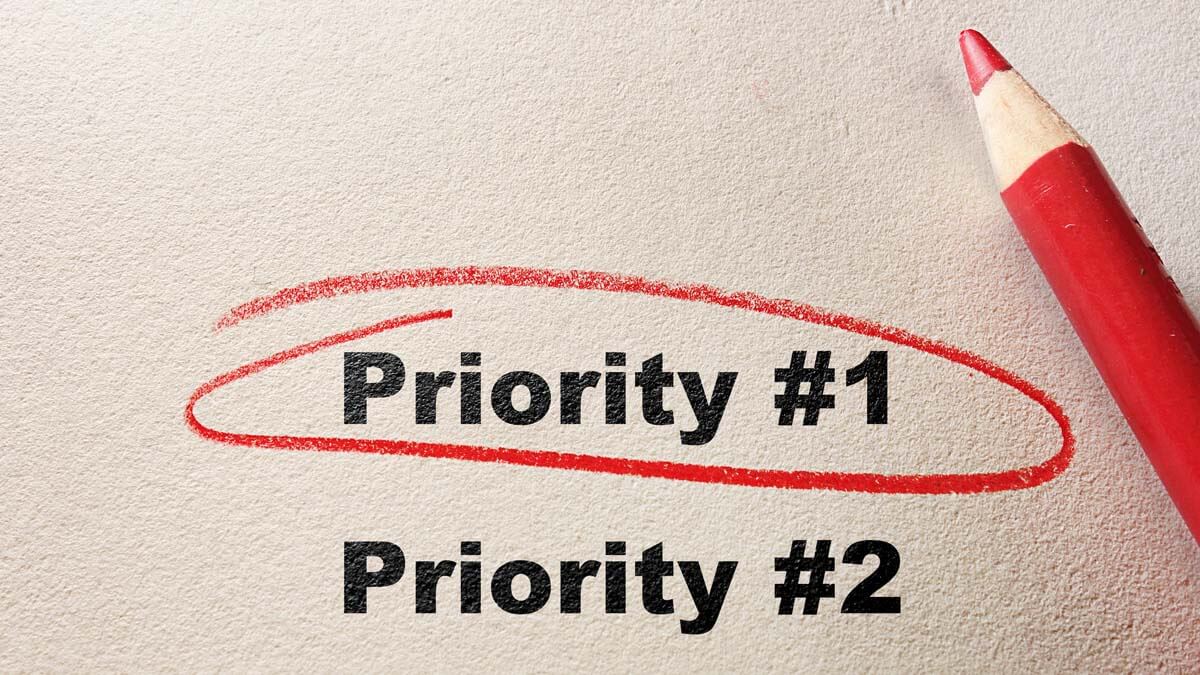

We researched this question with a survey of 300+ B2B professionals, examining these VOC skills: 1) Secure interviews, 2) Proper interviews, 3) Impress customers, 4) Uncover all needs, 5) Probe for meaning, 6) Probe for value, 7) Quantitative VOC, 8) Virtual VOC, 9) VOC debriefing, 10) Prioritize needs, 11) Segment market, and 12) Business case.

Can you guess which skill most differentiated the winners and losers in terms of new product development success? It was #10, Prioritize customer needs. The #2 skill wasn’t even close. So if you’re not conducting quantitative interviews to prioritize customer needs with confidence, you’ve got some serious “upside” to pursue. See 2-minute video, Quantitative interviews are a must.

More in white paper, Market Satisfaction Gaps.

The “fast follower” strategy seldom works, for a variety of reasons. One is that it’s often just an excuse for the lack of innovation, and isn’t supported by needed fast-follower capabilities. Next time a business leader touts this “strategy,” ask if they’ve invested heavily in a) early-warning competitive intelligence, b) robust patent minefield-avoidance competencies, and c) ultra-fast scale-up capabilities.

Unless they say “yes,” their fast-follower claim was just an excuse for avoiding Job #1: Understand and meet customer needs better than others. When you excel at Job #1, you’ll grow faster, more profitably, and more consistently than those shuffling along behind you trying to catch up.

More in article, Chasing the Fast Follower Myth

Extruder Die: This “output” represents your financial results. Fast-moving, high-quality output is like top-line growth and profitability. Feed Hopper: These are market-facing innovation projects supported by customer insight. Drive Screw: This is the work needed to transform the feed into high-value products, done by skilled, focused people.

The only way to get better extruder die output is to focus on the feed hopper input and drive screw horsepower. Watching the extruder die is just a spectator sport. Which is precisely what you’re engaged in during financial reviews. Wouldn’t you rather be in a participant sport? Then go to your feed hopper, and work on new products customers will love. See 2-minute video, Extend your time horizon.

More in article, B2B Organic Growth: 8 top lessons for leaders.

In my experience, VOO is much more common than VOC among B2B companies today. This will surely change, given the huge advantages of B2B-optimized VOC. (See e-book, Reinventing VOC for B2B.) You can learn your position on the VOO-vs.-VOC spectrum by diagnosing 10 factors: 1) interview scope, 2) interview objective, 3) types of questions, 4) note-taking, 5) interview skills, 6) observation skills, 7) companies interviewed, 8) deliverables, 9) engagement timeframe, and 10) interviewing staff.

For descriptions of all 10, see article, Why Advanced Voice of Customer Matters

I suspect you’d rather look at a map first, and then start your journey. So why do many B2B companies develop a new product and then show it to customers? With intelligent B2B voice-of-customer interviews (see e-book, Reinventing VOC for B2B), your customers are drawing a map for you: “Yes, go here and work on this outcome. No, that outcome isn’t important so don’t bother.” Granted, it’s more “daring” to ignore a map. But if you want to get to the right destination as quickly and efficiently as possible, it’s better to talk to your cartographers first.

See 2-minute video, Stop leading with your solutions

If you bring a prototype to a customer, this is “concept testing”… which is different than voice of the customer research. Prototypes are fine later in the process, but for many companies this is their first discussion with customers. B2B concept testing should occur after front-end voice-of-customer interviews. If you start with concept testing, you’ll incur confirmation bias, less-engaged customers, and the false impression you’ve acted in a customer-centric fashion. See 2-minute video, Stop leading with your solutions.

More in article, Don’t Confuse Concept Testing With VoC

Your growth rate has three hidden components: Inherited Growth (from past employee’s innovations), Market Growth (from matching market growth using average innovation) and Earned Growth. You only accomplish the latter by doing a better job than competitors in understanding and meeting customer needs. Every year, purchasing agents and competitors work hard to commoditize your products. So every year you need to earn your growth. It’s the only way to rise above “mediocrity.” And who wants that? See 2-minute video, How much growth did you earn?

More in article, Own the Future with B2B Customer Insight

Surely nobody would brag about using VOO to develop new products. But if you aren’t having intelligent conversations with B2B customers before developing your new products, isn’t this what you’re doing? A good test is to add up your hours of internal conversations and compare with your voice-of-customer (VOC) hours. If you are not happy with the ratio, this might explain why customers are not happy with your new products.

More in e-book, Reinventing VOC for B2B

It wouldn’t be hard to do. It often takes 2 or 3 decades for industry to broadly adopt new practices. This has been true for statistical process control, lean manufacturing, Six Sigma, Stage-Gate®, consultative selling, and others. What if your company identified and quickly mastered the next high-impact business practice? A good candidate is reinventing VOC for B2B: Before developing a new product, conduct B2B-optimized voice-of-customer interviews, so customers can tell you precisely which outcomes to improve.

More in e-book, Reinventing VOC for B2B

In his book, The Statue in the Stone, Scott Burleson describes Jobs-to-be-Done philosophy as “an ideology to help a person accomplish a job perfectly by removing every imperfection.” Over and over we’ve seen this simple fact when our clients interview their customers: Teams that focus on their products, technologies and hypotheses struggle. But teams that focus on customers’ jobs-to-be-done–and the outcomes supporting those jobs–are much more successful.

More at Dan Adams interviews Scott Burleson about his new book, The Statue in the Stone

Quality control inspectors made sense for manufacturers… until statistical process control. High-pressure closing techniques made sense for salespeople… until consultative selling. Payback periods made sense for financial decision-making… until discounted cash flow methods. Think of these as “awkward realities.” Today, it seems to make sense for B2B companies to “ideate” new products… without first having intelligent conversations with B2B customers. The ones who could tell them precisely which outcomes to improve.

More in article, Own the Future with B2B Customer Insight